- Published on

[CCL] Full Steam Ahead

- Authors

- Name

- Perpetual Alpha

Summary

- This global cruise operator smashed multiple profitability records in Q3, with revenues of $7.9B, up $1B from Q3 2023 and an adjusted EBITDA of $2.8 billion, up $600M.

- Buoyed by shifting consumer preferences, this company is succeeding in its strategy of yield optimization, with onboard spending climbing 6.7% Y/Y.

- This company is slated to unveil multiple growth catalysts in the next twelve months, including a private destination island to compete with other global cruise liners.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +147% versus +51%, with eight Alpha Picks soaring more than 100% since their addition.

Register for the Making Data-Driven Decisions This Election webinar on November 4th, 2024. Join Steven Cress, Seeking Alpha’s VP of Quantitative Strategy, as he demonstrates how to leverage Premium’s tools to navigate election-driven market trends.

Business Overview

Carnival Corporation & plc (CCL) is the top Quant-rated hotels, resorts, and cruise lines stock and the world’s largest cruise operator, controlling approximately 40% of the global cruise market in revenue share. Operating a combined fleet of over 90 ships, CCL’s portfolio of brands includes Carnival Cruise Line Brand, Princess Cruises, Holland America Line, Seabourn, P&O Cruises, Costa Cruises, and more. The company serves nearly 13 million passengers annually, visiting hundreds of ports globally.

Since the days of COVID restrictions, which halted business and shut down global operations, CCL has made an enormous comeback with record revenues and historically high occupancy levels.

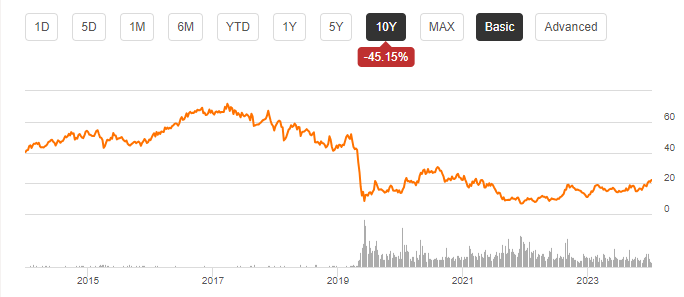

Despite Record Revenue, the Stock Trades Far Below its 2017 Peak

CCL has expansion plans slated for 2025, with the debut of Celebration Key, a private destination in the Bahamas built exclusively for Carnival Cruise Line, as well as the North American premier of the highly successful Sun Princess Cruise Ship.

Carnival Corporation & plc 1-year Trading Chart

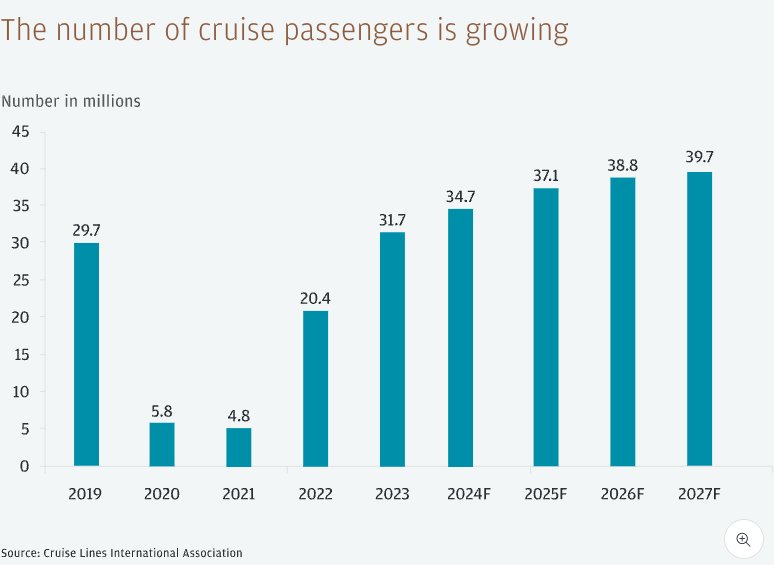

Popularity in the cruise industry has taken off in recent years, due to multiple factors.

Cruise vacation pricing has increased considerably less compared to land-based alternatives within the travel sector. With the availability of the internet via Starlink, better amenities, and a demographic shift, Carnival’s dominant market position makes it well-positioned to capitalize on this growing trend in shifting consumer preferences toward cheaper cruise vacations.

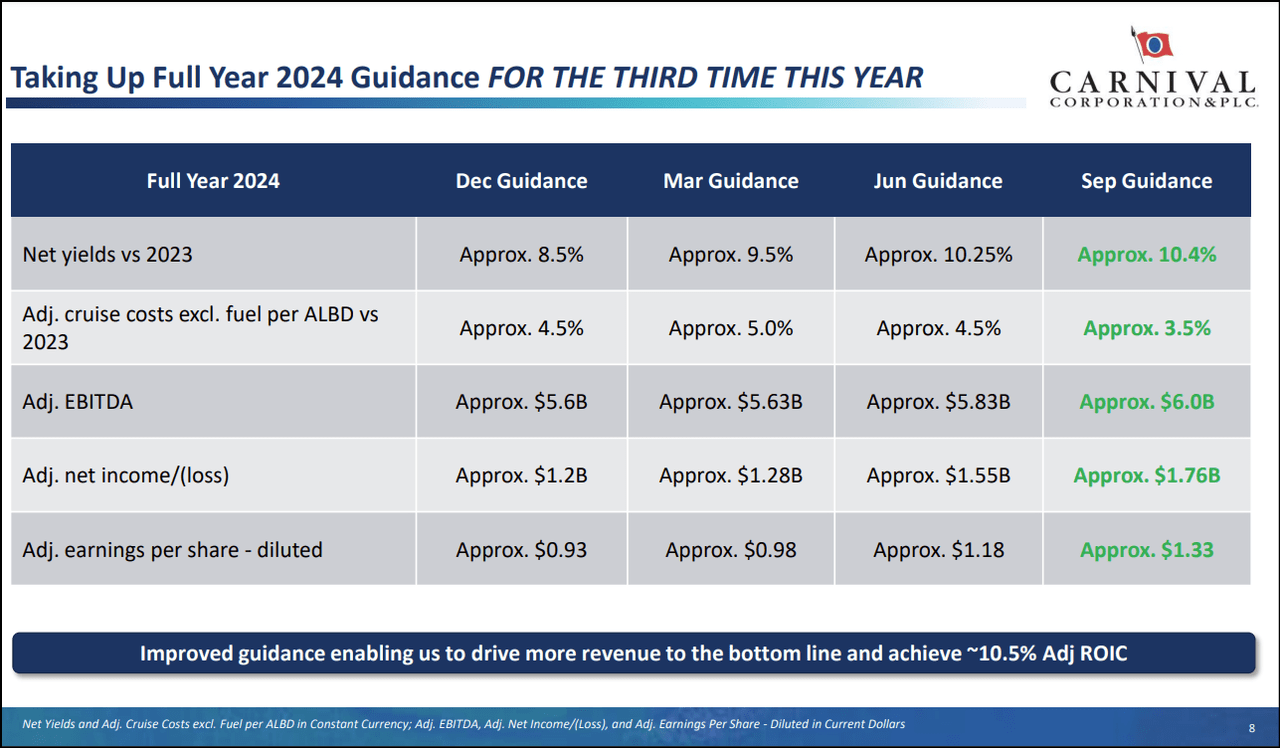

Our Buy Thesis

Carnival Corporation is executing a remarkable turnaround, having doubled revenue in two years and flipped a negative EBITDA to a projected record $6B in FY2024. CCL’s strategy is centered on yield optimization as opposed to fleet expansion, as the company balances its dual focus on growing margins and managing debt that accrued during the COVID-19 lockdown. Focused marketing efforts have driven web traffic up 40% compared to 2019 levels, which has translated to a 17% increase in new-to-cruise customers.

CCL continues to achieve exceptional pricing power, with yields up 8.7% and onboard spending increasing 6.7% compared with 2023. The company is experiencing unprecedented demand across multiple booking windows, with 2025 bookings at historical highs, both in terms of occupancy and price and record booking volumes for 2026.

Several near-term catalysts favor CCL’s continued growth, including the opening of Celebration Key, CCL’s planned private destination island. The planned development will offer cruise guests exclusive access to multiple beaches, pools, dining venues, and a water park, allowing Carnival to compete with other cruise lines’ private destination experience. Celebration Key will begin operations in the second half of 2025 and is expected to bring 19 ships in 2026. CCL’s commercialization strategy has resulted in customer deposits approaching $7B in Q3 and will likely help further propel Carnival’s extraordinary momentum.

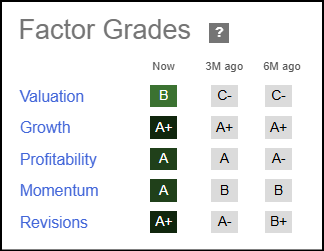

CCL Stock Factor Grades

SA Premium Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis. CCL’s Valuation, Growth, Momentum, Profitability, and Revisions Grades indicate that it offers excellent potential and is fundamentally sound compared to the sector.

CCL Stock Growth and Profitability

Carnival has delivered phenomenal earnings, highlighted by a third-quarter EPS of $1.27 up from $0.11 in Q2. The company delivered a record $7.9B in revenue, up $1B from Q3 2024, and $75M above estimates to beat revenue expectations for the seventh consecutive quarter. Optimism around CCL’s excellent potential has been consigned by Wall Street; the stock has received 22 FY1 up revisions in the last 90 days and zero down revisions.

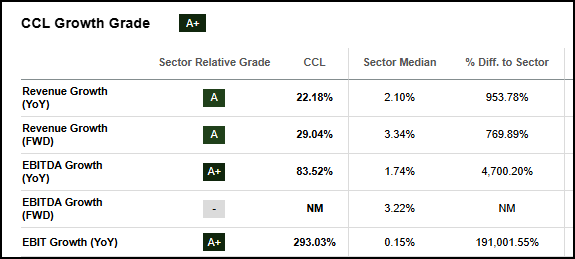

CCL Stock Growth Grade

Carnival notched several record-breaking profitability achievements in Q3 2024, driven by its strategy of yield optimization, by driving onboard spending and emphasizing cost controls.

- Record Q3 adjusted EBITDA of $2.8 billion, up $600M Y/Y and nearly $600M above the prior peak

- Adjusted net income of $1.75B, beating June guidance by $17M

- Net yields were up 8.7% and onboard spending was up 6.7% Y/Y

- Unit EBITDA and operating income were up 20% and 26%, respectively, reaching the highest levels in 15 years

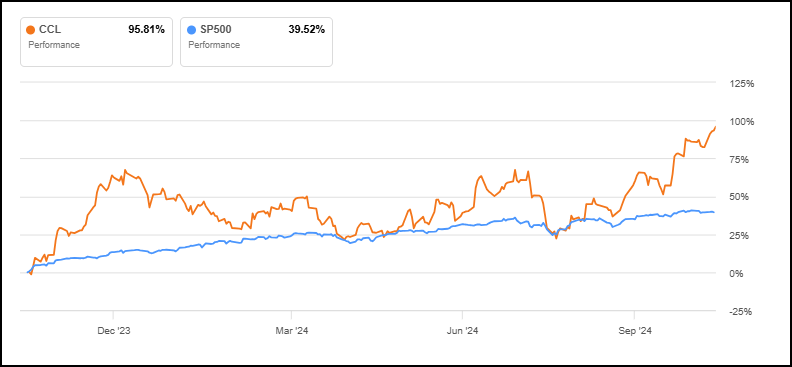

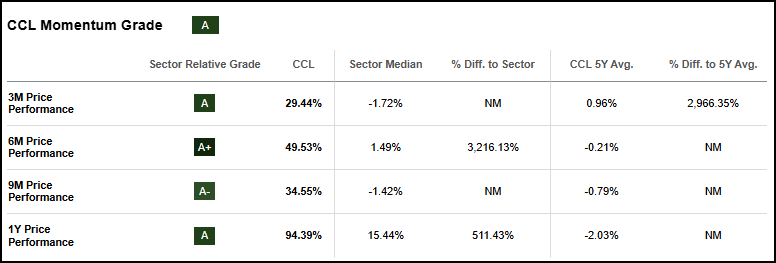

Carnival’s momentum has been exceptional over the past four quarters, delivering 94% on a trailing one-year basis.

CCL Stock Growth Grade

SA Premium While CCL is trading near its 52-week high, the case for momentum investing highlights the false theory that if a stock is at its 52-week high, it is overbought, and if it is at its 52-week low, it is an excellent value. Momentum is only one factor employed by Alpha Picks, but studies have distinguished the winning strategy between 52-week highs and lows.

CCL Stock Valuation

Carnival is trading at favorable multiples relative to the sector, maintaining an overall ‘B-’ valuation grade. Notable highlights include both CCL’s TTM and FWD Price/Cash flow of 4.9x and 5x, which represent a discount of more than 50% relative to the sector median. Additionally, CCL’s TTM EV/EBITDA comes in at 9.7x vs. the sector’s 11.2x.

Potential Risks

Despite Carnival’s operational gains, much like other cruise liners, its most pressing risk is its lingering debt accumulated from the COVID lockdown. While making progress toward investment-grade metrics, with a two-turn improvement in leverage this year, CCL faces two high-interest issuances in 2025 and significant maturity towers in 2027 and 2028.

Persistent macroeconomic uncertainty and inflation remain variable factors that could impact both demand and input costs in 2025. Commodity prices – particularly fuel – could surge, resulting in a potential profit contraction. Escalating geopolitical tensions and weather concerns could weaken demand for global tourism, creating challenges for CCL.

Concluding Summary

Carnival is a top Quant-ranked cruise line operator poised to continue capitalizing on the surge in travel demand and shifting consumer preferences toward cruise vacations. CCL has demonstrated exceptional operational performance with record-breaking Q3 results including $7.9B in revenue, and an adjusted EBITDA of $2.8 billion.

The company’s planned expansion into private destinations with Celebration Key in 2025, strong advance bookings through 2026, and successful yield optimization strategy position it well for continued growth. While substantial debt maturities loom, CCL’s improving leverage metrics, attractive sector-relative valuation, and unprecedented booking momentum make this stock a great potential long-term growth opportunity.

We have many stocks with strong buy recommendations, and you can filter them using Stock Screens to suit your specific investment objectives. We’ll continue to update you on stocks like CCL and don’t forget to join me for the Making Data-Driven Decisions This Election webinar.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.