- Published on

[PYPL] Payments Pioneer Redefines Digital Commerce

- Authors

- Name

- Perpetual Alpha

Summary

- With over 420M active accounts and processing $1.53T in payment volume in 2023, this company is a dominant force in digital payments.

- This fintech has strategically transformed from a pure-play payments provider to a comprehensive commerce platform, showing early success with 2H 2024 initiatives.

- Total payment volumes grew 9% in Q3, revenue climbed 6%, and EPS jumped an incredible 22% in the same period.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +166% versus +54%, with nine Alpha Picks soaring more than 100% since their addition.

Business Overview

PayPal Holdings, Inc. (PYPL) has connected merchants and consumers since 1998 and is the #2 Quant-ranked Transaction & Payment & Processing Services stock. Formerly known as Confinity and co-founded by Silicon Valley titan Peter Thiel, PYPL’s core business revolves around facilitating digital payments and simplifying commerce experiences. Confinity later merged with X.com, an online banking company founded by Elon Musk in 2000. The combined company was renamed PayPal in 2001 and went public in 2002 before being acquired by eBay, Inc. (EBAY) later that year. In 2015, eBay spun off PayPal into an independent, publicly traded company. The PayPal platform offers a wide range of services, including:

- Payment processing for online and mobile transactions.

- Peer-to-peer payments through PayPal and Venmo.

- Buy Now, Pay Later solutions.

PayPal holds roughly 45% of the global payments market share, stemming from a massive user base of over 420 million accounts and its adoption by about 36 million merchants across roughly 200 countries. As a first-mover in digital payments, PYPL is a fintech company with extremely high brand awareness.

In 2024, PayPal debuted several new AI-driven innovations to enhance customer experience. This is consistent with PayPal’s strategic focus, which has shifted towards creating an end-to-end platform that spans the whole commerce experience beyond just payments.

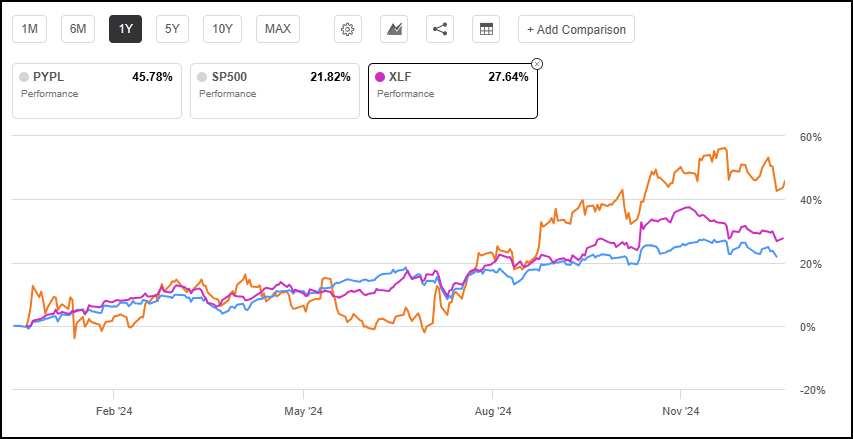

The PayPal Holdings, Inc. (PYPL) vs. Financial Select Sector SPDR® Fund ETF (XLF) vs. S&P 500 1-year Trading Chart

The company benefits from multiple market trends, including the ongoing shift to digital payments and the continued growth of e-commerce. In 2023, PYPL processed $1.53 trillion in total payment volume, flexing its dominant market position and yielding an incredible amount of data that provides PYPL strategic insights to strengthen its product set.

Our Buy Thesis

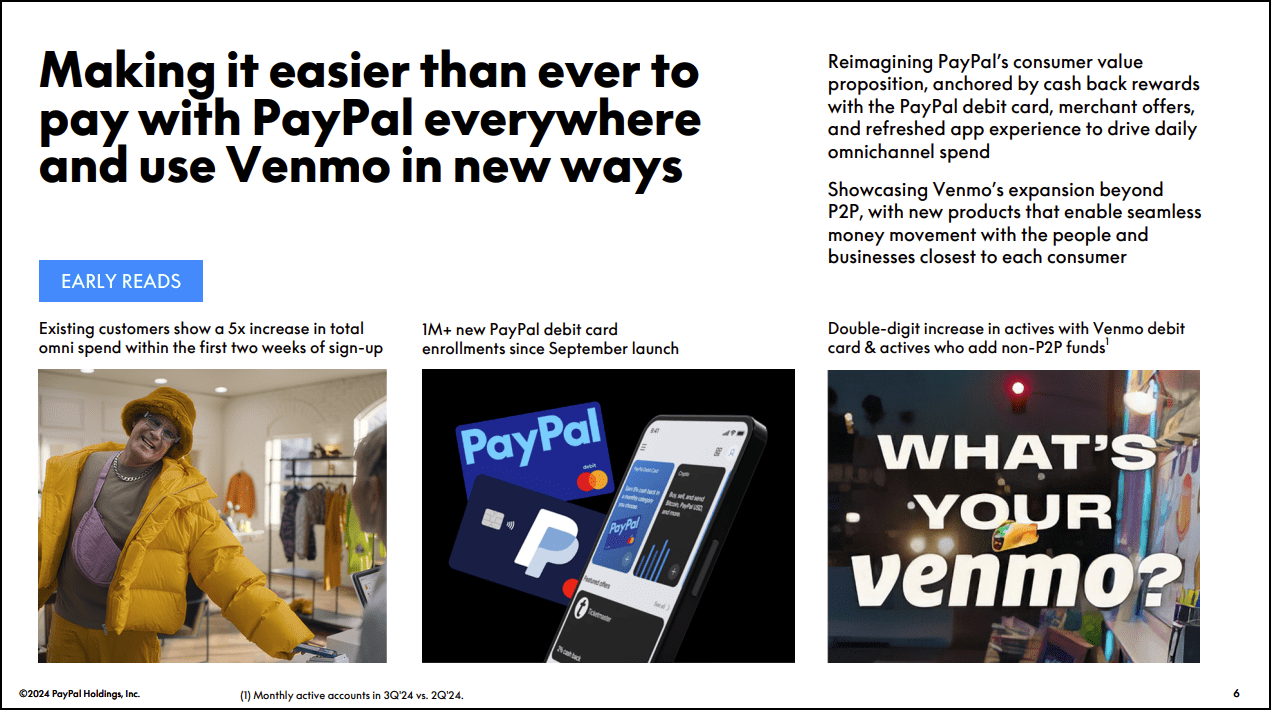

PayPal is at an inflection point as it transforms from a digital payments giant into a comprehensive commerce platform. Multiple initiatives geared towards consumers and merchants were launched in 2024 to expand PYPL’s total addressable market. One such example is Q2’s launch of PayPal Everywhere, which positions the company as an omnichannel solution for spending and sending money, offering cashback incentives to PayPal debit card users. The initiative has shown early success, with over one million new first-time debit card sign-ups.

Source Link: PYPL Q3 2024 Investor Presentation

PayPal’s transformation is also driving growth through PayPal Fastlane, an improved branded checkout experience allowing users to complete purchases in as little as one click, reducing checkout time by nearly a third, and minimizing abandoned carts.

The company achieved multiple milestones in Q3 2024, including a 9% growth in Total Payment Volume to $422.6B and a 6% increase in total revenue. This was achieved partly through PYPL’s new partnership with Canadian E-commerce giant Shopify Inc. (SHOP), becoming an additional payment processor for Shopify Pay. This integration is one example of of PYPL’s efforts to drive meaningful growth by streamlining merchant operations while potentially increasing conversion rates and driving revenue higher.

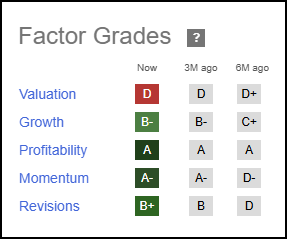

PYPL Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. PYPL’s strong Profitability and Growth grades indicate that the company has excellent potential and is fundamentally sound compared to the sector. The company scores highly across timeliness indicators with an A- Momentum grade and an EPS Revisions.

PYPL Stock Growth and Profitability

PayPal has been successful in striking a balance between its growth and profitability objectives in 2024. The company’s solid ‘B-’ Growth Grade is supported by a 31% FWD EPS GAAP Growth, more than 600% above the median for Financials sector stocks. This growth was powered by strong branded checkout performance and the continued success of its Venmo service, which has seen a monthly usage increase of 20%. In Q3, the company’s non-GAAP EPS showed significant improvement, rising 22% Y/Y, driven by both an increase in transaction margin dollars and better optimization of transaction losses.

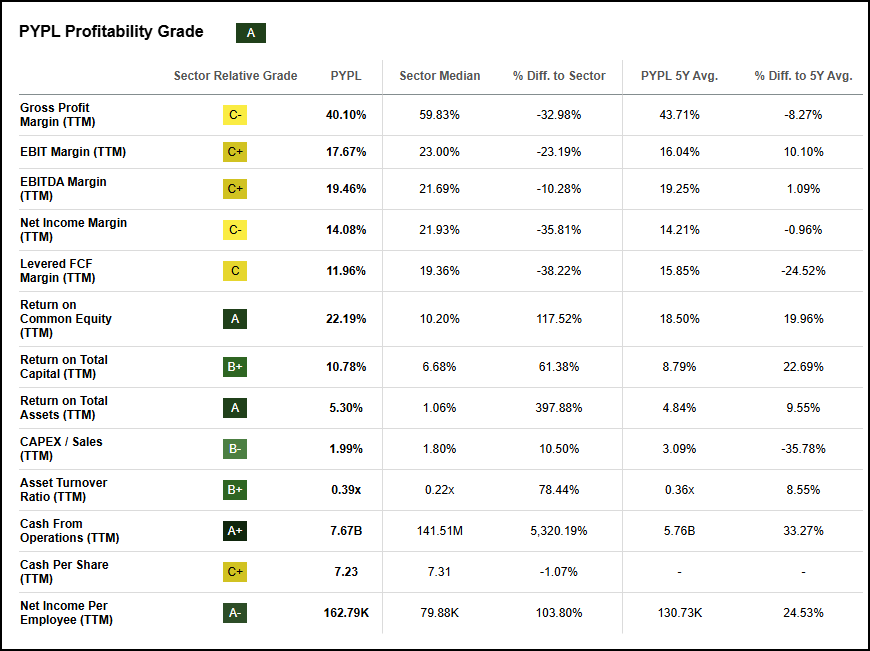

The company sports an ‘A’ profitability grade, supported by an ROE of 22% vs the Financial sector’s 10.20% and an incredible $7.67B in cash from operations.

PYPL Profitability Grade

Other Q3 highlights for PYPL include:

- Transaction margin dollars grew 8% to $3.7B.

- The company generated $1.4B in free cash flow in the quarter.

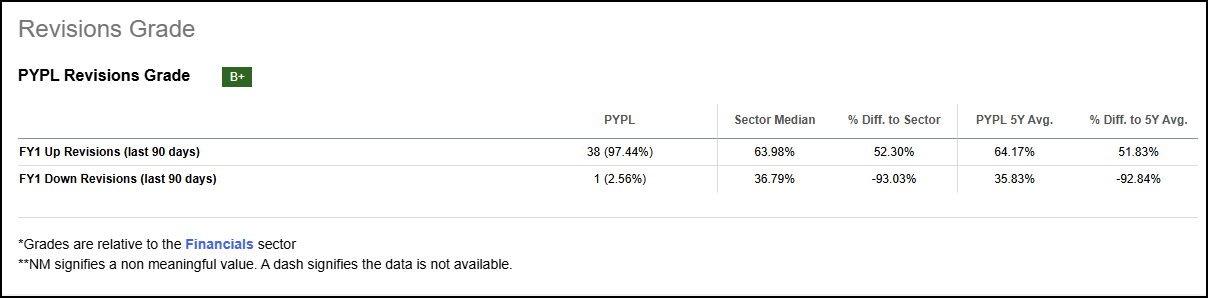

PYPL Stock Revisions & EPS Surprises

Over the last 90 days, EPS estimates have experienced 38 upward revisions and only one downward revision. Optimism around PYPL is further supported by its recent upgrade by Wolfe Research, which cited improving fundamentals and strong momentum as reasons for the upgrade.

Strong fundamentals and analyst expectations have contributed to the company’s excellent price momentum over the last year. PYPL has returned an impressive 49%, substantially exceeding its five-year average and beating the Financials sector median by 178%.

PYPL Financial Valuation

PYPL trades at a modest discount to the sector across multiple key valuation metrics. The company currently sports an FWD Price/Cash Flow ratio of 13x, which is a 13% reduction versus the sector median, while its TTM Price/Sales ratio is trading at a 6% discount to the sector.

Potential Risks

As a fintech company, Paypal faces increasing competition from tech giants, such as Apple Pay, and fintech startups that could erode market share and pressure margins. The company’s reliance on lower-margin products like Venmo has the potential to impact profitability over the long term. Macroeconomic factors, including lingering inflation, could threaten consumer spending and transaction volumes. The fintech industry is under increasing regulatory scrutiny, which could also have adverse implications for the company if major changes to the regulatory environment impact operations or profitability. Cybersecurity threats and system-wide technical issues also have the potential to disrupt business, as was the case in late November. However, the company’s team of experts was able to resolve the issue within an hour.

Concluding Summary

PayPal has demonstrated resilience and adaptability since its inception in 1998, solidifying its position as a digital payment leader. The company’s recent pivot towards becoming a comprehensive commerce platform has yielded impressive results, with growth in total payment volumes by 9% and total revenue increasing by 6%. PYPL’s innovative initiatives, such as PayPal Everywhere, have enhanced user engagement, while key partnerships are slated to expand the company’s total addressable market and augment transaction volume.

The company's strong fundamentals are reflected across multiple factors, including growth, profitability, and revision. It has outperformed both the broader market and XLF- Financial Sector SPDR ETF, 49% vs. 29% respectively, over the past year.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you PYPL the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.