- Published on

[AMPH] Amphastar Pharmaceuticals, Inc. Downgraded To Sell: Removed From AP Portfolio

- Authors

- Name

- Perpetual Alpha

Summary

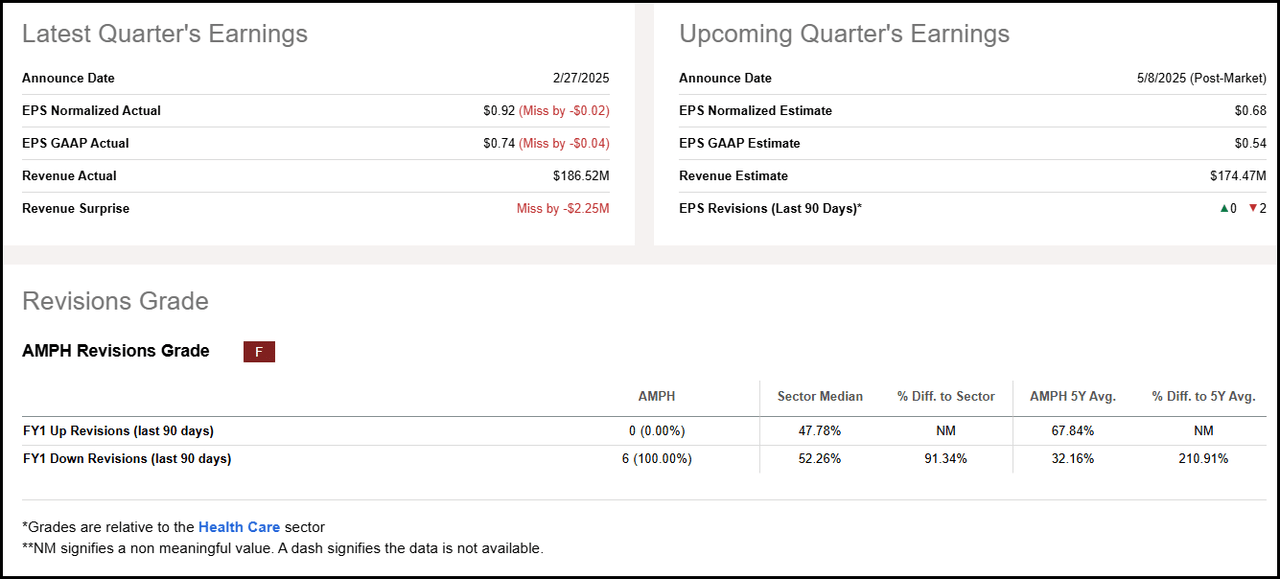

- Despite reporting full-year revenue growth of 14%, AMPH missed both its Q4 revenue and earnings targets, leading to an 11% share price decline following the announcement.

- AMPH faces increased competition across several key product lines, and management expects relatively flat sales growth in 2025.

- While sales are expected to rebound double-digits in 2026, weak near-term growth projections, poor momentum, and downward revisions contributed to the stock’s Quant Strong Sell rating.

- While not all stocks work out, Alpha Picks winners significantly outperform the losers. Five out of 37 Alpha Picks have returned more than 100% since their addition to the portfolio.

AMPH Falls To Strong Sell Rating

Fellow Alphas,

Amphastar Pharmaceuticals, Inc. (AMPH) is being removed from the Alpha Picks portfolio.

AMPH is a global biopharmaceutical company focused on developing, manufacturing, and marketing a range of proprietary and generic drugs. Compared to other healthcare stocks, the company has experienced declining growth, decelerating momentum, and downward EPS revisions, and its Quant-rating has fallen to a Strong Sell.

Despite reporting full-year revenue growth of 14%, AMPH missed Q4 revenue expectations by 0.02. The stock’s disappointing results led to an 11% share price decline following the earnings announcement. AMPH is grappling with increased competition across several key product lines, including glucagon, epinephrine, and phytonadione. Despite Y/Y growth in the company’s flagship asthma-relief product, Primatene Mist, management is projecting relatively flat sales for 2025 before anticipating a return to double-digit growth rates in 2026.

AMPH Revisions Grade

TEREX Material Processing and Aerial Work Platforms Equipment (TEX Q3 2022 Investor Presentation)

TEREX Material Processing and Aerial Work Platforms Equipment (TEX Q3 2022 Investor Presentation)

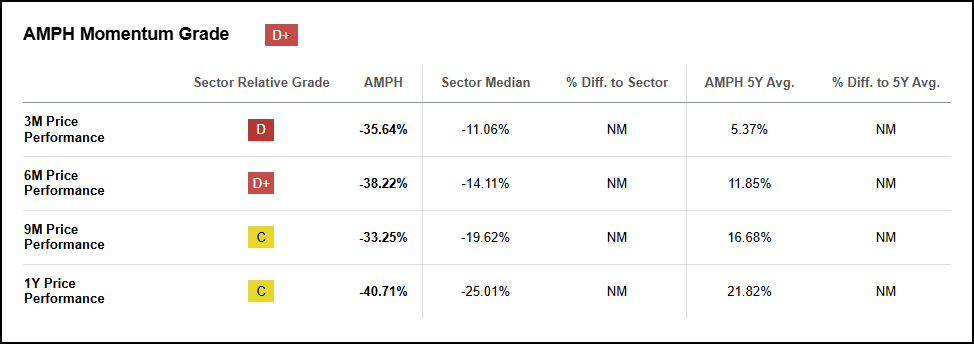

Analysts have expressed pessimism about AMPH’s prospects, resulting in six downward EPS revisions in the last 90 days and zero upward revisions. Deteriorating sentiment around the stock has impacted its price momentum. AMPH has returned -35.64% on a trailing three-month basis vs. the sector median of -11.06%.

AMPH Momentum Grade

AMPH’s profitability remains strong, with an ‘A-’ grade, supported by a TTM EBITDA margin of 35.30%, which is 455% greater than the sector median. The company also sports an ‘A’ valuation grade, trading at a 45% discount to the sector in terms of its trailing PEG. While many of AMPH’s metrics and fundamentals remain strong, Alpha Picks is a data-driven process, and when a Quant rating falls from Strong Buy to Sell, stocks are removed. Poor Momentum and Growth factor grades show signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Strong Sell rating.

AMPH’s profitability remains strong, with an ‘A-’ grade, supported by a TTM EBITDA margin of 35.30%, which is 455% greater than the sector median. The company also sports an ‘A’ valuation grade, trading at a 45% discount to the sector in terms of its trailing PEG. While many of AMPH’s metrics and fundamentals remain strong, Alpha Picks is a data-driven process, and when a Quant rating falls from Strong Buy to Sell, stocks are removed. Poor Momentum and Growth factor grades show signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Strong Sell rating.

Alpha Picks Selection Process

Alpha Picks adds one stock on the first trading day of every month and the closest trading day on or after the 15th of every month. Stocks that have fallen to Sell or Strong Sell will be sold. Alpha Picks stocks that remain a Hold for more than 180 days will be sold, and the “cash” generated from the sold position gets equally invested across the remaining stocks in the Alpha Picks portfolio. All dividends are reinvested. As AMPH has fallen to a Strong Sell rating, we are closing its positions as an Alpha Picks recommendation. As a friendly reminder, please check out the next Alpha Pick on March 17th and the webinar, where we will discuss AMPH’s removal in more detail.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha