- Published on

Alpha Picks Weekly Market Recap

- Authors

- Name

- Perpetual Alpha

Summary

- It was a volatile week as Wall Street’s ‘fear gauge’ soared with China’s DeepSeek AI threatening existing Western AI models.

- Despite volatility early in the week, indices rebounded, with the Nasdaq up 2.66%, the S&P 500 up 1.62%, and the Dow up 1.34% by mid-day trading Friday.

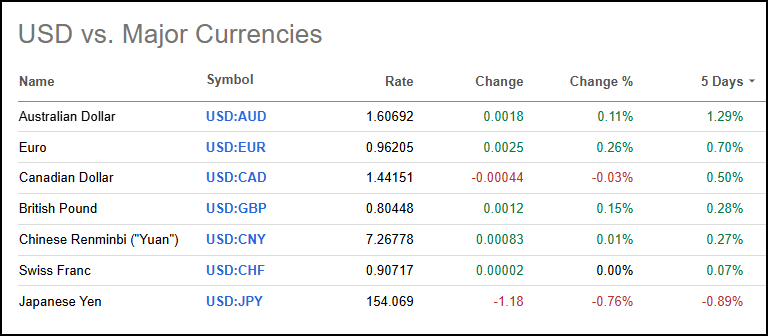

- US Treasury yields remained relatively stable, with the 10-year yield close to 4.55%, while the dollar showed mixed performance against major currencies amid ongoing trade and policy developments.

- The cryptocurrency market saw gains beyond Bitcoin after Fed Chair Powell announced that banks can service cryptocurrency, prompting the CME Group and Grayscale to announce the launch of crypto products.

- As anticipated, the Fed kept rates on hold, while U.S. GDP grew slower than expected in Q4. PCE rose 2.3% Q/Q, but moderated for the full year.

DeepSeek EarthQuake

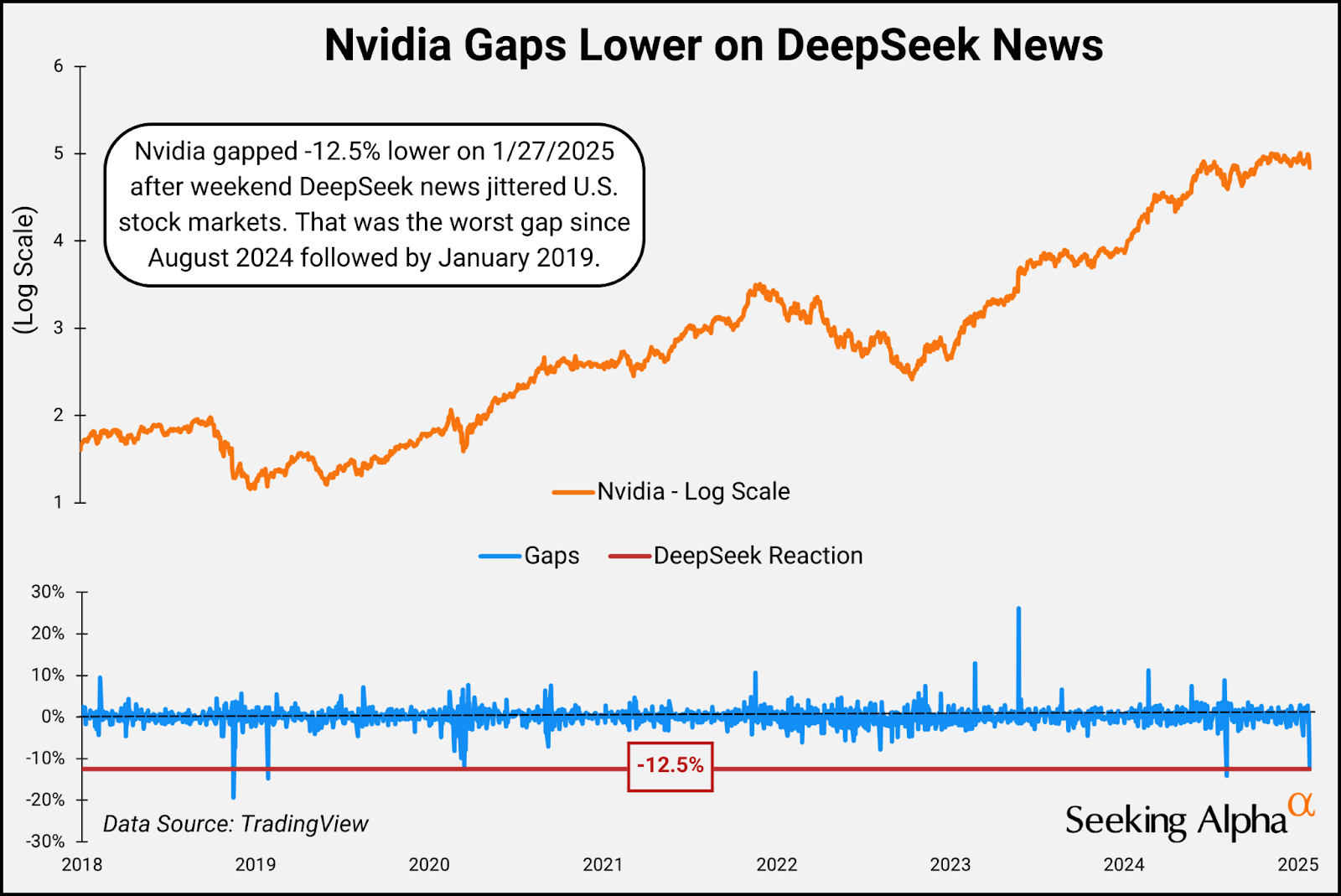

Monday kicked off a volatile week for major equities, as the release of DeepSeek’s AI model rattled both the tech and global markets. The model, developed by a Chinese startup, presents a low-cost alternative that rivals existing Western AI models like ChatGPT, raising concerns about potential competitive pressures. Key tech stocks like Nvidia (NVDA) and Microsoft (MSFT) experienced significant declines as investors recalibrated their expectations for future earnings. The impact was so strong that it caused Nvidia’s stock to gap -12.5%. A gap can happen to a stock after impactful news is released when markets are closed, such as during the weekend (which was when the DeepSeek news was announced). This caused the stock to open significantly lower than the previous trading day. The last time NVDA gapped this much was in August 2024, followed by January 2019.

The Nasdaq plummeted over 3% Monday and the S&P fell 1.5%. Meanwhile, the Dow was up 0.7%. This development underscores the disruptive power of emerging technologies and the challenges they pose to existing market leaders, particularly in the AI sector. As U.S. policymakers and tech investors digest this development, discussions on AI regulation and investment strategy are likely to intensify.

Geopolitical Events

Tariffs and trade tensions remain a focal point for companies concerned that supply chain disruptions and rising costs could hinder innovation, growth, and tech advancements. Separately, in discussions on national security, parallels are being drawn between DeepSeek and TikTok due to similar concerns about data privacy and potential governmental influence. DeepSeek, like TikTok before it, has come under scrutiny in the United States amidst fears that the Chinese government could leverage these platforms to gather sensitive information on American users, pointing to DeepSeek’s data collection practices and storing user information on servers in China, which closely resemble those that fueled the debate over TikTok. The U.S. Navy’s decision to ban DeepSeek from its ranks underscores the perceived risks associated with using foreign AI technology, where sensitive and personal data might be vulnerable to external monitoring.

The geopolitical implications further amplify these concerns. With DeepSeek positioned at the forefront of China’s AI advancements, fears around misuse extend beyond privacy to include influence over societal narratives and the potential for espionage. The platform’s refusal to address sensitive topics, such as the Tiananmen Square massacre and its assertion that Taiwan is part of China, fuel worries about content manipulation and ideological imposition. As a result, American policymakers are increasingly vigilant, weighing the risks posed by such technology and considering regulatory measures that could limit its integration into the U.S. digital ecosystem to safeguard national security interests.

Asia-Pacific markets demonstrated resilience this week, rising despite closures in Taiwan, South Korea, Hong Kong, and China for the Lunar New Year holidays. In Japan, the Nikkei 225 edged up by 0.06% to just below 39,400, as the Japanese yen strengthened past 154.5 per dollar, following comments from Bank of Japan Ryozo Himino that their central bank will continue to increase rates in 2025. Meanwhile, in India, the Sensex rose 0.22% to 76,836, marking its third consecutive day of gains, bolstered by sectors such as realty, metals, pharmaceuticals, oil & gas, and healthcare.

GICS Sector Performance

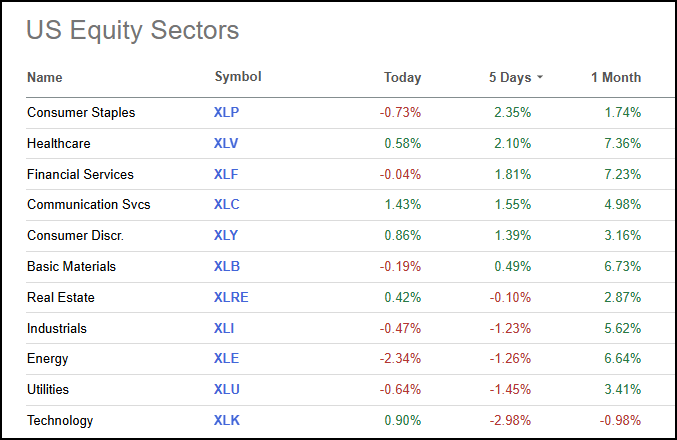

The Information Technology sector (XLK) faced downward pressure this week due to concerns over the emergence of China’s DeepSeek, leading to significant declines in key tech stocks like Nvidia and Microsoft. Conversely, the Consumer Staples and Financials sectors showed resilience, with solid performances in the healthcare (XLV) and financials (XLF) contributing positively amid a stable US dollar environment.

Tech was crushed this week and fell to be the worst-performing sector.

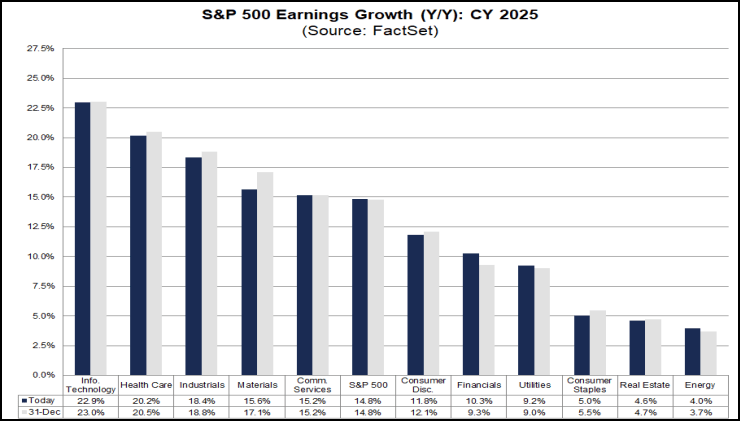

2025 could be another big year for tech stocks, as showcased in FactSet’s 2025 tech sector outlook below.

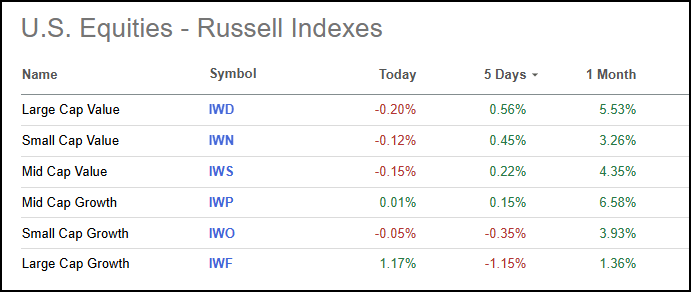

Value Stocks vs. Growth Stocks

Fear moved the markets this week, as the DeepSeek AI scare prompted investors to seek value stocks rather than growth stocks. Uncertainty surrounding tech created a less-than-favorable outlook, despite the push for innovation and tech trends that continue to capture investor interest and market share.

Over the past week, value stocks were the top-performing equities.

Cryptocurrency

Wall Street and the cryptocurrency markets continue to respond positively to Fed Chair Jerome Powell’s confirmation that US banks can serve crypto clients. Federal Reserve Chair Jerome Powell clarified that US banks are permitted to offer services to cryptocurrency clients, dispelling previous regulatory uncertainties. Powell emphasized the importance of risk management for banks entering the crypto market, urging them to implement necessary safeguards to mitigate potential financial risks associated with cryptocurrency transactions. On the heels of the news, CME Group announced the upcoming launch of financially settled options on Bitcoin Friday futures, which will enhance traders’ ability to manage short-term Bitcoin price risks.

Despite the DeepSeek-driven rout this week that led to Bitcoin (BTC-USD) hitting a multi-day low on Monday, crypto experienced a victory on Thursday. Grayscale’s rollout of the Grayscale Bitcoin Miners ETF (MNRS) offers investors exposure to Bitcoin, Riot Platforms (RIOT), MARA Holdings (MARA), Core Scientific (CORZ), CleanSpark (CLSK), and IREN (IREN).

"Bitcoin Miners, the backbone of the network, are well-positioned for significant growth as Bitcoin adoption and usage increases, making MNRS an appealing option for a diverse range of investors," said David LaValle, global head of ETFs at Grayscale.”

Closing out the week, Bitcoin experienced gains, with movements reflecting renewed market optimism following regulatory clarity and positive institutional sentiment toward digital assets.

Bitcoin, S&P 500, US Dollar Push Higher After Falling at the Start of the Week

Currency

The U.S. dollar plummeted Monday amid market volatility and investors evaluating the future of AI tech versus Chinese competition, but the greenback rose Tuesday on renewed tariff rhetoric. Despite the mixed performance observed in various currency markets, the US dollar faced renewed pressure primarily due to uncertain trade policy discussions, including the ongoing tariff debates under the Trump administration. The tension contributed to the dollar’s inability to sustain gains against major rivals. The euro, despite being down 0.55% on Tuesday against the dollar, managed to recover some losses by the end of the week, as markets remained focused on the upcoming European Central Bank meeting and its potential rate cuts.

USD gained this week against many major currencies.

The Australian dollar (AUS:USD) appreciated to around $0.623 after three days of losses, influenced by Australia’s better-than-expected export and import price data, as the Japanese yen rallied above 154.5 per dollar. Other major currencies, such as the euro (EUR:USD) and British pound (GBP:USD), showed relative stability ahead of upcoming central bank meetings.

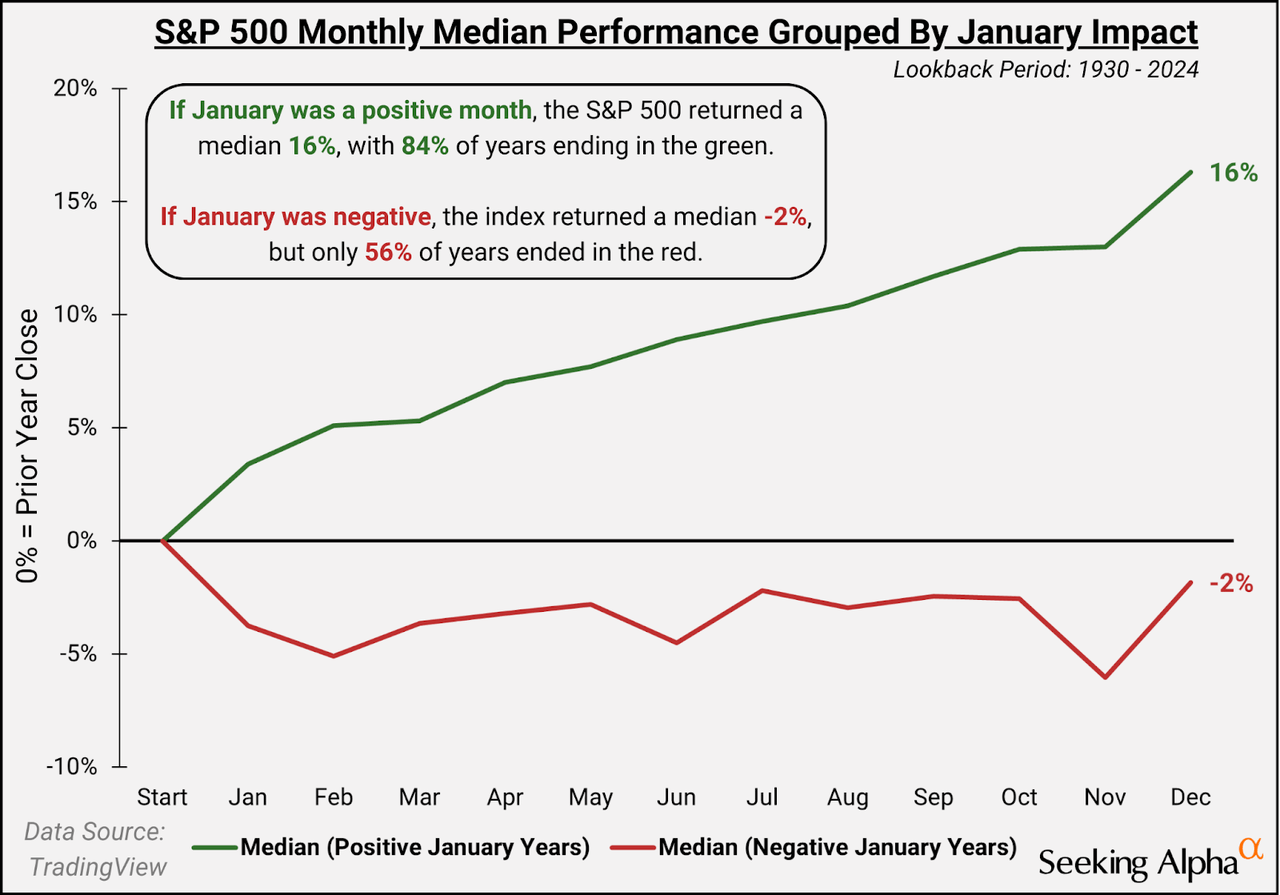

Chart of the Week - Will January’s Stock Market Performance Bring Good Fortune for the Rest of the Year?

What could the rest of 2025 look like if the S&P 500 rises in January? Using historical data since 1930, the index has returned a median of 16% by December in years when the first month was positive. This is compared to -2% in years when January was negative. This seems to support the “January Barometer” effect, where the theory is that the year's first month could determine what transpires over the year. It should be noted that past performance does not guarantee future results, and traders should treat this phenomenon with a grain of salt, given the volatility that can accompany a transfer of power in Washington.

Economic Rundown

► FOMC – The Federal Reserve maintained the federal funds rate at 4.25%-4.50% during the latest meeting, with Powell indicating no immediate plans for rate cuts, despite acknowledging that inflation remains somewhat elevated.

► Inflation – Q4 2024 saw inflation rise (PCE 2.3%, Core PCE 2.5%), but full-year inflation declined significantly from 2023 levels, down 1.3%

► Labor Market – Weekly unemployment claims unexpectedly fell to 207,000, down 16,000 from consensus estimates, indicating lower layoffs even as job opportunities become scarcer for those looking for work.

Seeking Alpha Earnings Calendar

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.