- Published on

[ALL] Insurance Giant’s Growth Pivot

- Authors

- Name

- Perpetual Alpha

Summary

- With roughly 200 million active policies and a comprehensive suite of protection services, this stock is the #2 Quant-ranked property and casualty insurer.

- A strategic turnaround plan helped this company pivot from five quarters of negative earnings to skyrocketing growth and solid profitability.

- In Q3, this company saw a 14.7% surge in revenues to $16.6 billion, while earnings topped expectations with a $1.51 EPS beat.

- Despite outperforming the broader market and financials sector, this stock offers investors exceptional value with a FWD PEG ratio of 0.07x, representing a 95% discount to the sector.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +159% versus +55%, with eight Alpha Picks soaring more than 100% since their addition.

Business Overview

The Allstate Corporation (ALL) is the #2 Quant-ranked Property and Casualty Insurance stock and one of the largest publicly held companies in the industry. As a leading auto, home, and life insurance provider, Allstate serves roughly 200 million active policies across multiple consumer segments. The company complements its core offerings with protection services like warranties, which are contributing to a growing share of the company’s top line.

ALL’s multichannel distribution approach, including direct agents, online platforms, and contact centers, has successfully expanded market reach and enhanced customer accessibility. By leveraging multiple channels simultaneously, the company can cater to diverse customer preferences and offer flexibility in the consumer experience.

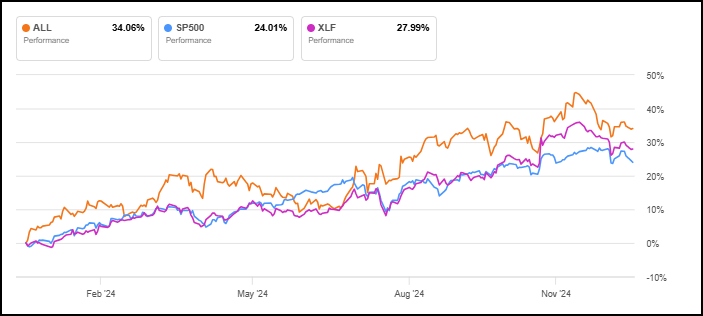

The Allstate Corporation (ALL) vs. Financial Select Sector SPDR® Fund ETF (XLF) vs. S&P 500 1-year Trading Chart

In the last year, Allstate has successfully executed an auto profit improvement plan, restored margins, and positioned itself for future growth. Its forward-looking strategy emphasizes increasing market share and expanding protection capabilities for customers.

Our Buy Thesis

Allstate faced negative earnings from Q2 2022 to Q2 2023 due to a combination of catastrophe losses, auto insurance challenges, and underwriting losses, among other operational challenges. The company implemented an aggressive turnaround strategy, including rate increases, expense reductions, more conservative underwriting practices, and investment portfolio adjustments. These changes effectively addressed the challenges, leading to a significant improvement in 2023. In the last twelve months, Allstate has also executed a specific focus on augmenting auto insurance profitability, contributing to a 26.1% return on equity and showcasing the company’s significant gains in operational excellence.

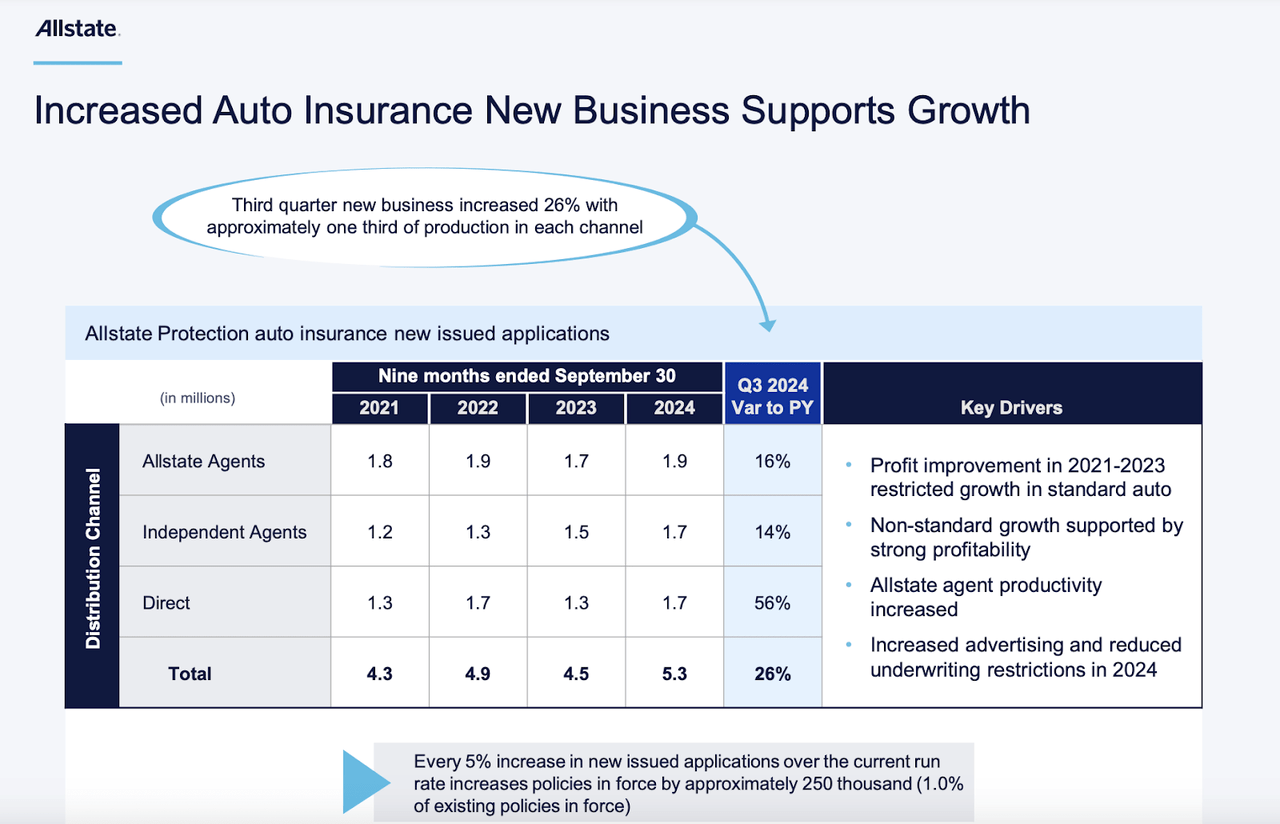

A linchpin of ALL’s recent success has been its multichannel distribution strategy. All three channels have experienced growth and increased advertising spending, spreading the company’s ubiquitous tagline, “You’re in good hands.” ALL’s 2024 strategic growth initiatives are already yielding positive results, with new business up 26% in Q3 2024.

Source: ALL Q3 2024 Investor Presentation

Higher rates in major markets have bolstered the company’s improving 2024 profitability. In Q2, Allstate received approval for a 34% California insurance rate increase, which went into effect in November.

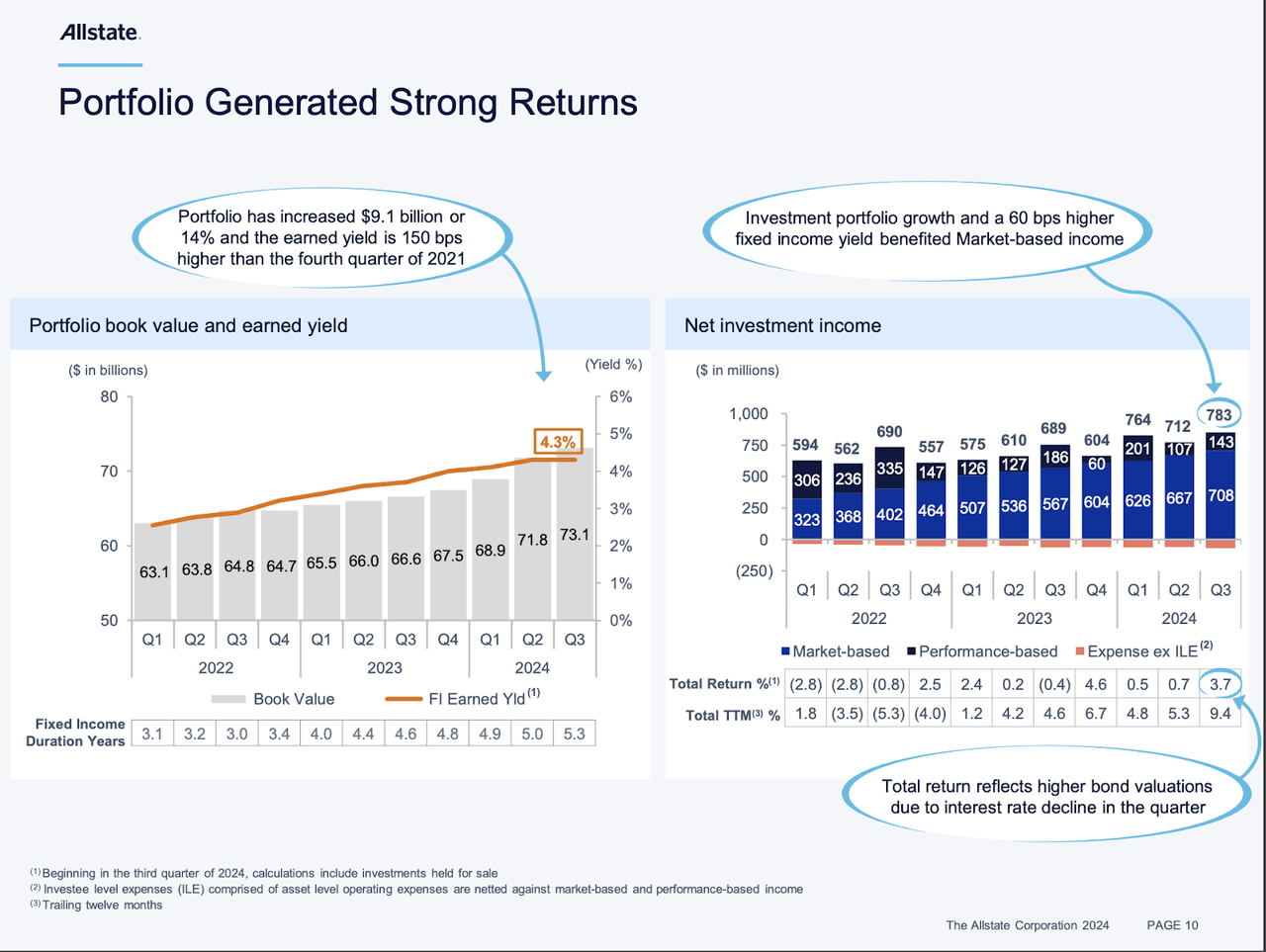

Another critical component of ALL’s improvement is its proactive approach to investment portfolio management, which includes lengthening duration at opportune times, ultimately leading to improved investment income.

Source: ALL Q3 2024 Investor Presentation

As we enter 2025, market expectations remain uncertain, with compelling arguments for bullish and bearish scenarios. Allstate is positioned to weather a downturn due to its commanding market position in the safe-haven insurance sector. Regardless of how 2025 unfolds, the company exhibits the versatility to weather a spectrum of economic scenarios and the capacity to deliver shareholder value.

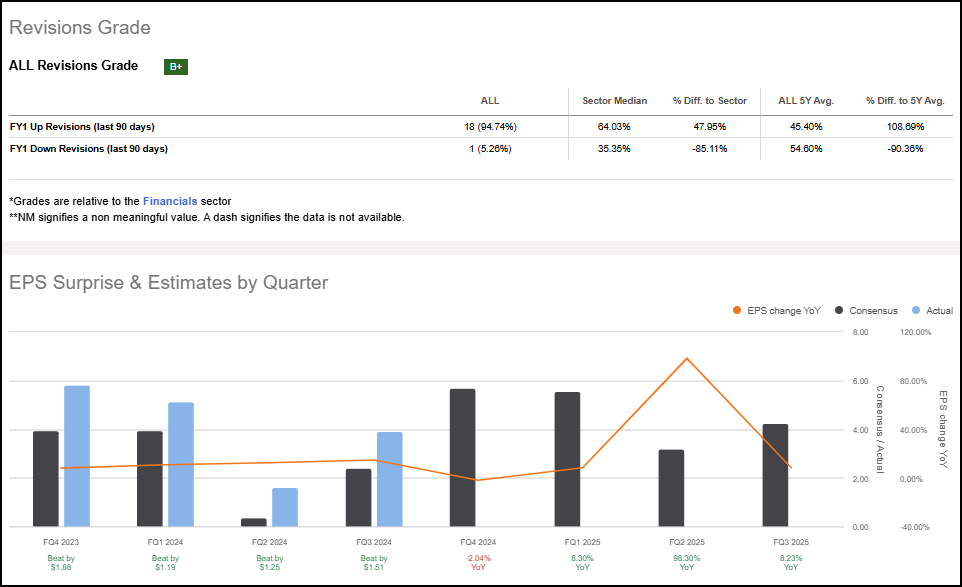

ALL Stock Revisions & EPS Surprises

Allstate reported Q3 net income of $1.2 billion and adjusted EPS of $3.91, beating estimates by $1.51. Its key metrics showed strong performance—auto insurance spent 94.8 cents of every premium dollar on claims and expenses (a 94.8 combined ratio), while the homeowners insurance underlying combined ratio came in at 62.1. ALL has beaten EPS estimates for five consecutive quarters and revenue estimates for eleven straight quarters. Over the last 90 days, EPS estimates have seen 18 upward revisions and one downward revision. Optimism around ALL is further supported by its status as one of the least shorted S&P 500 stocks in August, September, and October of this year.

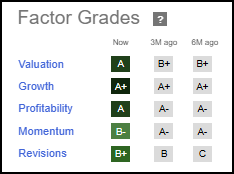

ALL Factor Grades

As highlighted above, ALL is a standout in terms of its discounted valuation relative to the sector, in addition to bullish momentum and exceptional growth, profitability, and revisions grades.

ALL Stock Growth

ALL offers outstanding metrics with a FWD revenue growth of 10.72% versus the sector’s 5.44%, an EPS FWD Long Term Growth of 175%, and a triple-digit percentage difference to the sector for operating cash flow growth Y/Y.

In Q3, ALL’s total revenues reached $16.6 billion, up 14.7% compared to the prior year, driven by higher insurance premiums and investment returns. Net investment income hit $783 million, up 13.6% year-over-year, helped by higher yields and a larger investment portfolio.

Additional key highlights for ALL’s Q3 2024 include:

Homeowners insurance grew policies by 2.5% with new applications up 20% year-over-year.

Auto insurance new business increased 26% across channels

Protection Plans business (warranty products) grew revenues 23.1% to $512 million Y/Y, with adjusted net income up $19 million to $39 million.

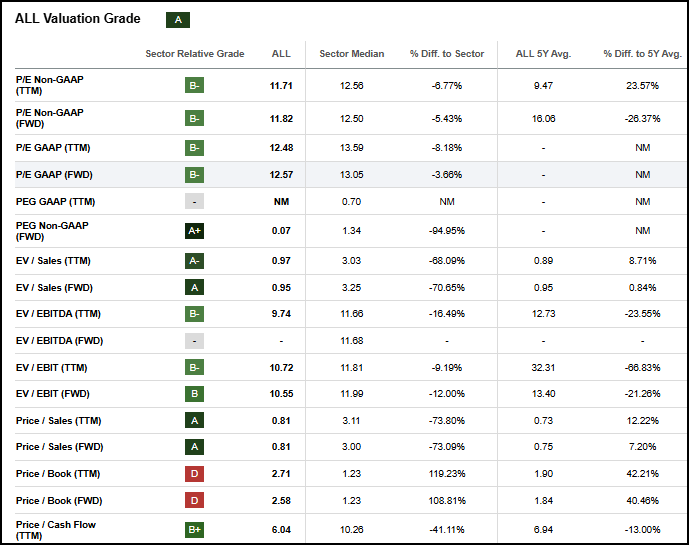

ALL Financial Valuation

ALL offers investors strong value characteristics, despite its bullish trailing one-year trend. ALL’s overall ‘A’ Valuation grade is supported by its exceptional FWD PEG Non-GAAP of 0.07x, which is a 95% discount to the broader financials sector.

ALL Valuation Grade

Other highlights include a TTM Price/Sales ratio of 0.81x and TTM Price/Cash Flow of 6x, representing a 73% and 41% discount to the sector median, respectively.

Potential Risks

As a property and casualty insurer, ALL is exposed to catastrophic events and severe weather, which can lead to substantial claims payouts. The company’s homeowners segment faced $1.2B of catastrophe losses in Q2 2024 alone. Regulatory challenges, including restrictions on rate increases, could impact the company’s margins. Fluctuating interest rates also pose a risk to ALL’s underwriting profitability and investment returns. Additionally, economic uncertainty could affect consumer demand for insurance products.

Concluding Summary

Allstate has executed a remarkable turnaround since its period of negative earnings from Q2 2022 through Q2 2023, stemming from comprehensive overhauls in its pricing strategy and distribution approach. The company’s protection services segment has been particularly impressive, with warranty products growing revenues by 23.1% and delivering adjusted net income of $39 million. This diversification of revenue streams, combined with proactive investment portfolio management that has captured higher yields, showcases the company's ability to drive growth across multiple fronts.

Having outperformed both the broader market and XLF over the past year, ALL trades at an attractive discount to its sector, with a forward PEG ratio of 0.07x, representing a 95% discount to the financials sector. The company's strong fundamentals are reflected across multiple factors, including growth, profitability, and revisions. With 31 consecutive years of dividend payments, successful implementation of rate increases in major markets like California, and a 26.1% return on equity in the last 12 months, Allstate has proven its ability to deliver shareholder value.

We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you all the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.