- Published on

[SKYW] Top Airline Stock For Portfolios

- Authors

- Name

- Perpetual Alpha

Summary

- Rated #1 in its industry, this top passenger airline has incredible partnerships and set block flights to ensure stable earnings until contract expiration, helping prevent revenue fluctuations.

- The stock delivered consecutive earnings beats, including Q1 2024 net income of $60M and a 5% block hour production increase.

- The stock has increased +140% over the last year reflecting the growth and improving profitability of the underlying business.

- The stock now offers strong fundamentals, a solid balance sheet, strong revenue and earnings, and a discounted valuation for a promising outlook.

Business Overview

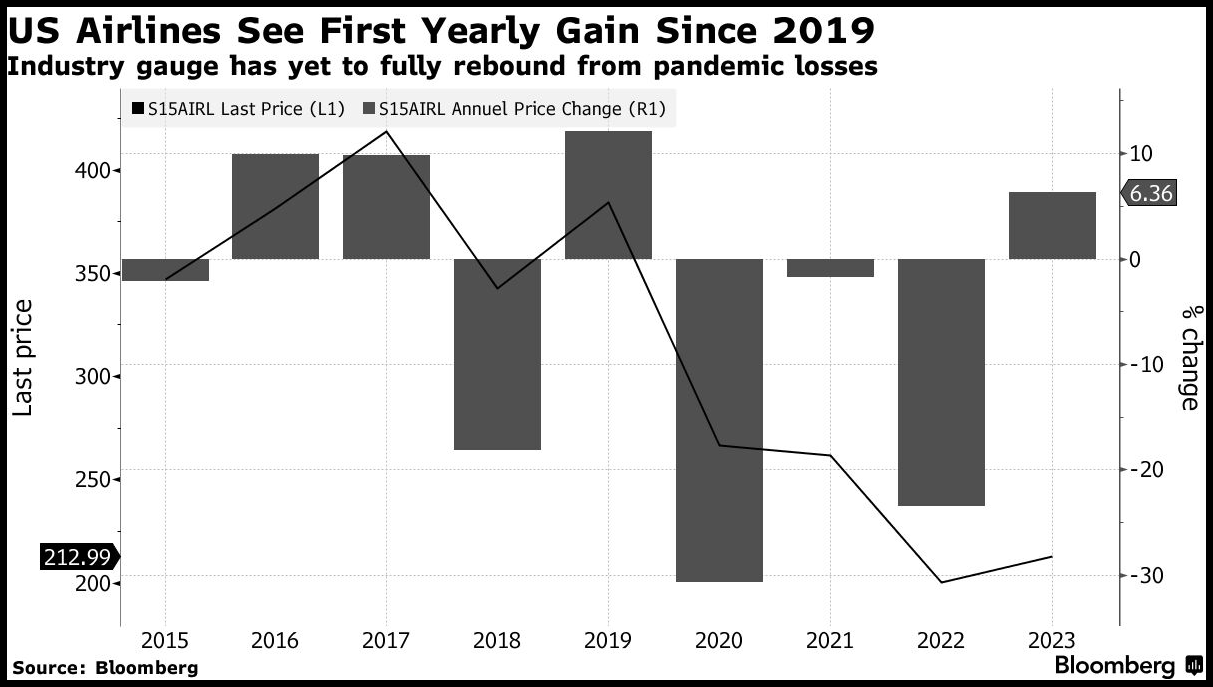

The summer season is upon us and with it tends to be a strong demand for frequent travel. SkyWest, Inc. (SKYW) is an affiliate of some of the biggest U.S. airline carriers. Offering more than 40 million passenger services to over 250 North American destinations, SkyWest’s partnerships and purchase agreements with affiliate companies provide the stability of a set block of flights in avoiding significant revenue fluctuations, making for stable earnings until contract expiration. Record year-end travel in 2023 allowed SkyWest to lead the airline charge as U.S. airlines experience their first yearly gain since the pandemic.

SkyWest has experienced a rebound and is in a strong financial position amid a resilient U.S. economy, despite elevated costs and inflation. Q1 2024 has proven positive for SkyWest and passenger airlines, given that projected airport traffic and long-term global passenger airport traffic are experiencing an increase.

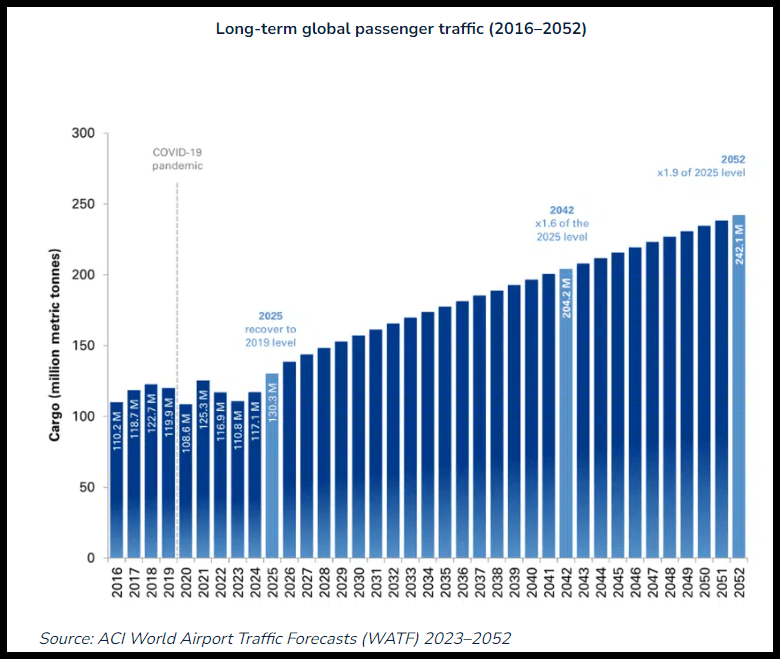

Long-term airport traffic is expected to increase (Airports Council International ((ACI)) World Traffic Forecasts)

According to the Airports Council International (ACI) World Traffic Forecasts, total global passenger traffic from 2023 to 2042 is expected to grow at a CAGR of 4.3%, with a substantial recovery gradient for the first 3 years (9.1% CAGR for 2023 to 2026), then converging to a pre-pandemic growth rate (3.6% CAGR for 2023 to 2052). Wall Street analysts are optimistic about SkyWest, given that two have revised fiscal year estimates up in the last 90 days, with zero downward revisions.

SkyWest is a Quant Strong Buy-rated stock whose track record for safety and reliability, partnerships, tremendous momentum, partnerships, and demand for its products has empowered it to consistently repurchase shares of common stock. SkyWest reported a net income of $60M, positive free cash flow from operations, repaid more than $110M in debt, and repurchased 136,000 shares for $9M in Q1.

SkyWest continues to focus on improving its profitability metrics. The stock’s quarterly price performance remains bullish: +53% versus the sector median of 12% in the last six months, +75% over nine months, and +141% over the last year. SkyWest’s stock price momentum significantly outperforms the S&P 500 and Industrials sectors.

SKYW stock rallies near its 52-week high compared to S&P 500 and XLI

SKYW stock rallies near its 52-week high compared to S&P 500 and XLI (NASDAQ: SKYW chart by TradingView)

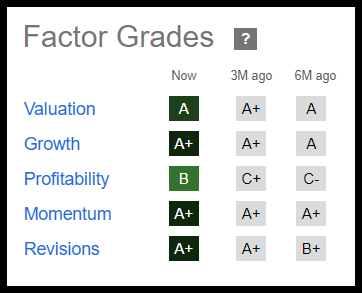

SkyWest is on an uptrend for investors seeking a top industrial and top passenger airline stock. According to the Quant Ratings, it offers incredible growth, momentum, profitability, and revision grades while trading at a discount.

Our Buy Thesis

SkyWest delivered its fifth consecutive EPS surprise, highlighted by strong Q1 revenues, a 5% increase in block hour production compared to Q1 2023, and the ability to meet partner demands for increased production and captain availability. Despite the cyclicality of the airline industry, labor constraints, and inflation, SkyWest maintains solid cash flow, robust demand, and growth and captured a new flying agreement with United Airlines (UAL) in March for 20 additional E175s. The deal was in addition to a 19 SkyWest-owned fleet, solidifying its United partnership and capitalizing on market demand. Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. A snapshot of SkyWest’s Factor Grades below showcases that the company offers incredible fundamentals, trades at a discount, and possesses incredible growth, profitability, and increased confidence in earnings estimates from Wall Street analysts.

SKYW Stock Factor Grades as of market close on 5/30/24

SkyWest’s growth, profitability, momentum, and revision grades indicate that the stock offers upside potential and is fundamentally sound compared to the sector. Although the sector median’s 31.05% gross profit margin (TTM) outperforms SKYW’s 28.34%, SkyWest’s A- trailing levered FCF margin, trailing EBITDA margin, and cash from operations significantly outperform the sector. In addition to strong profitability metrics, SkyWest also possesses strong underlying growth metrics, demonstrated by its A+ Growth Grade that includes a 3,589% difference to the sector in year-over-year EPS diluted growth. Additionally, SKYW has an A+ grade for momentum and earnings revisions, showcasing its rapid growth and analysts’ optimism compared to the sector.

SKYW Stock Growth

Despite plane and airline employee shortages prompting a slide in air fares, airlines for America anticipate a strong summer travel season, with 271M global passengers forecasted to travel between June 1st and August 31st on U.S. carriers. SkyWest has experienced an incredible uptrend over the last 52 weeks, soaring more than 135%, and has announced the addition of 19 new aircraft for 2024.

SkyWest has consecutively beaten earnings and posted strong Q1 2024 results, which discussed plans to monetize its existing CRJ assets and establish another pilot supply pipeline. SkyWest’s Q1 EPS of $1.45 beat by $0.26, and revenue of $803.61M (16.16% YoY) beat by $3.54M, with key highlights that include:

- GAAP net income of $60M

- Q1 pre-tax income of $80M

- Prorate and charter revenue for Q1 was $101M, up 31% from Q1 2023

- $366M cumulative deferred revenue to be recognized in future periods

- Repurchased 10.7M shares, or ~21% of outstanding company shares

SkyWest offers a solid balance sheet supported by strong product demand and reliable cash flow from operations, allowing it to repurchase 10.7M shares from 2023 through Q1 2024. According to consensus estimates, SkyWest’s positive earnings momentum is expected to persist. In the past three months, two Wall Street analysts have revised estimates up, with zero downward revisions. For FQ2 2024, consensus anticipates 400% year-over-year growth in EPS, and revenue estimates are expected to grow +12% for the same period.

Guided by strong demand, operating more flights than Q1 2023 with an adjusted completion rate of 99.97% and a greater crew balance, SkyWest’s President & CEO Chip Childs highlighted:

“We are pleased that we're beginning to see the benefit of our long-term business and fleet strategies. We spent the last several years investing heavily in our fleet and in our people to ensure we are the best in the best possible situation to respond to market demands.”

The #1 Quant Ranked Passenger Airlines stock, SkyWest, is focused on improving efficiencies, expanding its margins and footprint, and capturing market share. In addition to possessing incredible forward EPS diluted growth of 76% compared to the sector median’s 9% and 119% EPS FWD long-term growth (3-5Y CAGR), SkyWest’s year-over-year ROE growth is +262%, and it continues to trade at a discount.

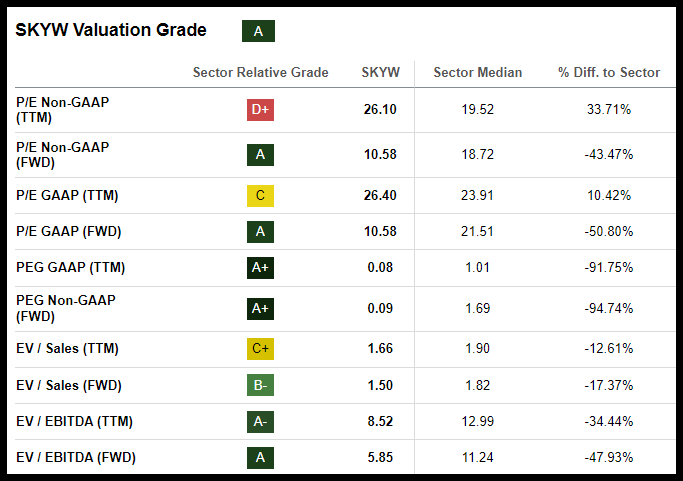

SKYW Stock Valuation

Seeking Alpha’s Quant Ratings shows SkyWest trades at an attractive discount, showcased by an overall ‘A’ Valuation Grade, supported by a forward P/E non-GAAP of 10.58x versus the sector median of 18.72x. Additionally, SkyWest’s forward PEG ratio is a 94% difference from the sector, and its EV/EBIT (FWD) is 11.44x, nearly a 27% difference; forward EV/sales is -17% from the sector.

SkyWest Stock Trades At A Nice Discount To the Sector

Potential Risks

Discounting fares, price wars, and market saturation in some regions have increased airline competition. Competition plays a factor, particularly as new entrants are heavily invested in technologies, better onboard amenities, and newer planes give some airlines an edge. Economic sensitivity and the cyclicality and changing macroeconomic and geopolitical environment also tend to impact profits. Airlines tend to perform well amid economic expansion and increases in leisure travel and discretionary spending, yet, downturns can result in consumers cutting back on travel and a reduction in airlines’ revenue and profitability.

With sticky inflation, fuel price volatility, and operational risks, including labor and mechanical issues, can pose challenges. In addition to stringent Federal Aviation Administration (FAA) regulations, airplane accidents, recalls, unexpected costs related to manufacturing, data breaches, and environmental social governance (ESG) factors can also adversely affect business.

Concluding Summary

SkyWest offers a broad network and affiliate purchase agreements that help shield it from many cyclical revenue fluctuations other airlines experience. Through a set block of flights, SkyWest maintains stable earnings until contract expiration, which has showcased its leading airline uptrend through year-end 2023 and has consecutive earnings beats.

SkyWest has experienced an incredible uptrend over the last year, +141%. The top Quant-ranked passenger airline offers analyst upward revisions, strong growth, and profitability; and forecasted demand for global passenger traffic from 2023 to 2042 is expected to grow at a CAGR of 4.3%, with a substantial recovery gradient for the first three years at 9.1% CAGR for 2023 to 2026. In addition to SkyWest’s strong fundamentals, we have many stocks with strong buy recommendations, and you can filter them using Stock Screens to suit your specific investment objectives. Seeking Alpha is an industry-leading financial media platform known for its unrivaled news coverage, stock analysis, and best-in-class investment tools. Join me in New York on June 18 as I host a breakout session at the Seeking Alpha Investing Summit, a full-day conference offering unique insights and actionable ideas alongside some of the industry’s most influential figures. Secure your pass today. We wish you much success and fun in your investing journey.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.