- Published on

[CAAP] Top Stock Ready To Take Flight

- Authors

- Name

- Perpetual Alpha

Summary

- Companies around the globe have been affected by inflation, rising interest rates, war, geopolitical concerns, and slowing economic growth.

- Despite global economic issues, airports are jam-packed, and air travel is predicted to be very strong this summer. At pre-pandemic levels, global air traffic is up 92% from February 2022.

- Strong demand recovery is priming airport stocks for the upside, so we are delivering a top stock in the airline industry without the many risks associated with an airline.

- Because Airport Service stocks are great businesses with long-term customer contracts and high barriers to entry, consider diversifying your portfolio with a small-cap international airport service stock.

- This top pick has excellent valuations, margin expansion, tremendous growth, solid profitability, and sector-beating momentum.

Business Overview

A global-leading private airport operator, Corporación América Airports S.A (CAAP), through its subsidiaries, serves 53 airports in six countries across Latin America and Europe. Headquartered in Luxembourg, CAAP is benefitting from continued recovery from the pandemic. Deriving most of its revenues from aeronautical and commercial services, its key revenue drivers include passenger traffic, commercial retail, duty-free, food and beverage shops, parking, and warehouse usage, to name a few. Airport service stocks have many strengths, including:

- Monopoly businesses in their facilities

- Steady revenue stream from commercial clients and high net-worth individuals

- Diversified income streams ranging from the tarmac to airport concessions

- High barriers to entry as contracts are for the long term

- Government regulations that prevent other businesses from setting up

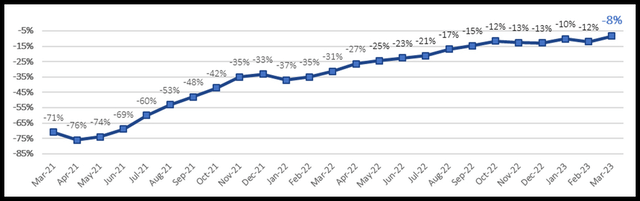

With passenger traffic at nearly 92% of pre-pandemic levels, CAAP’s bullish trend, supported by increasing cargo volumes +9.8% Y/Y in March, has led to a 67% rise in share price.

Corporación América Airports S.A. 1-year Trading Chart

Corporación América Airports S.A. 1-year Trading Chart (SA Premium)

Corporación América Airports S.A. 1-year Trading Chart (SA Premium)

While small-cap stocks can be more volatile than large-caps, especially when considering an investment in international stocks, as global economies face challenges amid slowdown, the ability to bargain-hunt for stocks that offer excellent value, growth, profitability, and positive analysts' earnings revisions are the essential qualities to help drive stock prices and future upside demand.

Our Buy Thesis

Airports have been experiencing passenger traffic recovery since last year, increasing 64.4% from 2021 to 2022. Despite the hard hit that airlines endured, grounding many flights amid the pandemic, CAAP has recovered with a vengeance. Reporting an uptick in passenger traffic by +33% year-over-year to reach 92% of its pre-pandemic levels, the resumption of flights, frequency, and operation across all segments and countries CAAP services, reaching or exceeding March 2019 levels.

Corporación América Airports S.A. Reports March 2023 Passenger Traffic

Corporación América Airports S.A. Reports March 2023 Passenger Traffic (BusinessWire)

Corporación América Airports S.A. Reports March 2023 Passenger Traffic (BusinessWire)

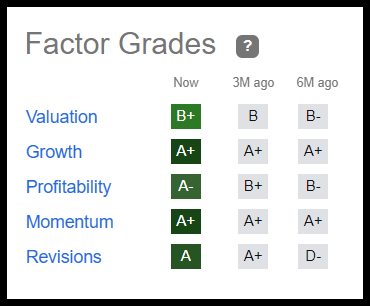

Consistently generating revenue and EBITDA growth, CAAP generates 44.23% of its total revenue from aeronautical services and 44.30% from its commercial segment. As evident in Seeking Alpha’s factor grades, CAAP possesses excellent fundamentals, capitalizing on the demand recovery in the airline industry. CAAP’s Factor Grades, which rate investment characteristics on a sector-relative basis, showcase a tremendous Growth Grade, excellent Momentum and Profitability Grade, and Revisions, indicating that CAAP is a rapidly growing and profitable Airport Services company.

Corporación América Airports S.A Factor Grades

Corporación América Airports S.A Factor Grades (SA Premium)

Corporación América Airports S.A Factor Grades (SA Premium)

With a strong track record of negotiating, acquiring, and renewing business across geographies, CAAP has maintained a Strong Buy rating when the broader airline industry has sold off and faced periods of both geo-political and economic uncertainty. Boasting stellar metrics, CAAP’s business strategy continues to improve, allowing for revenue growth, improvements in operating efficiency, and cost reduction, driven by its “deep operating know-how that includes:”

- Airlines and routes for expansion and increasing sources of revenue

- Commercial revenue expansion through strategic evaluation of store mix and real estate use

- Operation optimization involving facilities efficiency, flexibility, and capacity

As CAAP continues to grow and the demand for air travel increases, CAAP stock is flying high, ending 2022 with a healthy balance sheet and improving net debt.

CAAP Stock Growth & Profitability

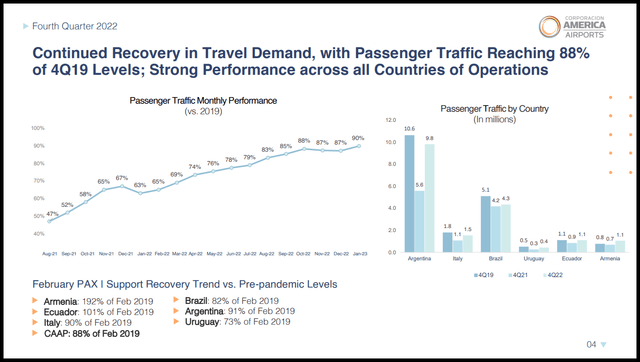

Showcasing tremendous factor grades in an industry primed for continued post-pandemic recovery, CAAP posted record levels of robust top-and-bottom-line results for Q3 2022. The trend continued. CAAP’s fourth quarter reached 87.6% of 4Q19 passenger levels. Additionally, cargo volumes increased to 92.5 thousand tons, 80.7% of 4Q19 levels, and CAAP aircraft movements increased to 94.3% of pre-pandemic levels.

“We are pleased to have ended the year with a strong quarter, delivering sustained and continued growth in revenues and adjusted EBITDA. These results underscore the recovering demand for air travel globally and the good performance of our countries of operation in particular. Total revenues excluding IFRIC were up 10.6% against fourth quarter of 2019, supported by a strong growth in commercial revenues and continued recovery in passenger traffic. This, along with our ongoing focus on cost control, allowed us to report an adjusted EBITDA of $123 million in the quarter, increasing 27% against the comparable period in the fourth quarter of 2019, while passenger traffic in 2022 stood at 88% of pre-pandemic levels,” said Martin Eurnekian, CAAP CEO.

CAAP Performance Continues to Soar Across All Countries and Operations

CAAP Performance Continues to Soar Across All Countries and Operations (CAAP Q422 Investor Presentation)

CAAP Performance Continues to Soar Across All Countries and Operations (CAAP Q422 Investor Presentation)

Strong performance has resulted in upward analyst revisions and an ‘A’ revisions grade. As post-pandemic recovery continues, CAAP staff expected continued increases in passenger traffic across all airports. CAAP’s primary revenue driver is passenger traffic, which has significantly increased to pre-pandemic levels. Spanning across geographies, CAAP’s passenger traffic and revenue benefit from the company’s ability to maintain good working relationships and partnerships with various governments. With a strong track record of negotiating, CAAP has maintained long-standing relationships that span the globe and the ability to acquire and renew its concession agreements. Emerging rapidly from the pandemic, almost unscathed, Corporación América Airports may deliver concessions; they haven’t had to make major concessions to remain an undervalued top stock pick.

Consistently evaluating airport capacity needs with its in-house experts for expansion and ways to optimize operations, CAAP has increased revenue streams. Focused on investment opportunities and growth by adding routes for value creation and maintaining a strong network of relationships, CAAP stock is +67% over the last year and continues upward, +22% YTD on the back of these core drivers.

CAAP Stock Valuation

CAAP is trading at a discounted valuation relative to its peers and is a Strong Buy. CAAP has a trailing P/E of 10.22x versus the sector median of 18.96x, more than 46% below the sector, Price/Cash Flow (TTM) a -61.30% difference, and EV/EBIT and EV/EBITDA all more than a -45% difference to the sector. CAAP’s B+ Valuation Grade is very attractive, especially given its +22% YTD, with a quarterly price performance significantly outperforming its peers.

Potential Risks

The pandemic grounded most global air travel, bringing many companies to their knees. And while the pandemic may be behind us in some regard, the fairly cyclical industry tends to fare well in good economic times and popular seasons. Conversely, airline stocks tend to summer during bad economic times as people are more cautious about their discretionary spending.

Weather and freezing temperatures can affect the airline industry. Not just the airplanes and flights, but freezing temperatures can take out networks, and technology glitches can prove problematic. As we recently saw with Southwest Airlines (LUV) grounding flights nationwide due to technical issues, whether weather-related or some other cause, travel can be a volatile sector.

Concluding Summary

CAAP is a tremendous small-cap international stock offering a balance of value and growth. With strong financials and benefitting from the uptick in travel that’s delivering year-over-year increases across key operating metrics, CAAP’s business is gaining. As the summer season approaches and travelers gear up for flight, CAAP should benefit from the busy season. Consistent revenue growth, top-and-bottom-line earnings beats, and bullish momentum are helping CAAP expand its margins and locations on the heels of increases in travel. In addition to its stellar metrics, CAAP may be flying under the radar, but it is currently our top quant-ranked stock in the Airport Services industry.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.