- Published on

[BRK.B] Top Financial Stock

- Authors

- Name

- Perpetual Alpha

Summary

- One of the five most profitable companies in the world, this top financial firm is focused on value investing, has a TTM net income of $73.42B, and its operating margins are 25%.

- A financial holding titan approaching Magnificent 7 territory, the company has delivered incredible profitability and growth, as evidenced by +$51B in cash, EBIT of +880% YoY, and operating cash flow of +30 %.

- Showcasing a diversified portfolio of holdings, the firm is cash-rich and trades at an attractive price based on P/E Growth ((PEG)) TTM at a mere 0.01, a 96% discount to the sector.

- This stock possesses a strong balance sheet, has consecutively beaten top and bottom lines, offers an attractive growth outlook, and its ETF-like qualities offer access to several industries that have proven to benefit during this period of elevated inflation.

Business Overview

Berkshire Hathaway Inc. (BRK.B), led by Oracle of Omaha Warren Buffett, is a diversified financial holding company with a highly profitable business model. A top financial stock, Berkshire is among the five most profitable companies in the world, delivering $73.42B in net income in the trailing twelve months and $94.44B in operating profit. A conglomerate that invests in many publicly traded companies, Berkshire has a vast number of subsidiaries in the insurance, rail, utilities, retail, services, manufacturing, and energy industries and invests in equities and treasuries. As a strong buy-rated company with ETF-like qualities, Berkshire is the perfect fit for the Alpha Picks strategy – designed for long-term buy-and-hold investors.

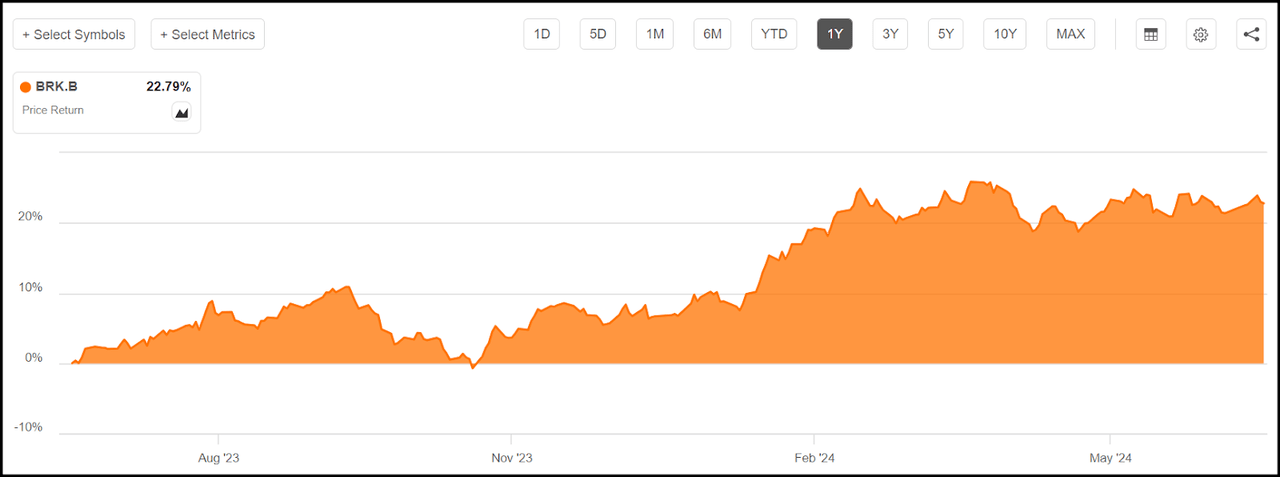

Berkshire offers a strong financial backbone. Where an ETF like SPDR® S&P 500® ETF Trust (SPY) is passively managed with a focus on growth and value, BRK.B is actively managed and tends to target more value-based investing. Berkshire has been up 22% in the past year, soundly outperforming the financial sector median of +14%. Its market cap has grown from $334B to nearly $880B.

Berkshire Hathaway (BRK.B) 1-Year Price Performance (as of 6/27/24)

Deemed one of the most successful investors of all time, Warren Buffett’s Berkshire Hathaway owns many companies, including popular names like:

- Apple (AAPL): 39.7% of the portfolio, valued at $149.8B

- Bank of America (BAC): 10.7% of the portfolio, valued at $40.6B

- American Express (AXP): 9.7% of the portfolio, valued at $36.8B

- Coca-Cola (KO): 6.7% of the portfolio, valued at $25.2B

- Chevron (CVX): 5.3% of the portfolio, valued at $20.0B

*Bulleted data is as of May 24, 2024.

Berkshire’s ETF-like qualities offer access to many industries that have proven to benefit during this period of elevated inflation, while others perform better during disinflation. Approaching the Magnificent 7 territory, Berkshire is a financial holding titan that has delivered incredible profitability and growth.

Our Buy Thesis

Berkshire is a powerhouse financial, offering incredible earnings power, evidenced by triple-digit profit growth led by insurance underwriting. Geico Insurance has been one of BRK.B’s biggest premium generators through direct-selling of auto insurance, responsible for 12.3% of the written premiums in the U.S. compared to the 18.3% industry leader, State Farm. Berkshire has taken steps to strategically enhance its investment portfolio in the insurance industry, which has a strong long-term outlook. The company is cash-rich and low-risk, sporting a 60M beta of 0.88. The company’s beta has averaged a mere 0.61 in the last 20 years, indicating the stock price has been significantly less volatile than the market. Berkshire is the #1 Quant-rated multi-sector holding stock, #4 in the financial sector, and among the top 30 of all Quant-rated stocks.

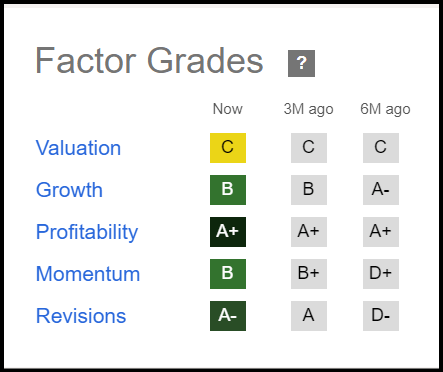

As showcased in the Seeking Alpha Factor grades, which rate investment characteristics on a sector-relative basis, Berkshire has excellent investment fundamentals, with an A+ in Profitability, A- in Earnings Revisions, and ‘B’ in Growth.

BRK.B Stock Factor Grades

Berkshire Growth

Driven by improvements in insurance and energy businesses, Berkshire delivered strong Q124 earnings growth and a record level of cash. Berkshire's quarterly adjusted operating earnings rose 39% YoY to $11.22B, and its cash pile reached $188.99B. BRK.B EPS of $5.20 beat by $0.29, and revenue of $89.87B (+5.2% YoY) beat by $9.46B.

Underwriting drove operating earnings growth in Q1, up 185% YoY. GEICO’s pre-tax underwriting earnings reflected higher average premiums per auto policy, lower claim frequency, and improved operating efficiencies, Berkshire said in its 10-Q. GEICO’s average auto policy premiums rose 9.8% due to rate increases, and Berkshire’s energy segment operating earnings grew 72% YoY, driven by growth in U.S. regulated utilities and natural gas pipelines.

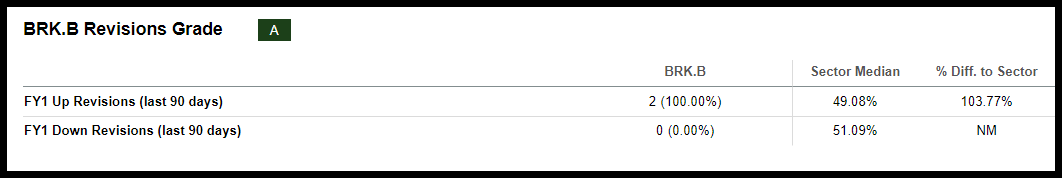

Berkshire has posted triple-digit profit growth in the trailing twelve months, with EBIT up 881%, EBITDA +413%, EPS +938%, and ROE +770%. Operating cash flow rose 30%, and capex +24%. EPS diluted growth FWD is at +12%. BRK.B FY24 EPS is projected to grow 14% to $19.63 and has had two upward revisions in the last 90 days.

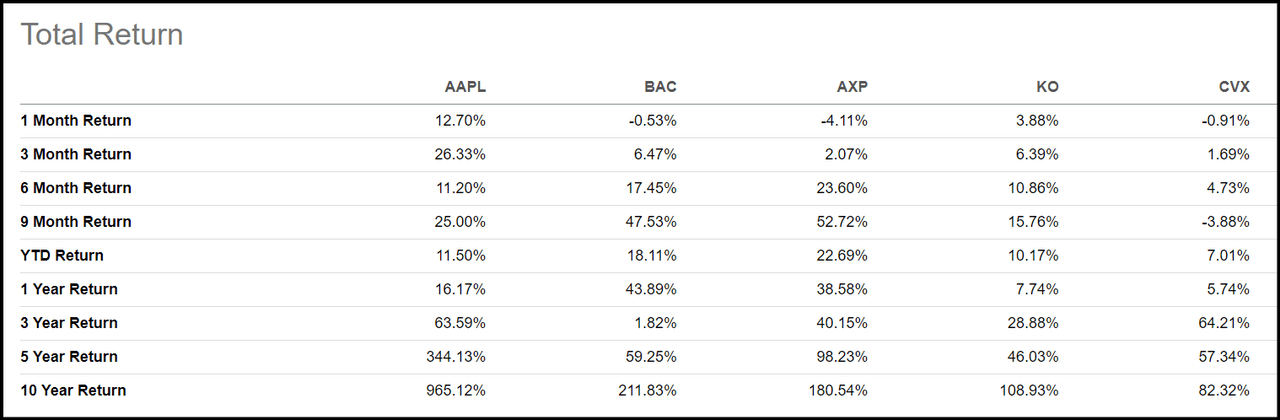

Nearly 75% of Berkshire’s equity investments at the end of Q124 were concentrated among Apple, Bank of America, American Express, Coca-Cola, and Chevron. All five stocks have ‘A+’ Profitability Grades and A’s or B’s in Dividend Safety and Consistency. Berkshire has long-term investment horizons, and its top holdings delivered solid total returns to shareholders over the past 3, 5, and 10 years.

Total Returns of Berkshire's Top 5 Investments: Apple, BoA, AMEX, Coke, CVX

Total Returns of Berkshire's Top 5 Investments: Apple, BoA, AMEX, Coke, CVX (SA Premium)

Berkshire unveiled a stake in Chubb Limited (CB) in a May filing, boosting the fair value of BRK’s investment portfolio by $6.7B, which sent the Swiss reinsurer’s stock surging by over 9%. The investment is small compared to Buffett’s stake in Apple, yet Chubb is an SA Quant Strong Buy stock with an A+ in Profitability. According to S&P Global analysis, speculation was fueled that Chubb could be an acquisition target given its strategic fit, and Berkshire is sitting on more than $51B in cash. Berkshire's A+ profitability factor grade is driven by a net income margin TTM of 19%, EBIT margin of 25%, and levered FCF of 15%. Berkshire's EBITDA margin of 29% and ROE of 13% each beat the sector by 28%. Berkshire’s cash per share is an astounding $24,726 vs. the sector’s $6.84. GEICO's direct-to-consumer model focuses on the mid-income market, while Chubb specializes in the high-net-worth market. Chubb aligns with Berkshire’s underwriting profitability paradigm, which Buffet has called "disciplined risk evaluation.”

BRK.B Stock Valuation

Berkshire has a ‘C’ in valuation, but its P/E growth (PEG) TTM of 0.01 represents a 96% discount to the sector’s 0.41. Other attractive valuation multiples include EV/EBITDA TTM of 7.67x vs. the sector’s 11.54x and EV/EBIT of 8.69x, a 25% discount to the sector. Berkshire’s balance sheet is solid, with $188.99B in total cash and $122.75B in total debt for a net cash position of $66.24B. The debt-to-equity ratio is only 21% and the company’s covered ratio of 18x indicates it has significant operating income to cover debt payments.

Potential Risks

Berkshire investments in fixed-maturity securities, loans, and other assets are subject to significant interest rate risk. Berkshire’s insurance segment could incur significant losses from catastrophic events such as natural disasters, terrorism, or cyber-attacks. BNSF rail derives a large amount of revenue from the transport of coal, and regulations impacting the product could have an adverse effect. BNSF could be exposed to losses from the release of hazardous materials. BHE utility and energy businesses are highly regulated by local, federal, and foreign governments; ESG risks inherent in some of the industries or major changes in regulations could negatively impact financial results. Berkshire manufacturing businesses are also subject to commodity price risks.

Concluding Summary

Berkshire is a growing, stable, and cash-rich muti-holding financial firm that is well-diversified across insurance, energy, manufacturing, and investment segments. Showcasing top-notch profitability and growth factor grades, Berkshire’s insurance and energy companies have shown encouraging improvements.

One of the most profitable companies in the world, Berkshire has posted staggering triple-digit earnings growth in the trailing twelve months. Berkshire’s investment portfolio targets large, dividend-paying stocks with a long track record of solid returns. Berkshire remains a Strong Buy on the back of solid investment fundamentals and offers investors a company with massive earnings growth, diversity, low risk, and a pristine balance sheet.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.