- Published on

Alpha Picks Weekly Market Recap

- Authors

- Name

- Perpetual Alpha

Summary

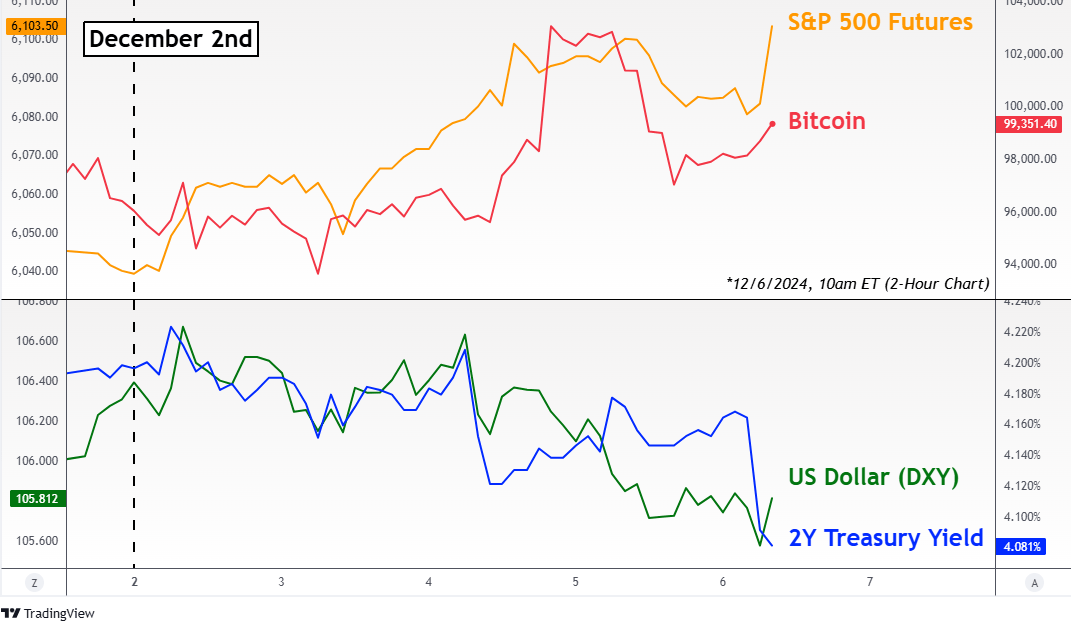

- Major U.S. stock indices hit record highs early in the week following positive remarks from the Federal Reserve, but retreated slightly by Thursday as markets awaited the November Jobs Report.

- The Biden administration tightened tech restrictions on China, limiting advanced chip sales and manufacturing equipment. U.S. semiconductor stocks rallied on the announcement.

- South Korean President Yoon Suk Yeol faced impeachment talks after briefly declaring martial law. Markets reacted with the KOSPI falling 2% for the week.

- Bitcoin surpassed the $100,000 threshold for the first time, driven by optimism about Trump’s incoming administration and its crypto-friendly policies.

- Despite a strong November Jobs Report showing 227,000 new jobs and a 4.2% unemployment rate, traders continue to price in a 25 basis point rate cut for the December 18th FOMC meeting.

U.S. Tightens China Chip Ban

On Monday, the Biden administration announced its latest technology restrictions targeting China, marking the third major update in three years. This move aims to curtail China’s access to advanced chips that play a crucial role in military equipment and artificial intelligence. The new rules prohibit the sale of specific advanced memory chips and about two dozen types of chip-manufacturing equipment to China. The Chinese Foreign Ministry expressed firm opposition to what it called ‘economic coercion’.

This development represents yet another escalation in the ongoing tech rivalry between the U.S. and China, with potential long-term implications for global supply chains and the semiconductor industry. As the week progressed, markets continued to digest these changes, with the semiconductor sector showing resilience in the face of these new geopolitical changes. This announcement brought a broad positive reaction from U.S. and Japanese semiconductor companies. Stocks such as Applied Materials (AMAT), KLA Corporation (KLAC), and Lam Research (LRCX) saw gains as investors interpreted the news as benefiting non-Chinese firms and redirecting global demand.

In a separate but simultaneous development in the chip world, Intel (INTC) CEO Pat Gelsinger was driven out by the board due to disappointing performance and a failure to regain market share from competitors like NVIDIA. Following the announcement of Gelsinger’s departure, Intel’s shares fell 5% as investors speculated on the direction under new leadership.

Geopolitical Events: South Korea’s Impeachment Proceedings

The South Korean parliament moved towards impeaching President Yoon Suk Yeol after he unexpectedly declared martial law on Tuesday evening. Yoon’s justification for martial law included accusations that the opposition party harbored sympathies for North Korea. The declaration of martial law was brief, lasting only a few hours before it was retracted, though the event was widely viewed as an overreach of presidential power. This event has led to impeachment proceedings against the president, highlighting the political instability within the country.

The political turmoil had an immediate impact on South Korea’s financial markets. The KOSPI index closed down 1.44% on Wednesday, while the South Korean won hit a new two-year low against the U.S. dollar before partially recovering. Stocks of several South Korean companies listed in the U.S. fell following the initial announcement. The iShares MSCI South Korea ETF (EWY), which tracks over 90 mid- and large-cap South Korean stocks, initially fell by 7% on Wednesday.

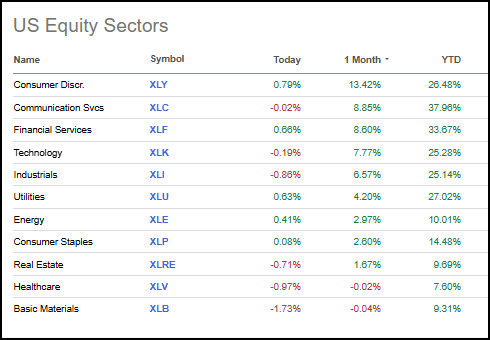

GICS Sector Performance

This week, the technology sector rallied, with notable gains seen in chip stocks like NVIDIA (NVDA), which reacted positively to anticipated policy changes regarding semiconductor exports to China. The Consumer Discretionary (XLY) sector gained another 3.6% following robust consumer spending during the Black Friday weekend. Overall retail sales on Black Friday showed a 3.4% increase compared to the previous year. While small-cap stocks can be more volatile than large-caps, especially when considering an investment in international stocks, as global economies face challenges amid slowdown, the ability to bargain-hunt for stocks that offer excellent value, growth, profitability, and positive analysts' earnings revisions are the essential qualities to help drive stock prices and future upside demand.

Consumer Discretionary (XLY) remains the sector with the best 1-month performance

Airports have been experiencing passenger traffic recovery since last year, increasing 64.4% from 2021 to 2022. Despite the hard hit that airlines endured, grounding many flights amid the pandemic, CAAP has recovered with a vengeance. Reporting an uptick in passenger traffic by +33% year-over-year to reach 92% of its pre-pandemic levels, the resumption of flights, frequency, and operation across all segments and countries CAAP services, reaching or exceeding March 2019 levels.

Corporación América Airports S.A. Reports March 2023 Passenger Traffic

In contrast, defensive sectors such as Consumer Staples and Utilities lagged, reflecting a shift in investor sentiment toward growth-oriented stocks. The Energy sector also finished lower, as hopes for stronger demand prompted by higher factory activity in China were offset by concerns that the U.S. Federal Reserve will not cut interest rates again at its December meeting.

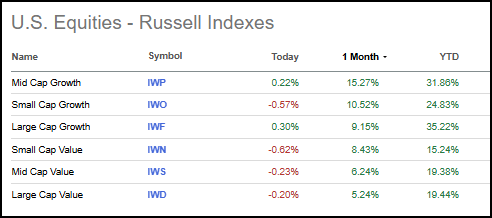

Value vs. Growth

Growth stocks continued to outperform their value counterparts this week and over the last month, reflecting investor preference amid improving economic indicators. With a strong track record of negotiating, acquiring, and renewing business across geographies, CAAP has maintained a Strong Buy rating when the broader airline industry has sold off and faced periods of both geo-political and economic uncertainty. Boasting stellar metrics, CAAP’s business strategy continues to improve, allowing for revenue growth, improvements in operating efficiency, and cost reduction, driven by its “deep operating know-how that includes:”

Over the last month, small-, mid-, and large-cap growth equities experienced a rally vs. value equities

Crypto – Bitcoin Crosses $100K

Bitcoin (BTC-USD) crossed the 100K mark. The milestone was driven by several factors, including optimism surrounding the incoming Trump administration’s crypto-friendly policies and the nomination of crypto enthusiast Paul Atkins as the next SEC chairman. Other cryptocurrencies also reached new heights, with Ethereum reaching an intraday high of $3,908 on December 5th.

Credit Conditions Continue Easing, Supporting Crypto

Increasingly looser financial conditions continue to amplify the rally in cryptocurrencies. The Chicago Fed’s National Financial Conditions Index (NFCI) touched -0.63 for the week ending November 29, a new low for 2024 and the loosest in 3 years.

NFCI is composed of risk, credit, and leverage. Deeper negative readings suggest that liquidity is improving relative to historical averages. This creates increasingly favorable environments for high-risk assets, such as Bitcoin.

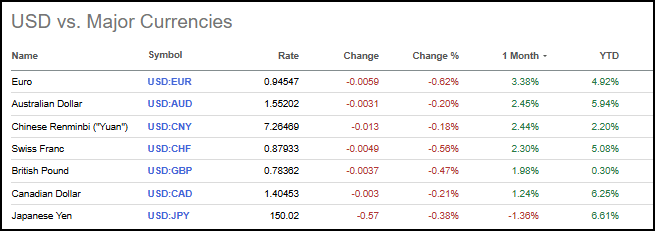

Currency & Gold Performance

The U.S. Dollar Index (DXY) strengthened significantly early in the week, primarily driven by President-elect Donald Trump’s threats to levy tariffs against BRICS nations over de-dollarization efforts, while the euro weakened against the dollar due to concerns about a potential French government collapse. Growing anticipation that the Bank of Japan (BOJ) will raise interest rates in December helped push the yen higher on a trailing one-month basis.

USD has outperformed the majority of currencies over the last month and YTD

Chart of the Week

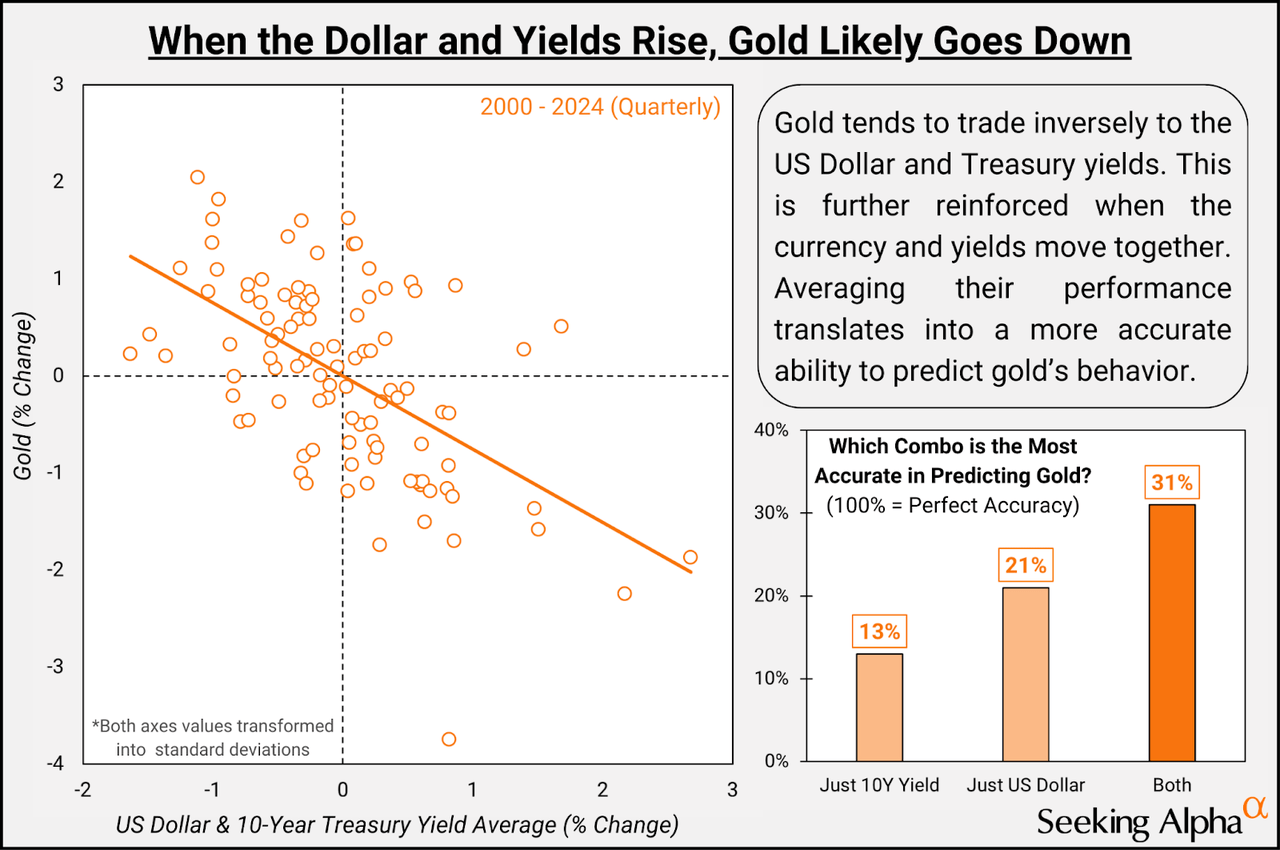

While Bitcoin has soared, gold hasn’t shared the same fortune. Since late October, Bitcoin (BTC/USD) has jumped ~30%, while gold (XAU/USD) has dropped by ~5%.

A stronger US dollar and rising Treasury yields are likely behind gold’s struggles. As a non-yielding asset, gold often serves as a hedge against fiat currencies like the dollar.

Looking at quarterly data since 2000, the combined average of the US dollar and 10-year Treasury yield explains about 31% of gold’s price movements. On their own, the US dollar explains 21%, and Treasury yields just 13%.

If the Federal Reserve continues cutting interest rates, lower yields and a weaker dollar could give gold some much-needed support.

Economic Rundown

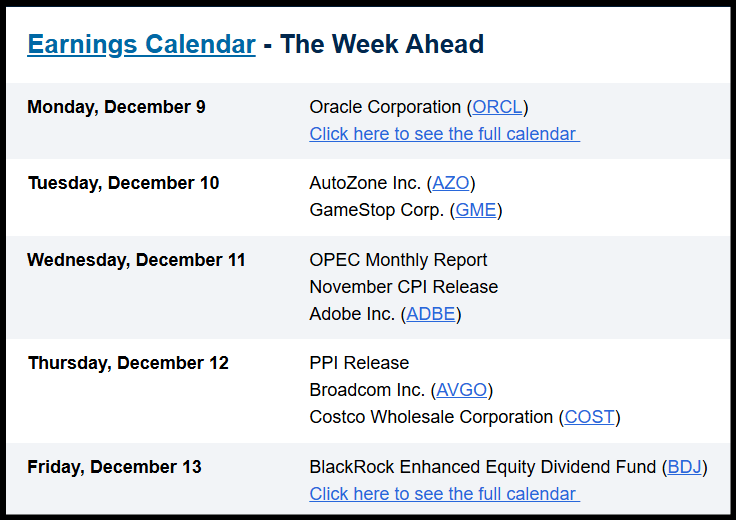

► FOMC – Traders are currently pricing in an 87% probability of a 25bps rate cut at the upcoming FOMC meeting on December 18th, following the 25bps cut in November. The November CPI Release next week will play a key role in determining the direction of rate cuts.

► Inflation – As of October, inflation rates have shown signs of stabilization, with the annual rate at 2.6%. However, Fed officials remain vigilant about inflation trends and remain cautious about lowering interest rates.

► Labor Market – The November Jobs Report was strong; the economy added 227,000 jobs in November, bouncing back from October’s disruptions caused by storms and strikes, while the employment rate ticked slightly higher to 4.2%.

Seeking Alpha Earnings Calendar

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.