- Published on

CLS Surges 15%, Six Other Alpha Picks Report Q4 Results

- Authors

- Name

- Perpetual Alpha

Summary

- A total of nine Alpha Picks have reported Q4 financial results so far, highlighted by EAT and CLS posting double-digit gains since earnings season kicked off.

- Five reporting Alpha Picks have exceeded earnings expectations, with seven beating revenue targets and four besting both top- and bottom-line consensus estimates.

- Alpha Picks identifies two best-of-the-best Quant ‘Strong Buy’ recommendations monthly, and ten out of 37 Alpha Picks have delivered returns over 100%.

- Since its inception, the Alpha Picks Portfolio Total Return has delivered an incredible 171% compared to the S&P 500’s 59%.

Celestica Inc. Crushes Expectations

Two-time Alpha Pick Celestica Inc. (CLS) jumped nearly 15% by mid-day trading on Thursday after it crushed Q4 expectations, reporting revenues of $2.55B, up 19% Y/Y, and beating adjusted EPS estimates by $0.05. The Communications & Cloud Solutions (CCS) segment grew by 30%, driven by continued growth in hyperscaler demand and 65% growth in its networking products. The company reported an improved adjusted gross margin of 11% and a non-GAAP operating margin of 6.8%.

Looking ahead, management raised its 2025 revenue outlook to $10.7B, representing 11% growth and 22% EPS growth. CLS is one of Alpha Picks’ top performers, having delivered an incredible 324% since it was originally picked on October 16, 2023, and has added an additional 43% since it was re-picked on November 15th, 2024.

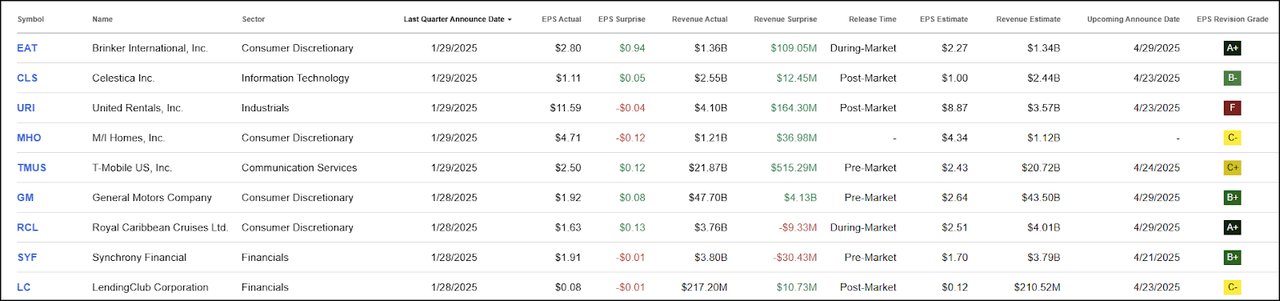

Earnings Update

Only nine out of 37 Alpha Picks stocks have reported quarterly financial results so far, with five exceeding earnings expectations, seven beating revenue targets, and four besting both top- and bottom-line consensus targets.

Alpha Picks’ Earnings Results

Below is a summary of earnings highlights from the Alpha Picks portfolio that have reported quarterly results so far.

Alpha Picks Q4 Earnings Season Results

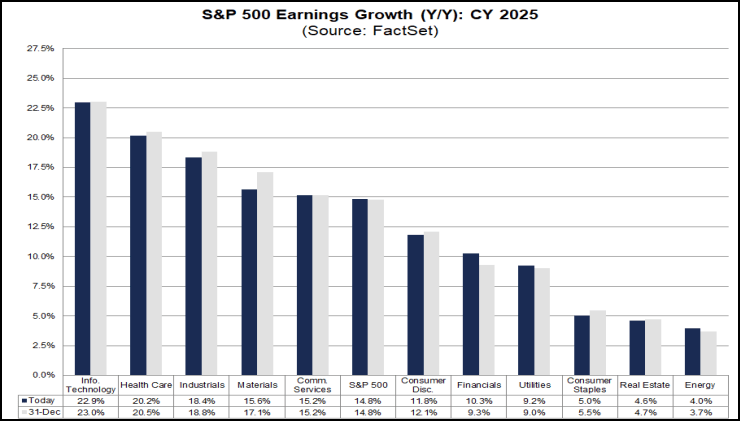

- General Motors (GM) reported strong Q4 2024 results, with 9% revenue growth Y/Y, beating expectations by an incredible $4.13B and exceeding earnings estimates by $0.08. GM’s growth was driven by higher vehicle wholesale volumes (up 6%) and market share gains in both their internal combustion engine segment and electric vehicles. Despite the positive result, GM’s shares took a hit on Tuesday due to several uncertainties addressed in the earnings call; tariffs, EV policy changes, and the absence of a new share repurchase announcement are all potential headwinds for the stock. Management is taking a proactive approach to some of these potential challenges. Chairman & Chief Executive Officer, Mary Barra, said: 2025 could be another big year for tech stocks, as showcased in FactSet’s 2025 tech sector outlook below.

“With respect to possible tariffs, we are working across our supply chain, logistics network and assembly plants so that we are prepared to mitigate near-term impacts. Many of these actions are no cost or low cost. What we won't do is spend large amount of capital without clarity. Whatever happens on these fronts, we have a very broad and deep portfolio of ICE vehicles and EVs that are both growing market share, and we'll be agile and execute as efficiently as possible.”

T-Mobile US, Inc. (TMUS) achieved record-breaking growth in 2024 and delivered a top- and bottom-line beat for Q4. The company reported $21.87B in revenue while exceeding adjusted EPS estimates by $0.12. Key performance metrics include:

903,00 postpaid phone net additions

Over 60% of new customers selected premium plans

5G broadband achieved the highest industry net share with 428,000 additions in Q4

The company returned $31.4B to shareholders since 2022

Cruise liner Royal Caribbean (RCL) had a strong quarter, despite missing revenue estimates by $9.3M. The company exceeded expectations with adjusted earnings per share of $1.63, driven by a 7.3% net yield growth, contributing to the stock’s 17% gain over the last five days. The company achieved $1.1B in adjusted EBITDA, which is a 10% increase Y/Y. Strong performance was driven by better revenue across brands, with robust pricing and onboard spending. RCL is one of Alpha Picks’ best-performing stocks, having returned more than 110% since it was added on March 15th, 2024.

Despite 24% revenue growth reaching $1.21B and EPS rising 29% to $4.71, M/I Homes, Inc. (MHO) missed earnings estimates by $0.12. While gross margins declined 250 basis points sequentially due to increased mortgage rate buy-downs, new contracts improved 11% Y/Y. MHO has been challenged by the macro environment, with rising mortgage rates despite the monetary easing that began in Q3. CEO Bob Schottenstein said:

“We are particularly proud of our performance given the changing economic conditions and demand challenges we faced, particularly throughout the latter part of the year. As everyone knows, mortgage rates began rising during the third and fourth quarters.” “Demand has become a bit more choppy during the fourth quarter, and the need for such rate buy-downs became an even more important part of our business strategy.”

MHO is a top-performing Alpha Pick and part of the Winner’s Circle, having returned an incredible 255% since its addition to the portfolio in October 2022.

Equipment rental behemoth United Rentals, Inc. (URI) delivered a record quarter, with revenue up 9.8% to $4.1B. Despite reporting an adjusted EBITDA of $1.9B, the company missed EPS estimates by $0.04. The company highlighted strong specialty rental growth of over 30%. Management provided 2025 guidance, projecting 3.3% revenue growth.

Consumer financial services company Synchrony Financial (SYF) is the only Alpha Picks company to report both a top- and bottom-line miss for Q4. Despite a decrease in delinquencies, the company reported a 6.7% charge-off rate, up from 6.2% in November and notably higher than last year’s 5.6%.

The majority of Alpha Picks have yet to report, and we are expecting nine more companies to report next week, including two in the Winner’s Circle. Stocks that return over 100% to the Alpha Picks portfolio are added to the Winner’s Circle, and the AP portfolio currently has ten stocks that qualify. We will continue to keep Alpha Picks subscribers updated as our Quant models digest earnings results, and ratings are updated. Stocks that are up more than 100% are part of the Good-to-Great category because we like to let our winners run.

Let Your Winners Run—Good-to-Great

If a company that has doubled or more receives a Sell or Strong Sell recommendation, we will only sell the initial investment and let the rest of the position remain.

If another Sell or Strong Sell is triggered and the position does not have a value greater than 2x the initial investment, it will be entirely sold from the portfolio.

Like some of our other winning stocks, including Celestica (CLS) and Brinker International (EAT), which are successfully crushing top- and bottom-line earnings, Alpha Picks will continue highlighting the best-of-the-best quantitative picks in hopes of more portfolio winners. Happy investing!

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha