- Published on

[ITRN] Tracking Profits While Delivering Yield

- Authors

- Name

- Perpetual Alpha

Summary

- With over two million active subscribers, this company has secured key strategic partnerships to become a global leader in the telematics services industry.

- This company stands out as one of the rare tech stocks offering a substantial 4.35% FWD yield - nearly double the sector median.

- With a 30% ROE and EBITDA margin of 27%, this company demonstrates exceptional profitability dovetailed by 7% revenue growth Y/Y.

- Trading at a -45% discount to the sector in terms of its FWD PEG ratio, this tech company delivers remarkable value despite its market-beating performance.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +180% versus +61%, with eight Alpha Picks soaring more than 100% since their addition.

Company Overview

Founded in Israel in 1994, Ituran Location and Control Ltd. (ITRN) has emerged as a leading provider of telematics services and products. In an increasingly data-driven transportation ecosystem, ITRN has met demand from businesses and individual consumers seeking enhanced security, operational efficiency, and connectivity solutions for individual vehicles and fleets. Since going public in 2005, the company has built its reputation on advanced GPS and cellular technologies that power its core offerings, which include:

- Stolen vehicle recovery services

- Fleet management solutions

- Usage-based insurance telematics

- Connected car platform

Operating via a recurring revenue model based on subscriptions, Ituran has created a stable financial foundation while continuously investing in technological innovation that has contributed to its expanding subscriber base exceeding 2 million active users.

The company has established a strong market presence in Latin America due to its early market entry, local partnerships, and customized solutions addressing region-specific security concerns and fleet management needs. In November of 2024, ITRN penned a five-year contract with Nissan Chile, with Ituran slated to provide Vehicle Location Units (VLU) and telematics services for three Nissan models, potentially adding tens of thousands of vehicles to the company’s subscriber-base. The company has gained industry recognition, highlighting the its excellence in on-time delivery, engineering capabilities, and problem-solving.

Our Buy Thesis

Ituran is the number one Quant-ranked Communications stock and is strategically positioned to capitalize on the growing integration of telematics services in vehicles. The company's total addressable market is expanding rapidly, driven by increasing security concerns, evolving partnerships with Original Equipment Manufacturers ((OEMs)), and emerging opportunities in usage-based insurance. The global automotive telematics market, projected to reach $320.6 billion by 2030 with a compound annual growth rate (OTC:CAGR) of 28%, underscores the significant opportunity for Ituran to expand its footprint.

Ituran’s technological leadership has proven to be widely applicable, with emerging use cases with the potential to further diversify the company’s revenue stream. Last April, ITRN partnered with Microsoft (MSFT) and Porsche (OTCPK:POAHY) to introduce real-time data telemetry technology to the Porsche Carrera Cup motor race series, enabling Porsche engineering teams to make informed decisions during races. This partnership showcases ITRN’s ability to broaden its reach across industries and applications for connected-car solutions

The company offers an established, diversified geographic presence across predominantly across Israel, Brazil, and other markets mitigating risks associated with a single market while enabling growth in multiple regions.

Ituran is demonstrating steady growth across its operations while successfully expanding its subscriber base and geographic footprint. The company maintains strong financials with consistent dividends and solid cash generation, positioning it well for shareholders. Strategic partnerships and ongoing discussions with major automotive manufacturers point to continued growth opportunities and improving profitability in the years ahead.

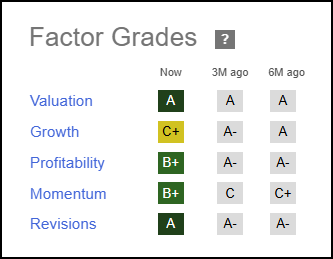

ITRN Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. ITRN exhibits excellent fundamentals compared to the broader IT sector, while also scoring favorably across timeliness indicators, with an ‘B+’ Momentum grade and an ‘A’ EPS Revision grade.

ITRN Stock Growth and Profitability

Ituran delivered solid Q3 2024 revenue of $83.5M, representing a 3% Y/Y increase in USD terms, while achieving 7% growth in local currency terms. Product revenues were particularly strong, climbing 14% Y/Y driven by accelerating demand for the company’s hardware solutions.

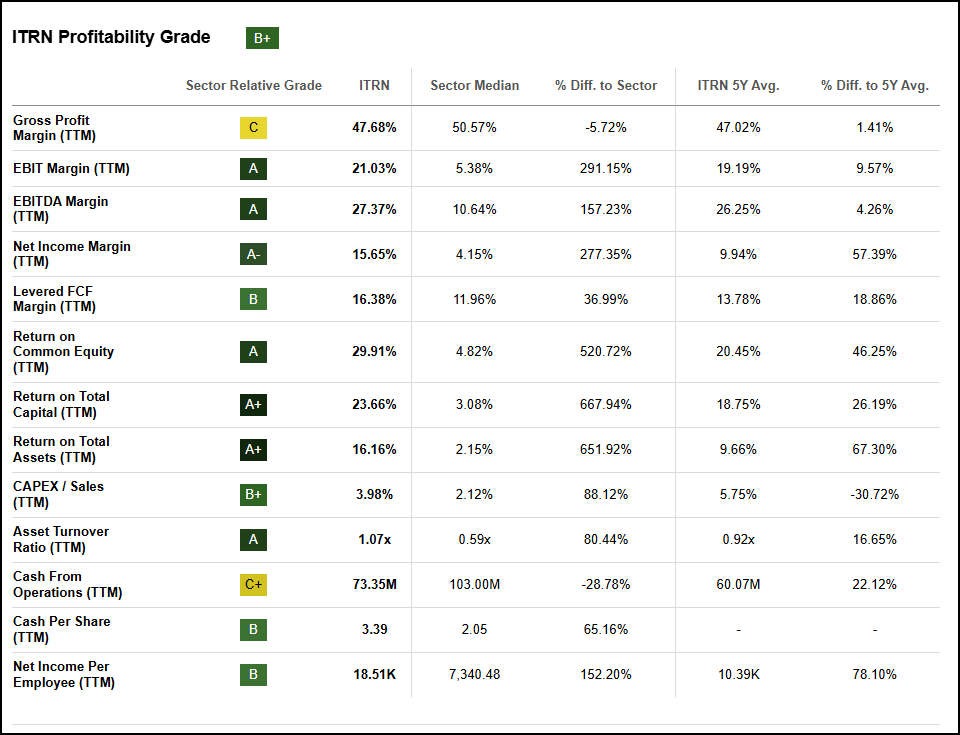

ITRN stands out as a remarkably solid company due to its exceptional net cash position of $67.M with virtually no debt. This is an anomaly in the tech sector where leveraged growth is the prevailing approach. ITRN strengthened its profitability in Q3 2024, with net income growing 9% Y/Y in USD terms. Operating margin expanded significantly from 20.8% to 22% Y/Y. ITRN’s B+ profitability grade is highlighted by its incredible 30% ROE and TTM EBITDA margin which are 521% and 157% above the sector median respectively.

ITRN Profitability Grade

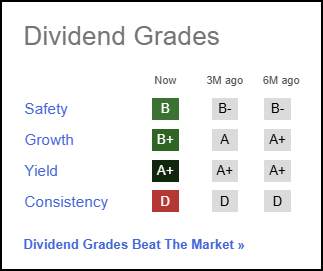

ITRN Dividend Profile

ITRN's operating cash flow reached $17.2M for the quarter, enabling the company’s ‘A+’ FWD dividend yield of 4.35%, nearly 200% above the sector median. ITRN, which was selected as a Top 10 Dividend Stock for 2025, also showcases exceptional dividend safety and growth which are critical considerations for income-focused investors.

ITRN Dividend Scorecard

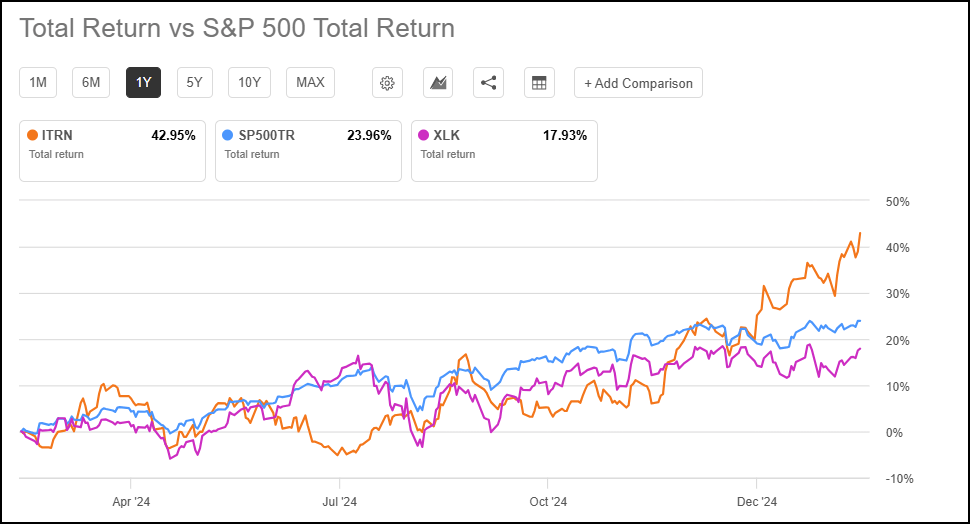

The company has delivered an incredible 43% in total return over the past year, compared with the Technology sector’s (XLK) 18% and the S&P 500’s 24%. The gains have contributed to the company’s ‘B+’ Momentum grade.

Ituran Location and Control Ltd. (ITRN) vs. The Technology Select Sector SPDR® Fund ETF’s (XLK) vs. S&P 500 1-year Trading Chart

ITRN Valuation

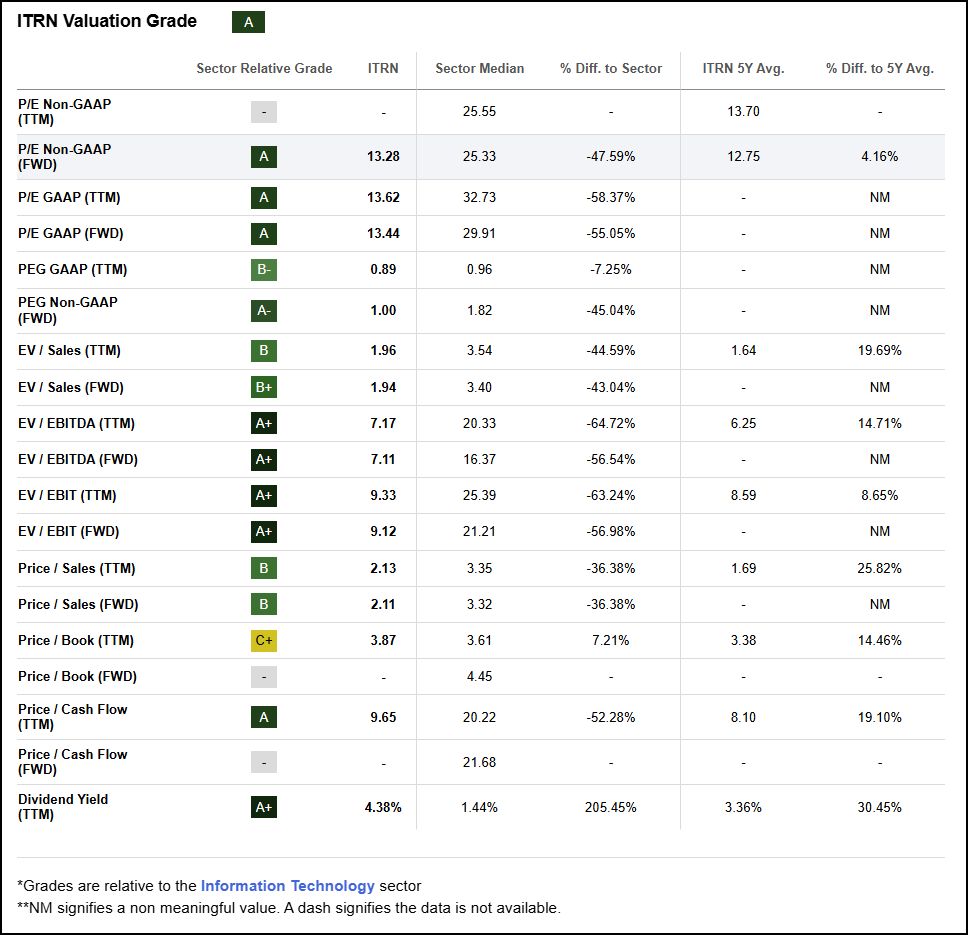

ITRN sports a very attractive valuation, despite its massive gains on a trailing one-year basis. The company is trading at a -45% discount relative to the IT sector in terms of its FWD PEG Ratio, while its TTM Price/Cash Flow stands at 9.7x vs. the sector’s 20x.

ITRN Valuation Grade

While many tech companies have commanded lofty valuations in recent years, ITRN stands out as an exception, presenting an attractive opportunity as the market is yet to price in its exceptional fundamentals.

Potential Risks

Ituran’s most pressing risk is a potential data breach, compromising sensitive location data and potential regulatory changes affecting privacy laws. Competitive pressures from new market entrants, supply chain disruptions, increased global trade tensions, and exchange rate fluctuations all have the potential to impact the company’s bottom line. The company is also exposed to possible disruptions from geopolitical instability in the Middle East, which could have an impact on operations.

Concluding Summary

Ituran Technology Group Holding Ltd has emerged as a leading player in the telematics services space, establishing itself as the #1 Quant-ranked Communications stock and the #15 overall Quant-ranked Information Technology stock. The company’s strategic focus on vehicle location technologies are increasingly in demand for a wide range of applications.

ITRN displays exceptional fundamentals, particularly impressive profitability with a 30% ROE and expanding operating margins. The company trades at a -45% discount relative to the IT sector in terms of its FWD PEG ratio. Over the last year, the company has significantly outperformed both the broader market and technology sector. ITRN is a rare tech stock offering 4.35% dividend yield, alongside excellent dividend safety and growth, which are critical considerations for income-focused investors.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.