- Published on

Terex Corporation Downgraded To Sell: Removed From AP Portfolio

- Authors

- Name

- Perpetual Alpha

Summary

- Terex was added on January 16th, 2023, and is down 1.21% despite an excellent valuation and solid profitability. YTD, the Alpha Picks portfolio is up 58.46% vs. the S&P 500.

- Terex experienced a 6% year-over-year drop in Q3 net sales due to reduced rental orders and project deferrals, with deteriorating sentiment driving an 18.51% stock decline over the past year.

- Despite Q3 adjusted EPS of $1.46, which exceeded analyst estimates, declining growth and slowing momentum contributed to the stock’s downgrade to a Quant Sell, warranting the closeout of its position.

- YTD, the Alpha Picks portfolio is up 58.46% vs. the S&P 500, up 27.11%.

- While not all stocks work out, the winners in the Alpha Picks portfolio significantly outperform the losers.

- Nine out of 37 Alpha Picks have returned more than 100% since their addition to the portfolio.

TEX Falls To Sell Rating

Fellow Alphas,

Terex Corporation (TEX) is being removed from the Alpha Picks portfolio.

TEX, a global industrial equipment manufacturer, has experienced declining growth and decelerating momentum compared to other Industrial stocks, and its Quant Rating has fallen to a Sell.

Terex faced headwinds in Q3 from rental customers reducing orders and project deferrals due to economic uncertainty. This impacted overall net sales, which were down 6% Y/Y, and bookings trending downward from historical patterns, affecting TEX’s growth grade.

"We're seeing more challenging macro dynamics as the trajectory of future interest rate cuts and the upcoming U.S. election are casting a shadow of uncertainty leading to more cautious decision making. Although, investments in infrastructure and manufacturing continue to grow, the rate of growth has somewhat slowed and we're seeing local projects being deferred until investors have more clarity on the macro environment," said Terex Corporation CEO Simon Meester.

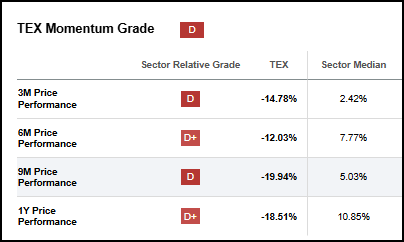

Deteriorating sentiment around the stock has impacted its price momentum recently. TEX has returned -18.51% on a trailing one-year basis vs. the sector median of 10.85%.

TEX Momentum Grade

Alpha Picks is a data-driven process, and while many of TEX’s metrics and fundamentals remain strong, we must follow our process, and when a Quant Rating falls from Strong Buy to Sell, stocks are removed. Momentum Factor Grades show signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Sell rating.

Alpha Picks Selection Process

Alpha Picks adds one stock on the first trading day of every month and the closest trading day on or after the 15th of every month. Stocks that have fallen from Strong Buy to Sell or Strong Sell will be sold. Alpha Picks stocks that remain a Hold for more than 180 days will be sold, and the “cash” generated from the sold position gets equally invested across the remaining stocks in the Alpha Picks portfolio. All dividends are reinvested. Since TEX has fallen to a Sell rating, we are closing its positions as an Alpha Picks recommendation. As a friendly reminder, please check out the next Alpha Pick on January 2nd and the webinar, where we will discuss TEX removal in depth.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.