- Published on

[ANF] Abercrombie & Fitch Co. Downgraded To Sell: Removed From AP Portfolio

- Authors

- Name

- Perpetual Alpha

Summary

- Abercrombie & Fitch Co. was added on October 2, 2023, and has returned a solid 47% to the Alpha Picks portfolio since its selection.

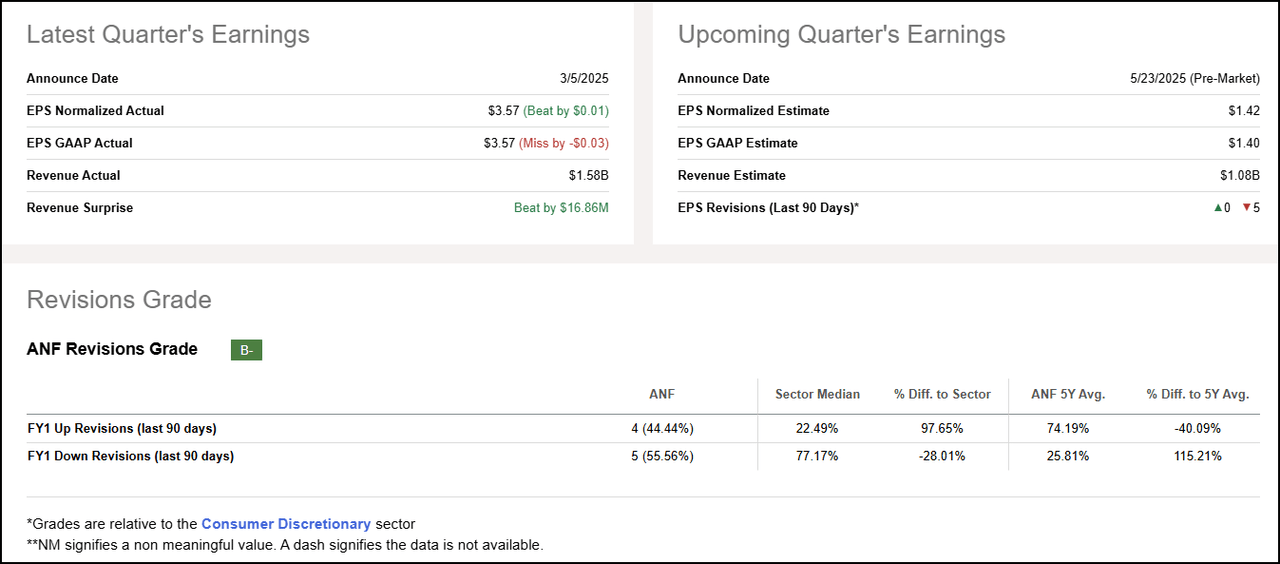

- Despite beating Q4 revenue estimates by nearly $17M, decelerating momentum and declining growth contributed to the stock’s downgrade to a Quant Sell, warranting the close out of its position.

- The company issued disappointing FY 2025 guidance, while higher inventory levels also contributed to a significant drop in projected Q1 EPS compared to consensus estimates.

- ANF has also faced macroeconomic headwinds, with plummeting consumer confidence weakening momentum.

- Since inception, the Alpha Picks Portfolio Total Return has delivered an impressive +134% versus the S&P 500’s +50% with stocks like ANF.

ANF Falls To Strong Sell Rating

Fellow Alphas,

Alpha Pick Abercrombie & Fitch Co. (ANF) is being removed from the Alpha Picks portfolio.

ANF, a prominent American apparel retailer, has delivered an excellent 47% since its initial selection on October 2, 2023. Decelerating momentum, slowing growth, and downward earnings revisions compared to other Consumer Discretionary stocks have caused its Quant Rating to fall to a Sell.

Despite beating revenue and earnings estimates in Q4, ANF’s management issued cautious full-year projections for 2025. The company forecasts a 3-5% net sales growth for the year that falls short of analysts’ expectations, contributing to concerns about slowing growth. Higher inventory levels also contributed to a significant drop in projected Q1 2025 EPS compared to consensus estimates.

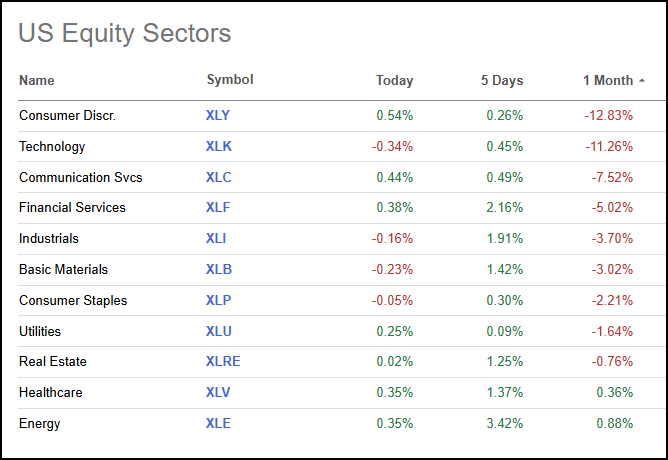

ANF’s disappointing guidance has coincided with a broader climate of plummeting consumer confidence, likely impacting spending habits across the retail sector. As consumers become more cautious, retailers like ANF might face challenges maintaining growth and momentum. The Consumer Discretionary sector (XLY) has been the worst-performing sector over the past month

US Equity Sector Performance

These negative factors have driven five analysts' downward revisions versus four upward revisions in the past 90 days.

ANF Revisions Grade

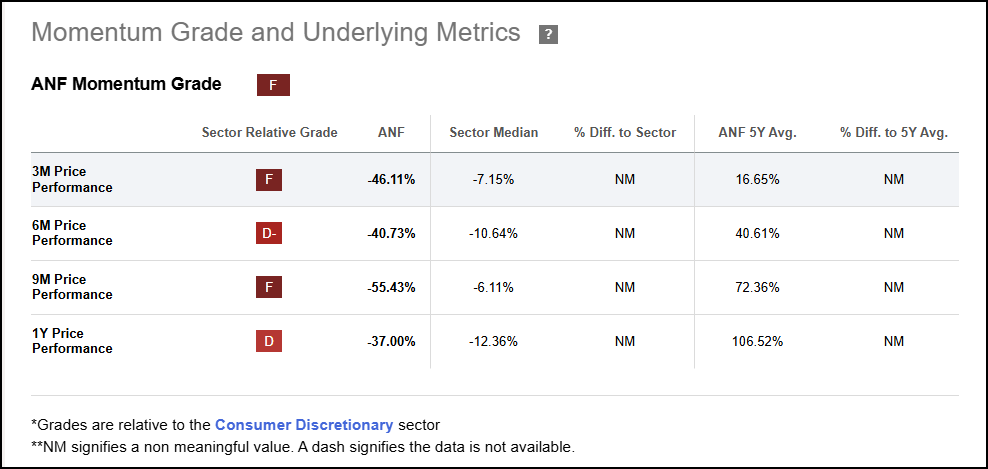

ANF’s disappointing earnings contributed to a substantial decline following the announcement. Deteriorating sentiment around the stock has strongly impacted its more recent price momentum. ANF has returned -46.11% on a trailing three-month basis vs. the sector median of -7.15%.

ANF’s disappointing earnings contributed to a substantial decline following the announcement. Deteriorating sentiment around the stock has strongly impacted its more recent price momentum. ANF has returned -46.11% on a trailing three-month basis vs. the sector median of -7.15%.

ANF Momentum Grade

Alpha Picks is a data-driven process, and while ANF’s valuation and profitability remain solid, we must follow our data-driven process. Stocks are removed when a Quant Rating falls from Strong Buy to Sell. ANF’s declining Growth and Momentum Grades shows signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Sell rating.

Alpha Picks is a data-driven process, and while ANF’s valuation and profitability remain solid, we must follow our data-driven process. Stocks are removed when a Quant Rating falls from Strong Buy to Sell. ANF’s declining Growth and Momentum Grades shows signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Sell rating.

Alpha Picks Selection Process

Alpha Picks adds one stock on the first trading day of every month and the closest trading day on or after the 15th of every month. Stocks that have fallen from Strong Buy to Sell or Strong Sell will be sold. Alpha Picks stocks that remain a Hold for more than 180 days will be sold, and the “cash” generated from the sold position gets equally invested across the remaining stocks in the Alpha Picks portfolio. All dividends are reinvested. As ANF has fallen to a Sell rating, we are closing its positions as an Alpha Picks recommendation. As a friendly reminder, please check out the next Alpha Pick on April 1st and the webinar, where we will discuss ANF’s removal in more detail.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha