- Published on

[QTWO] Digital Banking Dynamo

- Authors

- Name

- Perpetual Alpha

Summary

- Powering digital banking for more than 50% of America’s top 100 banks, this fintech leader commands significant market share.

- This company’s EBITDA margin has expanded to 19%, while maintaining 13% revenue growth achieving the coveted “Rule of 30” profitability target.

- With ARR growing 15% Y/Y and a record backlog exceeding $2B, this company is positioned to continue on its exceptional growth trajectory.

- Free cash flow has increased to $70M YTD, showcasing dramatically improved operational efficiency.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +184% versus +60%, with eight Alpha Picks soaring more than 100% since their addition.

Register for today’s webinar at 4 PM ET for key insights on this month’s new Alpha Pick with our VP of Quantitative Strategy, Steven Cress.

Business Overview

Q2 Holdings, Inc. (QTWO) is a top Quant-ranked application software company that offers digital transformation solutions, lending tools, and relationship pricing software for retail, small business, and commercial banks.

Serving over 1,400 customers, Q2 has capitalized on the surge in digital banking adoption, which accelerated rapidly in the wake of the COVID-19 pandemic, by providing smaller banks with a cloud-native digital banking platform.

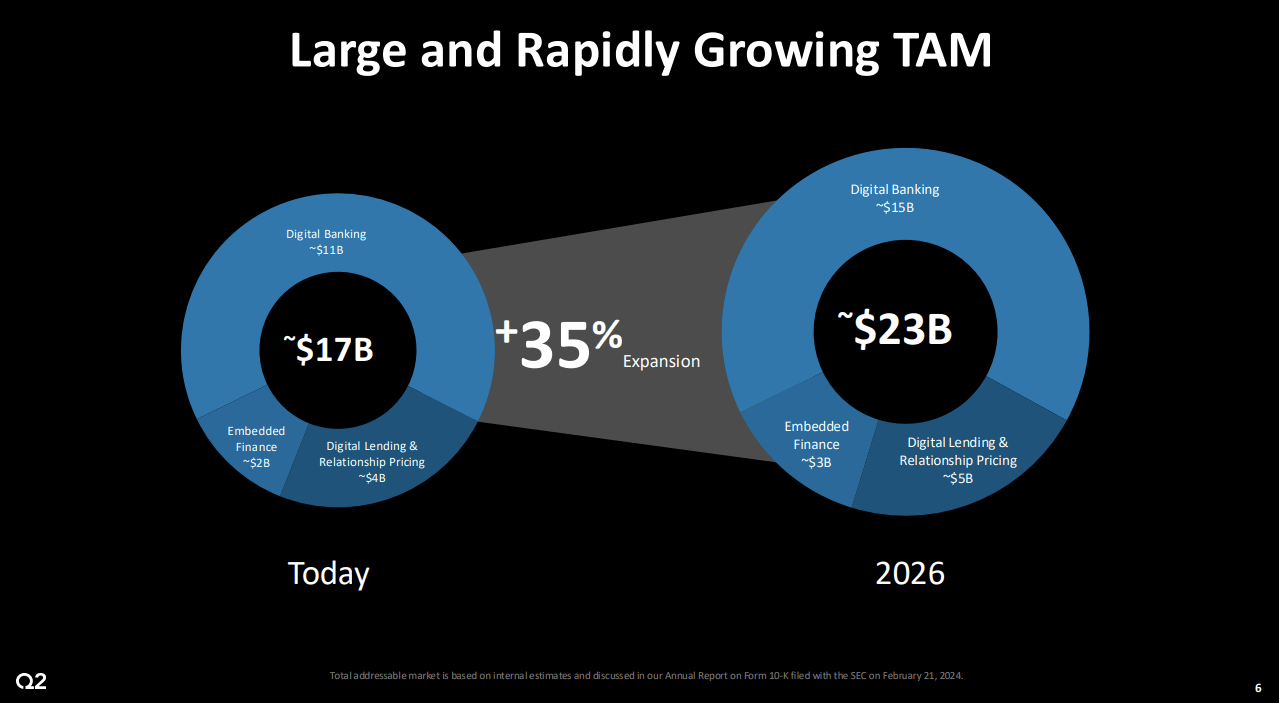

In 2022, Q2 expanded beyond its core digital banking platform, with the launch of its product, Helix, which empowers fintechs, consumer brands, and other enterprises with embedded finance solutions into their broader ecosystems. Additionally, Q2 has developed complementary lending, relationship pricing, and fraud & risk management solutions to round out its holistic financial technology platform.

Digital transformation has become a key priority for financial institutions seeking to modernize their banking infrastructure and augment customer experience. QTWO has been at the forefront, powering nearly 60% of America’s top 100 banks, as ranked by Forbes, solidifying its position as a digital transformation market leader. The company’s continued success in winning large enterprise deals and expanding relationships with existing customers demonstrates the growing demand for sophisticated digital transformation solutions.

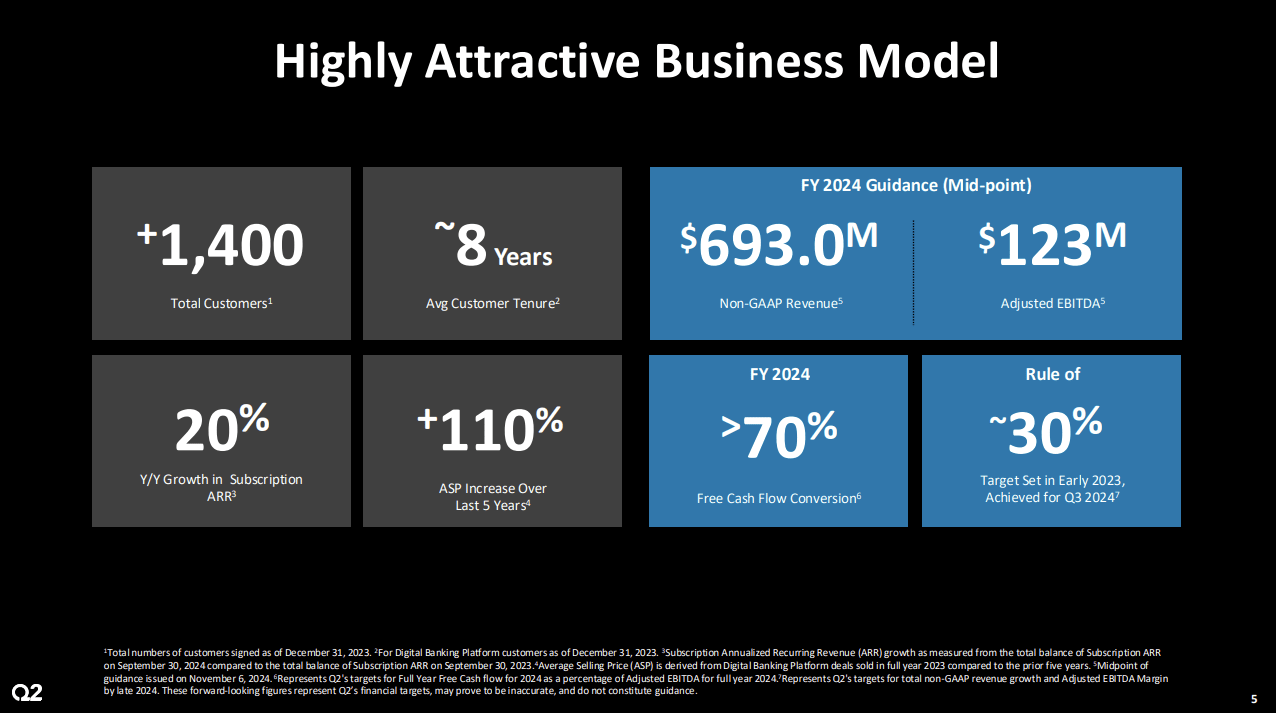

Our Buy Thesis

QTWO has demonstrated a compelling and profitable growth trajectory, underpinned by its diverse product portfolio and operational gains. Q2 has made a concerted effort to transition away from lower-margin services toward higher-margin subscriptions, which grew 18% Y/Y and now make up approximately 80% of total revenue. The company successfully achieved its ‘Rule of 30’ target, which combines revenue growth (13%) and an expanding EBITDA margin (19%) to exceed 30, showcasing its ability to balance growth with profitability.

In 2024, QTWO notably expanded its partnerships with larger financial institutions, while maintaining strong momentum in its core markets, demonstrating the company’s competitive strength in the fintech sector.

“In terms of notable stand-alone win and enterprise top 50 banks selected our digital banking platform to service the retail customer base. This customer will leverage key components of our recently announced Q2 Engage portfolio. Enabling the bank to drive personalization and differentiation in their consumer banking offerings,” said Matt Flake, Chief Executive Officer of Q2 Holdings, Inc.

Other major highlights from Q2 Holdings, attesting to the strength of its business, solid track record, and investment fundamentals, include the following:

- Adjusted EBITDA of $32.6M, up 66% Y/Y

- YTD free cash flow of $70M, up from $10M in the first nine months of 2023

- Total ARR grew to $796M, up 15% Y/Y

- Subscription ARR reached $655M, up 20% Y/Y

- Record backlog exceeded $2B, up 30% Y/Y

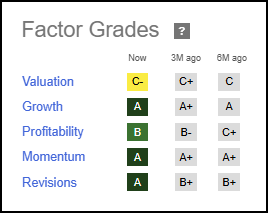

QTWO Stock Factor Grades

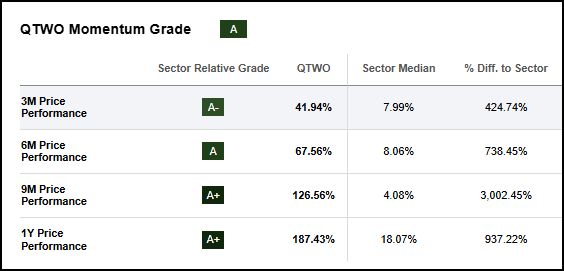

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. QTWO’s Growth and Profitability Grades indicate that Q2 Holdings, Inc. has excellent potential and is fundamentally sound compared to the sector. These solid fundamentals are dovetailed by exceptional price momentum and EPS Revisions grades, expressing a highly optimistic sentiment around the stock.

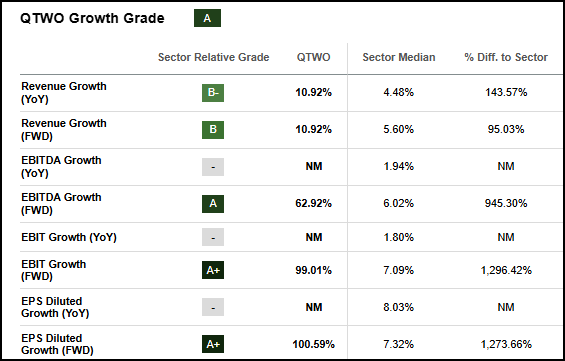

QTWO Stock Growth

QTWO produced excellent Q3 earnings, with revenue reaching $175M (up 13% Y/Y) beating consensus estimates by $1.55M. Solid results were driven by higher-margin subscription growth, coupled with a strategic focus on operational gains. In addition to the positive financial results, QTWO saw promising potential in future pipeline opportunities. In QTWO’s Q3 earnings call, Executive Vice President of Strategy & Emerging Businesses, Jonathan Price, stated:

“In addition to our strong financial performance, we saw broad-based booking success in the quarter. Highlighted by a total of 6 enterprise and Tier 1 deals, 3 of which were enterprise wins with top 50 U.S. banks as well as significant bookings contribution from the Tier 2 space. Our sales activity spanned across the portfolio with a variety of digital banking, relationship pricing and Helix wins, which we executed through a mix of net new and expansion deals.”

QTWO Growth Grade

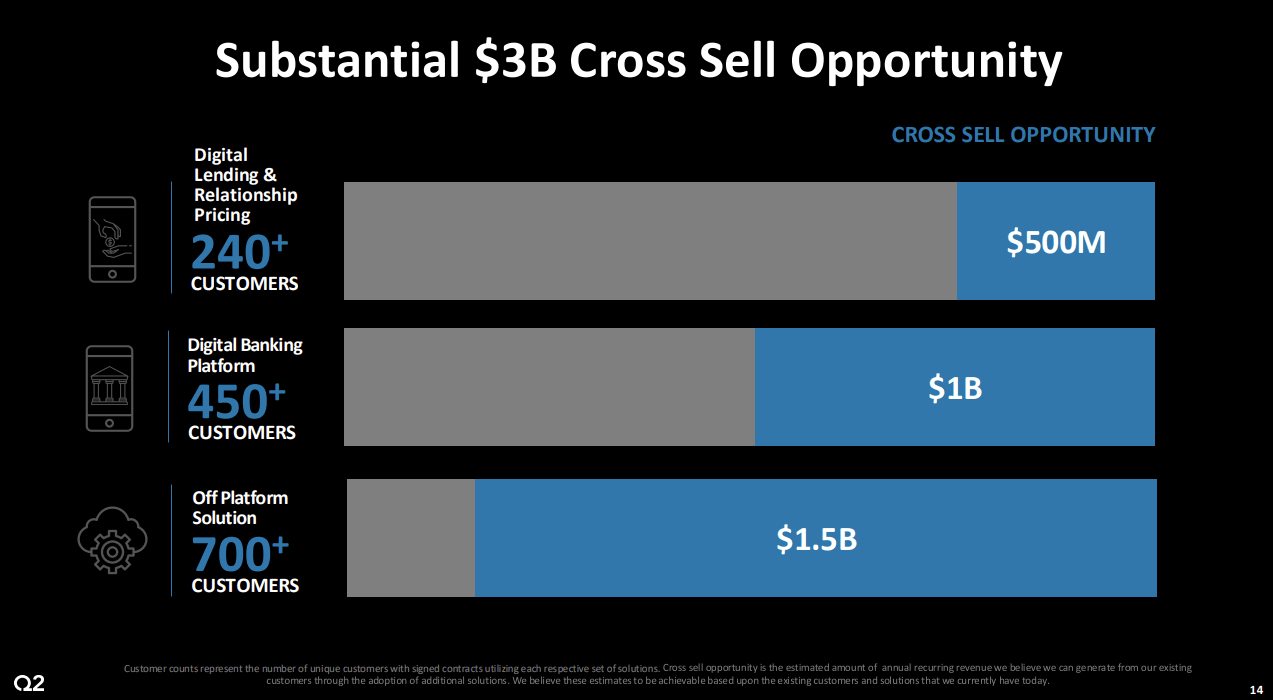

SA Premium Over the last seven quarters, Q2 Holdings, Inc. has beat analyst earnings estimates consistently. Looking ahead, QTWO has further untapped growth potential based on cross-selling opportunities within its strategic customer base. Among Q2’s 100 customers with over $5B in assets, more than 50% are subscribed to only one major product, representing a substantial expansion opportunity.

QTWO has demonstrated that it possesses both the strategic positioning and proven ability to capitalize on further gains within its existing customer base, which could further support the stock’s already exceptional price momentum.

QTWO Momentum Grade

QTWO Stock Valuation

Q2’s value profile has been diminished due to its tremendous gains over the last year, though its overall ‘C-’ grade still trades at a modest premium relative to the broader IT sector.

Potential Risks

Global macroeconomic uncertainties and challenges in the financial services industry, including an economic downturn, inflation, and an uncertain interest rate environment, could negatively impact Q2. The fintech industry is under increasing regulatory scrutiny, which could also have adverse implications for the company, should major changes to the regulatory environment impact operations or profitability. Additionally, increased competition in the fintech space could erode Q2’s market share.

Concluding Summary

Q2 Holdings has established itself as a leading provider of digital banking solutions for small- and medium-sized banks. Increasingly, Q2 is securing major wins with larger banks, further underscoring its credibility within the fintech sector. The company’s strategic shift towards higher-margin subscription growth has yielded excellent financial results, demonstrating an aptitude for profitable growth. Substantial cross-selling opportunities within its existing customer base suggest further growth potential. Q2’s proven ability to execute on product expansion, operational pivots, and enter new markets, coupled with organic, growing demand for digital banking solutions, positions the company for future success.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.