- Published on

[APP] You’ll Love This Stock!

- Authors

- Name

- Perpetual Alpha

Summary

- The punished Tech Sector (XLK) of 2022 rallied strongly in 2023, and our mobile advertising application software pick is +300% YTD.

- Posting record-breaking performance with Q3 revenues of $503M, up 65% from the previous year, this stock allows app developers to connect, scale, and grow their user base.

- Wall Street analysts are bullish on this stock that has consecutively crushed earnings, and this stock is expected to generate more than $1.2B in free cash flow through 2023.

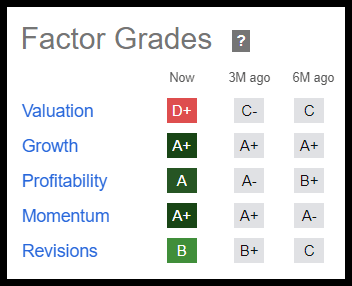

- Seeking Alpha’s Factor Grades showcase the company’s excellent fundamentals, strong balance sheet, robust profitability, A+ Growth and Momentum, and upward analysts’ revisions.

Business Overview

AppLovin Corporation (APP) is an application software company focused on advertising so that app developers and mobile gamers can enhance their marketing for business growth. Offering end-to-end software solutions, this ad tech’s customers can leverage AI for data-driven marketing decisions. With unique tools that allow developers to increase user engagement for revenue generation, AppLovin’s diverse portfolio of free games and applications and its aggressive acquisition strategy have resulted in extraordinary cash flow generation. With its software platform adjusted EBITDA accounting for nearly 90% of its total adjusted EBITDA and free cash flow generating over $194M in Q3 alone, AppLovin is gaining market share.

Despite the technology sector experiencing a rough 2022, its recovery in 2023, with the Magnificent 7 leading the way, offers secular tailwinds, especially as the demand for software and artificial intelligence increases.

AppLovin has experienced tremendous growth with more than 19 offices globally, 16B downloads, and +2.5M requests per second. As evidenced by the chart below, many investors are “lovin'” this stock, which boasts record-breaking performance for the third quarter.

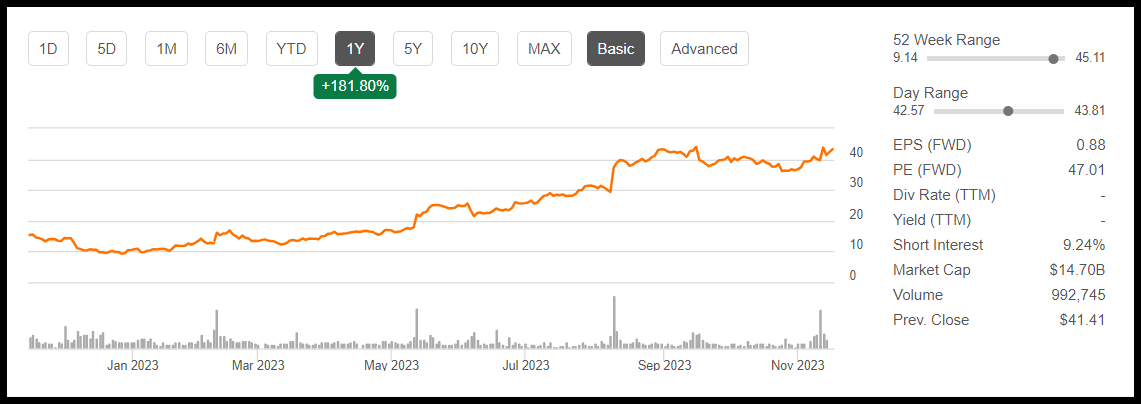

AppLovin Corporation (APP) 1-year Trading Chart

As you can see, APP has experienced exceptional success over the last year. AppLovin’s YTD price performance is +303%, and its one-year share price is +181%. Through strategic initiatives and enhancements to its platform, APP was able to consecutively beat earnings. Despite the sector and industry headwinds experienced last year, APP’s Co-Founder and CEO Adam Foroughi is optimistic about the company’s outlook and commends its trajectory as it looks to expand and grow.

“A year ago, we faced significant challenges, yet our team's resolve and enthusiasm never faltered. Our efforts this year have not only solidified our short-term growth trajectory but have also set the stage for sustained long-term expansion.”

Our Buy Thesis

Capitalizing primarily on software solutions, AppLovin’s company strength has continued to increase, benefitting application developers who market to their customers through four primary methods:

- AppDiscovery: Focused on user acquisition, AppDiscovery targets high-quality users for growth, optimizes performance goals for return on investment, allows developers to scale globally.

- Max: Used to maximize profits, AppLovin’s Max helps developers save on time and costs while maximizing revenue streams.

- Adjust: The end-to-end analytics suite of solutions for tracking data, in-depth reporting, and insights for strategic growth.

- Wurl: Software platform designed for the monetization, marketing, and distribution of Connected TV (CTV), Wurl combines the three previously mentioned solutions to generate more revenue and decrease churn.

Through a series of acquisitions, AppLovin has rapidly grown, adding the leading marketing platform Wurl to its mix.

“We are excited to complete the acquisition of Wurl and provide advertisers with a seamless way to enter the rapidly growing CTV market,” said Adam Foroughi, CEO and co-founder of AppLovin. “This partnership will allow us to scale our technology beyond mobile with the goal of bringing performance marketing to the CTV market and becoming the world’s largest advertising ecosystem.”

Exceeding the high end of its guidance and crushing Q3 earnings, AppLovin’s software platform reached a record revenue of $504M, a 65% increase from the previous year and a 24% jump, quarter-over-quarter. Benefitting from industry tailwinds and strong overall performance, AppLovin’s executive staff is targeting another quarter of growth and revenues in Q4 between $910M and $930M, adjusted EBITDA between $420M and $40M and margin between 46% and 47%.

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. Despite trading at a relative premium on value, highlighted by a D+ valuation grade, one of our favorite value metrics, Forward PEG Non-GAAP, has an A- Factor Grade. The stock is an excellent value on this metric. The forward P/E for the stock is a B+ at 15X versus the sector median at 21x, which is an attractive discount.

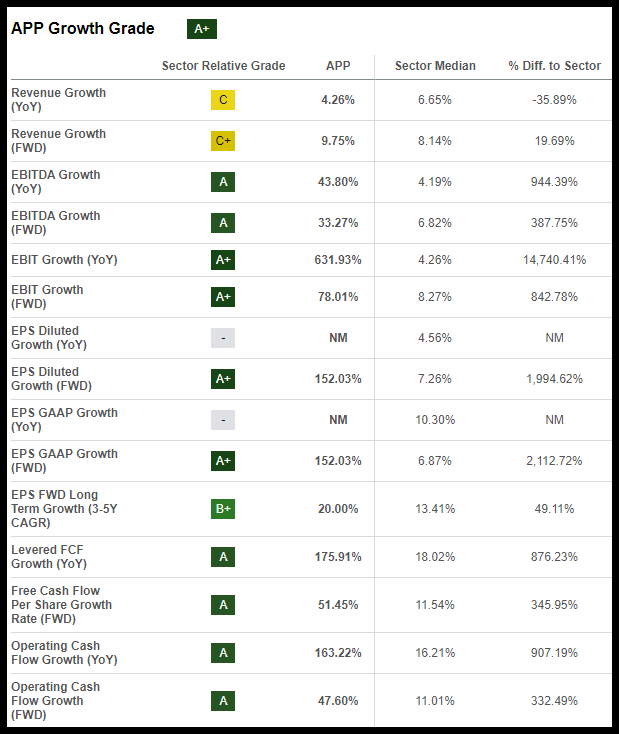

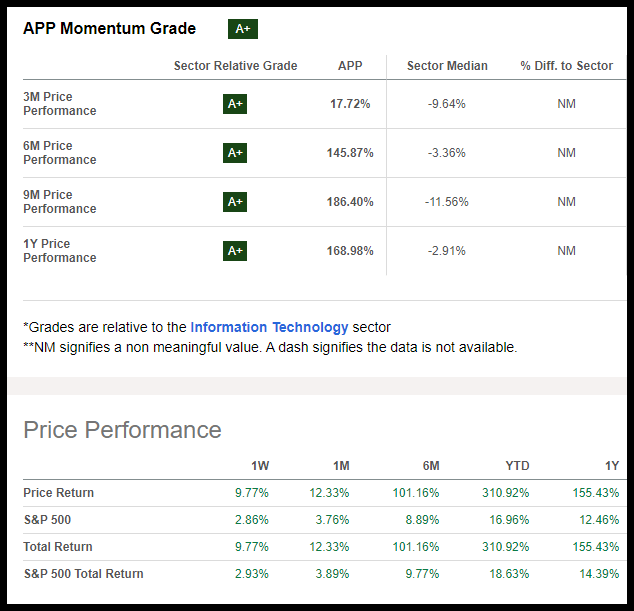

AppLovin’s A+ Growth and Momentum Grades, ‘A’ Profitability Grade, and ‘B’ EPS Revisions indicate that APP has excellent potential and is fundamentally sound compared to the sector. With fast-growing momentum, APP is a company whose shares investors have been actively purchasing and driving higher prices.

APP Stock Factor Grades

AppLovin Corporation Growth

This year's first and second quarters for technology have been strong, with Q3 offering tremendous top-and-bottom-line results for APP. Despite the macro environment, which includes high inflation and the strength of the U.S. dollar creating some headwinds for tech companies, APP has continued to outperform with the backing of strong financials that have continued to improve, allowing them to pay down debt, repurchase $1.2B of Class A common stock, and focus on delivering shareholder value.

With strong back-to-back earnings, AppLovin posted Q3 2023 EPS of $0.30, which beat by $0.03, and revenue of $864.26M, which beat by more than 21% year-over-year. Expected to generate $1.2B in free cash flow for 2023 and anticipated increases to its software platform business, APP showcases excellent profitability and growth. APP’s margins highlight the company's improved efficiencies and solid balance sheet, and with its forward EPS Long Term Growth (3-5Y CAGR), nearly a 50% difference to the sector, its growth outlook is strong. Out of 20 Wall Street analysts, 12 are bullish for AppLovin, with a price target of more than an 11% upside.

APP Stock has solid top-and-bottom line growth.

AppLovin’s App segment grew $360M in the third quarter, its first quarter of growth, a 5% sequential rise. Offering application solutions to connect audiences across the globe to achieve meaningful growth, APPs AI-based advertising technology is powerful and flexible to meet the business needs of all. Additionally, it helps developers optimize their operations, cut costs, while expanding their footprint. In addition to having tremendous profitability, APP has consistently high EBITDA margins, and its software business continues to grow by +20% CAGR. With guidance projecting $980M EBITDA, as highlighted by analyst Michael Wiggins De Oliveira,

“We can safely estimate that AppLovin will make $1.3 billion adjusted EBITDA in 2023. And if we take analysts' current estimates of 11% revenue growth for 2024 and keep in mind that the business will be significantly more profitable in 2024 given its Software Segment, this means that AppLovin should easily make $1.5 billion of EBITDA.”

APP Stock Valuation

AppLovin is trading near its 52-week high of $45.11 and has rallied this year by over 180%. Trading at a relative premium, APP’s overall valuation grade is a D+. However, some of AppLovin’s underlying valuation metrics are very attractive. Possessing a forward P/E ratio of 15.29x compared to the sector’s 21.32x, APP comes at a near 30% discount. Additionally, the ad-tech’s all-important forward PEG ratio is an A- and more than a 55% difference to the sector. The 'PEG ratio' (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company's expected growth. Given the company’s strong growth prospects, solid financials, and overall fundamentals, this stock has upside potential.

Potential Risks

The recent announcement of AppLovin’s current CFO stepping down prompted shares of the stock to fall. While this is one risk, the tech industry is subject to some risks, including but not limited to regulatory and intellectual property factors, security breaches, competition, and sector volatility. As showcased in the sector’s (XLK) near 30% decline in 2022, APP and many techs were resilient. APP is trading near a 52-week high, with strong demand, and tech has made a comeback in Q1 and Q2 of 2023. But Q3 has shown some signs of slowing as geopolitical and macroeconomic factors, including inflation, warfare, and sanctions around the globe, impact businesses. Although APP has solid financials, its nearly $2.4B of net debt is another downside. APP amended a portion of its term loans, extending the maturity to 2030, but given its focus on expanding through acquisition, this large amount of debt may be a hindrance.

Concluding Summary

APP has posted unprecedented price returns over the last year. Continuing on that trajectory, the stock has bullish momentum and has crushed back-to-back earnings, resulting in 10 FY1 analyst upward revisions in the last 90 days.

Offering innovative technology using AI models to aid developers with the applications to market and better monetize users, APP produces record revenues while capturing market share to scale and grow. Through an expanding global footprint, AppLovin Corporation is a Top Technology Stock to consider for portfolios. Machine learning and artificial intelligence are expanding how people work and play. By offering a performance marketing channel for growth to meet the needs of clients and the consumer, this top application software delivers strong guidance, improving financials with a strong balance sheet, and offers an incredible tech option with excellent fundamentals to consider for your portfolio.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.