- Published on

[AGX] Watt’s Up?

- Authors

- Name

- Perpetual Alpha

Summary

- Driven by unprecedented demand for energy infrastructure, this top Quant-ranked construction and engineering company has significantly outperformed the industrial sector.

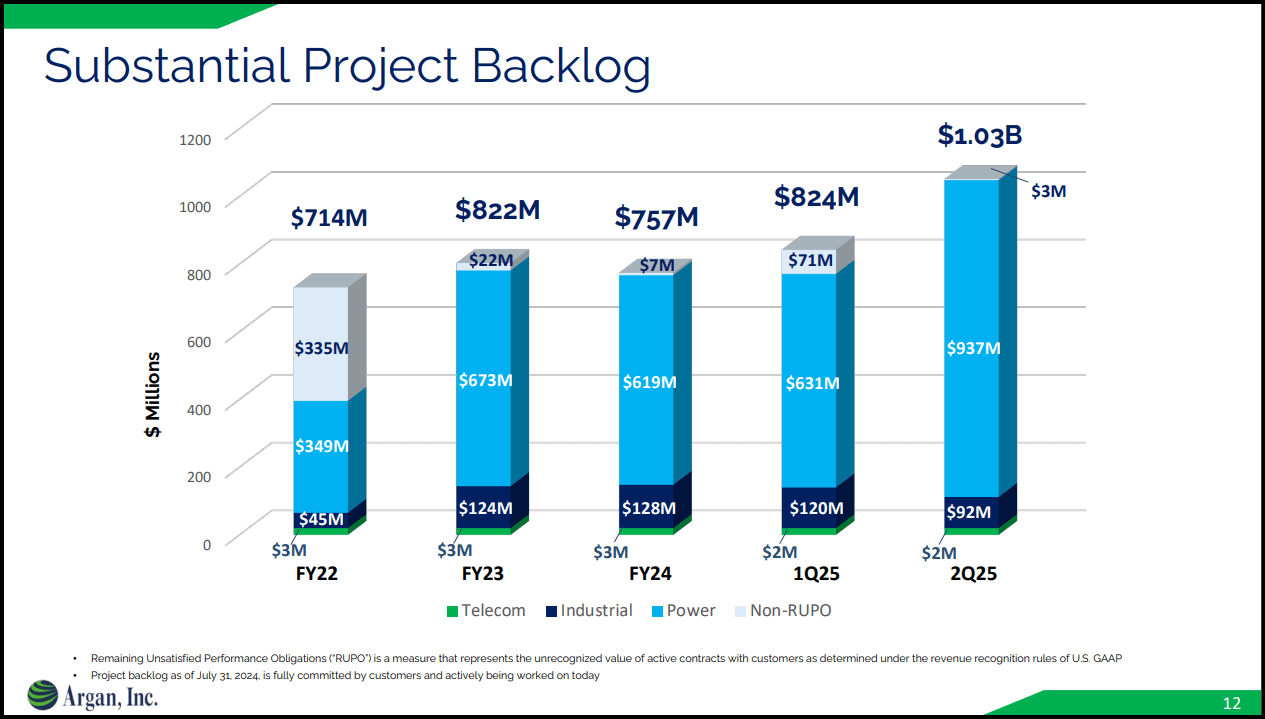

- With a $1B backlog and diverse capabilities, this company offers expertise in servicing both traditional and renewable energy sectors.

- This company saw revenue increase double digits across multiple segments, climbing 61% compared with the previous year, its strongest showing since 2017.

- The stock is poised to continue capitalizing on significantly higher energy demand in the wake of the AI revolution, global electrification of vehicles, and the replacement of old power plants.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +157% versus +55%, with eleven Alpha Picks soaring more than 100% since their addition.

Register for the Money Show Conference in Orlando, Florida, on October 17-19, 2024. The full-day conference will convene top influential figures in business and finance. Steven Cress will share unique insights and unparalleled analysis, including breakout sessions on Politics & Your Money for the election year.

Business Overview

Founded in 1961, Argan, Inc. (AGX) is the top Quant-rated construction and engineering stock that operates as a holding company with four subsidiaries in the US and Ireland, across three distinct business segments:

- Power Industry Services

- Industrial Construction Services

- Telecommunication & Infrastructure Services

AGX’s largest segment, Power Industry Services, focuses on the engineering, procurement, and construction (EPC) of several types of power facilities in the US, Ireland, and the UK. AGX’s Power Industry Services includes natural gas-fired power plants, solar energy fields, biomass facilities, and wind farms and contributed 77% to the company’s top line in Q2. AGX’s Industrial Construction Services segment services multiple industries in the southeast region of the US with on-site turn-key construction services and drove another 22% of revenue last quarter. Telecommunication & Infrastructure Services, accounting for less than 2% of AGX’s total business, provides a wide range of hard wire communication and power distribution solutions to commercial, local, and federal government customers.

Argan has been strategically expanding its presence in the renewable energy sector to diversify its portfolio and capitalize on the growing demand for clean energy solutions. This shift aligns with broader industry trends and positions the company to adapt to changing market dynamics in the power generation landscape.

Argan, Inc. 1-year Trading Chart

Our Buy Thesis

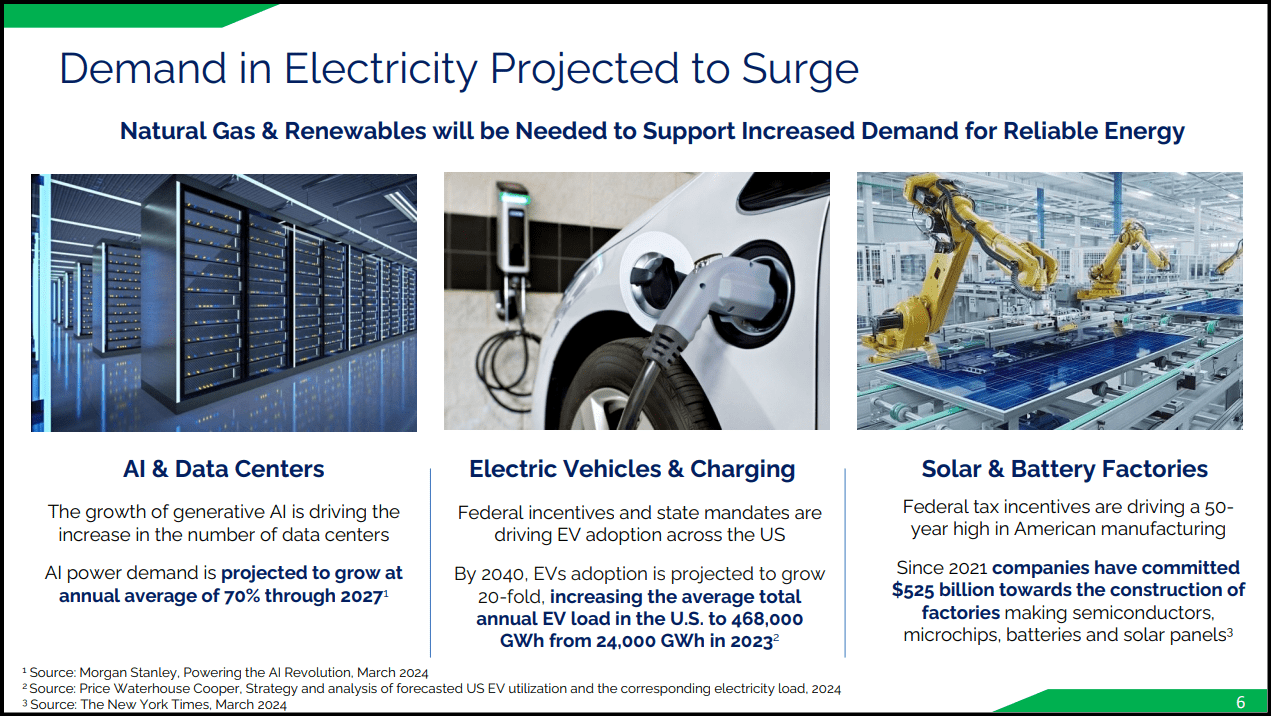

AGX has benefitted from the enormous demand for energy infrastructure. The explosive growth of AI and associated data centers, electric vehicles and their charging needs, and increased domestic manufacturing due to federal tax incentives, among others, have contributed to demand.

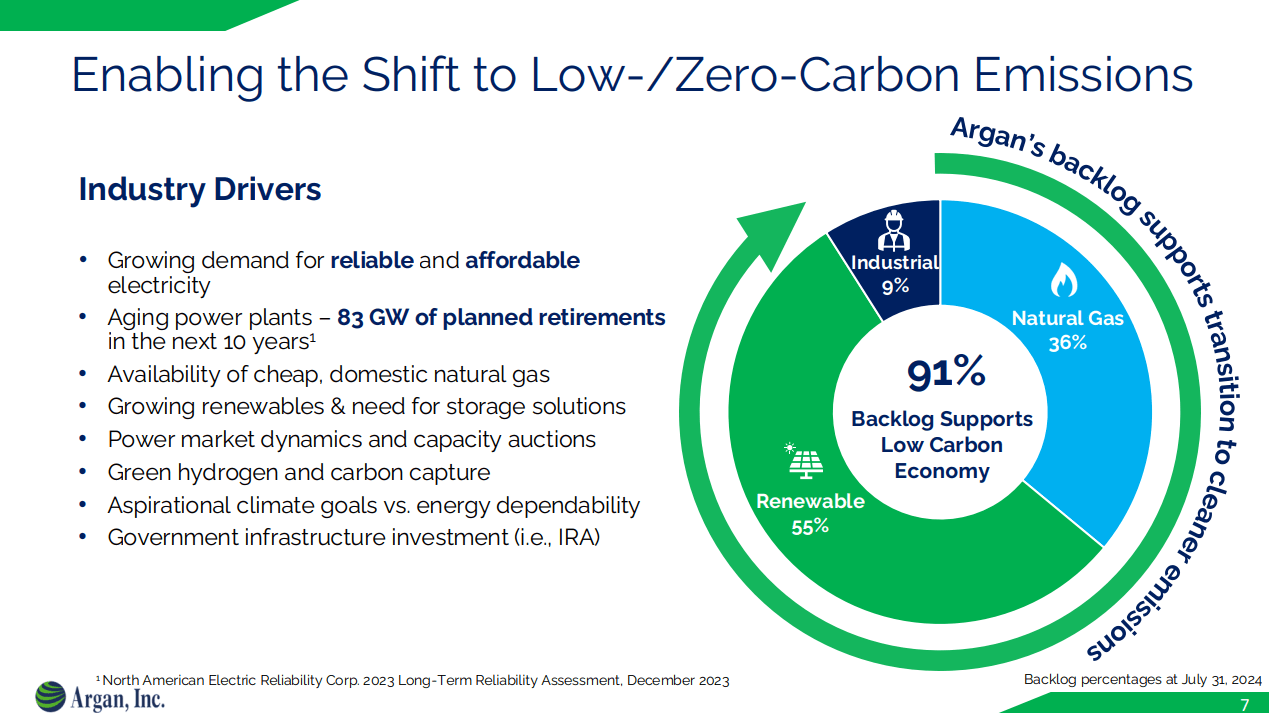

There is a growing demand for reliable and affordable electricity, driven by aging power plants and the availability of domestic natural gas. With increasing renewable energy adoption and the need for storage solutions, power market dynamics and capacity auctions are becoming critical. Government infrastructure investments and climate goals are pushing developments in green hydrogen, carbon capture, and energy dependability.

Argan’s expertise in servicing both traditional and renewable energy projects makes it well-positioned to capitalize on this pivotal moment in the power industry landscape.

"We're energized by the pipeline of opportunities we're seeing and look forward to working with both new and existing partners who recognize our expertise and diverse capabilities as a valued collaborator on the anticipated impending build out of power resources needed to meet the forecast of unprecedented demand.” said David Watson, President and CEO of Argan, Inc.

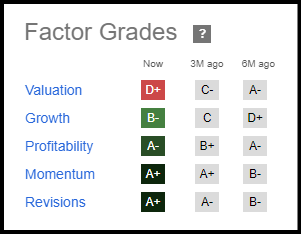

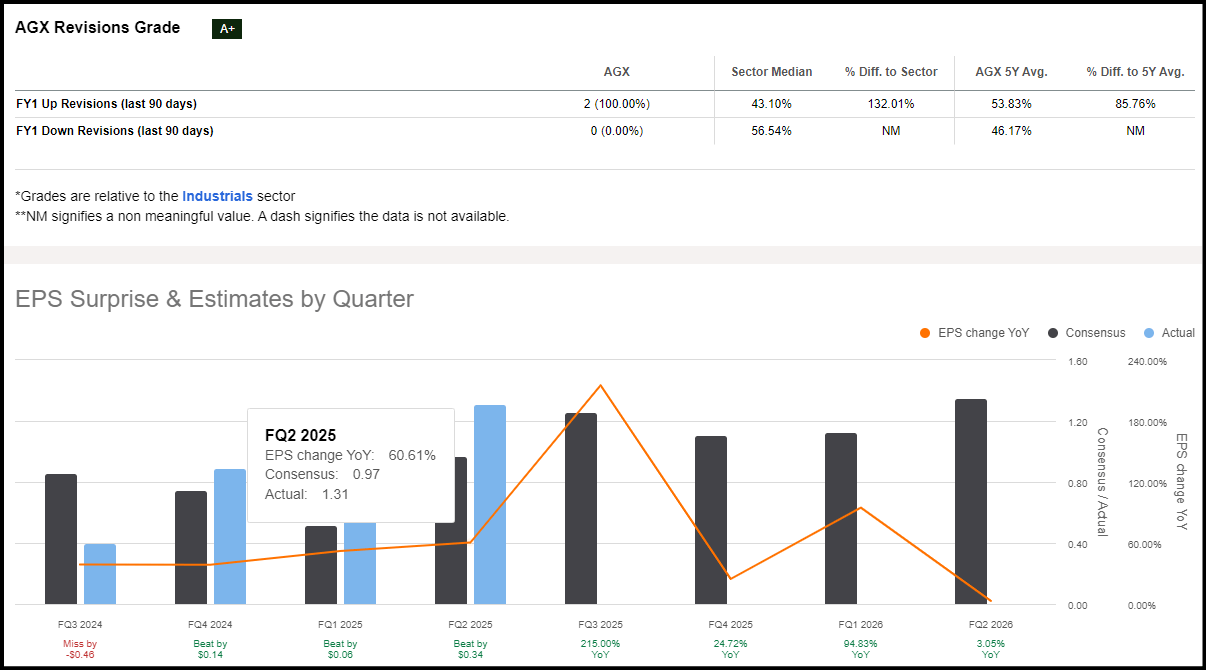

Argan saw a 61% increase in revenues yoy in Q2, totaling $227 million, and achieved growth across all business segments. As of July 31, 2024, the company reported net liquidity of $260M and no debt. The company’s strong financial position, current market dynamics, and factor grades below illustrate why AGX is currently rated a strong buy.

AGX Stock Factor Grades

Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis. AGX’s Growth, Momentum, Profitability, and Revisions grades indicate that AGX offers excellent potential and is fundamentally sound compared to the sector.

With a project backlog exceeding $1B, which grew 25% in Q2, AGX is a stock well-positioned for growth and has the operational excellence to translate that into profitability and value for shareholders.

AGX Stock Growth and Profitability

Argan, Inc. has delivered robust earnings, highlighted by a second-quarter FY2025 EPS of $1.31, which is more than double the $0.58 from the previous quarter. The company beat revenue expectations for the fifth consecutive quarter, delivering $36M above expectations.

Argan, Inc. EPS Surprise & Estimates

Revenue for AGX’s Power Industry Services segment increased 65% yoy, contributing $173.8M, while its Industrial Construction Services segment rose 52% compared to Q2 FY2024, totaling nearly $50M. Argan’s growth is not only exceptional, but it is diversified, creating more room for this company to run as it grows both organically and through potential future strategic acquisitions, as it has done in the past. The company acquired its four subsidiaries between 2003 and 2015.

Revenue for AGX’s Power Industry Services segment increased 65% yoy, contributing $173.8M, while its Industrial Construction Services segment rose 52% compared to Q2 FY2024, totaling nearly $50M. Argan’s growth is not only exceptional, but it is diversified, creating more room for this company to run as it grows both organically and through potential future strategic acquisitions, as it has done in the past. The company acquired its four subsidiaries between 2003 and 2015.

With a robust balance sheet and significant capital for further investment, Argan is positioned for long-term profitability. AGX’s second quarter key highlights include:

- Net income of $18.2 million, up from $12.8 million in Q2 FY2024

- EBITDA of $24.8 million, up from $17.8 million in Q2 FY2024

- $485M in cash and cash equivalents as of July 31, 2024

- A 25% dividend increase announced on September 18, 2024

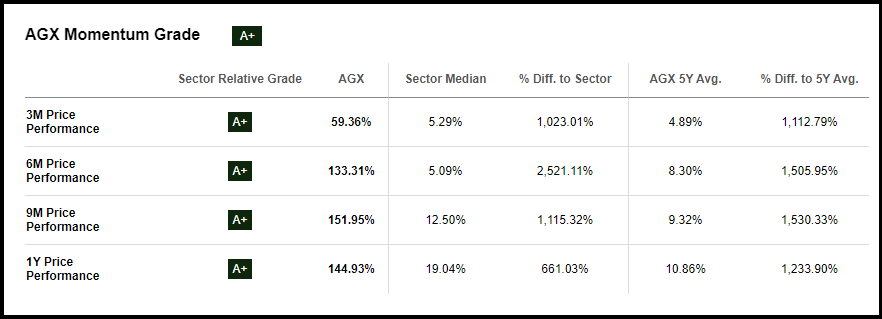

Argan’s momentum has been exceptional over the past four quarters, sporting ‘A+’ grades for each period.

AGX Stock Momentum Grade

While a shift in the mix of project types and contract types slightly negatively impacted gross profit margin year-on-year, $570M of the company’s current $1B backlog is comprised of renewable energy projects. The company received a full notice to proceed on a utility-scale solar field in Illinois that is poised to deliver 405 megawatts of electrical power. This project is the company’s largest solar project to date and represents AGX's multiple layers of diversification, even with the Power Industry Services segment.

While a shift in the mix of project types and contract types slightly negatively impacted gross profit margin year-on-year, $570M of the company’s current $1B backlog is comprised of renewable energy projects. The company received a full notice to proceed on a utility-scale solar field in Illinois that is poised to deliver 405 megawatts of electrical power. This project is the company’s largest solar project to date and represents AGX's multiple layers of diversification, even with the Power Industry Services segment.

AGX Stock Valuation

Argan, Inc.’s valuation profile has been somewhat diminished due to its phenomenal and sustained momentum over the last year. However, it is still trading at a discount relative to the sector in key areas, such as its current price-to-cash flow of 9x and its FWD EV/sales ratio of 1.3x, which are -40% and -32% reductions compared to the sector medians, respectively.

Potential Risks

AGX operates in a heavily regulated industry, and various headwinds could impact the pace at which it is able to move through its backlog, as the company relies on permitting from the EPA and other agencies to proceed with the development of its project sites. Broader regulations to the energy sector could also have ancillary effects on AGX and its operations and profitability. As with any large-scale industrial project, there can be difficulty in predicting when contracts will be awarded, which may create lumpiness and hinder the smooth delivery of projects.

Concluding Summary

Argan, Inc. is a top Quant-ranked construction and engineering company poised to continue capitalizing on significantly higher energy demand in the wake of the AI revolution and global vehicle electrification. AGX has expertise across the power sector and beyond, operating across three distinct business segments, two of which have seen substantial growth in the last quarter.

The company’s foothold in the US and abroad broadens its reach, despite potential regulatory headwinds that might come its way. Its enormous backlog, diverse set of capabilities within the power sector, healthy balance sheet, and exceptional momentum make this stock an excellent pick.

We have many stocks with strong buy recommendations, and you can filter them using Stock Screens to suit your specific investment objectives. We’ll continue to update you on stocks like AGX, and I hope to see you at the Money Show!

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.