- Published on

[LC] This Lending Legend Continues To Grow

- Authors

- Name

- Perpetual Alpha

Summary

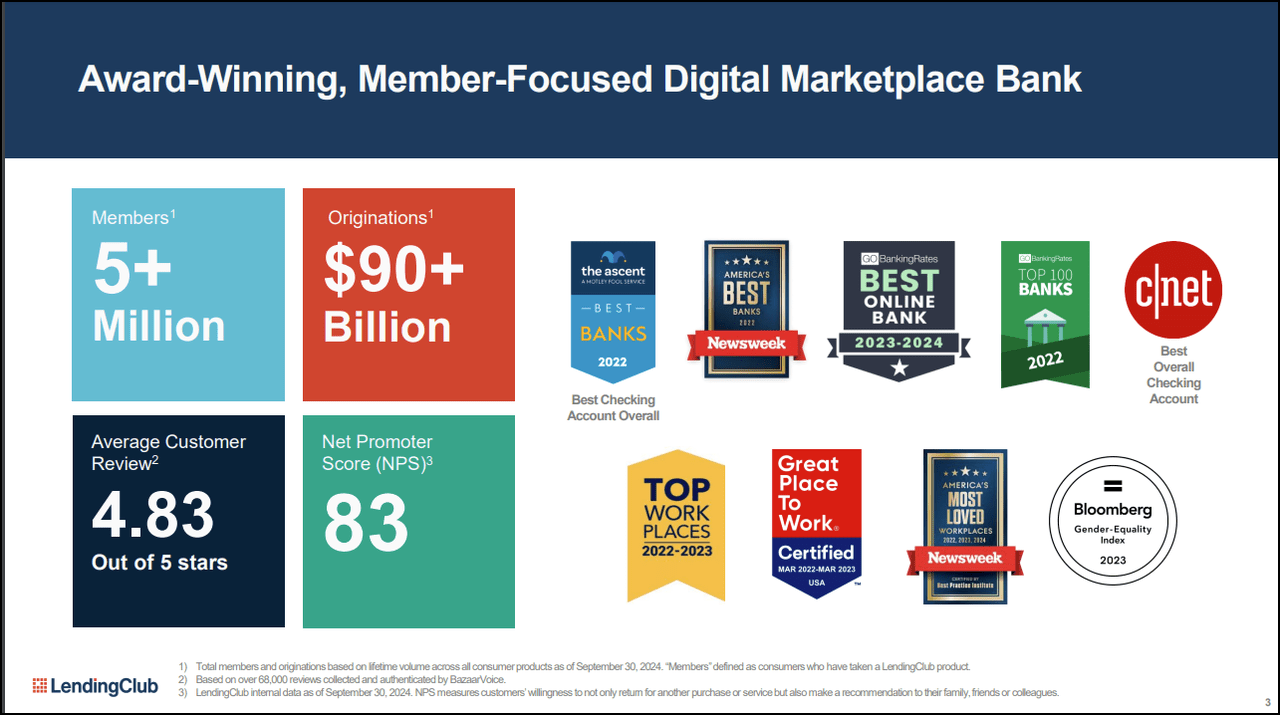

- Serving over five million members and facilitating more than $90B in loans to date, this company has established itself as a leader in digital marketplace banking.

- This company’s Q3 2024 results showed strong momentum, with originations up sequentially 6% to $1.9B and revenue up 8% to $200M.

- With a balance sheet growth of 25%YTD, this company has demonstrated successful execution of its transition from solely a lending place facilitator to a hybrid bank model.

- Recent bank partnerships are expected to generate over $1B in loans purchased over the next 12 months, marking a significant expansion of the marketplace business.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +177% versus +60%, with nine Alpha Picks soaring more than 100% since their addition.

Business Overview

LendingClub Corporation (LC) is a top Quant-ranked consumer finance company that connects borrowers and investors, facilitating a range of lending products, including personal, business, and auto loans, as well as refinancing options. Founded in 2007, LendingClub has grown to serve over 5 million members and facilitated more than $90 billion in loans to date. Its aim is to help customers pay less when borrowing and earn more when saving.

LendingClub is a digital marketplace that focuses on retaining customers using a three-pronged approach:

- Acquiring new members through its core personal loans franchise

- Driving member engagement through compelling products, tools, and features

- Deepening relationships by offering additional products and features to meet members’ evolving needs over time.

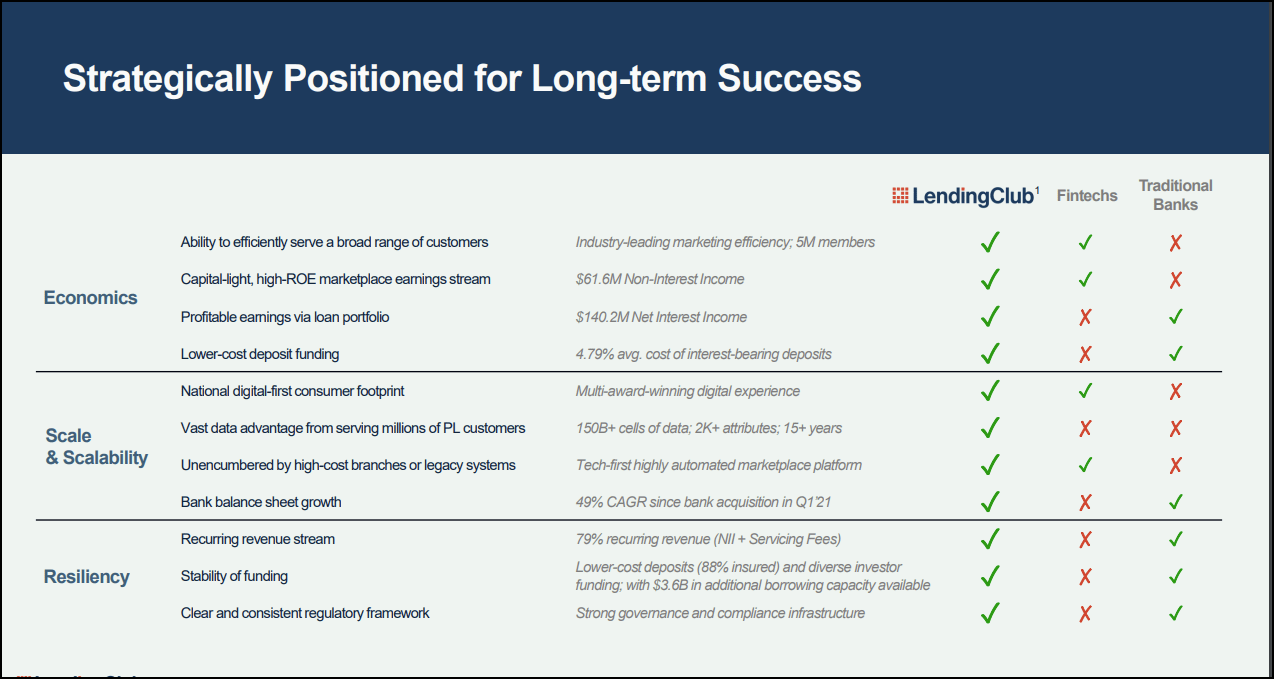

LendingClub leverages its vast data advantage, with over 150 billion cells of data and 15+ years of experience in the personal loan market, to offer its members competitive rates and personalized financial solutions.

LC has made several innovative and growth-focused strategic moves in the last year, including:

- Acquiring technology from Tally to enhance credit card management services.

- Launching LevelUp Savings, a high-yield savings account attracting over $500 million in deposits.

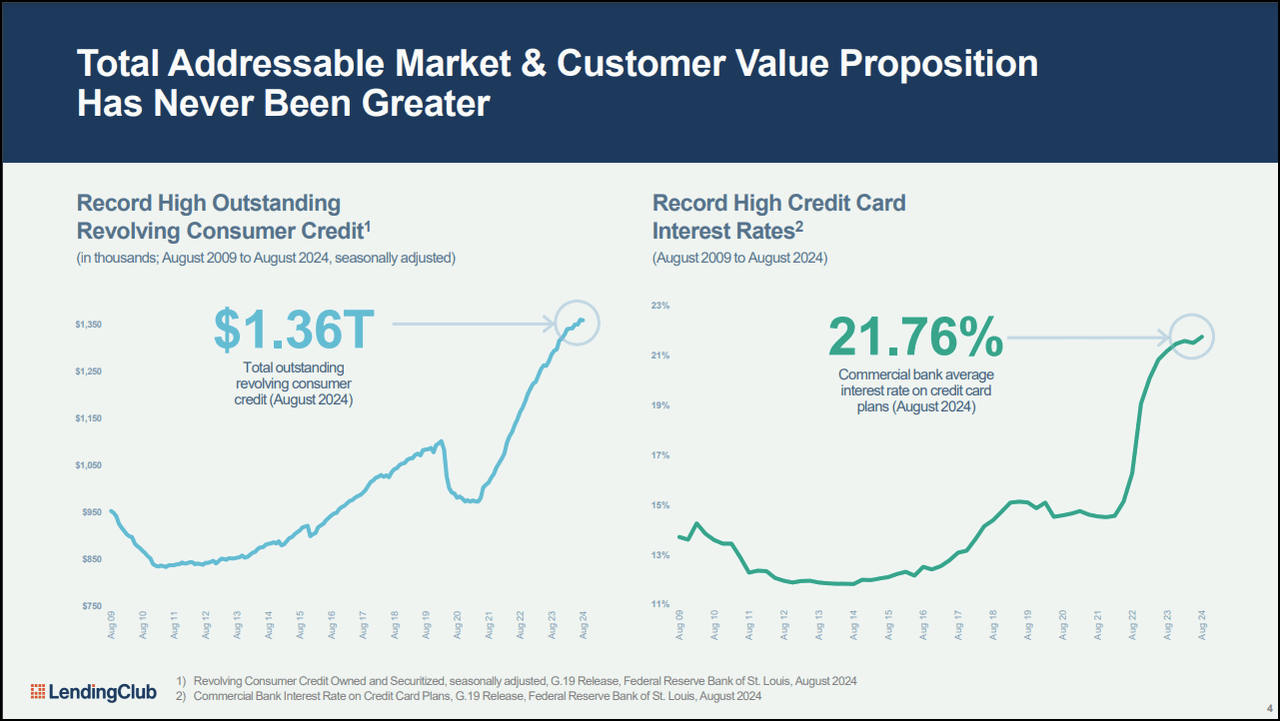

LendingClub benefits from several tailwinds, including the growing demand for lower-cost credit options and the ongoing digitalization of banking services. As credit card interest rates remain at record highs, LendingClub's personal loan offerings present an attractive alternative for consumers looking to consolidate high-interest debt.

With its innovative product offerings, strong market position, and focus on customer satisfaction (as showcased by its Net Promoter Score of 80), LendingClub is well-positioned to capitalize on the growing fintech market and continue its trajectory as a leading digital marketplace bank.

Our Buy Thesis

LendingClub has demonstrated a strong growth trajectory underpinned by its diverse product portfolio and operational gains. Notably, the company has made significant progress in transitioning to a more balanced business model, combining marketplace lending with a growing balance sheet of held-for-investment loans. In 2021, LendingClub acquired Radius Bank, in an effort to transform its business and lower costs by eliminating fees paid to partner banks and minimizing funding expenses through access to Radius’ low-cost deposits. This strategy has increased recurring revenue and strengthened the company’s profitability, which has expanded beyond transaction fees.

“Our balance sheet has now grown 25% since the beginning of this year to just over $11 billion in total assets. That represents a quadrupling since we acquired the bank in 2021, which speaks to our commitment to building a resilient recurring revenue stream to deliver consistent shareholder value,” said Scott Sanborn, Chief Executive Officer of LendingClub.

In Q3 2024, LC achieved notable milestones across key metrics:

- Originations grew 6% sequentially to $1.9B

- Revenue increased 8% to over $200M Q/Q

- Pre-provision net revenue (PPNR) grew 19% to $65.5M

- GAAP net income reached $14.5M

The company successfully expanded its partnerships with banks, a crucial development for improving its marketplace revenue. LendingClub welcomed back its first returning bank buyer and secured a new bank partner, expecting over $1 billion in additional loan purchases over the next 12 months. This progress demonstrates the company's competitive strength in the fintech sector and its ability to adapt to changing market conditions.

Other major highlights, attesting to the strength of its business, solid track record, and investment fundamentals, include:

- Balance sheet growth of 25% since the beginning of the year to over $11B in total assets

- Net charge-off ratio decreased to 5.4% from 6.2% in the previous quarter

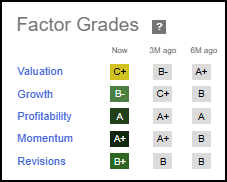

LC Stock Factor Grades

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. LC’s strong Profitability and Growth grades indicate that the company has excellent potential and is fundamentally sound compared to the sector. LC scores exceptionally well across timeliness indicators in addition to its fundamentals with an A+ Momentum grade and an EPS Revision grade that indicate Wall Street analysts are highly optimistic about the stock.

LendingClub Corporation Stock Growth and Profitability

In 2024, LendingClub has demonstrated consistent progress in its growth trajectory and evolution in its strategy. The company boasts a 19% EPS FWD Long Term Growth (3-5 Year CAGR), which is 85% above the median for Financials sector stocks. This exceptional growth has been driven partially by a transition in its strategy, moving from a loan “matchmaker” to growing its balance sheet by keeping more loans on its books. In turn, LC is accruing more income by building its base of interest-bearing assets. This shift has also contributed to the stock’s exceptional ‘A’ Profitability grade, as this change in approach provides more stable recurring revenue via interest payments. LC sports a 97% levered free cash flow margin and an incredible $9.05 in cash per share, 400% and 22% higher than the sector median, respectively.

In addition to growing origination volumes and a growing interest-bearing asset base, the company has undergone a series of product launches showing promising early results. The launch of DebtIQ, a debt monitoring and management solution, and its LevelUp Savings account has helped drive customer engagement and repeat business.

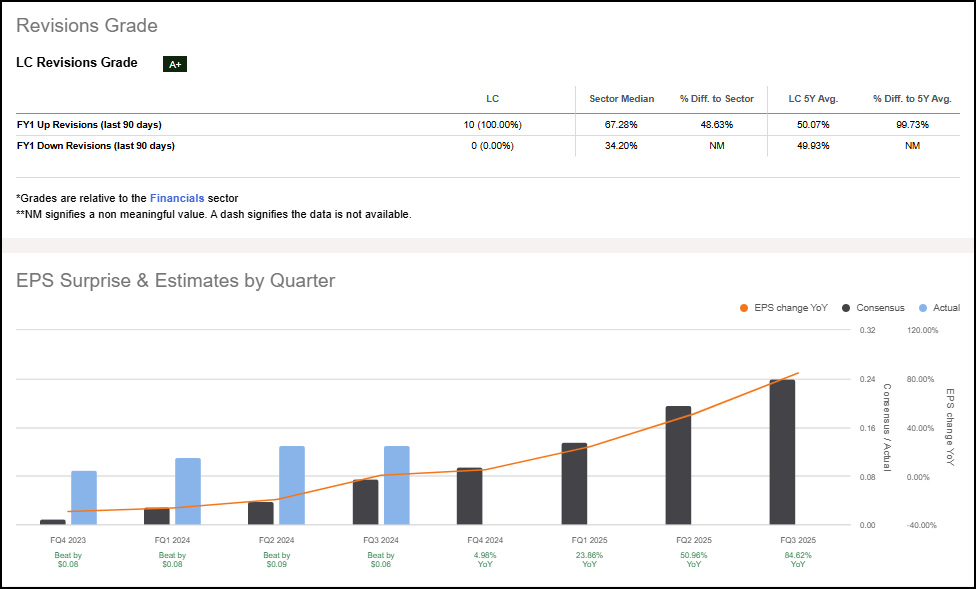

LendingClub Corporation EPS Revisions

The range of profitability and growth drivers discussed above have contributed to strong consensus optimism for LC and its ‘A+’ EPS Revisions Grade. In the last 90 days, the company has received 10 FY1 up revisions and zero down revisions, and analysts project an incredible 85% increase in EPS by Q3 FY2025.

LC EPS Revisions

LC has a strong track record in exceeding expectations; the company has beaten analyst earnings and revenue estimates for the last 15 consecutive quarters.

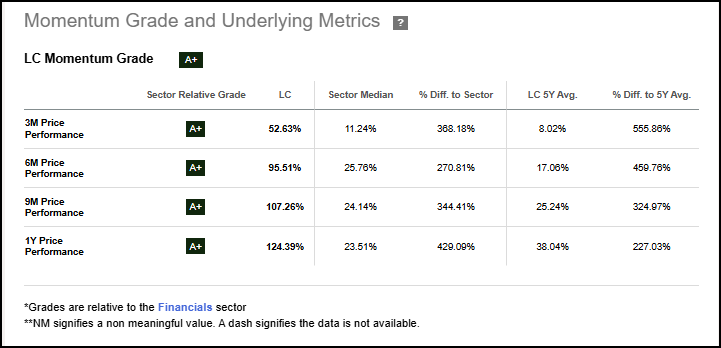

Strong fundamentals and analyst expectations have contributed to the company’s extraordinary price momentum over the last year. LC has returned an impressive 124%, substantially exceeding its own five-year average and beating the Financials sector median by 429%

LC Momentum Grade

LC Stock Valuation Grade

Despite the stock's sustained price momentum, LC trades at a substantial discount to the sector across several key valuation metrics. The company currently sports a TTM Price/Sales ratio of 1.7x, which is a 25% reduction versus the sector median, while its FWD EV/Sales ratio is trading at 1.1x, a 66% discount to the sector.

Potential Risks

Key risks to LendingClub’s growth outlook include a potential deterioration in consumer credit quality amid high interest rates and inflation, and competition in the personal loan market. The company’s increased retention of loans on its balance sheet also exposes it to greater credit risk. Additionally, if the expected Federal Reserve rate cuts don’t materialize or are delayed, it could impact loan demand and pricing.

Concluding Summary

LendingClub has established itself as a leading digital marketplace bank, successfully bridging the gap between borrowers seeking lower-cost credit and investors looking for attractive returns. The company’s strategic evolution from strictly a marketplace lender to a balanced hybrid model, combining lending facilitation with a growing balance sheet, has yielded strong financial results and increased recurring revenue. The return of bank buyers and the successful launch of several new products demonstrate the company’s ability to innovate and adapt to market conditions. With its vast data advantage from $90B in loan originations, strong credit performance, outperformance of competitors, and growing mobile engagement, LC is well-positioned to capitalize on a substantial opportunity in the space.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.