- Published on

[EAT] Back For Seconds

- Authors

- Name

- Perpetual Alpha

Summary

- Driven by superior growth and profitability, this Alpha Pick has surged 188% since its April 1, 2024 addition to the Alpha Picks portfolio, and has rallied 12% YTD.

- The stock’s growth and profitability are better today vs. six months ago on the back of comparable restaurant sales that surged 27% driven by successful marketing and expanded customer traffic.

- Restaurant operating margins expanded significantly to 19.1% despite industry headwinds, elevating this company from its competitors.

- This stock has received a unanimous Wall Street endorsement with 20 upward EPS revisions in the past 90 days and zero downward, bolstering its phenomenal momentum.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +120% versus +43%, with six Alpha Picks soaring more than 100% since their addition.

Business Overview

Brinker International, Inc. (EAT) continues to build on its success as one of Alpha Picks’ top-performing stocks, showcasing a phenomenal earnings season in Q2 FY2025. Alpha Picks initially selected EAT for the portfolio just over a year ago at $51.25 per share, and today, EAT is currently trading at $147.64, totaling a return of 188%. Why choose a stock that has already outperformed the S&P 500 by nearly 20% YTD? Alpha Picks’ buy criteria uses a data-driven process, allowing ‘Strong Buy’ rated stocks to be re-selected after one year. Alpha Picks follows a GARP (Growth at a Reasonable Price) strategy. When a stock has been in the portfolio for at least one year achieves a Quant Score higher than other stocks that have held a Strong Buy rating for 75 days, our systematic model selects the GARP stock with the strongest Quant Score. Brinker International just achieved this status in the Alpha Picks model. Notably, Brinker was also recently recognized by Morgan Stanley as an attractive small-cap stock due to its high ROE and momentum characteristics, underscoring the importance of these attributes for future performance.

Alpha Picks has a strong track record regarding stocks that have been re-selected for the portfolio. Modine Manufacturing Company (MOD) delivered an incredible 348% from when it was initially selected in December 2022, and more than 50% since it was re-picked in January 2024 until it was closed in February of this year.

Brinker offers no-frills casual dining for cost-conscious consumers and is the holding company behind popular franchises like Chili’s® Grill & Bar, Maggiano’s Little Italy®, and It’s Just Wings®. The company is excelling in 2025 due to strong sales growth, particularly with Chili’s, where value-driven promotions like their popular “3 For Me” deal have been highly effective in attracting new customers and improving same-store traffic. Strong cost controls and operational efficiency have become evident in the company’s bottom line with earnings.

"Chili's sales comps accelerated to +31%, driven both by new guests trying Chili's and return guests coming more frequently despite a more competitive promotional environment. These results would indicate we are building a much stronger business for the long term," Brinker CEO Kevin Hochman said in the earnings report.

EAT’s recent earnings results were so compelling that management substantially raised its FY2025 guidance, projecting sales of $5.15B–$5.25B (up from $4.70B–$4.75B) and earnings per share of $7.50–$8.00 (increased from $5.20–$5.50) leading to its share price to notch record-high back in January. Brinker is frequently ranked as the #1 Quant-Rated restaurant stock, while still trading at an attractive valuation and having shown meaningful improvement in its fundamentals since it was first chosen as an Alpha Pick.

Our Buy Thesis

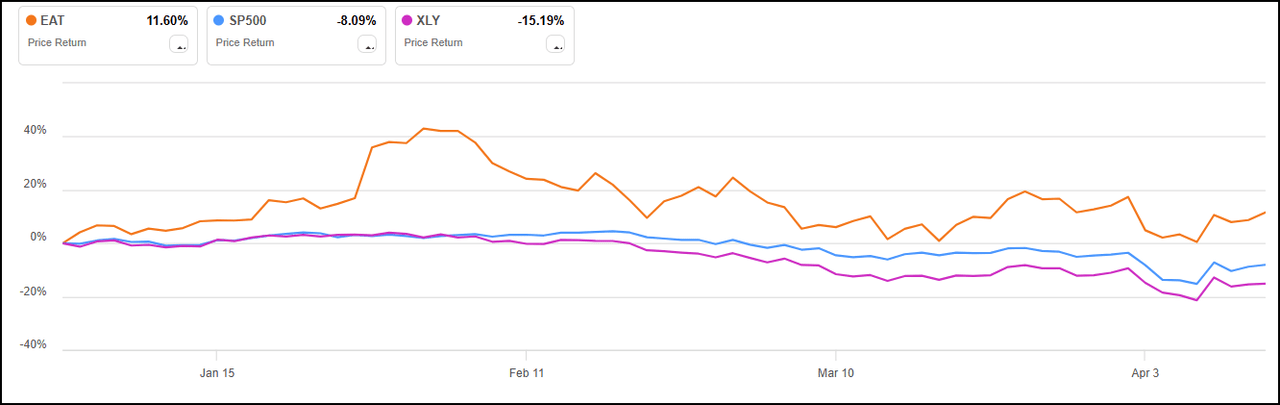

Brinker International has strongly outperformed the Consumer Discretionary sector (XLY) and the broader market year-to-date. This feat is particularly impressive given the backdrop of negative consumer sentiment and macroeconomic uncertainty that has pervaded markets since the start of the year.

EAT Stock is Outperforming the S&P 500 and Consumer Discretionary (XLY) YTD

Despite industry-wide headwinds, Brinker delivered a remarkable 27.4% increase in comparable restaurant sales, notching a new record.

This growth is partially attributed to successful marketing campaigns like the “3 For Me” combo mentioned above and the viral Triple Dipper social media campaign which has brought in a new demographic of customers.

“The investments we have been making over the last 3 years are working. Marketing is doing a great job of bringing guests in and putting Chili's back in culture again. Operation simplification, investments in labor and facility improvements are working to get guests to return. In short, Chili's is broadly relevant again and delivering a guest experience that has restored its leadership position in casual dining,” said Brinker CEO Kevin Hochman.

Margins also expanded significantly, despite the promotional environment, with the restaurant operating margin reaching 19.1%, aided by sales leverage and cost efficiencies.

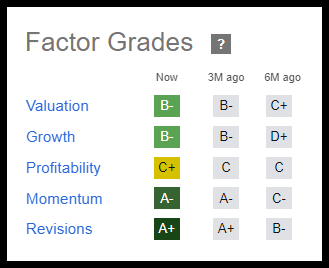

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. A snapshot below showcases EAT’s factor grades when it was initially selected back in March 2024.

EAT Stock’s Factor Grades as of 3/28/24

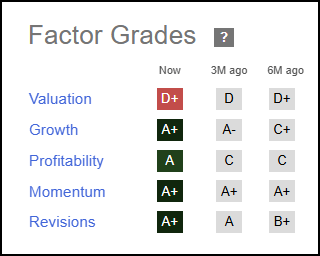

When comparing factor grades since its initial selection, Brinker International’s profitability and growth have shown meaningful improvement, indicating that EAT offers further upside potential and is fundamentally sound compared to the sector. Wall Street analysts have responded to the company’s performance with a unanimous endorsement; the stock has received 20 FY1 Up revisions in the last 90 days versus zero downward. Notably, the stock’s factor grades for growth and profitability are better today vs. six months ago.

EAT Stock’s Factor Grades as of 4/15/2025

This show of confidence has buoyed the stock’s strong price momentum, which is an ‘A+’ grade over the last year.

EAT Stock Growth and Profitability

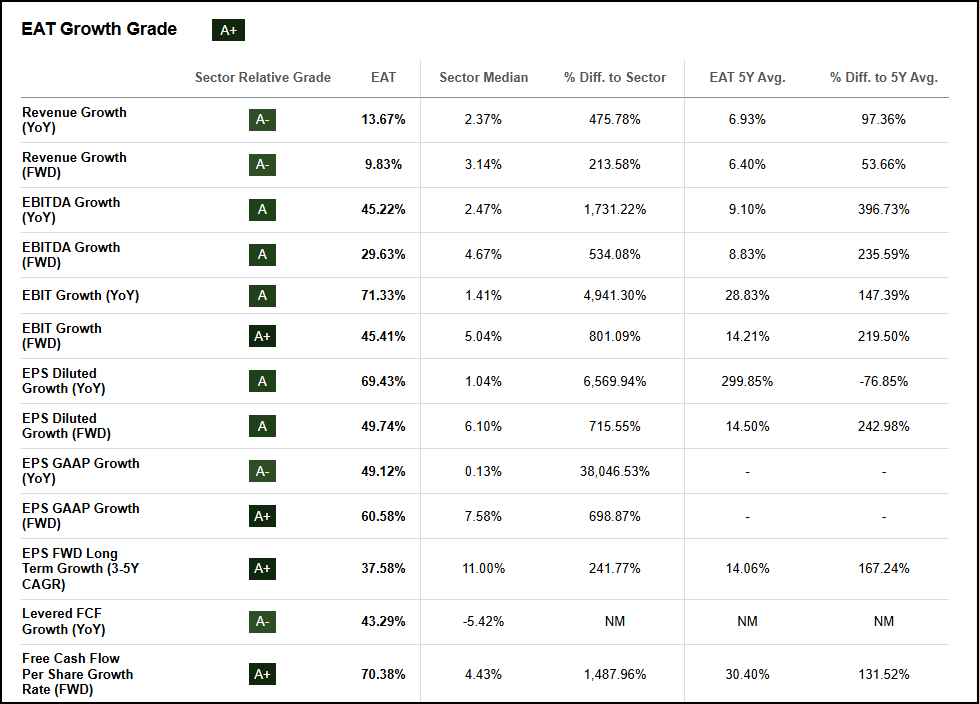

Brinker’s recent financial performance significantly exceeded analysts' expectations, with EPS jumping from $0.99 in Q2 FY 2024 to $2.80 in 2025 and revenue climbing 26% Y/Y to $1.36B. Operational improvements, including menu simplification and investments in kitchen technology, have enhanced efficiency impacting the bottom line. EAT’s operational investments are projected to yield impressive results over the long term , with an EPS FWD Long Term Growth (3-5Y CAGR) that is more than 240% above the sector median.

EAT Stock Growth Grade

Brinker paid down approximately $164M of its debt last quarter, reducing its lease-adjusted leverage ratio to 2.3x. With reduced debt exposure, Brinker has enhanced financial flexibility to weather varying economic conditions and maintain its financial obligations. Additional profitability highlights include a Net Income Margin of 5.45% vs. the sector’s 4.44% and over $550M in Cash from Operations.

EAT Stock Valuation

Brinker’s valuation is a key aspect of its fundamental picture. Despite returning close to 200% since it was originally picked, EAT is still trading at only a slight premium relative to Consumer Discretionary stocks across the majority of its valuation metrics. Brinker offers a 63% discount in terms of its FWD PEG ratio, suggesting that the market has not yet fully priced in the company’s earnings growth potential and is currently trading 23% below its 52-week high.

Potential Risks

Tariff risk remains top of mind for investors, though Brinker is not uniquely exposed relative to its competitors. The National Restaurant Association has raised concerns about the new tariff regime’s impact on the industry:

"Applying new tariffs at this scale will create change and disruption that restaurant operators will have to navigate to keep their restaurants open. The biggest concerns for restaurant operators—from community restaurants to national brands—are that tariffs will hike food and packaging costs and add uncertainty to managing availability while pushing prices up for consumers."

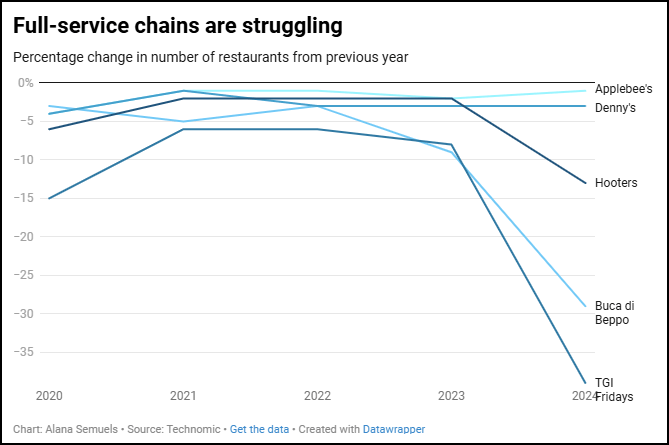

Should the company choose to absorb some cost, this could adversely impact Brinker's profitability. In the same vein, the inflationary impact of tariffs could lead to reduced consumer spending, detracting from Brinker’s top line. Recession risk would also lead to a likely decline in consumer discretionary spending. Restaurants are notoriously low-margin businesses; however, Brinker’s healthy margins and reduced leverage should help it weather adverse impacts from tariffs and economic uncertainty. Additional risks include intense competitive pressure from promotional activity and potential supply chain disruptions also stemming from tariffs.

Concluding Summary

Brinker International continues to impress investors with remarkable performance, returning 188% since being selected by Alpha Picks just over a year ago. The company’s recent earnings showcased exceptional growth with a 27.4% increase in comparable restaurant sales driven by successful, viral marketing campaigns. Operational improvements and cost-efficiencies have expanded restaurant operating margins to 19.1%, while EPS jumped from $0.99 to $2.80 Y/Y. Despite this strong performance, EAT still offers a compelling valuation, with a 63% discounted PEG ratio, and is currently trading at 23% below its 52-week high. Enhancing financial flexibility through debt reduction has bolstered the company’s financial position, enabling it to weather challenges it may face as a result of tariffs.

EAT’s legacy and solid fundamentals offer a positive growth outlook, as evidenced by 20 upward analyst revisions. Seeking Alpha’s Factor Grades and Quant Ratings can help you make tactical investment decisions when picking stocks. Consider Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.