- Published on

[TEX] Give Your Portfolio A Lift With This Top Stock

- Authors

- Name

- Perpetual Alpha

Summary

- Amid worldwide inflation and supply chain bottlenecks, our Alpha Pick has delivered strong earnings, capitalized on the need for heavy equipment components and replacement parts, and has a $3.9B backlog.

- Strong macro tailwinds, funding from the Inflation Reduction Act, and continued infrastructure spending should enable our pick to benefit for a sustained time.

- Even with an anticipated economic slowdown, this top industrial stock offers “magic in a bottle” to help lift customers into the new year.

- Amid supply chain constraints, this company managed sales of $1.1B, up 13% Y/Y, a forward EBITDA growth rate of 63.01%, and a Return on Total Assets (TTM) of 69% and is returning cash to its shareholders and growing its dividend.

- Our Alpha Pick’s long-term growth, driven by global increases in the need for construction activities, especially utility transmission infrastructure, stands to benefit in the new year as a top stock. blue boom lift perspective indoor

Business Overview

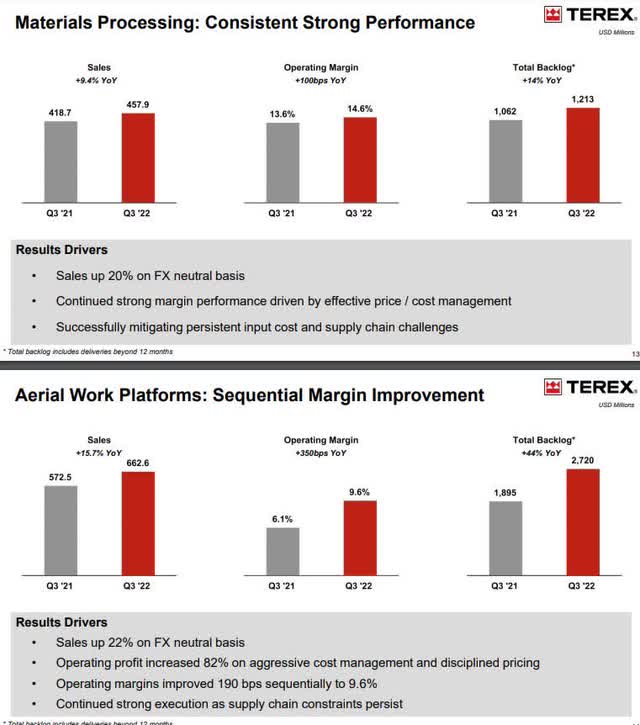

Terex Corporation (TEX) is a diversified worldwide manufacturer of a broad range of equipment. Terex sells aerial work platforms and materials processing machinery and is focused on delivering reliable, client-driven solutions. Operating in two primary segments, Aerial Work Platforms (AWP) and Materials Processing (MP), TEX has benefited from long-term growth driven by global increases in the need for construction activities, especially in utilities.

TEREX Material Processing and Aerial Work Platforms Equipment

TEREX Material Processing and Aerial Work Platforms Equipment (TEX Q3 2022 Investor Presentation)

TEREX Material Processing and Aerial Work Platforms Equipment (TEX Q3 2022 Investor Presentation)

With an array of product offerings, Terex designs, builds, and supports applications that include but are not limited to construction, utilities, infrastructure, mining, shipping, and transportation. In addition to being firmly committed to ESG practices, TEX offered tremendous support, relief, and rebuilding following Hurricane Ian.

“Terex is committed to providing equipment and supporting the uptime of our machines in the field. Our utility trucks are operated day and night to restore the power grid. MP environmental equipment processes biomass and C&D waste to open infrastructure and provide cleanup. Our equipment in action demonstrates our company purpose to help improve the lives of people around the world…We continue to increase our pipeline for inorganic growth. We are focused on specialized equipment and materials processing, utility parts and service and investments in technologies that advance our product offerings” -John Garrison, Terex Chairman & CEO.

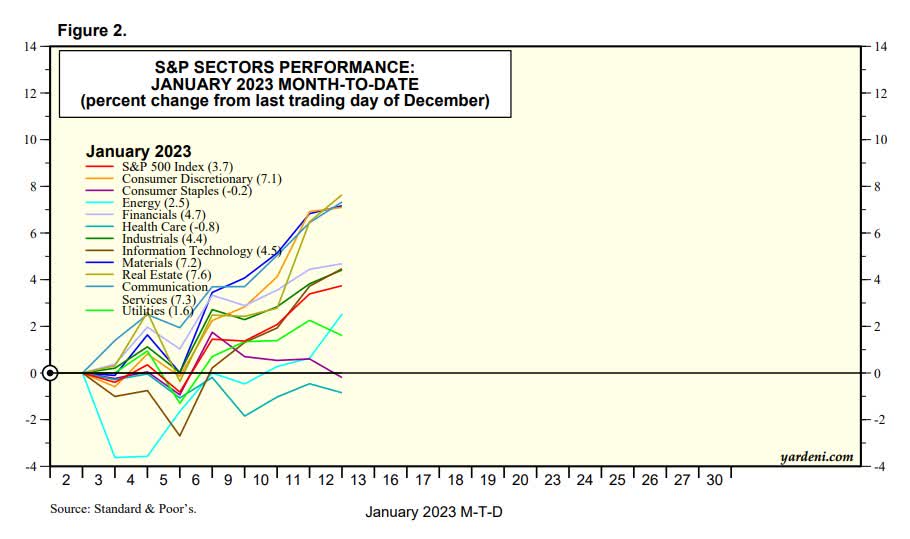

Month-to-Date S&P 500 Sectors Performance (through January 13, 2023)

Month-to-Date S&P 500 Sectors Performance (through January 13, 2023)

Terex Corporation (TEX) Materials Processing & Aerial Work Platforms Performance & Improvements Terex Corporation (TEX) Materials Processing & Aerial Work Platforms Performance & Improvements (TEX Q3 2022 Investor Presentation)

Terex Corporation’s segments have experienced success over the last year. Its AWP sequential margin improvement year-over-year has increased, despite supply chain constraints, and it has outperformed the sector median quarterly. With A+ Momentum, TEX continues to drive results and maintain bullish momentum.

TEX Stock Momentum Grade (SA Premium)

TEX Stock Momentum Grade (SA Premium)

Considered one of the top companies in the heavy equipment industry, Terex’s clients value its strong brand and performing products, many of which offer field efficiency and consistent access to parts. TEX’s geographically diverse portfolio of aerial lifts and materials processing equipment has been able to capitalize on its strong network. With a strong backlog into 2023 and the high demand for its products, TEX offers excellent potential for the New Year.

Our Buy Thesis

In the midst of worldwide inflation and supply chain bottlenecks, Terex Corporation has consistently delivered strong earnings, capitalizing on the need for heavy equipment components and replacement parts for its AWP and MP segments. Strong performance backed by Terex management’s expectation of reaching $6B in sales by 2027; robust demand coupled with increases in infrastructure spending; and funding from the Inflation Reduction Act should offer tremendous benefits for the company that reported top-line growth of 12.7% Y/Y for Q3.

Strong demand leading to a backlog has allowed its line of products, including the highly regarded Genie brand, to thrive. Boasting “quality by design,” Genie is considered one of the strongest brands in the industry and operates lifts on compressed air, the “magic in the bottle.” Although the heavy machinery rental industry is price-competitive, much of Terex’s growth can be attributed to the demand for Genie. Terex’s hybrid and electric-drive products offer more fuel efficiency and technology-enabled lifts that improve operational efficiency and safety. Additionally, TEX delivers high rates of return and value.

Although inflation has increased costs and macro headwinds have created some supply chain and logistics constraints, TEX continued its bullish trend last year. Some of the sector’s most significant gains followed its latest earnings report through the start of the new year.

Month-to-Date S&P 500 Sectors Performance (through January 13, 2023)

Month-to-Date S&P 500 Sectors Performance (through January 13, 2023) (Standard & Poor's, Yardeni Research)

Month-to-Date S&P 500 Sectors Performance (through January 13, 2023) (Standard & Poor's, Yardeni Research)

TEX is committed to investing in its business and returning cash to shareholders, whose solid free cash flow for Q3 was $53M. Although its dividend yield is a modest 1.08%, its dividend safety grade is a B+, and its dividend continues to grow.

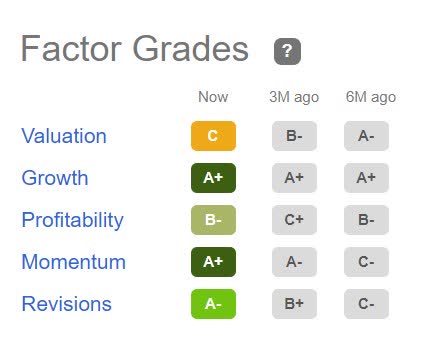

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. Tex’s Growth grade indicates that TEX has excellent potential and is fundamentally sound compared to the Industrial sector. With a current B- Profitability grade and an A- Earnings Revision, TEX is a profitable company in its sector with solid growth prospects and stellar momentum.

TEX Factor Grades

TEX Factor Grades  TEX Factor Grades (SA Premium)

TEX Factor Grades (SA Premium)

Terex Corporation Growth

On the heels of increased infrastructure spending in the U.S. plus the Inflation Reduction Act of 2022 that offers incentives for renewable energy projects, the construction industry could see a lot of growth in 2023. Based on historical trends showcased in Morgan Stanley’s upgrade to the machinery group, Terex has rebounded from pandemic lows. Morgan Stanley analyst Dillon G. Cumming said,

“While our fundamental work implies a more bullish backdrop for the bulk of our coverage, we are not ignoring the potential risk of a recession and still see pockets of excess with our end market exposures. North American construction equipment remains the primary vertical where we see tangible evidence of peak cycle risk in 2023.”

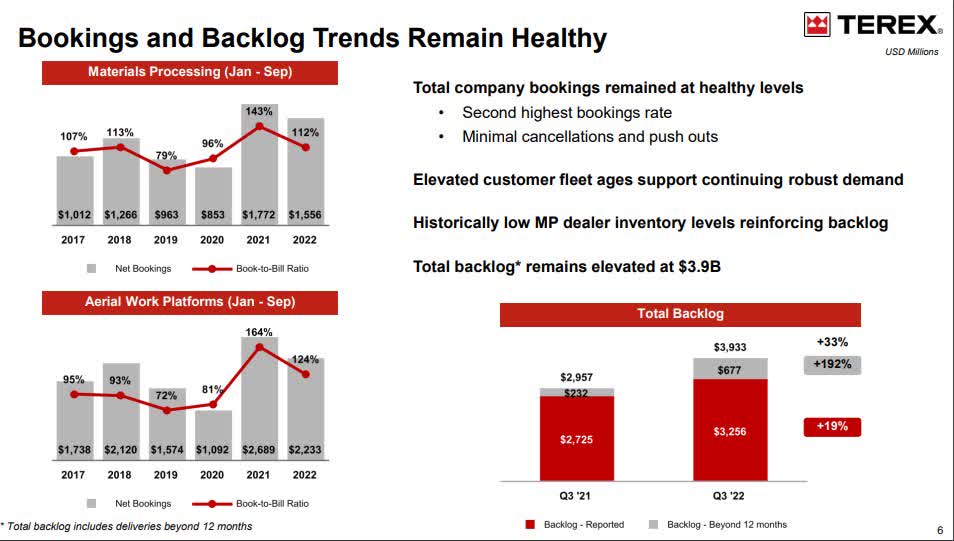

While there are some risks when investing in this stock, to be discussed below, TEX has many advantages. Third-quarter EPS of $1.20 beat by $0.16, and revenue of $1.12B beat by $48.40M, an increase of 12.75% Y/Y. Terex’s stellar growth and solid profitability figures resulted in its full-year EPS outlook rising between $4.00 and $4.20. With a backlog of $3.9B, +33% year-over-year, TEX has some cushion coming into a slowing 2023. By focusing on improving costs and pricing, TEX has been able to expand gross profit margins by 21.2%. Operating margins improved by 10.8%.

TEX Bookings and Backlog Trends (TEX Q3 2022 Investor Presentation)

TEX Bookings and Backlog Trends (TEX Q3 2022 Investor Presentation)

Terex has an advantage given its strong brand with diverse product offerings, markets, and geographies. Not only does its backlog offer tailwinds, robust demand and minimal cancellations primes Terex to grow while still trading at a relative discount to its sector peers.

Terex Corporation Valuation

Terex Corporation is trading near its 52-week high of $48.11 per share. With an overall C Valuation grade, TEX’s forward P/E of 11.68x is more than a 40% discount to its sector peers, indicating that it is relatively undervalued; its forward PEG is 0.75x, a -53.03% discount. With Q3 operating margins of 10.8% compared to the previous year’s results, TEX’s ROIC is nearly 23% and should support its forward multiple. In addition to its current uptrend outperforming its sector median peers quarterly, its bullish momentum indicates that investors are actively buying shares at the current price as it looks to continue its uptrend.

Potential Risks

Post-pandemic and in the current slowing economic environment, commercial construction spending has experienced a slowdown, which could impact the demand for TEX’s products in the near term. The economic slowdown and weaker demand for heavy machinery fleets may delay the company replacing its aging fleet of equipment, posing a competitive advantage for rival companies like Oshkosh’s JLG brand and sales pressures.

Industrials in the Construction Machinery and Heavy Trucks industry are exposed to product safety issues and carbon emissions regulation. With health and safety concerns and potential customer and employee injuries while operating heavy equipment, some exposure poses potential risks to the company.

In the worldwide push for fewer environmental impacts and carbon emissions regulations, Terex has been focused on solutions to deliver electric and hybrid products for quieter and emission-free performance in support of renewable energy. In 2019, TEX’s popular electric-drive products reached cost parity with its combustion engine products, and this success has aided TEX in improving its total cost of ownership through fuel efficiency. Although there are risks to consider, TEX has been ahead of the game regarding its environmental business and material processing and could benefit from increasing environmental regulations.

Concluding Summary

Industrials is a cyclical sector, and overall the sector’s sales are likely to be constrained by supply chain disruptions and the high costs of raw materials. But, TEX is focused on mitigating these issues by reducing and offsetting costs, engaging with suppliers and customers, and using alternatives.

As showcased with the latest CPI figures, we may experience some moderating, which should aid TEX in terms of raw material costs, logistics, and supply chain constraints. Moderating prices and better supply chains should be music to TEX’s ears in 2023, given its healthy backlog, which should aid its profit margins into the New Year.

Although a recession could spell trouble for many cyclical companies, TEX has benefited from secular tailwinds, including increased infrastructure spending in its segments, Aerial Work Platforms, and Materials Processing. Trading near its 52-week high, with tremendous earnings and momentum, and potential benefits from increased construction activity and demand, TEX is a Strong Buy rated stock. Despite the volatile macroeconomic conditions of 2022, TEX had a successful year with a strong balance sheet and growth that allowed for continued payment of its quarterly dividend, returning ~$120M of capital to its shareholders. Although inflation continues to run hot, with some moderating on the horizon, Terex Corporation’s disciplined capital allocation strategy and sequential margin improvements could offer an upside in the new year.

Written by Steven Cress

Head of Quantitative Strategies at Seeking Alpha

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.