- Published on

[MHO] Could Second Time Around Be Twice As Good?

- Authors

- Name

- Perpetual Alpha

Summary

- Alpha Picks portfolio total return hit an all-time high on 12/14/23, +62.39% versus the S&P 500’s 24.67%, with four Alpha Picks rallying more than 100% since their addition.

- Up more than 235% since its October 3, 2022 addition to the AP portfolio and record Q3 2023 revenue, AP is reintroducing a pick for the first time.

- Despite surging mortgage rates, slowing real estate demand, and market uncertainty, one of the nation’s leading homebuilders still ranks among our top two Alpha Picks.

- Showcasing why momentum investing remains a successful strategy, this pick remains bullish and has excellent fundamentals, a diversified geographic footprint, product, and service offerings, and a strong balance sheet.

Business Overview

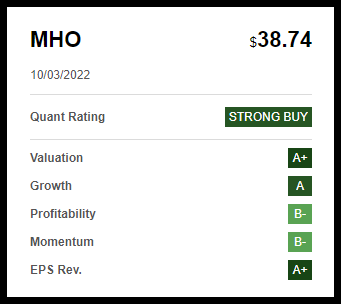

Despite affordability and macro headwinds, surging mortgage rates, and market uncertainty, M/I Homes’ tremendous fundamentals, as snapshot by the below Quant Ratings and Factor Grades, nailed this homebuilder as a Strong Buy.

MHO Stock’s Quant Rating and Factor Grades as of market close on 10/03/22

MHO Stock’s Quant Rating and Factor Grades as of market close on 10/03/22 (SA Premium)

A Top 10 Stock for the second half of 2023, M/I Homes, Inc. (MHO) continues to build on its success. Alpha Picks initially selected MHO for the portfolio on October 3, 2022, at $36.23 per share. At the market close on October 3rd, MHO was trading at $38.74 and has maintained bullish momentum, currently trading at $123.67 per share, a return of +235% since its addition!

So, why choose another stock trading at its 52-week high? We shared Alpha Picks’ case for Momentum Investing yesterday and will outline below why MHO remains a top pick.

With its subsidiaries, MHO is one of the leading single-family homebuilders in the United States. It offers design, construction, marketing, and sale of homes, plus the origination and selling of mortgages and title services. With demand increases, year-over-year decreases in cancellation rates, and key strategies for growing market share across the U.S., MHO is focused on financial strength. Posting record earnings despite significant headwinds, MHO President and CEO Robert Schottenstein said it best during the Q3 Earnings Call:

“We want to continue to maintain our momentum. We think the underlying demographics in our industry, as you pointed out, as much as anyone has, frankly, are very strong, with household formations, millennial homeownership rates increasing incredibly low levels of inventory of existing homes. We know things are by no means perfect. We know there's still inflation. We know rates are in an unsteady state. But we're bullish on the homebuilding industry, and we're bullish on M/I Homes.”

Our Buy Thesis

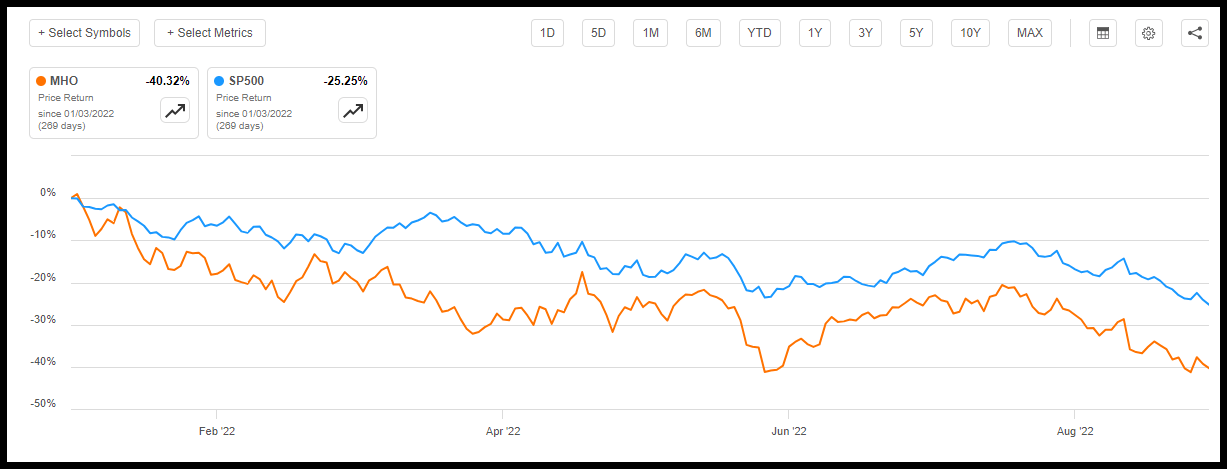

Alpha Picks first selected MHO amid extreme declines within the homebuilder industry when its price-return was down 40.32% YTD in October 2022 versus the S&P 500’s 25.25% for the same period, an ‘early pain’ equals ‘early gain’ opportunity.

MHO vs. S&P 500 YTD Price Performance (January 1, 2022 through September 30, 2022)

MHO vs. S&P 500 YTD Price Performance (January 1, 2022 through September 30, 2022) (SA Premium)

Although investor sentiment was low, the MHO has resulted in incredible results for the Alpha Picks Portfolio and is our second-best performing Alpha Pick, up 235%. Although many homebuilders and homebuilding-related stocks have fallen, MHO and those with solid fundamentals continue to post strong earnings and results.

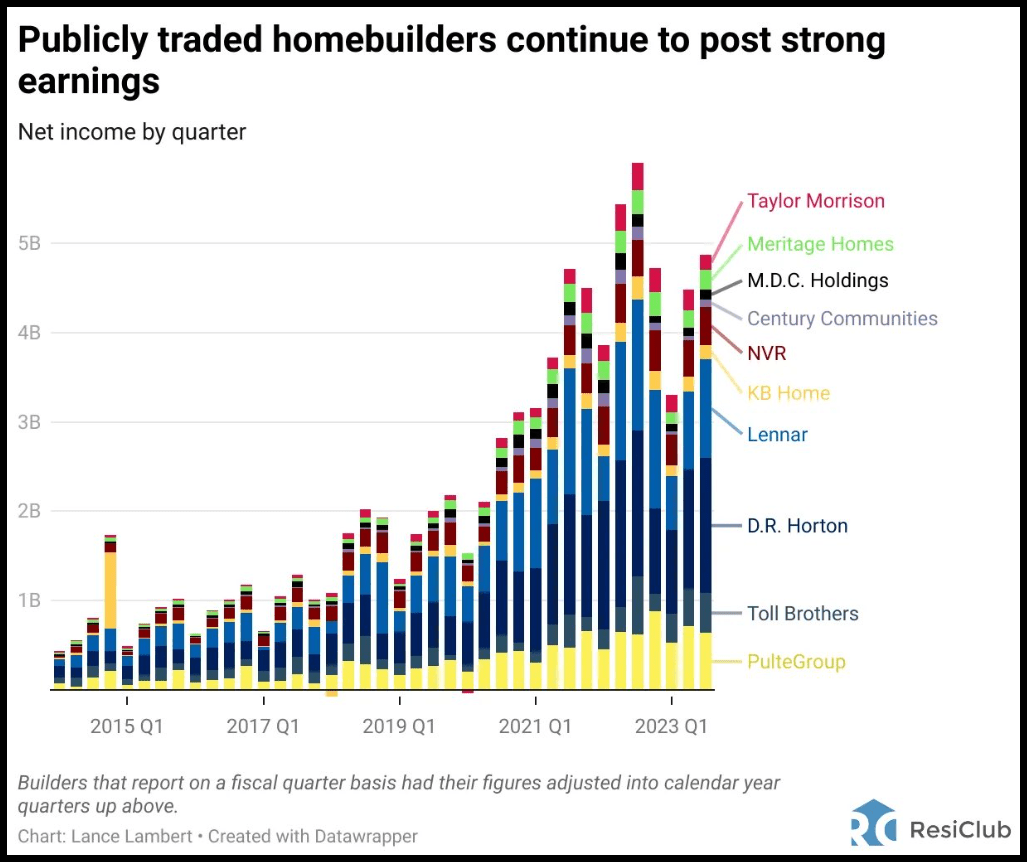

Many homebuilders with solid fundamentals continue to surge despite macro headwinds.

Many homebuilders with solid fundamentals continue to surge despite macro headwinds. ( ResiClub, Lance Lambert @NewsLambert, Twitter)

Mortgage applications have fallen to lows, resulting in stocks experiencing pullbacks within the industry. In the September Alpha Picks Portfolio Review, we highlighted Alpha Picks stocks within homebuilding and related sectors that fell from Strong Buy ratings to Buy and Hold – MHO included. Hold does not mean sell.

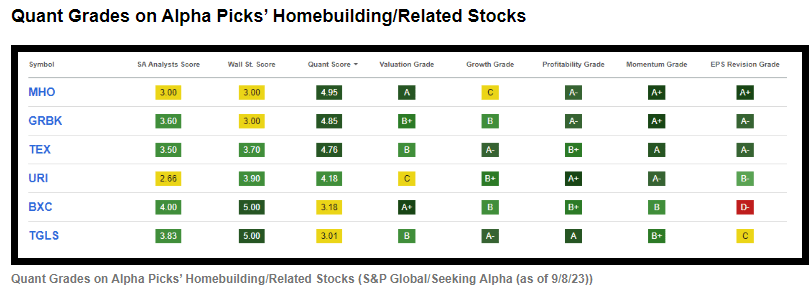

Quant Grades on Alpha Picks' Homebuilding/Related Stocks (S&P Global/Seeking Alpha (as of 9/8/23))

As you can see from the table, MHO dropped from a Quant Strong Buy to Hold amid negative sentiment surrounding homebuilding and related stocks. However, the negative sentiment created potential opportunities for some long-term buy-and-hold investors. According to SA Quant Ratings, MHO’s fundamentals remained strong, and improvements in metrics resulted in the rating returning to Strong Buy again, our Alpha Pick, currently ranking #1 out of 24 in its industry.

Green Brick Partners, Inc. (GRBK) is another homebuilder that fell from Strong Buy to Hold. We addressed many of your questions and comments, and as you can see from our AP update, GRBK has rallied back strong as one of the best-performing picks over the four weeks in November.

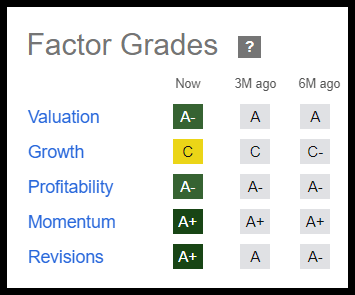

MHO is currently ranked #1 out of 24 in its industry and #9 out of 536 in the consumer discretionary sector. MHO’s Factor Grades rate investment characteristics on a sector-relative basis.

MHO Stock Factor Grades

MHO’s Growth Grade is solid, complemented by a discounted valuation, tremendous Momentum, Profitability, and EPS Revisions Grades to indicate that the company is a fast-growing homebuilder offering a solid long-term outlook according to Seeking Alpha’s Quant rankings.

MHO’s Growth

Capitalizing on demographic trends, innovation, and favorable economic conditions, MHO’s Smart Series is a money-maker! Given the shortage of affordable housing in the United States, MHO is trying to solve that problem by increasing its community mix exposure to more affordable housing, capitalizing on the trend. Highlighted in the latest earnings call, Schottenstein discusses the expansion and demand for affordable housing.

“55% of our buyers are first-time buyers now...I remember when it was 25%, we said we thought it could get to 30% or 35%. Then, when it got to 35%, we thought it could get to 40% to 45%. Then, when it got to 40% to 45%, we thought it could get to 50% to 55%. It's at 50% to 55% now. We continue to really push with more affordable product. If that continues to stay about that level or even go up a little, fueled by millennials and Gen Zers – which it likely will be – that could also push that Smart Series mix number up…I could see it getting up there to 60% or 65% at some point.”

MHO's affordability nameplate, Smart Series, was approximately 55% of record sales during F3Q23, attracting primarily Millennials, more than 50% of which are first-time buyers. Because the Smart Series offers the most affordable line of homes, it appeals to Millennials, given an average selling price of $481,000, which generates higher margins and better return on investment. Given MHO’s extremely well-run company, looking to build the most profitable company possible, it’s no surprise that the third quarter offered another earnings beat.

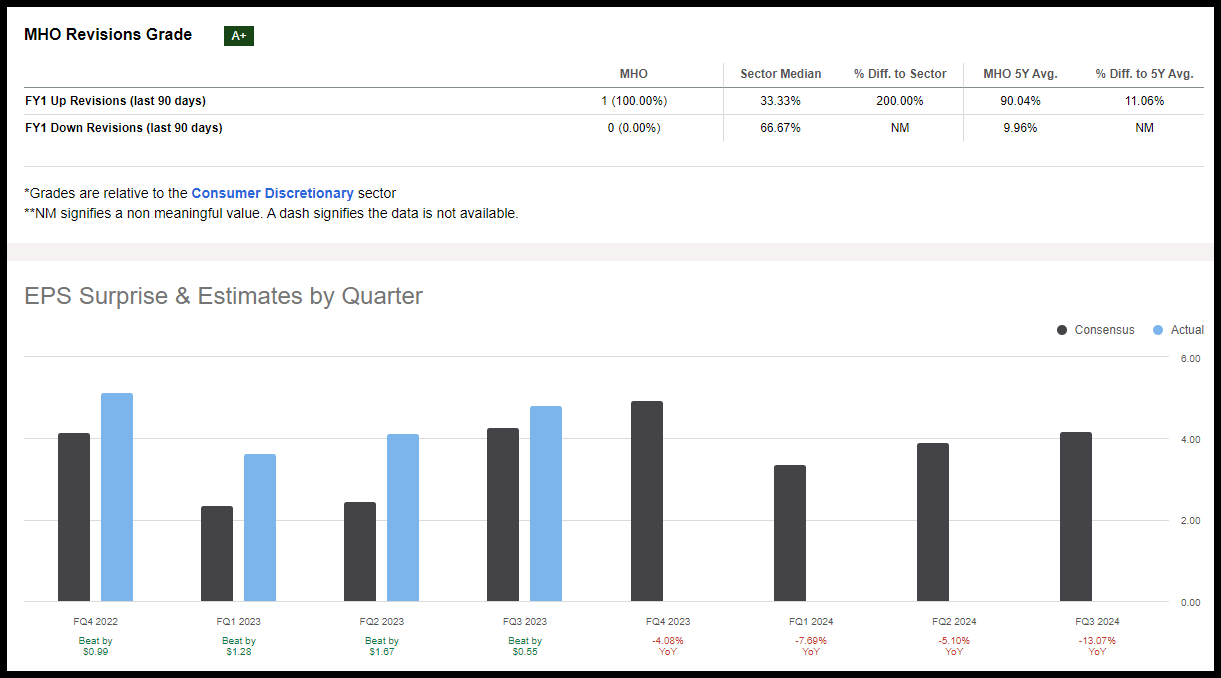

MHO Stock beats Q3 earnings, and analyst revises up

Despite Q3 revenue falling below expectations, MHO increased revenues by 3% to a record $1B. Margins improved by 27%, and EPS of $4.82 beat by $0.55, resulting in another A+ overall revision grade.

MHO delivered 60% of its backlog, a total of 2,096 homes in Q3, for an average backlog sale price of $510,000. Keeping costs flat and generating $185M of EBITDA, MHO is optimistic about the future despite the rising interest rate environment and macroeconomic pressures. MHO’s in-house mortgage and title operations experienced a 25% increase from $7.9M in Q3 2022 and a 17% increase in revenue to $23.6M for the same period. Despite volatility in a rapidly changing market, MHO continues to experience solid financial conditions and new contracts. With the average mortgage amounts increasing, average loan-to-value on first mortgages remaining the same at 82%, and volume of loans sold increasing by 13%, “Our borrower profile remains solid, with an average down payment of almost 18%, and an average credit score of 748, compared to 745 in 2022's third quarter,” said Derek Klutch, President, MHO Mortgage Company.

If you didn’t buy MHO when Alpha Picks Quant Ratings first recommended this Quant Strong Buy trading at $36.23 per share, consider it now while its valuation still highlights a discounted price.

MHO Valuation

According to the Quant Ratings, M/I Homes, Inc. is still highly undervalued, even if you’re anchored to its initial $36.23 share price. The stock has surged +227% since its initial recommendation in October 2022 to the Alpha Picks portfolio. However, it maintains an A- valuation grade, supported by a forward P/E ratio of 6.55x, a -61% difference to the sector. In addition, MHO’s forward EV/Sales and forward Price/Book each come at more than a 50% difference to the sector, highlighting that this stock offers a great price point.

Additionally, MHO is currently buying back shares. The company recently increased its buyback authorization by $100 million, bringing the total authorization to $300 million. To date, they’ve bought back $147 million, so they still have $153 million left in their buyback plan. Although the share price has risen, management believes this is still a good use of shareholder capital and for continued reward.

Potential Risks

Interest rate increases continue to affect mortgage rates and homebuying industries. Mortgage rates topped 8%, causing a slowdown in buying and selling activity. Given budget constraints and higher costs, raw materials like lumber, steel, and other construction supplies can impact homebuilder costs.

Shortages of labor and skilled workers can lead to delays in construction and project timelines, resulting in higher costs for builders. Natural disasters like MHO experienced following Hurricane Ian in Florida led to a 13% decline in deliveries for its Southern region. Rebuilding after a natural disaster can hinder profits and growth, particularly as insurance companies have exited states like Florida.

Concluding Summary

Despite shifts and some headwinds in the housing market, MHO has proven resilient and maintained a solid run as Alpha Picks' first pick – for the second time. Although mortgage rates have risen and some slowing has occurred, many homebuilders with solid fundamentals continue to surge.

MHO continues to be an extremely discounted stock with a strong balance sheet, continued bullish momentum, attractive fundamentals, and a proven track record. MHO has proven a successful stock amid market, sector, and industry declines, falling from Strong Buy to Hold to Strong Buy again. Showcasing why momentum investing remains a successful strategy, consider MHO for a portfolio.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.