- Published on

[WFC] Banking Behemoth Breakout

- Authors

- Name

- Perpetual Alpha

Summary

- Increasingly unburdened by regulatory challenges, this financial giant stands as America’s third-largest bank, with $1.9T in assets.

- Profitability remains exceptional, with 18 consecutive quarters of earnings beats and 11% Y/Y EPS growth.

- This bank sports a robust 11.1% CET1 ratio, providing a solid cushion against economic headwinds and flexibility for growth.

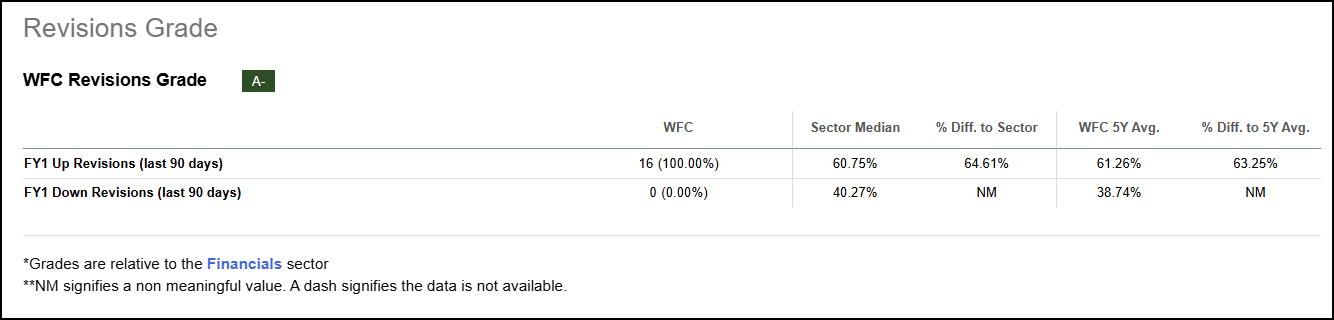

- Analysts have shown overwhelming confidence in this stock, with 16 upward revisions in the last 90 days versus zero downward.

- The total return of the Alpha Picks portfolio continues to outperform the S&P 500, +148% versus +57%, with six Alpha Picks soaring more than 100% since their addition.

Business Overview

Wells Fargo & Company (WFC) is one of America’s largest Financials and is the #2 Quant-ranked Diversified Bank stock. Serving nearly 70 million customers across more than 5,000 branches, WFC is ranked as the third-largest bank in the U.S., with $1.9T in consolidated assets. The company operates through four main segments:

- Commercial Banking

- Corporate and Investment Banking

- Wealth & Investment Management

- Consumer Banking and Lending (its largest revenue driver)

WFC provides a wide range of banking, investment, and lending products to consumers, businesses, and institutions. The company’s growth strategy is multi-faceted, having made significant investments in tech and digital platforms while simultaneously upgrading its lending capabilities and risk systems. By allocating more budget to marketing efforts and hiring relationship managers, Wells Fargo is focusing on cultivating its Corporate and Investment Banking segment and increasing its market share.

WFC has experienced regulatory challenges that have impacted the company’s growth and profitability. However, the bank has been making huge strides in addressing regulators’ concerns; WFC has closed 10 consent orders since 2019, with four remaining. In the company’s Q4 earnings call, Wells Fargo CEO Charlie Scharf noted:

“Our operational risk and compliance infrastructure is greatly changed from when I arrived and while we are not done, I'm confident that we will successfully complete the work required in our consent orders and embed in operational risk and compliance mindset into our culture.

WFC increased its dividend by 15% and repurchased over $20B in common stock in 2024. With 25 consecutive years of dividend payments, Wells Fargo has demonstrated a reliable commitment to shareholder value through its distributions.

Our Buy Thesis

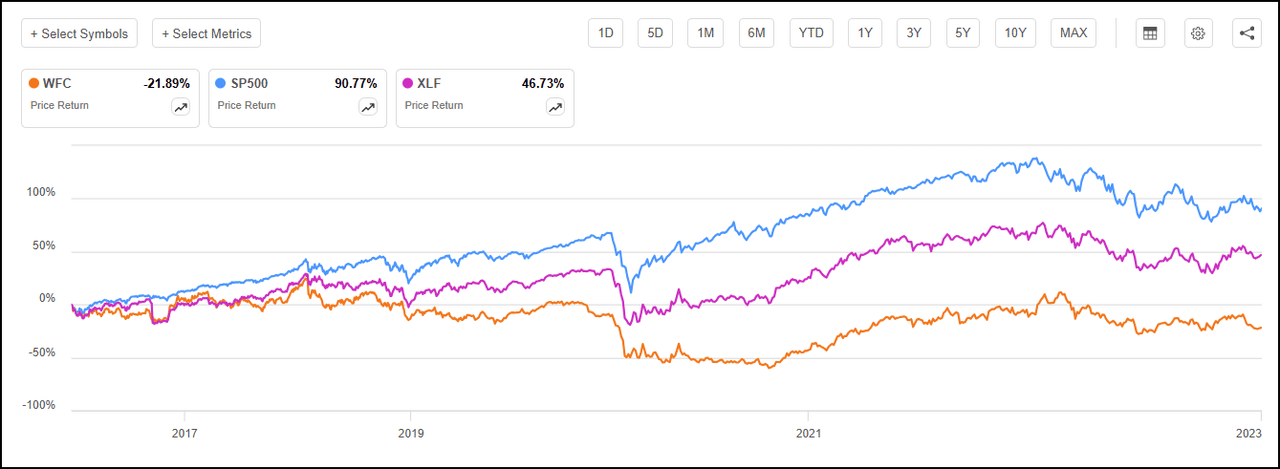

WFC is on the precipice of turning a corner with respect to its legacy regulatory challenges. Stemming from revelations around the creation of fraudulent accounts between 2011 and 2016, WFC has been subjected to multiple enforcement actions over the past several years. In 2018, the Federal Reserve imposed an asset cap of $1.95T. In addition to reputational damage, these actions put significant downward pressure on WFC’s share price in the years when the bulk of the actions were enforced.

Wells Fargo Corporation. (WFC) vs. (XLF) - Financial Select Sector SPDR Fund ETF vs. the S&P 500 January 1, 2016–December 31, 2022

However, the tide is turning for WFC. The company has closed numerous consent orders, leading to optimism that its asset cap could be lifted as early as H1 2025. Lifting the restriction would give the bank expansive flexibility to grow its balance sheet and pursue new business. This regulatory progress has allowed WFC to redirect critical resources from remediation to growth, particularly in corporate and investment banking. The growth was evident in WFC’s stellar performance in 2024, with share prices climbing over 40%, significantly outpacing both the sector and the broader market.

Wells Fargo Corporation. (WFC) vs. (XLF) - Financial Select Sector SPDR Fund ETF vs. the S&P 500 Trailing One-Year Return

Other strategic initiatives are bearing fruit, with its credit card business showing strong momentum; WFC has launched 11 new cards since 2021, with 2.4M new accounts and growing card spend in 2024. The company recently announced partnerships with Audi and Volkswagen as their preferred purchase finance provider starting in April 2025.

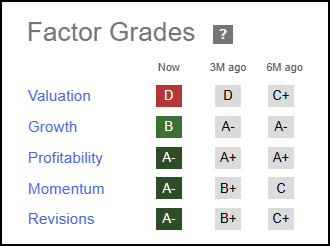

As showcased in the Seeking Alpha Factor grades, which rate investment characteristics on a sector-relative basis, WFC’s grades indicate that it has excellent potential and is fundamentally sound compared to other financials. Its ‘A-’ Profitability grade, bullish momentum, and ‘A-’ Earnings Revisions highlight WFC as a profitable company with solid growth prospects.

WFC Stock Factor Grades

Wells Fargo & Company Growth & Profitability

Robust fee-based revenue helped propel Wells Fargo’s solid growth and profitability in 2024, with net income reaching $5.1B and adjusted EPS climbing 11% Y/Y. While the company missed revenue estimates, WFC has delivered 18 consecutive quarters of earnings beats. This feat was particularly impressive in Q4, as the company successfully offset a decline in interest income. WFC sports a FWD diluted earnings growth of 12.7%, more than 30% above the sector median, coupled with exceptional cash from operations of $3.04B.

Another measure of Wells Fargo’s solid financial positioning is its impressive CET1 ratio of 11.1%. This capital cushion provides Wells Fargo with resilience against potential economic headwinds and the flexibility to pursue strategic growth initiatives. Analysts are increasingly taking notice of WFC’s financial fortitude; the company has received an exceptional 16 FY1 up revisions in the last 90 days, versus zero downward.

WFC Earnings Revisions Grade

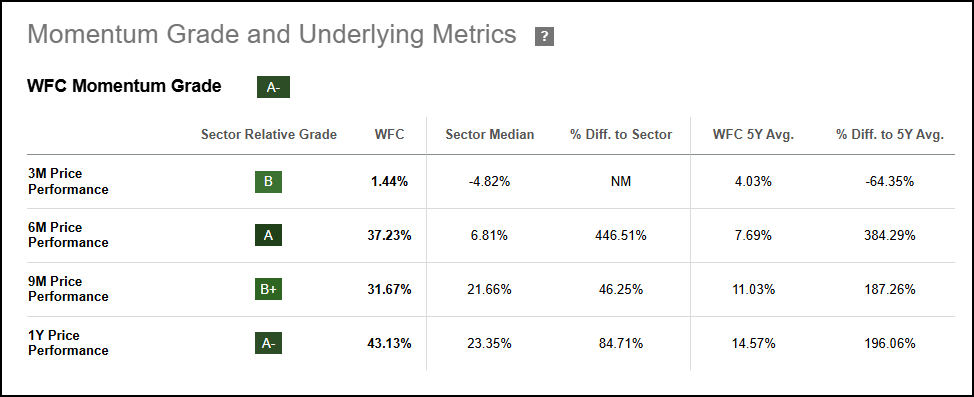

Wall Street’s bullish projection has contributed to the stock’s excellent momentum, which ranks well above the sector median, quarterly.

WFC Momentum Grade

Wells Fargo & Company Financial Valuation

WFC’s strong gains over the last year have diminished its overall valuation. However, the stock trades broadly in line with the sector across most of its underlying metrics. When examining its FWD PEG ratio, a combination of a stock’s potential growth relative to its current valuation, we see the stock trading at a 12% discount to the financial sector.

Potential Risks

As a financial services company, Wells Fargo is particularly vulnerable to economic headwinds, such as slower GDP growth and moderating consumer spending in 2025. The financial sector has seen a stabilization in credit card delinquencies, but lending has slowed to some degree, which could impact WFC’s performance. Increased regulatory scrutiny will remain a top risk for WFC, with the possibility that its asset cap is not lifted which could constrain long-term growth prospects. Cybersecurity and privacy breaches also rank among the top risks for the bank.

Concluding Summary

Increasingly unburdened by its previous regulatory challenges, Wells Fargo’s focused growth initiatives have helped the stock surge over 40% in the last year. The company has demonstrated a strong track record of operational excellence and prudent financial management, with 18 consecutive earnings beats and an excellent CET1 ratio of 11.1%. Strategic partnerships and burgeoning growth in its credit card segment position WFC for future growth in 2025.

Trading at a solid discount in terms of its FWD PEG ratio, with tremendous profitability and upward analyst revisions, this company is on solid footing in terms of its fundamentals and important timeliness indicators. The potential for removing its asset cap could help catapult WFC in 2025.

We have numerous stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you the best in your investment journey. Happy investing.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.