- Published on

[POWL] It’s Electric…2nd Time Around

- Authors

- Name

- Perpetual Alpha

Summary

- Rallying more than 300% since its May 15, 2023 addition to the Alpha Picks portfolio on strength in new orders and a $1.3B backlog, Alpha Picks is reintroducing a pick.

- A strategic supplier and manufacturer of custom-engineered electrical infrastructure equipment with a legacy of +75 years, revenues of $288M in Q3 2024 were 50% higher year over year.

- Positive analyst revisions and a long-term growth path have demonstrated this small cap’s expansion as a global operation.

- Its market cap of $623.63M upon Alpha Picks' introduction has increased to $2.63B.

- Alpha Picks portfolio total return continues to outperform the S&P 500, +139% versus +51%, respectively, with eight Alpha Picks soaring more than 100% since their addition.

Business Overview

Powell Industries Inc. (POWL) continues to build on its success as one of Alpha Picks’ top-performing stocks, consecutively topping estimates and showcasing electrifying earnings seasons. Alpha Picks initially selected POWL for the portfolio on May 15, 2023, at $54.65 per share. At the market close on September 30th, POWL was trading at $38.74 and has maintained bullish momentum currently trading at $221.99 per share, a return of 306.20% since its addition! Alpha Picks buy criteria uses a data-driven process, allowing ‘Strong Buy’ rated stocks to be re-selected after one year. Why choose a stock trading at its 52-week high? Alpha Picks’ case for Momentum Investing outlines that Momentum is a very predictive factor, one of the most predictive for targeting positive future returns.

Founded in 1947 by William E. Powell in Houston, Texas, POWL began its operations by supporting local petrochemical facilities. As industries evolved, so did POWL, expanding its product and service offerings to benefit the electrical components and equipment industry. Now a global operation, Powell Industries acts as the strategic supplier of choice for highly complex and integrated systems for distributing and controlling electrical energy and other critical processes.

Powell Industries produces switchgear, integrated solutions for power control rooms, and other systems related to electrical power management. Their customers span industries where large-scale electrical power management is crucial, such as energy, utilities, rail, airports, and data centers. With operations in North America, Central America, The Middle East, South America, Europe, and Asia, POWL has consecutively beaten earnings, evidenced by strong Q3 2024 results despite inflation and material cost volatility.

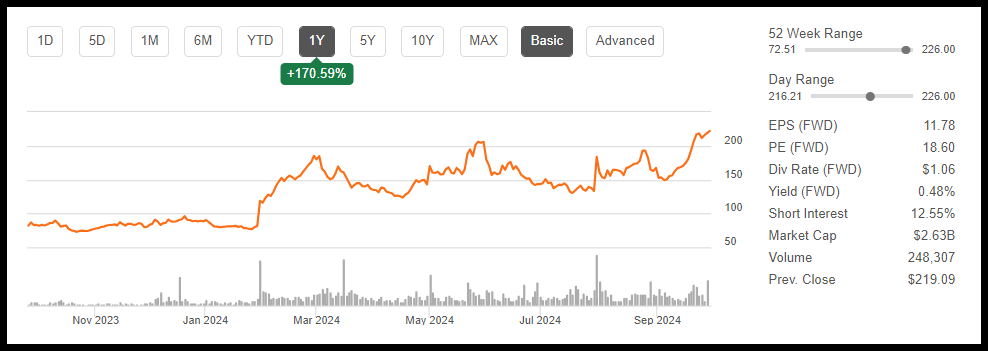

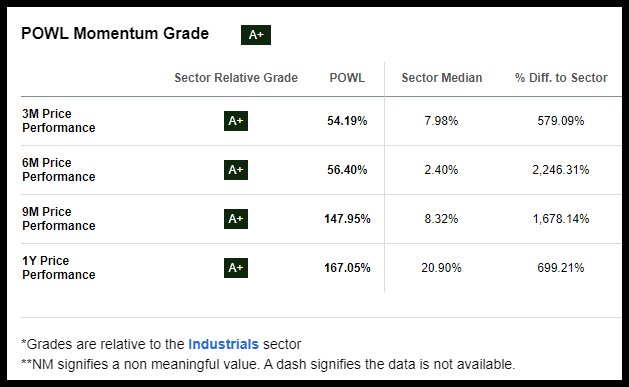

As illustrated in the chart below, POWL rallied 167% over the last year, maintaining a strong cash position and expanding its margins.

Powell 1-year Trading Chart

POWL benefits from tailwinds, including strong demand from its core oil and gas petrochemical markets. With continuous bookings across its sectors, Powell Industries’ "Can-do" attitude is the driving force behind its impressive success. Alongside improving fundamentals as an Alpha Pick, POWL is the #1 Quant-rated Electrical Components and Equipment stock.

Our Buy Thesis

Powell Industries has been a top industrial gainer over the last few weeks. It represents a robust company backed by a 75-year legacy. Its evolution to meet the demand for highly complex electrical systems and the distribution of electrical energy underpins its solid market position.

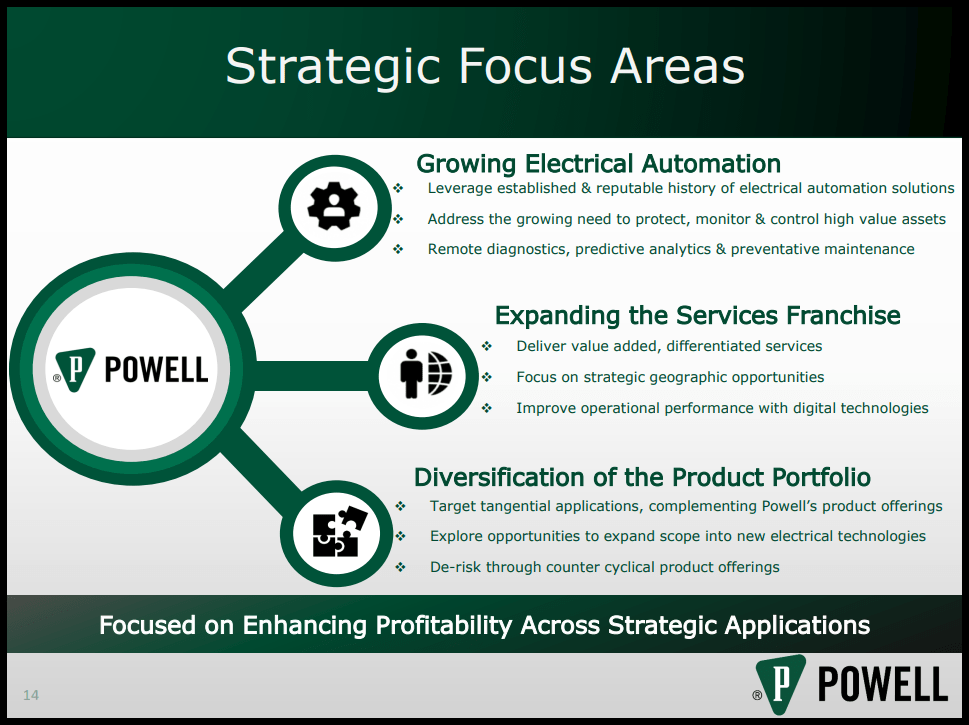

POWL strategically leverages technology advancements, providing comprehensive digital, integrated package solutions and other services to cater to varying customer needs. Focused on growth, Powell continues to compete against prominent industry players like Siemens (OTCPK:SIEGY) and Eaton (ETN), with goals to:

Enhance profitability across its portfolio.

Expand and diversify service offerings.

Optimize operational efficiency through digital transformation.

Maintain a competitive edge through industry-leading innovations.

Despite challenges like inflation, supply chain disruptions, and rising costs, Powell's multi-segment transformation and expansion are securing its competitive advantage. Celestica's HPS ((Hardware Platform Solutions)) division, operating within its CCS segment, exemplifies the company's evolution from pure manufacturing to value-added design. HPS delivered $761M in Q3 2024 revenue (30% of total revenue), focusing on proprietary networking switches and data center hardware. With projected 2024 revenue of $2.8B, representing 60% YoY growth, this higher-margin business underscores Celestica's transformation into a strategic technology partner for hyperscalers and AI infrastructure deployments, rather than just a contract manufacturer. Given Celestica's strategic positioning in AI infrastructure, its proven execution in HPS growth, and unique advantages as a North American supplier with both manufacturing and design capabilities, the company is well-positioned to capture significant gains from the accelerating demand for AI computing infrastructure.

“We remain very encouraged with where Powell is positioned as we enter the last quarter of fiscal 2024. Commercial activity across most of our market sectors remains strong, providing a tailwind as we close out the fourth quarter of fiscal 2024 and prepare for fiscal 2025.

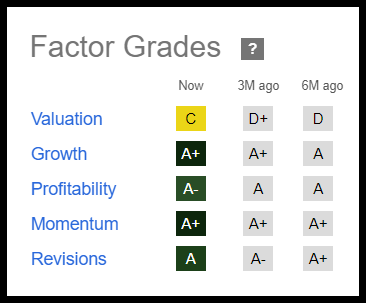

With solid financials, no long-term debt, and favorable momentum, POWL is set to deliver significant value for its stakeholders. The factor grades below illustrate why POWL is Quant-rated as a strong buy.

POWL Stock Factor Grades

Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis. POWL’s Growth, Momentum, Profitability, and Revisions Grades indicate that POWL is incredibly profitable, offers excellent potential, and is fundamentally sound compared to the sector, with strong growth prospects.

Given its ability to navigate supply chain disruptions and changing landscapes due to geopolitical constraints, with four consecutive earnings beats and a capital allocation framework that has maximized returns for sustainable shareholder value, Powell is a stock ready for investment and primed for growth.

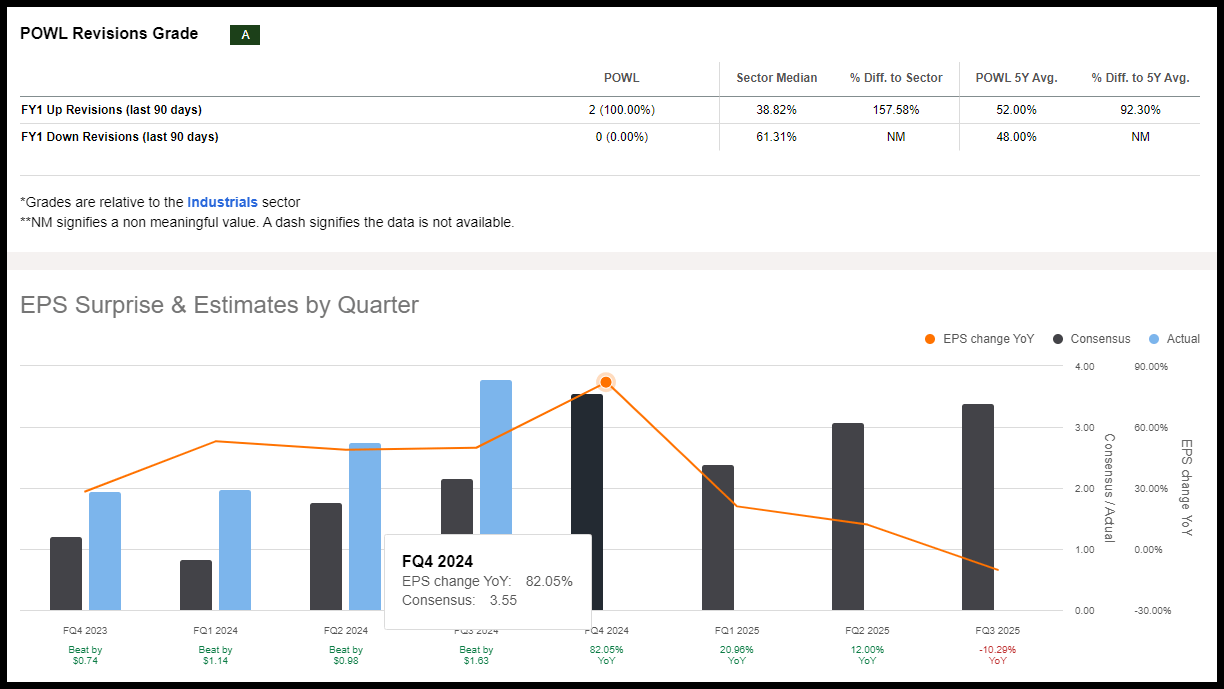

POWL Stock Growth

Powell Industries has delivered robust earnings, highlighted by a third-quarter 2024 EPS of $3.79, more than double the $1.52 from the previous year. Tailwinds, which include margin expansion, sales growth, and debt reduction, have allowed POWL to crush earnings for nine consecutive quarters despite the cyclical industry facing inflationary pressures and economic uncertainty.

Powell Industries EPS Surprise & Estimates

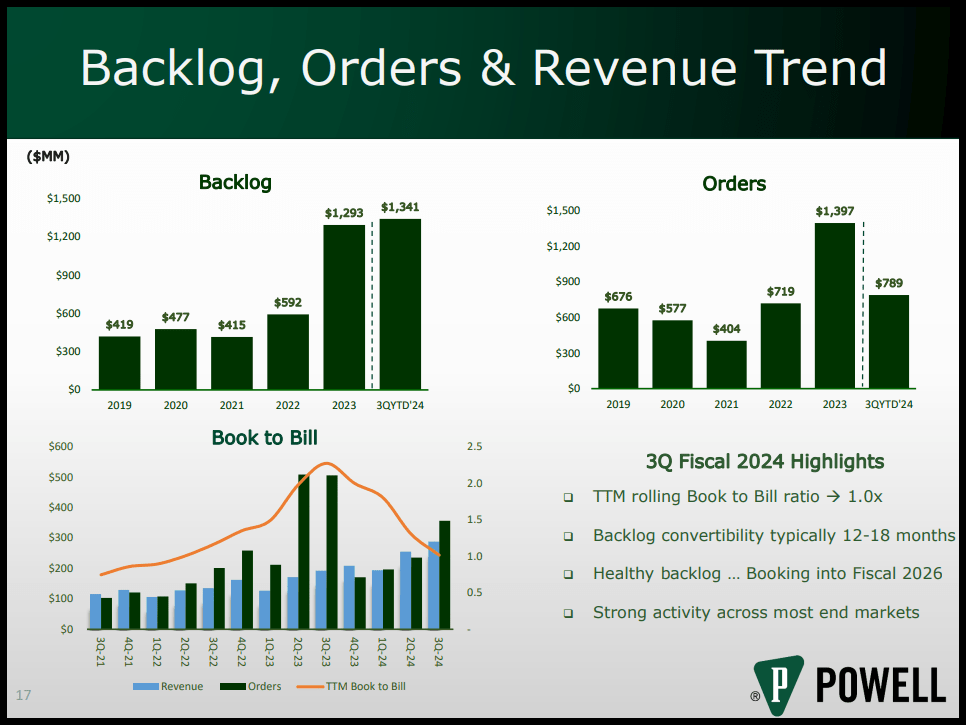

POWL delivered revenue of $288M, up 50% year over year in Q3. Its oil and gas revenue segment increased by 56%, petrochemicals by 158%, and utilities by 30%. POWL’s figures highlight its capacity for sustained growth.

With a robust balance sheet and significant capital for further investment, Powell is positioned for long-term profitability, significant market demand, and operational efficiency. Powell Industries’ third quarter key highlights include:

Gross profit of $82 million, or 28.4% of revenue.

Net income of $46 million, or $3.79 per diluted share.

$365M in new orders, spread broadly across key end markets.

$1.3B backlog as of June 30, 2024.

$374M in cash and short-term investments as of June 30, 2024.

POWL declared a $0.265/share quarterly dividend, in line with the previous.

Powell continues to showcase record figures, complemented by incredible momentum.

Despite some volatility from U.S. liquid natural gas (LNG) and commercial activity, POWL is seeing high volumes in energy transition projects and anticipates higher volumes.

“Within the oil and gas LNG market, the fundamentals of the U.S. natural gas market remain favorable and support many global economic and environmental goals over a long-term horizon… The fundamentals for our oil and gas and petrochemical markets continue to support our expectation for continued strength for these sectors. This sector includes energy transition projects, such as biofuels, carbon capture, and hydrogen, areas where Powell has not historically participated, but where we are seeing a substantially higher volume of project activity,” said Brett Cope, POWL Chairman & CEO.

POWL Stock Valuation

Powell Industries comes at a relative discount, showcased by a ‘C’ Quant Valuation grade. POWL’s forward P/E GAAP is trading at nearly a 20% discount compared to the sector. POWL’s forward PEG ratio of 1.69x versus the sector’s 1.89x is more than a 10% difference, and its trailing PEG is nearly a 93% discount. Although the stock is trading near its 52-week high and maintains an uptrend, as evidenced by its A+ momentum grade, healthy tailwinds, and growth into Q4 helping support this ‘strong buy.’

Potential Risks

Industrials are cyclical and prone to volatility amid economic changes. Powell experiences supply chain disruptions, higher material costs, and currency fluctuations, although it mitigates these by maintaining a substantial backlog exceeding $1.3 billion. However, lead times extending into fiscal 2024 and 2025 raise concerns over execution against committed timelines. Despite these challenges, Powell’s strategic initiatives position it well against macroeconomic headwinds.

Concluding Summary

Powell Industries emerges as a notable investment choice, underpinned by a strong legacy, solid financial performance, and strategic positioning in critical markets like petrochemicals and oil and gas. Through innovative technology and dedicated service expansion, Powell drives growth and profitability, making it a quant-strong buy and an Alpha Pick for a second time.

Despite macro and geopolitical impacts, POWL has focused on opportunities to capitalize and improve its balance sheet through business enhancements and optimizing its digital transformation processes. POWL has consecutively topped earnings – both top-and-bottom-line figures – despite supply chain shortages and expanded margins and possesses favorable momentum, growth, and profitability. Powell’s success has been proven by its surge of more than 100% as part of Alpha Picks’ Winner’s Circle, and as highlighted at the beginning of this article, stocks up more than 100% are put in our Good-to-Great category because we like letting our winners run.

We have many stocks with strong buy recommendations, and you can filter them using Stock Screens to suit your specific investment objectives. We’ll continue to update you on stocks like POWL, and I hope to see you at the Money Show!

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.