- Published on

[EZPW] Cashing In When Others Cash Out

- Authors

- Name

- Perpetual Alpha

Summary

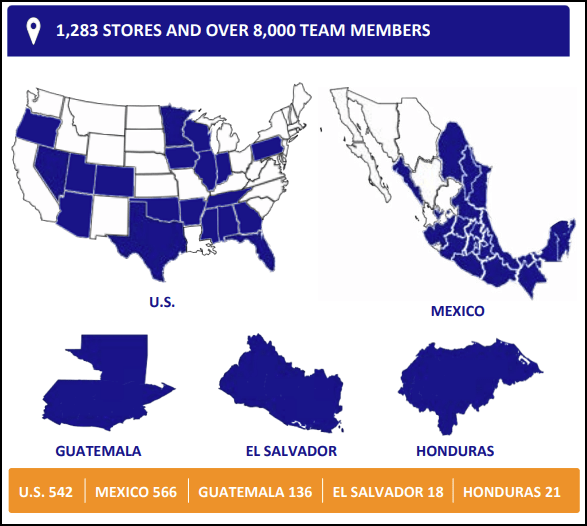

- As a leader in alternative lending solutions, this company operates over 1,200 stores across the U.S. and Latin America.

- Q1 FY25 total revenue surged 10% Y/Y to 282.9M, driven by strong consumer demand and operational execution.

- This company’s online payment collections surged 30% last quarter, with its customer loyalty program driving 77% of transactions, showcasing its commitment to customer engagement.

- Trading at a 73% PEG discount despite a 30% TTM return, Wall Street analysts have shown unanimous confidence in this company’s future prospects.

- The total return of the Alpha Picks portfolio continues to outperform the S&P 500, +126% versus +48%.

Business Overview

Founded in 1989, EZCORP, Inc. (EZPW) is a leading provider of pawn transactions and consumer lending solutions in the United States and Latin America. The company serves underbanked customers through its extensive network of pawn and retail stores, offering alternative financial services that traditional institutions typically do not provide.

EZCORP’s business model centers on two core services:

Pawn lending: Offering collateralized short-term loans using personal property without conventional credit checks

Retail merchandise sales: Selling affordable pre-owned merchandise from forfeited collateral to cost-sensitive consumers

Through its flagship brands, including EZPAWN and Empeño Fácil, EZCORP has gained a prominent market share in the alternative lending space. Recent efforts have centered on enhancing its digital presence, resulting in significant online transaction growth. Through its customer loyalty program, EZ + Rewards, the company has made considerable strides in customer growth and retention, showcasing a commitment to innovation and customer engagement.

Our Buy Thesis

EZCORP has solidified its dominant position in the pawn and pre-owned retail market, as showcased by its record-breaking Q1 FY2025 performance. The company achieved 282.9 million.

Operating a vast network of more than 1,200 stores across the U.S. and Latin America, EZCORP leverages its geographic diversification to drive stability and growth. Its multifaceted expansion strategy combines organic store openings (four new stores were added in Q1 FY25) with a strong M&A pipeline, positioning the company to capitalize on rising demand for expedited cash solutions and affordable second-hand goods.

EZPW saw U.S. online payment collections rise 30% in Q1 FY25, aided by its robust adoption of digital efforts to enhance customer engagement and streamline operations. Initiatives such as the EZ+ Rewards program—accounting for 77% of transactions— demonstrate the company’s successful execution of customer retention efforts.

EZCORP is particularly well-positioned in the current economic climate. With consumers facing rising costs of living and limited credit options, demand for the company's pawn services continues to grow significantly. Simultaneously, more cost-conscious shoppers are turning to affordable, second-hand goods, creating a favorable environment for EZCORP's dual-revenue model of pawn service charges and merchandise sales.

Historically, pawn shops perform very well during difficult economic periods or recessions. They have low-risk business models that are secured by collateral that is easy to recover. Gold prices tend to rise during periods of economic uncertainty, and pawn shops specialize in precious metals. They also tend to benefit as unemployment rises and credit tightens.

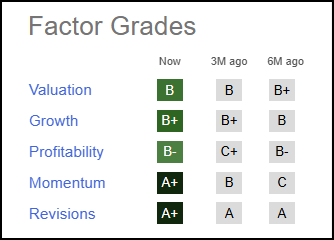

EZPW Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. Compared to the broader financials sector, EZPW exhibits excellent growth, value, and profitability while scoring exceptionally across timeliness indicators, with ‘A+’ Momentum and Revisions grades.

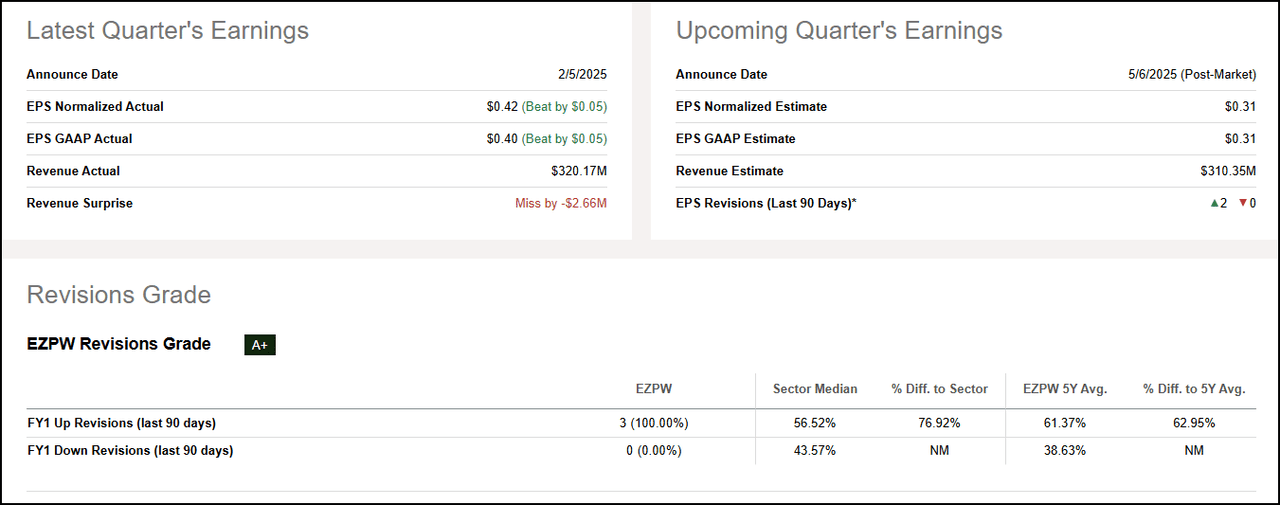

EZPW’s Revisions Grade

In addition to record-breaking revenue, EZPW’s Q1 FY25 success translated to its bottom line, with EBITDA rising 12% Y/Y to 0.42.

The company's solid financial results were driven by strength in its Pawn Loans Outstanding (PLO) segment, which grew impressively by 16% to 192.9 million, while merchandise gross profit grew by 4%. These results have contributed to the company’s ‘B+’ Growth Grade, supported by key metrics like its 37% EPS diluted growth (FWD), which is 284% above the sector median.

In addition to the company’s ‘A+’ Momentum Grade, EZPW’s impressive results across the dual-revenue streams have contributed to analysts’ confidence in its future prospects. EZPW has received three FY1 Up Revisions in the last 90 days, compared to zero downwards.

EZCORP, Inc.’s Financial Valuation

Despite gaining nearly 30% on a trailing one-year basis, EZPW offers considerable value with an overall ‘B’ Valuation Grade. EZCORP trades at a 73% discount in terms of its TTM PEG ratio, as well as a key forward-looking metrics like its 0.65x FWD Price/Sales ratio.

Potential Risks

EZPW faces concentration risk due to the interdependence of its pawn loans and merchandise sales. The company provides short-term loans secured by personal property, and if borrowers default, the collateral is sold as pre-owned merchandise in its stores. This system generates revenue from both lending and retail operations, creating operational efficiency. However, it also introduces concentration risk; any disruption in loan demand or merchandise sales could ripple through its profitability model. Additionally, regulatory risks in the U.S. and Latin America could affect operations, particularly specific laws targeting lending practices. Given the company’s presence in Latin America, currency fluctuations are also a consideration. Competition from local operators or emerging lending fintechs may pressure margins. Lastly, challenges in executing acquisitions or expanding store networks could hinder growth, as evidenced by the recent termination of a key acquisition deal.

Concluding Summary

EZCORP has established itself as a key player in pawn transactions and consumer lending across the U.S. and Latin America. The company's Q1 FY25 results show strong momentum, with total revenue reaching $329.7 million (up 10% year-over-year) and pawn loans growing by 16%. With over 1,200 stores, EZCORP benefits from its broad geographic presence while making significant progress in digital transformation, which has increased online payment collections by 30%. Its dual-revenue model of pawn services and merchandise sales is particularly effective in the current economic environment, where consumers are facing rising costs and more limited lending options. The company's fundamental strength is evident in its exceptional factor grades, particularly growth and profitability, with highlights including 37% FWD EPS growth and a nearly 6% return on total assets. While EZCORP stock has outperformed the sector, it still trades at a discount compared to its peers, offering potential upside for investors.

We have numerous stocks with ‘Strong Buy’ recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into the desired sectors you like. The Alpha Picks Team wishes you the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha