- Published on

85% Of Alpha Picks Stocks Deliver Earnings Beats

- Authors

- Name

- Perpetual Alpha

Summary

- Multiple drivers of uncertainty, including inflation, tariffs, interest rates, and rising recession fears have created a challenging environment for investors, leading to a shift to risk-off assets.

- Despite roughly 75% of S&P 500 companies beating earnings estimates and the index tracking toward its highest Y/Y earnings growth since Q4 2021, the S&P 500 is down 4.5% YTD.

- This contrast between strong financial performance and current stock prices underscores a recent decoupling in the market, where fear and sentiment are driving market dynamics rather than fundamentals.

- In spite of sentiment, 85% of Alpha Picks have exceeded earnings expectations, easily beating the S&P 500’s average of 75%, demonstrating the model’s ability to pick stocks with strong fundamentals.

- Recent reassurance from the Fed could suggest that it is a good time to hold high-quality stocks, as the market typically reverts to fundamentals when fear subsides.

Earnings in the Crosshairs of an Uncertain Market

It has been an uneasy start to 2025, as we wrote back in February, Brace For Turbulence: Navigating Rough Market Conditions Ahead. Stubborn inflation and whipsaw announcements around tariffs have contributed to market uncertainty. As a result, investor sentiment has shifted, favoring risk-off assets, and major indices have struggled YTD. Market uncertainty underscores that when market sentiment takes over, even stocks with solid fundamentals and strong earnings can be dragged down by investors rushing to defensive safe-havens.

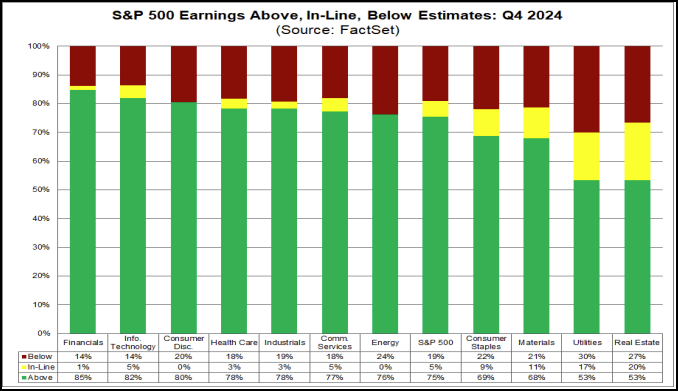

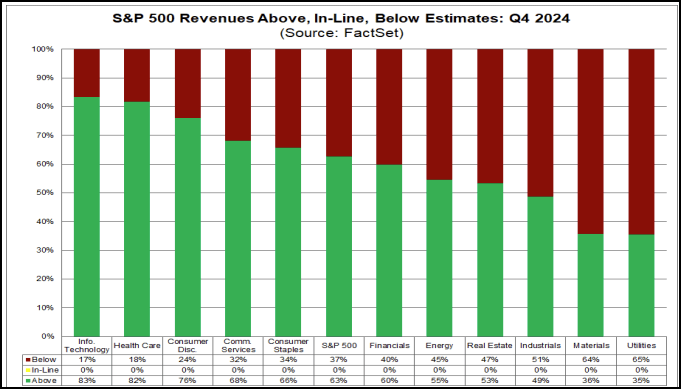

This is especially interesting in the context of earnings season. Nearly all of the S&P 500 companies have reported their Q4 results. Overall, the season is showing modest weakness in earnings surprises— roughly 75% of companies beat EPS estimates, which is slightly below the five-year historical average of 77%.

Revenues are experiencing a similar trend, with approximately 63% of companies reporting a positive revenue surprise, which is lower than historical averages.

Despite fewer positive surprises in aggregate, the S&P 500 is on track to deliver its highest Y/Y earnings growth since Q4 2021. However, the market’s reaction to these positive financial results has been muted; the S&P 500 is down 4.5% YTD as of mid-afternoon trading on Monday, March 10th.

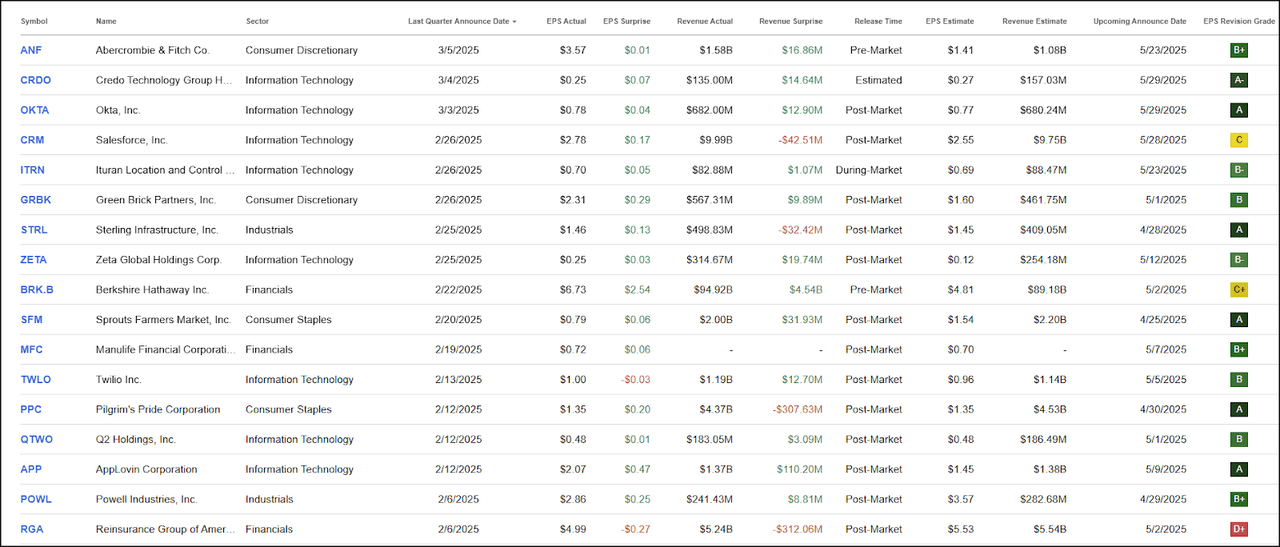

This contrast between strong financial performance and current stock prices underscores a recent decoupling in the market. The contrast is even more notable in the context of the Alpha Picks portfolio. Despite recent extreme share price weakness, our stock selections have demonstrated remarkable resilience in terms of earnings performance. Out of 34 reporting Alpha Picks, 29 or 85% of stocks have exceeded earnings expectations, with 24 or 71% beating revenue expectations, handily beating the S&P 500’s average. This shows that when sentiment drives the market, even stocks with the strongest fundamentals and best earnings results can be pulled down by fearful investors seeking defensive safe-havens.

Alpha Picks’ Earnings Results

Following the release of Friday’s February Jobs Report, Federal Reserve Chair Jerome Powell reassured investors of the soundness of the U.S. economy despite policy changes from the new administration. He emphasized that the Fed will take a measured approach to monetary policy, without being influenced by one-off impacts from tariffs.

"The new administration is in the process of implementing significant policy changes ... uncertainty around the changes and their likely effects remains high," Powell said. "We are focused on separating the signal from the noise as the outlook evolves. We do not need to be in a hurry, and are well-positioned to wait for greater clarity."

This indication of monetary stability is a positive sign for investors, particularly those holding stocks with strong fundamentals, as the market tends to revert to fundamentals when fear subsides. Below is a summary of earnings highlights from the Alpha Picks portfolio, covering stocks that have reported quarterly results since our last update.

Information Technology

- Cloud-based identity and access management solutions provider, Okta, Inc. (OKTA) delivered a fantastic Q4 FY2025 result, catapulting the stock more than 10% in after-market trading following its announcement. OKTA beat both earnings and revenue estimates, driven by increased demand for its identity security platforms as organizations accelerate their digital transformations. Product innovation has helped spur expansion within its existing customer base.

“Our relentless focus on product innovation has been resonating with our customers as over 20% of Q4 bookings were from new products such as Okta Identity Governance, Privileged Access, Device Access, Fine Grain Authorization, Identity Security Posture Management, and Identity Threat Protection with Okta AI,” said CEO and Co-Founder Todd McKinnon.

Ituran Location and Control Ltd. (ITRN), a location-based telematics services provider, beat revenue estimates by 13.8M, exceeding expectations despite currency headwinds. The company’s strong results were driven by a substantial increase in subscriber growth (40,000 net in Q4) and successful partnerships with auto manufacturers like Nissan Chile.

Credo Technology Group Holding Ltd. (CREDO) significantly beat its Q3 FY25 earnings expectations, delivering an 87% sequential increase in revenue and topping EPS estimates by $0.07. This remarkable growth was driven by its largest hyperscale customer scaling production of AI platforms, with its Active Electrical Cable products experiencing triple-digit Q/Q growth.

Q2 Holdings, Inc. (QTWO) delivered non-GAAP revenue of 0.01. Q4 marked the company’s second-strongest bookings quarter, with record renewal activity across Tier 1 and Enterprise segments.

Salesforce, Inc. (CRM) beat earnings by $0.17 while missing consensus revenue estimates. Growth in Data Cloud and AI offerings contributed to the company’s bottom-line beat. The company projects Q1 FY26 revenue to climb 6–7% Y/Y.

Cloud communications platform Twilio Inc. (TWLO) delivered a 0.03. Strong performance across messaging and email products, particularly during the holiday season, contributed to the revenue beat.

Industrials

Broad strength across all segments helped Powell Industries, Inc. (POWL) beat earnings estimates. Its Q1 FY 2025 net income was 241.43M.

Sterling Infrastructure, Inc. (STRL) missed revenue estimates by 0.13. Growth was driven by its E-infrastructure segment, fueled by strong demand for data center construction.

Consumer Discretionary

Strategic cost management and growth across all regions helped Abercrombie & Fitch Co. (ANF) beat revenue estimates by 0.01. Net sales climbed 9% Y/Y, exceeding the range the company provided in early January.

Homebuilder Green Brick Partners, Inc. (GRBK) delivered a double beat in Q4, with adjusted EPS climbing 46% Y/Y driven by record home closings and a 24% increase in home closing revenue. The company maintains industry-leading gross margins along with a 29% increase in new home orders Y/Y.

Consumer Staples

Sprouts Farmers Market (SFM) beat expectations in Q4, delivering 0.79, a 61% increase Y/Y. The strong result was driven by broad growth across all channels, with robust e-commerce sales that grew roughly 37%.

Despite missing revenue estimates by 0.20.

Financials

A surge in operating earnings and soaring underwriting profits helped Berkshire Hathaway Inc. (BRK.B) deliver an excellent Q4 result. The conglomerate beat revenue estimates by 2.54.

Manulife Financial Corporation (MFC) surpassed adjusted earnings estimates by 13.3B in net inflows for its Global Wealth and Asset Management business.

Higher-than-expected expenses from incentive compensation accruals and lower investment income contributed to Reinsurance Group of America, Incorporated’s (RGA) earnings miss in Q4. RGA came up short of revenue estimates by 0.27.

Concluding Summary

The start of 2025 has been uneasy, as markets have struggled amidst multiple drivers of uncertainty. Despite 75% of S&P 500 companies beating earnings estimates and the index tracking toward its highest Y/Y earnings growth since Q4 2021, the reaction has been subdued, with the S&P 500 down 4.5% YTD. The Alpha Picks portfolio’s earnings performance has been remarkable, with 85% of its stocks exceeding expectations. Reassuring comments by Federal Reserve Chair Jerome Powell suggest that those holding stocks with strong fundamentals could be well-positioned when fear in the market eventually subsides.

Three more companies have yet to report for the quarter, and Alpha Picks will continue highlighting the best-of-the-best quantitative picks in hopes of more portfolio winners.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha