- Published on

[MHO] Build Your Portfolio With M/I Homes, Inc.

- Authors

- Name

- Perpetual Alpha

Summary

- Despite a surge in mortgage rates, slowing demand, and market uncertainty, one of the nation’s leading homebuilders still ranks as our top Alpha Pick.

- Offering a diversified footprint across 16 markets with multiple products and services, M/I Homes has a strong balance sheet, conservative leverage, and an ROE of 27% (LTM 6/30/2022).

- While there may still be some downside to the cyclical business, purchasing at or near the bottom has led to incredible upside in the past within this industry.

- MHO capitalizes on pricing competition, limited inventory, and demand within the real estate areas of operation.

- Year-to-date, real estate and housing stocks have been hammered on rising rates, and they may still face some headwinds. MHO is trading at 52-week lows, but it has excellent fundamentals, a strong operating history, and solid bottom-line growth.

Business Overview

Together with its subsidiaries, M/I Homes, Inc. (MHO) is one of the leading single-family homebuilders in the United States, primarily constructing planned and mixed-use communities. Headquartered in Columbus, Ohio, MHO is a homebuilder with Financial Services segments, offering design, construction, marketing, and sale of homes, plus the origination and selling of mortgages and title services.

With key strategies that include growing its market share by expanding into diverse geographies across the U.S., MHO is focused on financial strength. It has developed a Smart Series of more affordable communities with an average selling price of $430,000 to generate higher margins and better return on investment. Smart Series sales for the most recent quarter comprised 50% of the company’s sales, a 10% increase from one year ago. In addition, MHO is committed to ESG by designing communities that help preserve open spaces and aid climate change and green initiatives while focusing on diversity within its corporate governance.

Our Buy Thesis

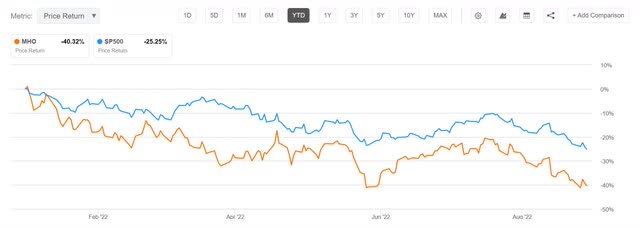

The homebuilder industry is beaten down, as evidenced by MHO’s -40.32% YTD performance compared to the S&P 500’s -25.25% YTD. And while higher mortgage rates and slowing consumer demand pose headwinds for homebuilders, ‘early pain’ equals ‘early gain,’ according to KeyBanc Capital Markets housing analyst Kenneth Zener.

MHO vs. S&P 500 YTD Price Performance

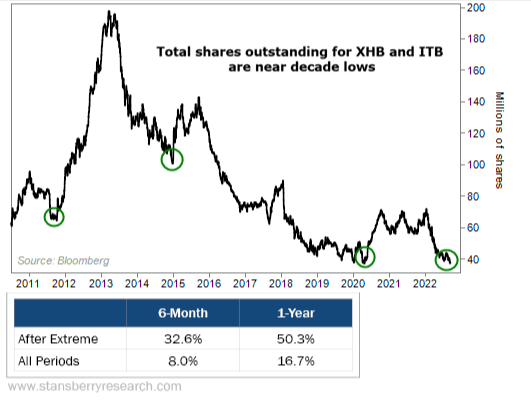

Zener was recently interviewed for his upgrade to homebuilders and bullish stance regarding stocks in the sector. When looking at the total shares outstanding of the sector’s two largest ETFs, SPDR S&P Homebuilders Fund (XHB) and iShares U.S. Home Construction Fund (ITB), since 2010, periods of negative investor pessimism resulted in selloffs. Still, they showcased that homebuilder stocks rallied shortly after. We agree that the relative risk to return for homebuilder stocks is compelling, and Seeking Alpha’s quant ratings support it.

Homebuilder and Construction ITB & XHB Total Shares Outstanding (2010-2022) (Dailywealth.com)

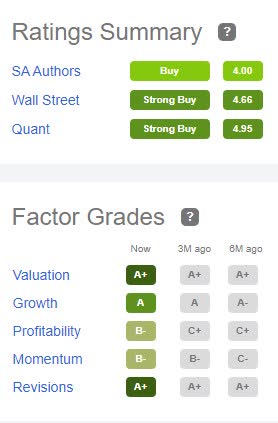

When investor sentiment is low and investors sell off, purchasing at or near the sentiment bottom has led to the incredible upside in the past within this industry. And while past performance is not indicative of future results, there is an opportunity for upside, whether housing is at or near the bottom. Add in that MHO is currently ranked #1 out of 24 in its industry and its factor grades rate investment characteristics on a sector relative basis, MHO’s Growth Grade, Revisions, and Momentum indicate that the company is a fast-growing homebuilder, which offers a solid long-term outlook according to Seeking Alpha’s quant rankings.

MHO Factor Grades & Rankings

MHO’s Growth

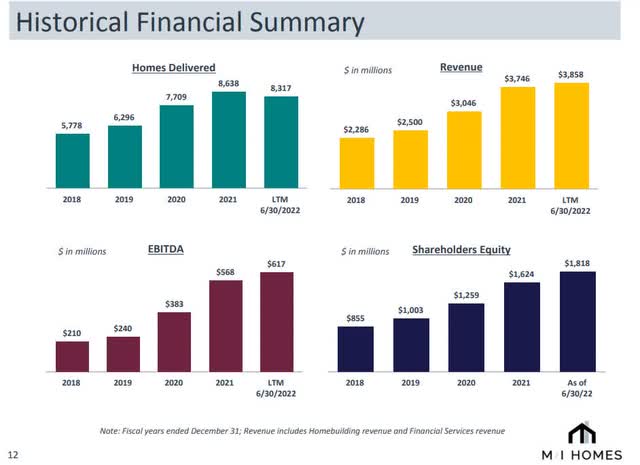

Posting consecutive earnings beats, MHO’s stellar 2022 Q2 results delivered an EPS that outperformed the market’s estimates by 26.5% and resulted in an A+ revision grade on the heels of analyst FY1 Up revisions.

Although revenue of $1.04B missed by $1.55M, the company still reported one of its most profitable quarters ever, with a net profit margin of 13.15%. Additionally, with a significant backlog, sales contributed to the positive results, providing a pretax income of $8.7M for Q2.

As expressed by MHO’s executive leadership, the company has experienced some slowing in housing demand due to the rising interest rate environment and macroeconomic pressures. Despite the uncertainty, the company remains in a strong financial condition.

“We ended the quarter with record shareholders' equity of $1.8 billion, an increase of 24% over last year, book value of $66 per share, cash of $189 million, zero borrowings on our $550 million credit facility, and a homebuilding debt to capital ratio of 28%. Additionally, housing fundamentals remain solid with an undersupply of available homes and favorable demographics. Looking ahead, we believe we are well positioned to manage through these changing and uncertain times given the strength of our balance sheet, low debt levels, record backlog sales value, diverse product offerings, and well-located communities," Robert H. Schottenstein, M/I Homes CEO & President.

Despite volatility in a rapidly changing market, MHO continues to experience a solid financial condition, new contracts and maintains a backlog of inventory. With a record quarterly net income of $137M, gross margins that improved by 220 basis points to 27.3%, and backlog sales from June 30, 2022, that jumped 9% for a Q2 record $2.7B, we believe that the strong buy rating for this stock is warranted, especially at its severely, discounted price.

MHO Valuation

M/I Homes, Inc. is highly undervalued. With a YTD price decline of 40.32%, trading near its 52-week low of $34.42, a housing shortage coupled with high demand provides a solid case for buying MHO at cheap levels. Given its A+ valuation and a forward P/E ratio of 2.20x, MHO trades at a -81.96% difference to the sector. In addition, its forward PEG of 0.04x is an excellent metric because it combines the stock's earnings growth rate with a core valuation metric. It is one of my favorite valuation metrics and showcases that MHO is severely discounted at -96.14% below its sector peers.

Potential Risks

The Fed’s aggressive rate increases are affecting the industry and mortgage rates which topped 7%, causing the economic outlook for the industry to become more turbulent. There may be further declines in sales over the coming months, on the heels of peak prices and sticky inflation. Although the demand for homes is still high, we’re seeing a slowdown in buying and selling.

MHO has experienced a 13% decline in deliveries for its Southern region and an overall 21% decline due to macroeconomic factors that could affect profitability. When you factor in the recent impact of Hurricane Ian on MHO’s Florida communities, we have yet to know what costs the company will incur. To rebuild post-Ian may deliver an added blow to profits and growth, particularly as insurance companies have been exiting Florida. Whether losses will be covered remains to be seen, and to what degree it will have on the industry is to be determined.

Concluding Summary

Despite some shifting in the 2022 housing market, it has maintained a solid run, keeping the U.S. economy resilient, as NAR Chief Economist Lawrence Yun expressed. Although some economic headwinds are predicted, homebuilding stocks can offer solid returns over the long term, even within a rising rate environment.

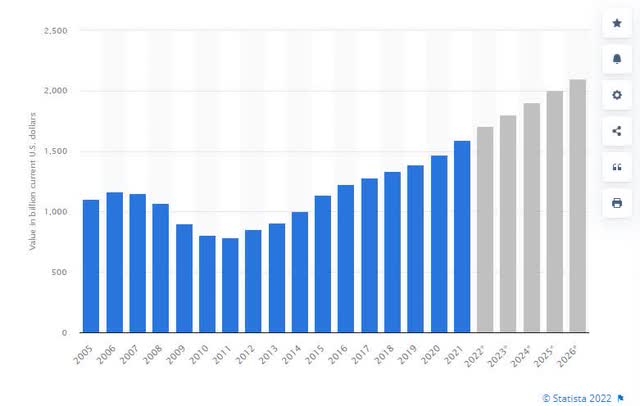

New Construction in the U.S. with forecasts (2005-2026)

Homebuilding and the housing market may have some continued volatility, the chart above offers a snapshot of a key economic indicator: new construction.

Construction spending showcases the health and growth forecasted in the U.S. Although there’s been a slowdown in construction, inventory is limited, allowing prices to remain strong within the housing sector. An extremely discounted valuation and strong balance sheet make MHO’s upside potential, attractive fundamentals, strong buy rating, and track record even more appealing. If you’re looking to invest for the long-term in a sector that’s historically benefitted on the heels of market declines, consider M/I Homes, Inc.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.