- Published on

[PEP] Refresh Your Portfolio In 2024 With This Stock

- Authors

- Name

- Perpetual Alpha

Summary

- A household brand with over 500 products in more than 200 countries, this defensive Consumer Staple is among the most profitable in its sector and industry.

- Offering inflation- and recession-resilient qualities, the demand for essentials like food and beverage typically offers stability during periods of uncertainty.

- A Dividend King with 51 years of consecutive dividend growth, this stock has crushed top-and-bottom-line earnings since 2019 and remains attractive on a sector-relative basis.

- Sticky inflation and market volatility can restrict investment options for investors looking to prevent financial loss, but you may be able to protect your portfolio with Consumer Staple stocks during these periods.

Business Overview

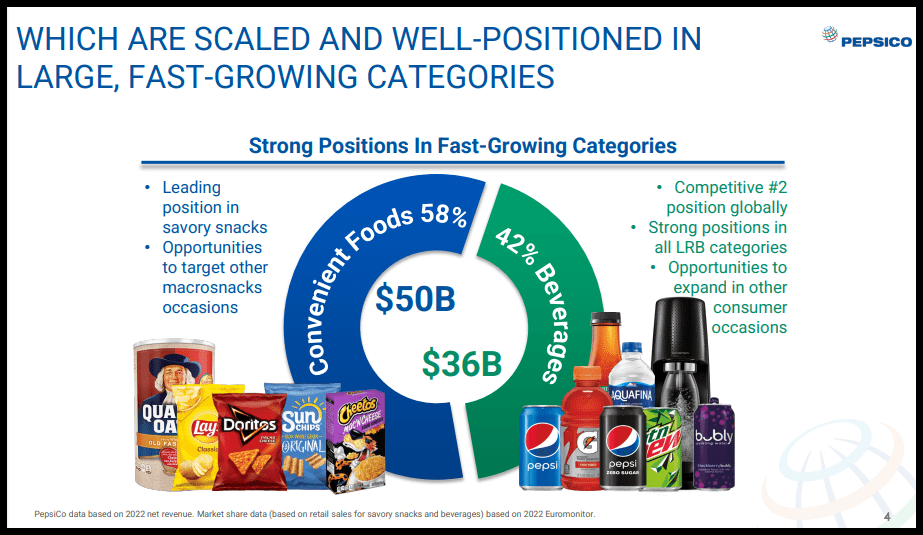

A household name with significant brand recognition and consumer loyalty, PepsiCo, Inc. (PEP) is a global leader in convenience foods and the second-largest beverage company behind rival Coca-Cola (KO).

Offering a diversified portfolio of products spanning diverse geographies, Pepsi’s more than 500 brands and products in more than 200 countries generated over $86B in net revenue in 2022 and controlled 23% of the market in 2023, according to Euromonitor International. Capitalizing on iconic snack brands like Frito-Lay, which include Cheetos, Doritos, and Lay’s potato chips, has likely helped Pepsi to maintain better top and bottom line growth compared to the Consumer Staples sector.

As a consumer staple, Pepsi benefits from the demand for food and beverage essentials, which tend to be more resilient investments during high volatility and recession periods. As an affordable snack brand with a significant end-to-end supply chain, strong retail and business relationships like its NFL sponsorship deals help shield the company from many headwinds that create a slowdown in other sectors. In addition to the company’s integrated business model, leveraging technology and embedding data analytics, Pepsi has experienced a transformation that’s driving the company’s efficiency and operations.

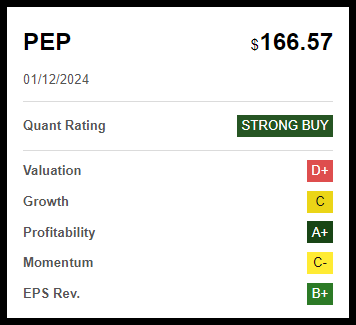

A snapshot of the Quant Ratings and Factor Grades below shows that although Pepsi trades at a relative valuation premium, the stock offers strong Factor Grades on certain growth metrics, profitability ratios, and increased confidence in earnings estimates from Wall Street analysts.

PEP Stock’s Quant Rating and Factor Grades as of market close on 1/12/24

PEP Stock’s Quant Rating and Factor Grades as of market close on 1/12/24 (PEP Stock Factor Grades)

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. PEP is currently a top Quant-ranked Consumer Staple. PEP’s Growth Grade is solid, complemented by tremendous profitability, which includes a $12.14B cash hoard and EPS Revisions Grades to indicate that the company has a solid long-term outlook according to Seeking Alpha’s Quant rankings.

Our Buy Thesis

Food prices in 2023 outpaced inflation, benefiting many companies like Pepsi that were able to take advantage of pricing power. While rising interest rates and a stronger dollar posed headwinds for some consumer staples, Pepsi offers a strong growth outlook, supported by consecutive top-and-bottom-line earnings and organic sales +8.8% YOY in Q3.

"We believe that our businesses can continue to perform well in the coming years with category growth normalizing, as we have made numerous investments in our brands, manufacturing capacity, go-to-market systems, supply chain, technology, and people, to execute against our strategic framework and modernize our company. Therefore, we expect our full-year 2024 organic revenue and core constant currency EPS growth to be towards the upper end of our long-term targets as we advance towards our vision to become the global leader in beverages and convenient foods by winning with pep+," said Pepsi CEO Ramon Laguarta.

This is the 55th consecutive quarter that PEP has either met or exceeded consensus estimates. The company also mentioned that it has yet to see any meaningful demand impact caused by the emergence of GLP-1 drugs. This has been a risk that many analysts have priced into the stock.

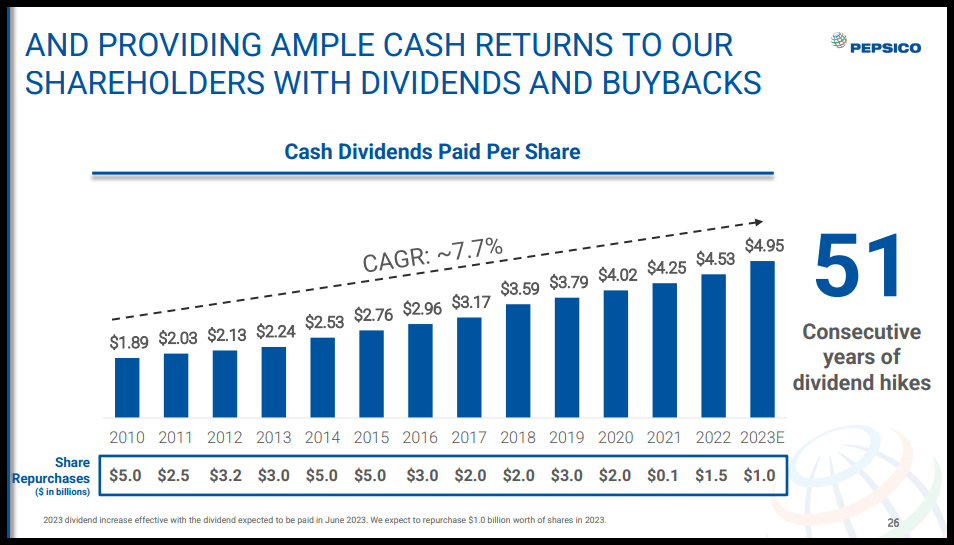

Strong sales growth, consistent volumes, and investment in digital and commercial initiatives have likely driven consumers to the brand. Given its balance sheet, Pepsi is in excellent financial health, highlighted by consistently returning cash to shareholders. Pepsi has a payout ratio of more than 64% and over 51 years of consecutive dividend growth. Although Consumer Staples (XLP) was the second-worst performing sector in the final quarter of 2023, rising +5% versus the S&P 500, up nearly 11% for the same period, with Q4 earnings season around the corner, stocks like Pepsi could benefit. Should Consumer Staples see an uptrend in 2024, given their defensive attributes, while Pepsi’s stock price is down nearly 5% over one year, the stock’s outlook and ability to often prove resilient in high inflationary environments and against macroeconomic challenges could make it an attractive investment opportunity.

PEP Stock Growth

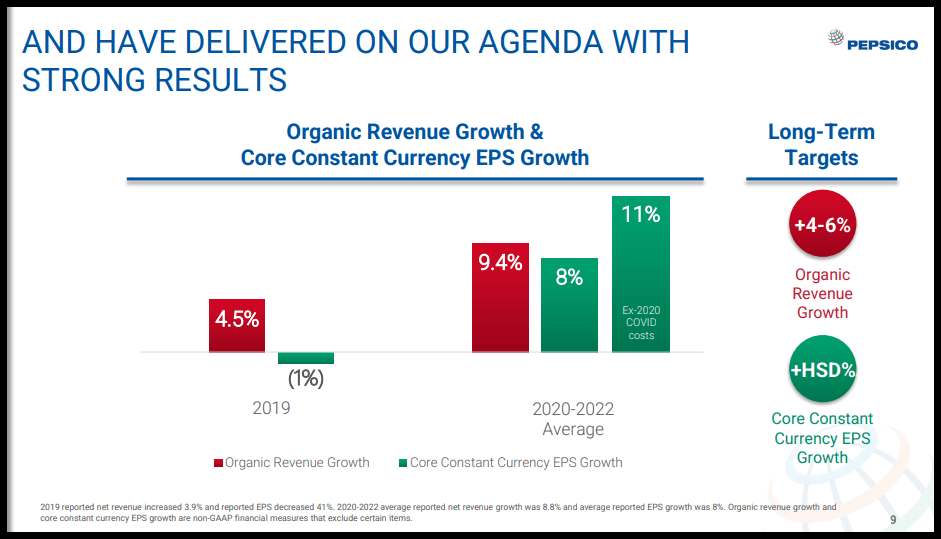

Consumer Staple Pepsi has showcased tremendous success worldwide. Through favorable ad campaigns, Pepsi maintains volumes, and despite economic challenges, it remains inflation-resilient. Essentials like food and beverage are must-haves in good and bad times. Despite increasing costs, Pepsi has capitalized on its pricing power and demand. Showcasing consecutive top-and-bottom-line earnings beats since 2019, Pepsi has consistently reported net revenue increases, including average net revenue growth from 2020-2022 of 8.8% with an average EPS growth of 8%.

For Q3 2023, Pepsi’s EPS of $2.25 beat by $0.10, and revenue of $23.45B beat by $45.62M year-over-year. Pepsi has improved its supply chains for greater efficiency and scale by investing in advertising and digital capabilities to drive business.

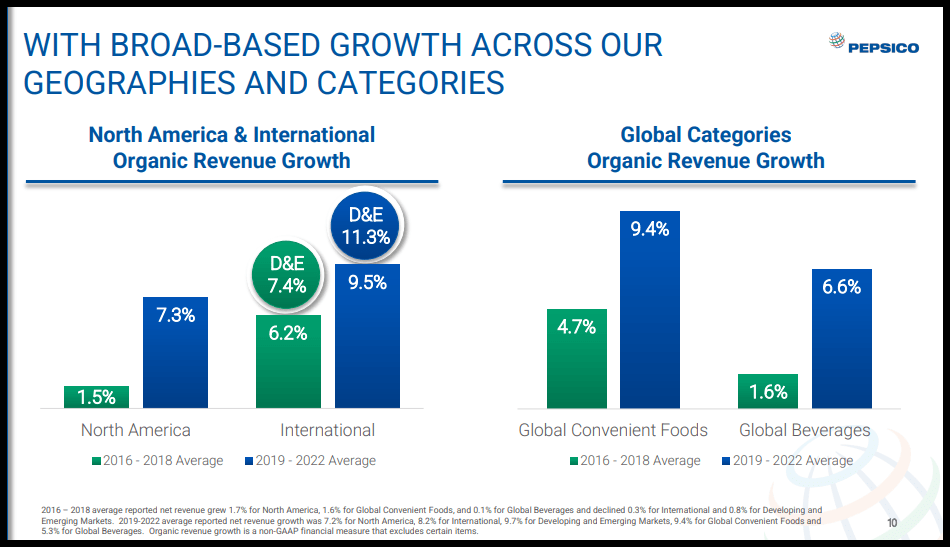

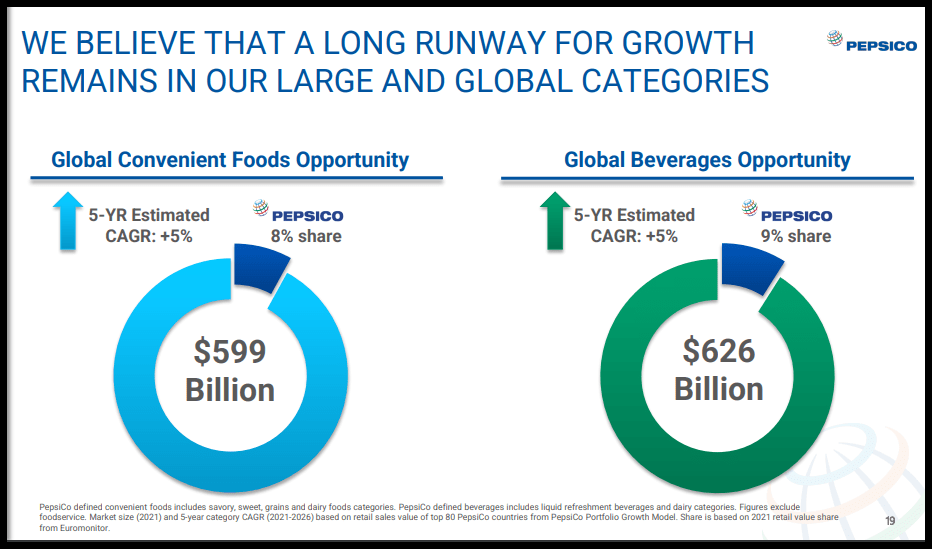

Pepsi’s strong brand presence has delivered broad-based growth across diverse geographies. With a long runway for growth projected, Pepsi management believes it will capture 8% of the global market share of convenient foods, which they state translates to $599B, and its global beverage opportunity is 9%, which would account for an estimated $626B.

Pepsi’s diversity of product offerings has fueled snack consumption globally despite demographic and lifestyle shifts. As consumer shopping habits have shifted online, Pepsi’s investment in enhancing its digital supply chains and offerings has boosted digital engagement, its network, and relationships. Morningstar equity analyst Dan Su, CFA, writes:

“We expect the strong intangible assets and cost advantage to enable the firm to deliver investment returns that exceed its cost of capital for more than 20 years. On our estimate, PepsiCo will generate returns on invested capital, or ROICs, including goodwill, averaging in the mid-20s over our explicit 10-year forecast period, compared with our weighted average cost of capital at 7.1%.”

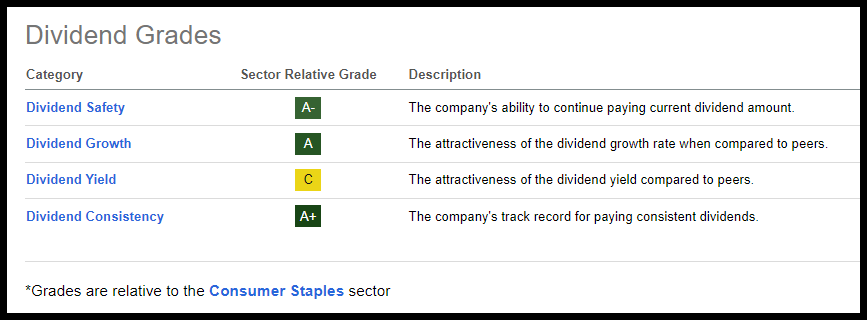

Pepsi is a well-run company that prioritizes its shareholders, as evidenced by 51 consecutive years of dividend hikes and a tremendous dividend scorecard. As one of the most profitable companies in its sector, Pepsi’s margins are strong, with Gross Profit Margin (TTM) a 62% difference to the sector, Net Income Margin (TTM) +84% difference to the sector, and Return on Common Equity (TTM) of 44% versus the sector median 12%. These strong figures and $12.14B in cash allow Pepsi to return cash to its investors.

Although the stock is down over one year and food price inflation is below the overall price of inflation, keep an eye on Pepsi. As Investing Group Leader Jason Fiber highlights, PepsiCo is a “Defensive, steady business with long-term dividend growth.”

PEP Stock Valuation

According to the Quant Ratings, Pepsi comes at a relative premium valuation. Showcasing a D+ overall valuation grade, the stock’s forward P/E ratio of 22.47x versus the sector median of 19.17x is a 17% difference. The stock’s forward PEG also shows a 12% difference to the sector. Although some prudence is needed if considering an investment in Pepsi, the stock’s price performance over the last year is -4.84%.

Pepsi is trading below its mid-52-week range, and given its organic sales growth, increasing global revenues, and CAG for food and beverage anticipates growth of +5% over the next five years, the company is primed for upside in the new year, but there are risks to consider.

Potential Risks

Obesity is a growing problem worldwide, and as consumption patterns change and people become more health-conscious, convenience foods could see declines. Another factor is the rise of prescription weight-loss drugs dominating headlines and conversations. Healthier snack alternatives are becoming more popular, and the intake of sugar, sodium, and saturated fats is changing many consumption patterns that could affect Pepsi products.

Competition is a factor. One of Pepsi’s biggest competitors is Coca-Cola. Competition can disrupt pricing structure and supply chain constraints, which can handicap efforts to bridge the gap between the rivals, particularly when food recalls. When you factor in product recalls that may adversely affect consumers, these risks pose potential threats to the Soft Drinks & Non-alcoholic Beverages industry, and the appointment of a new CFO may create some operational changes. Despite the concerns that businesses must consider, Pepsi’s consistent track record, tremendous dividend safety grades, and strong profitability highlight a Quant Strong Buy-rated company to consider for a portfolio in 2024.

Concluding Summary

The Consumer Staples sector offers an opportunity to help hedge inflation and reduce the impact a recession can have on an equity portfolio. Pepsi has a long legacy of strong brand recognition, diversified product offerings, and a global presence, offering investors a fundamentally strong stock amid economists’ mixed reviews and the economic uncertainty in the new year. Operationally, Pepsi offers a strong leadership whose focus on digital transformation and a positive growth outlook serve as tailwinds for continued momentum and profitability.

Amid the uncertainty surrounding monetary policy, elevated prices are likely to persist, even with the Fed’s help to curb inflation, and consumer staples are necessities that are likely to serve as a defense during periods of uncertainty. Capturing significant global market share, Pepsi possesses solid fundamentals and a positive growth outlook, and Seeking Alpha’s Factor Grades and Quant Ratings can help you make tactical investment decisions when picking stocks without changing your overall risk level. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.