- Published on

[ARQT] Earnings Growth At A Healthy Pace

- Authors

- Name

- Perpetual Alpha

Summary

- This company boasts an award-winning product that treats dermatological conditions with superior efficacy, along with multiple products pending FDA approval in 2025.

- Q4 revenues soared 471% year-over-year, and continued momentum is expected in 2025, driven by strategic partnerships and an expanding total addressable market.

- This biotech is on solid financial footing, with a healthy cash position and a recent $100M debt payment that will free it up for future growth in 2025.

- Analysts have shown strong confidence in this stock, with five upward revisions in the last 90 days versus zero downward.

- The total return of the Alpha Picks portfolio continues to outperform the S&P 500, +130% versus +49%.

Business Overview

Founded in 2016, Arcutis Biotherapeutics, Inc. (ARQT) is a biotech company specializing in developing, marketing, and distributing innovative, non-steroidal treatments for dermatological conditions.

ARQT leverages recent advancements in immunology to create patient-friendly therapies with superior efficacy compared to traditional treatments. Unlike large pharma companies with broad product portfolios, Arcutis is dedicated to dermatology, offering targeted solutions that fill critical gaps in the market.

ARQT’S award-winning flagship product, ZORYVE is a multi-use product that treats common conditions such as Plaque Psoriasis and Dermatitis, among others. By inhibiting the specific enzymes that lead to inflammation, ZORYVE can be prescribed for long-term use versus traditional steroidal treatments.

“What is really unique about the profile of Zoryve cream is that it works quickly, but it’s also appropriate for long-term treatment. Oftentimes, we would have to go to 2 different therapies in order to address these different parts of the treatment.,” said Patrick Burnett, MD, PhD, FAAD, Chief Medical Officer of Arcutis.

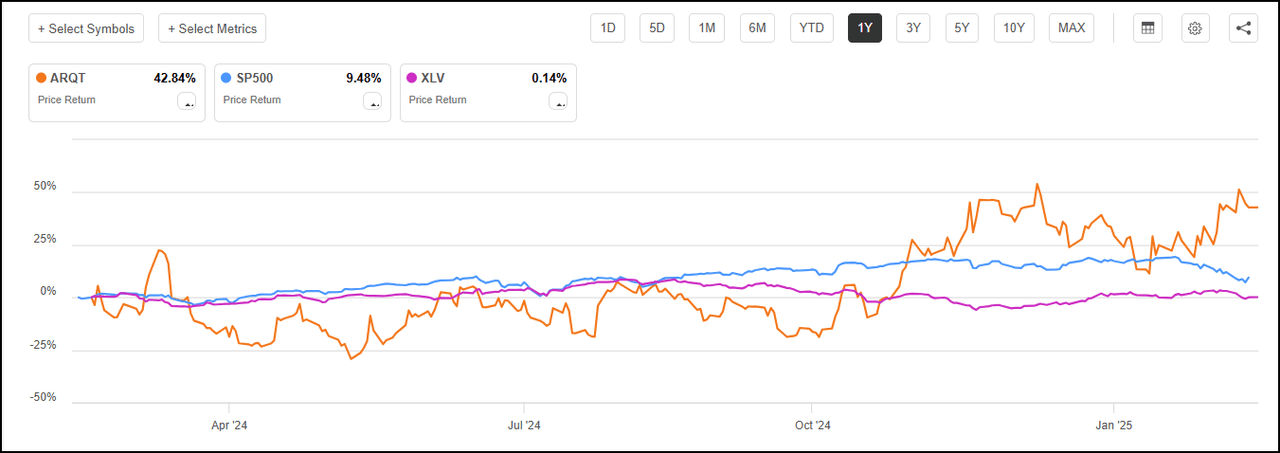

Despite Healthcare (XLV) returning just 0.14% over the last twelve months, ARQT has been immune to many headwinds facing the broader healthcare sector.

Arcutis Biotherapeutics, Inc. (ARQT) vs. The Health Care Select Sector SPDR® Fund ETF (XLV) vs. S&P 500 1-year Trading Chart

The company’s solid product portfolio, track record of FDA-approved products, expanding strategic partnerships, and strong commercial execution in a niche market have given this biotech company an edge over the sector and pharma industry.

Our Buy Thesis

ARQT has established a solid foundation through its ZORYVE franchise and is positioned for further growth with its expected approval for scalp and body psoriasis in 2025. The company targets a substantial market poised to break open through its strategic partnership with Kowa Pharmaceuticals and other distribution channels.

“We're now making great progress in gaining Medicare and Medicaid coverage, which is expanding ZORYVE usage into the almost 4 million dermatologists treated patients with government insurance. Furthermore, our Kowa commercial partnership permits us to simultaneously pursue the more than 8.5 million patients being treated outside of the dermatology office for these indications. This includes primary care physicians and pediatricians for whom ZORYVE represents an ideal, easy-to-use topical anti-inflammatory agent,” said Frank Watanabe, President & Chief Executive Officer of Arcutis.

As a commercial-stage biotech, ARQT has a strong cash position and expects to reach cash break-even in 2026. With a robust pipeline and strategic partnerships, Arcutis is poised to continue its growth trajectory and become a leading player in the dermatology market.

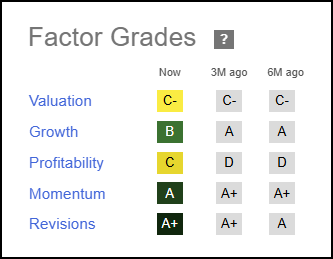

ARQT Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. ARQT exhibits solid fundamentals compared to the broader Healthcare sector while scoring exceptionally across timeliness indicators, with an ‘A’ Momentum grade and an ‘A+’ EPS Revision grade.

Arcutis Biotherapeutics, Inc.’s Growth & Profitability

Arcutis achieved remarkable revenue growth in 2024, with ZORYVE sales increasing by 471% Y/Y to $167M. The company expects continued momentum in 2025, driven by market share gains from topical steroids. The company’s FWD revenue growth is an incredible 93.73% vs. the sector’s 7.34%.

ARQT reported a Q4 EPS of -$0.09, reflecting a significant improvement from -$0.72 in the same period in 2023, -$1.18 in 2022, and -$1.42 in 2021. Despite these negative earnings, the company’s profitability trajectory is promising, with net product revenue reaching $69.4M, a 413% increase Y/Y. Alpha Picks typically avoids selecting stocks with negative earnings. However, identifying a company with a strong growth trajectory and capitalizing on the transition from negative to positive earnings can be highly rewarding for long-term investors. Successfully capturing this inflection point often leads to substantial gains as market sentiment shifts and fundamentals improve. In Q4, Arcutis paid $100M of its debt, reducing interest expense for 2025 and enhancing its financial flexibility as it grows its product suite. The company currently boasts a 90% Gross Profit Margin, which exceeds the sector median by over 50%.

Analysts have noticed ARQT’s growth prospects and proximity to profitability. The company has received five FY1 upward revisions in the last 90 days versus zero downward revisions.

ARQT’s Earnings Revisions

Arcutis Biotherapeutics, Inc.’s Financial Valuation

Despite negative earnings, ARQT trades broadly in line with the sector in terms of its FWD EV/Sales and Price-to-Sales ratios.

Potential Risks

ARQT faces concentration risk due to its heavy reliance on its ZORYVE franchise for revenue. Additionally, an ongoing shift in healthcare policies and reimbursement structures could impact profitability in the future. Regulatory risk from FDA delays could also hamper the pace of ARQT’s growth. Furthermore, competition from potential generic entrants also poses a threat to ARQT.

Concluding Summary

Founded in 2016, Arcutis Biotherapeutics has built its success on its flagship product ZORYVE, offering superior, long-term treatment for dermatological conditions. Typically, Alpha Picks avoids negative-earnings stocks, but capturing growth as earnings turn positive can yield significant long-term investor gains. Arcutis seems to be on this trajectory. Despite healthcare sector headwinds, ARQT has demonstrated strong performance over the last year through a focused approach, its growing product pipeline, and strategic partnerships that will help expand its target market with companies like Kowa Pharmaceuticals. With a strong cash position and projected cash break-even in 2026, Arcutis is well-positioned to continue its growth trajectory and establish itself as a leader in the dermatology market.

We have numerous stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into the desired sectors you like. The Alpha Picks Team wishes you the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.