- Published on

M/I Homes, Inc. Downgraded To Sell: Removed From AP Portfolio

- Authors

- Name

- Perpetual Alpha

Summary

- Two-time Alpha Pick M/I Homes, Inc. was first added on October 3rd, 2022, and has returned an incredible 230% to the Alpha Picks portfolio since its initial selection.

- MHO has faced significant macroeconomic headwinds. Rising mortgage rates have negatively impacted home affordability and demand, causing the company to resort to rate buy-downs to incentivize sales.

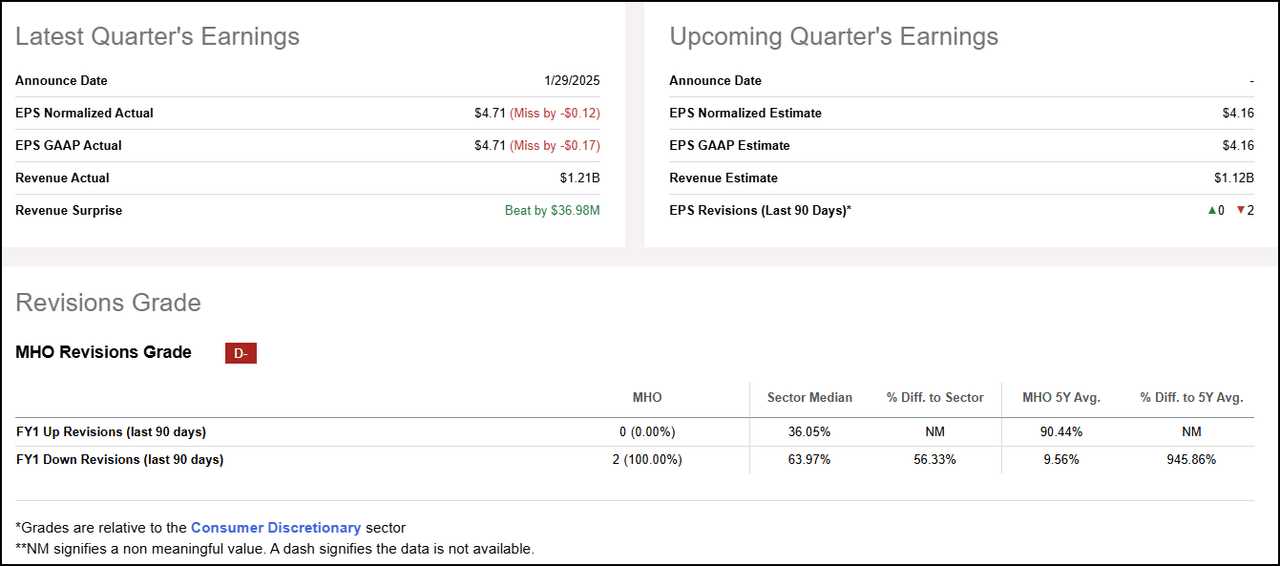

- Gross margins decreased by 250 basis points sequentially in Q4, and management expects further compression in 2025.

- Despite Q4 revenue of $1.2B, which exceeded analyst estimates by nearly $37M, decelerating momentum and downward EPS revisions contributed to the stock’s downgrade to a Quant Sell.

- While not all stocks work out, the winners in the Alpha Picks portfolio significantly outperform the losers. Eleven out of 38 Alpha Picks have returned more than 100% since their addition to the portfolio.

MHO Falls To Sell Rating

Fellow Alphas,

Two-time Alpha Pick M/I Homes, Inc. (MHO) is being removed from the Alpha Picks portfolio.

MHO, a prominent American homebuilder, is one of Alpha Picks’ top-performing stocks, having delivered an exceptional 230% since its initial selection on October 3rd, 2022. The stock was so successful that it was re-picked on December 15th, 2023, and has since delivered a disappointing -1.54% in that time. Decelerating momentum and downward earnings revisions compared to other Consumer Discretionary stocks have caused its Quant-rating to fall to a Sell.

MHO suffered a mixed earnings result in Q4, with high mortgage rates impacting home affordability and demand. The company has been increasingly relying on rate buydowns, which increased to 50% of sales in Q4, to incentivize sales.

“As everyone knows, mortgage rates began rising during the third and fourth quarters. At that time, we implemented mortgage rate buy-downs to generate traffic and incent sales. Demand has become a bit more choppy during the fourth quarter, and the need for such rate buy-downs became an even more important part of our business strategy,” said Bob Schottenstein, President and Chief Executive Officer of M/I Homes, Inc.

As a result, gross margins decreased 250 basis points sequentially in Q4. These negative factors have driven two analysts' downward revisions and zero upward revisions in the past 90 days. While two analysts represent limited coverage for MHO, it represents the entirety of Wall Street’s current research coverage on the stock.

MHO Revisions Grade

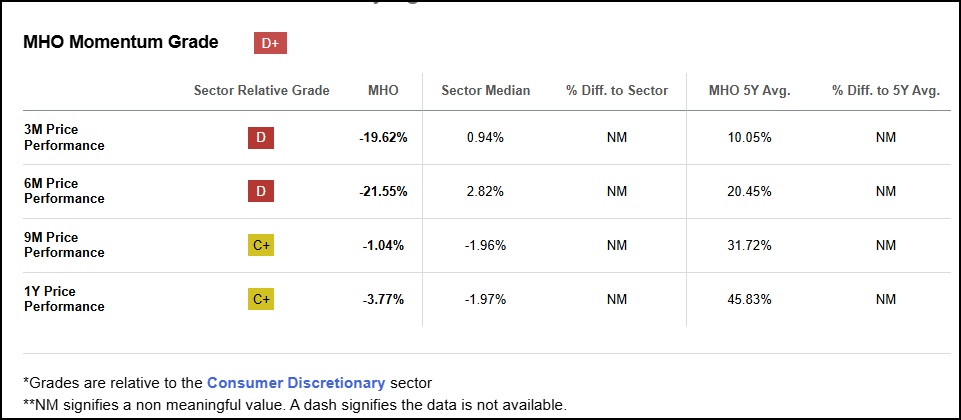

Deteriorating sentiment around the stock has strongly impacted its more recent price momentum. MHO has returned -19.62% on a trailing three-month basis vs. the sector median of 0.94%.

MHO Momentum Grade

Alpha Picks is a data-driven process, and while MHO’s valuation, growth, and profitability remain solid, we must follow our data-driven process. Stocks are removed when a Quant Rating falls from Strong Buy to Sell. Momentum and EPS Revisions Factor Grades show signs that are historically associated with poor future performance. These factors led to the stock’s downgrade to a Quant Sell rating.

Alpha Picks Selection Process

Alpha Picks adds one stock on the first trading day of every month and the closest trading day on or after the 15th of every month. Stocks that have fallen from Strong Buy to Sell or Strong Sell will be sold. Alpha Picks stocks that remain a Hold for more than 180 days will be sold, and the “cash” generated from the sold position gets equally invested across the remaining stocks in the Alpha Picks portfolio. All dividends are reinvested. Because MHO has fallen to a Sell rating, we are closing its positions as an Alpha Picks recommendation. As a friendly reminder, please check out the next Alpha Pick on February 18th and the webinar, where we will discuss MHO’s removal more in-depth.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.