- Published on

[MFC] Treat Yourself And Portfolio Post-Halloween

- Authors

- Name

- Perpetual Alpha

Summary

- A leading global financial services group, this company offers financial advice, insurance, wealth, and asset management to over 34M customers with $1T in AUM at the end of 2022.

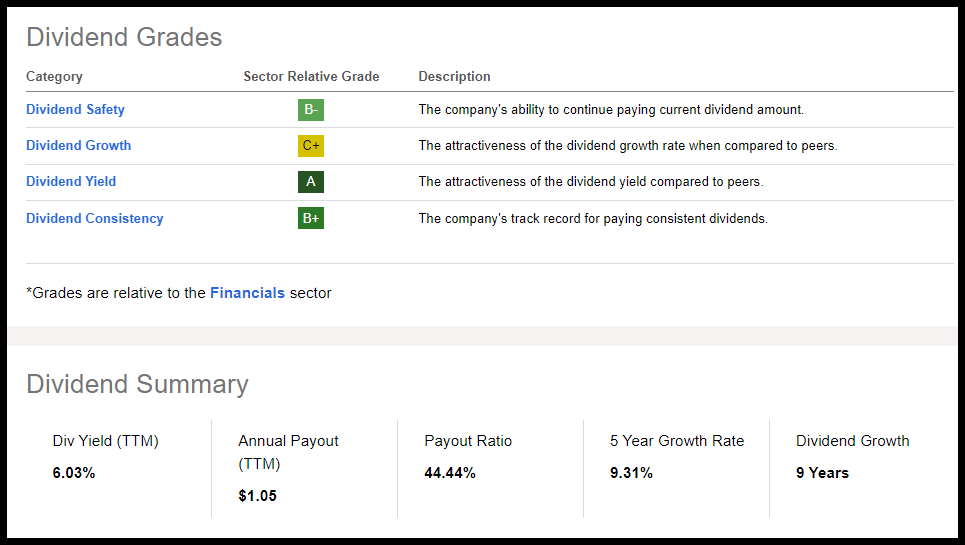

- Offering 22 years of consecutive dividend payments, a 6% yield ((TTM)), and a strong dividend scorecard, this stock offers a steady income stream and hedge against inflation.

- This company returned over $6.6B of capital to shareholders through dividends and buybacks and +$440M during Q2 and trades at more than a 95% discount to the sector on PEG.

- This leading financial entity stands to gain from increasing interest rates, remarkable profitability, a wide array of products and services globally, and solid fundamentals - all underscored by robust quant grades.

- Like its peers in the financial sector, the stock experienced a decline in 2023. However, this could be viewed as a potential buying opportunity, given the optimism from professional analysts, evidenced by 11 upward revisions of earnings estimates and a notably high dividend yield.

Business Overview

Treat yourself to our Halloween pick, Manulife Financial Corporation (MFC), which operates primarily as John Hancock in the United States. Merging in 2004, Manulife is among the Big Three of Canada’s life insurance industry (Manulife, Great-West Lifeco Inc. (OTCPK:GWLIF), and Sun Life Financial Inc. (SLF)), Fitch Ratings estimates that the Big Three represent over two-thirds of the Canadian market. Founded in 1887 and headquartered in Toronto, Canada, Manulife is Canada’s 10th largest bank and one of Canada’s leading life insurers. Together with its subsidiaries, MFC offers financial products and services globally, including Wealth and Asset Management arms, Insurance and Annuity Products, and Corporate and Other segments.

Manulife Financial Corp. has tremendous fundamentals. Benefitting from diversification, rising interest rates, and its ability to reinvest in its fixed-income portfolio, the company offers an attractive dividend yield and scorecard while trading at a significantly discounted valuation.

The banking crisis in March of 2023 triggered sharp declines in banking and financial stocks worldwide, with Financial Services (XLF) as one of the worst-performing sectors year-to-date and over the last year. MFC felt the effects. With it trading closer to its 52-week low of $15.95 per share, at its current price, bullish momentum, upward revisions, and strong growth, Manulife poses a buy-the-dip opportunity.

Despite the economic slowdown and ongoing market volatility, MFC returns capital to shareholders and offers a track record of risk management, leveraging its network and banking relationship for profitability.

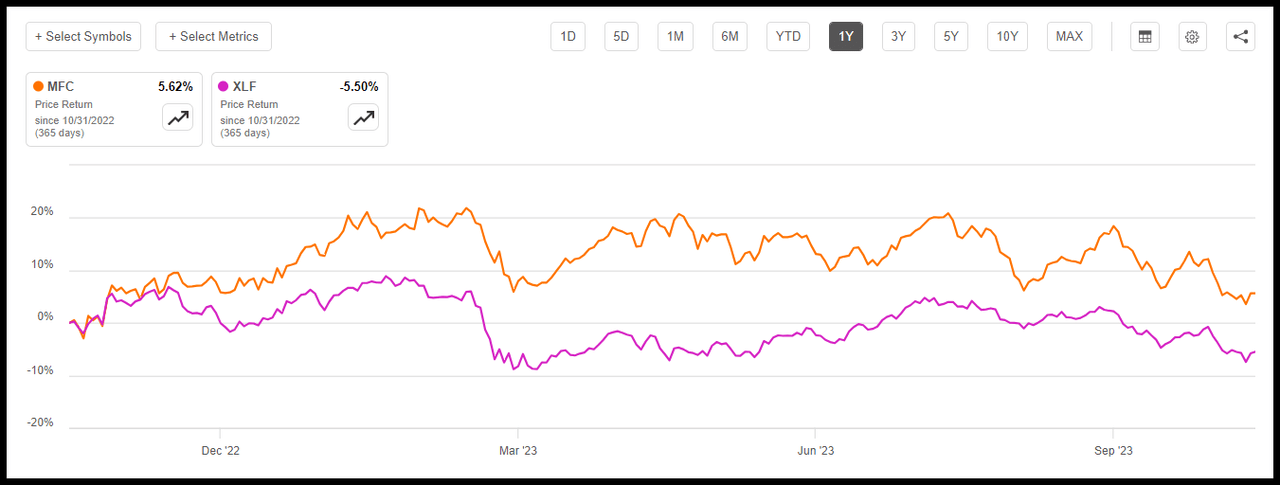

Manulife Financial Corp. (MFC) vs. (XLF) - Financial Select Sector SPDR® Fund ETF 1-year Trading Chart

Manulife Financial Corp. (MFC) vs. (XLF) - Financial Select Sector SPDR® Fund ETF 1-year Trading Chart (SA Premium)

As you can see from the chart above, MFC has been slow and steady, given the market volatility and headwinds affecting financials over the last year. Manulife’s share price is +5% compared to (XLF), which is down more than 5% for the same period. Its diversified offerings in the rising rate environment help serve as a tailwind, given that insurance-based products and financials tend to benefit when rates rise, earning more from fees and the assets they manage. Manulife is a leading provider of insurance products in Asia, one of the fastest-growing economies, posing a tremendous opportunity to capitalize. With more than $14B in Cash from Operations (TTM), strong liquidity, and plans to accelerate growth in Asia, MFC offers excellent potential.

Our Buy Thesis

Manulife’s diversified revenue streams come from approximately 67% insurance (group and individual), 14% banking, and 19% from its annuities division. For 2022, approximately 85% of Manulife’s U.S. earnings resulted from its insurance business and the remainder from annuities. Given annuities tend to perform better in rising rate environments; surging inflation has aided MFC in maintaining solid yields.

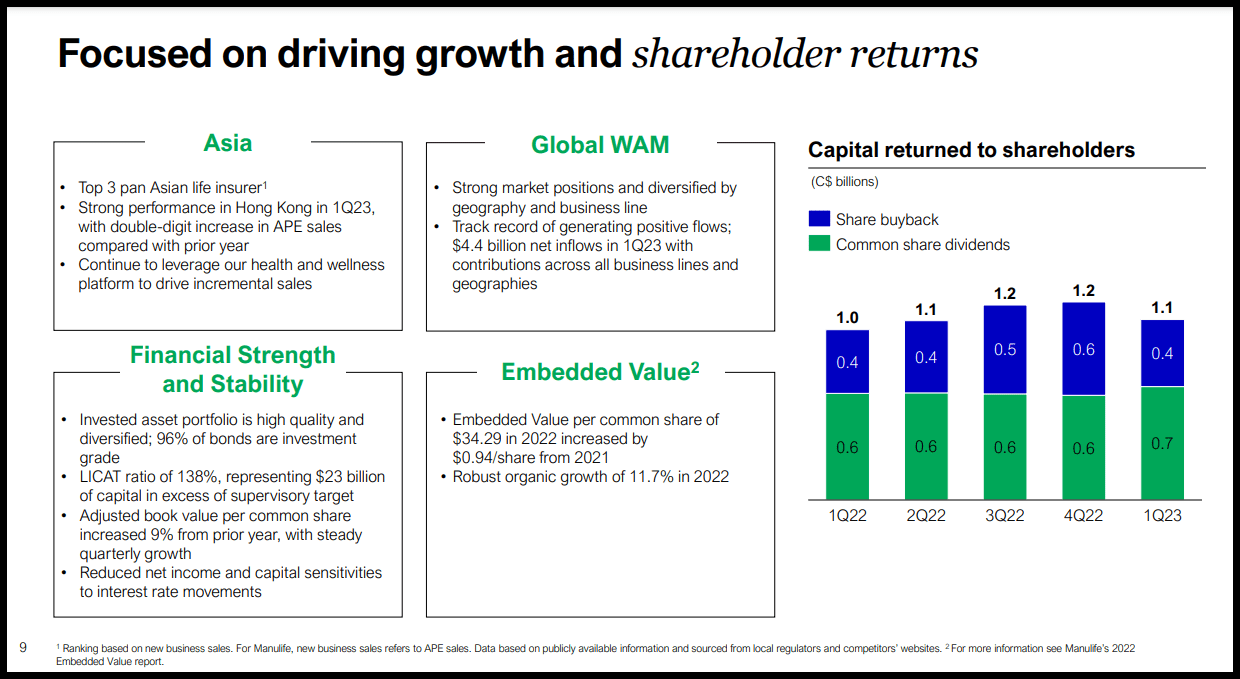

With a focus on driving growth and shareholder returns, MFC has consistent organic growth and a high-quality, diversified portfolio for financial strength and stability. John Hancock Life Insurance comprises 3.3% of the U.S. market share premiums, ranked seventh behind big names like New York Life, Mass Mutual, and Northwestern Mutual.

MFC has maintained its dividend payments amid economic headwinds, delivering significant shareholder returns, continues to rank as a top financial, and is one of the most profitable companies in its sector and industry. MFC returned over $6.6B of capital to shareholders through dividends and buybacks, including +$440M during Q2, and trades at more than a 95% discount to the sector on PEG (TTM).

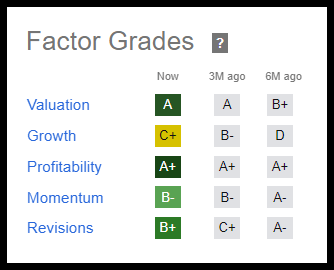

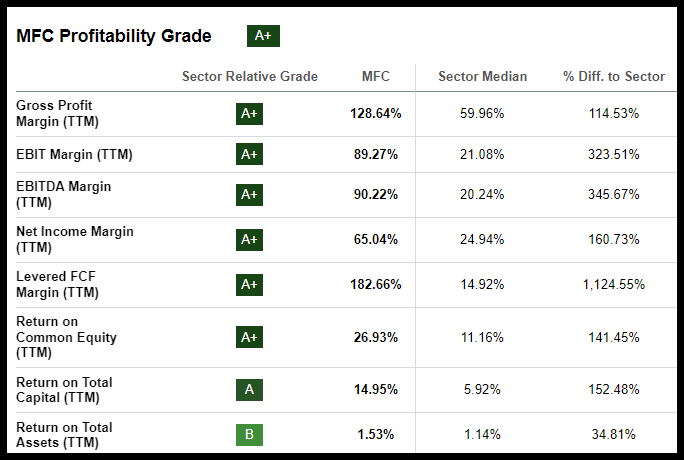

As showcased in the Seeking Alpha Factor grades, which rate investment characteristics on a sector-relative basis, Manulife’s grades indicate that it has excellent potential and is fundamentally sound compared to other financials. Its A+ Profitability grade, bullish momentum, and B+ Earnings Revisions highlight MFC as a profitable company with solid growth prospects.

MFC Stock Factor Grades

Manulife Financial Growth & Profitability

MFC’s earnings have been driven by its desire to become its industry's most digital customer-centric global company. Ending 2022 with record net inflows to its Global Wealth Asset Management (WAM) business, with Asia accounting for 63% of core earnings, MFC wants to capture market share by focusing on five strategic priorities:

- Accelerate growth

- Become a digital customer leader

- Expense efficiency

- Portfolio optimization

- Capitalize and develop a high-performing team

Highlighted in Manulife’s Annual Report, Roy Gori, President and CEO stated:

“In Asia, we are not only at scale as a top three pan-Asian insurer, but we are well positioned to benefit from the 4 | 2022 Annual Report significant growth opportunities in the region. In Global Wealth and Asset Management (Global WAM), we are a global leader in retirement, a top 10 global retail multi-manager, and one of the largest natural resource asset managers for institutional investors globally. We are a leading life insurer in Canada, and we are a global leader in behavioral insurance. We continue to believe in the growing need for health, wealth, and retirement solutions, which have been amplified by the pandemic, and we are well-positioned to capitalize on global megatrends.”

Manulife Financial is scheduled to release Q3 earnings on November 8th. Despite ongoing volatility, geopolitical concerns, and broader equity market declines, Q2 EPS of $0.62 beat by $0.05, and revenues were solid. Manulife’s Global Wealth and Asset Management provided a net inflow of $2.2B in Q2, net income to shareholders of $1B, and $1.6B in core earnings. Showcasing excellent Growth Profit Margin and a strong Return on Common Equity (TTM) which is a +152% difference to the sector, Manulife is a quant-rated strong buy looking to expand its footprint.

Although Manulife’s overall Growth Grade is a C+, its trailing and forward-looking underlying year-over-year Revenue Growth growth metrics are not as attractive. However, management has effectively demonstrated their ability to control expenses and produce strong profit-margin growth in the form of year-over-year EBITDA Growth of 1,838% versus the sector's 3.32%.

Additionally, year-over-year EBIT Growth is a 21,226% difference to the sector, so while the top line has not been as strong as management’s control of the bottom line and expanding ROE, which is currently 35,813% versus the sector -1.32%, its measures are why Manulife has been able to deliver 22 years of consistent dividend payments and growth.

Manulife Financial Valuation

MFC comes at an extreme discount, highlighted by an ‘A’ overall valuation grade. MFC’s P/E GAAP (TTM) ratio is 3.4x compared to the sector median of 9.07x, a 62% difference to the sector. Its trailing PEG is more than a 99% discount, indicating that this stock is undervalued and ripe for picking.

Potential Risks

Manulife has maintained strong leadership, and anytime there’s a leadership change, this could pose risks. Despite Manulife’s diverse offerings and international presence, financials are considered cyclical industries linked to economic growth. Variable annuities ((VAs)) create some headwinds for the life insurance industry, notably during the global financial crisis, where minimum living and death benefits guarantee customer payouts, exposing underwriters to capital market risks. VAs can be highly leveraged and contingent on AUM levels that fluctuate with the markets. Their fees can also rise or fall accordingly, depending on economic turbulence. Although higher interest rates can aid bottom lines, should the Fed reverse course, financials can experience less upside, with higher costs eating into the payouts for annuity premiums. Annuities can also be expensive. As fear moves the markets, many investors are getting defensive or going to cash for fear of losing.

Concluding Summary

Manulife Financial has benefited from inflation and the high-interest rate environment, with the ability to reinvest maturing fixed-income securities. Having an expanding global that includes Global Wealth and Asset Management net inflow of $2.2B in Q2, net income to shareholders of $1B, and $1.6B in core earnings for the same period, MFC is a Strong Buy treat worth having post-Halloween for a portfolio.

Trading at an extreme discount with tremendous profitability and upward analyst revisions, the company’s portfolio offers product diversification to shield investors from declines in income, an excellent dividend scorecard that includes +6% yield, and 22 years of consecutive payments. Operational efficiency, a focus on digital innovation, strong momentum, and industry tailwinds are why Alpha Picks has a solid potential outlook.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.