- Published on

[CRDO] A Rising Connectivity Champion

- Authors

- Name

- Perpetual Alpha

Summary

- With an exceptional Q2 FY2025 performance, this company is on track to deliver triple-digit revenue growth for FY2025.

- Q2 financial metrics show robust execution, with non-GAAP operating margin expanding 780 basis points sequentially.

- Despite displaying extraordinary price momentum, this semiconductor company trades at a 26% discount to the IT sector on a FWD PEG basis.

- Management’s confidence is reflected in its projection of ~50% annual growth beyond 2025, supported by improving free cash flow, which grew $1.4M sequentially in Q2.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +175% versus +59%, with ten Alpha Picks soaring more than 100% since their addition.

Business Overview

Founded in 2008, Credo Technology Group Holding Ltd (CRDO) provides high-speed connectivity solutions for data center infrastructure and is the #2 Quant-ranked semiconductor stock. The company’s core business focuses on developing products optimized for optical and electrical Ethernet applications. Key products in CRDO’s portfolio include Integrated Circuits ((ICs)) and Active Electrical Cables ((AECs)), crucial inputs for modern data infrastructure, as they enable faster data with lower signal degradation and enhanced reliability and power efficiency. These technologies are essential for meeting the growing bandwidth demands of next-generation data centers constructed worldwide.

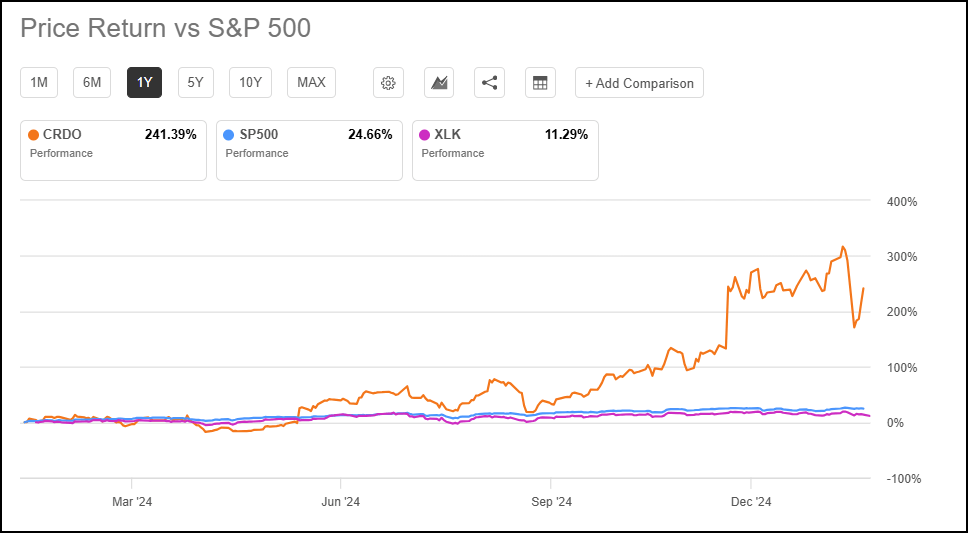

Credo’s products are known for their high performance, low power consumption, and cost-effectiveness. The company’s customer base is diverse, including hyperscalers, original equipment manufacturers ((OEMs)), and original design manufacturers ((ODMs)). CRDO serves customers globally, with significant sales in Hong Kong, the US, Mainland China, and Taiwan. The company has had a phenomenal run over the last year, delivering an astounding 241%, strongly outperforming the broader tech sector and S&P 500. Share prices dipped slightly after last week’s DeepSeek market reaction, creating a buying opportunity for investors seeking exposure to its rocket ship trajectory.

Credo Technology Group Holding Ltd (CRDO) vs. Technology Select Sector SPDR® Fund ETF (XLK) vs. S&P 500 1-year Trading Chart

CRDO is well-positioned within the high-speed connectivity market, focusing on delivering solutions that address critical needs within the AI infrastructure market.

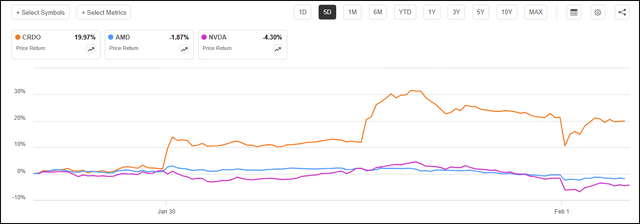

Despite Recent Tariff Concerns, CRDO Has Outperformed Both NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD)

Our Buy Thesis

CRDO has evolved from a routine connectivity player into a critical enabler of AI infrastructure deployment. Credo's AEC technology is the cornerstone of its transformation, which has become increasingly vital for AI deployments looking to future-proof their operations. CRDO’s AEC products have demonstrated exceptional reliability, with zero reported link failures across billions of operational hours. This is crucial for AI training clusters, where network disruptions can lead to substantial productivity losses.

CRDO is more diverse in its revenue distribution relative to the industry. This broadening adoption suggests significant untapped potential as AI infrastructure buildouts accelerate across the industry.

“Our top three end customers were each greater than 10% of revenue in Q2. We had another four end customers that were each between 5% and 10% of revenue. While customer mix will vary from quarter to quarter, the fact that Credo had seven end customers at greater than 5% of revenue in the second quarter strongly reinforces how we are diversifying our customer base,” said Dan Fleming, Credo Technology Group Holding Ltd’s CFO.

CRDO also boasts diversification across its product portfolio. The company’s growth extends beyond AECs, with record revenues achieved in optical DSPs and line card retimers. With multiple catalysts driven by AI adoption, demonstrated technological advantages, and deepening relationships, CRDO presets a compelling play on the buildout of mission-critical AI infrastructure.

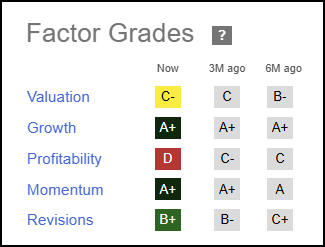

CRDO Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. CRDO displays exceptional growth compared to the sector. The company scores highly across timeliness indicators, with an A+ Momentum grade and an EPS Revision grade, which show Wall Street analysts have expressed consensus optimism around the stock.

CRDO Stock Growth and Profitability

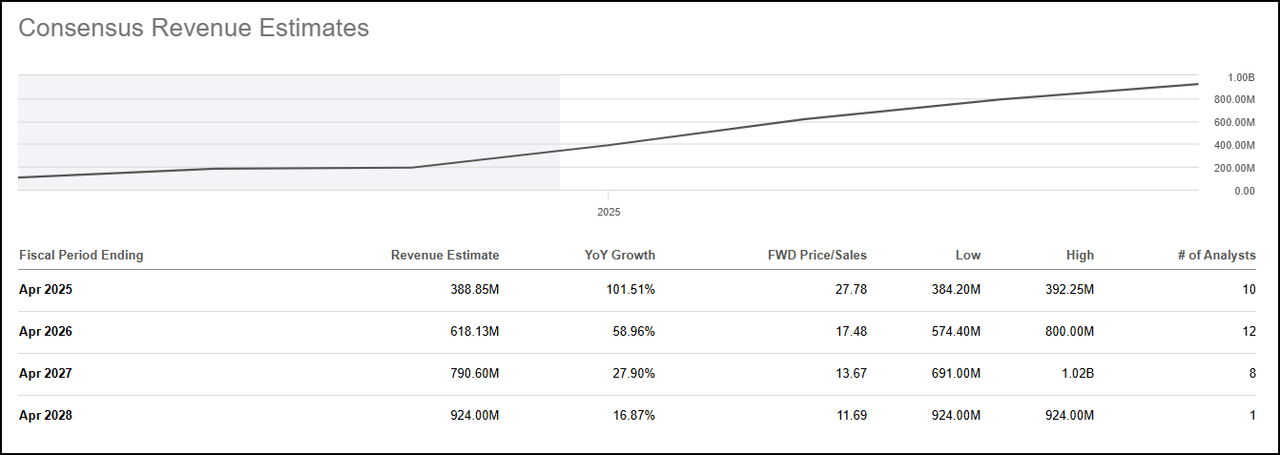

Credo delivered exceptional Q2FY25 results, with revenue reaching $72M, an astounding 21% sequential growth and 64% Y/Y growth. Management expects Q3 revenue to reach $115–125M, implying 67% sequential growth at the midpoint. CRDO projects over 100% Y/Y revenue growth for FY25, consistent with analyst estimates for the period.

CRDO Consensus Revenue Estimates

Profitability metrics reinforce the strength of Credo’s execution, with Q2’s non-GAAP operating margin expanding 780 basis points sequentially. Management also forecasts that operating expenses will grow at less than half the rate of revenue in FY25, hinting at the potential for expanded future profit margins.

Other Q2 highlights for CRDO include:

Management forecasts ~50% annual growth continuing beyond 2025.

Q2 non-GAAP operating income $8.3M vs. $2.2M in Q1.

Free cash flow improved to $11.7M from $10.3M in Q1.

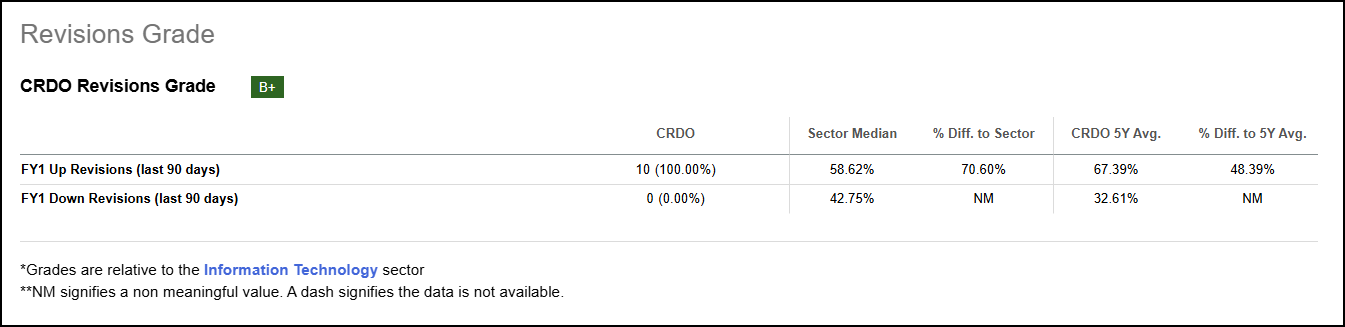

CRDO Stock Revisions & EPS Surprises

Over the last 90 days, CRDO has received an incredible 10 FY1 up revisions and zero downward revisions. In December, Bank of America analyst Vivek Arya issued a notable double upgrade, moving from ‘Underperform’ to ‘Buy’ with a dramatically increased price target from $27 to $80, citing material growth inflection driven by AI cluster adoption.

Strong fundamentals and analyst expectations have contributed to the company’s excellent price momentum over the last year; CRDO has returned an incredible 207%.

CRDO Financial Valuation

CRDO’s incredible run-up in the last year has diminished its valuation profile. However, the company is currently trading at a -26% discount to the broader IT sector in terms of its FWD PEG ratio. A PEG ratio is a significant financial metric, as it contextualizes the company’s current price against its expected earnings growth. While a high P/E ratio alone might suggest overvaluation, a low PEG ratio (even when accompanied by a high P/E) could indicate an attractive opportunity if the company’s earnings are growing rapidly enough to justify the premium.

Potential Risks

Credo faces risks, including intense semiconductor industry competition and the threat of technological obsolescence in this rapidly evolving space. While relatively diversified compared to the industry, CRDO still relies on key hyperscaler and enterprise clients, making it vulnerable to concentration risk.

Tariff Impact

The newly implemented U.S. tariffs on imports from Mexico, Canada, and China could increase production costs for Credo, which relies on global supply chains for components used in its products. If further retaliatory measures come to pass, Credo could face reduced demand for its products in Asian markets, complicating its growth strategy. Despite potential tariff compacts, robust demand for Credo’s products, and projected revenue doubling by 2025 suggest the company should be sufficiently resilient to absorb or offset increased costs and lower profitability from trade tensions.

Concluding Summary

Since its founding in 2008, Credo Technology Group Holding Ltd has emerged as a crucial player in the high-speed connectivity solutions space, establishing itself as the #2 Quant-ranked semiconductor stock. The company’s strategic focus on next-generation AI infrastructure technologies and diverse product portfolio have driven exceptional performance, with Q2 FY25 revenue growing 64% year-over-year to $72M. The company’s industry-relative diversification and robust product mix have contributed to its success.

CRDO displays solid fundamentals, particularly strong growth, and trades at a discount relative to the sector in terms of its FWD PEG ratio, a critical financial valuation metric. Over the last year, CRDO has significantly outperformed both the broader market and the technology sector, delivering an astounding 207% return. With projected revenue growth exceeding 100% for FY25, CRDO appears well-positioned to deliver through 2025 and beyond.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.