- Published on

[ZETA] A Star Ready To Shine

- Authors

- Name

- Perpetual Alpha

Summary

- The Tech Sector was punished amid the August global market selloff, but this top application software pick was unphased and is up 25% over the last month on improving fundamentals.

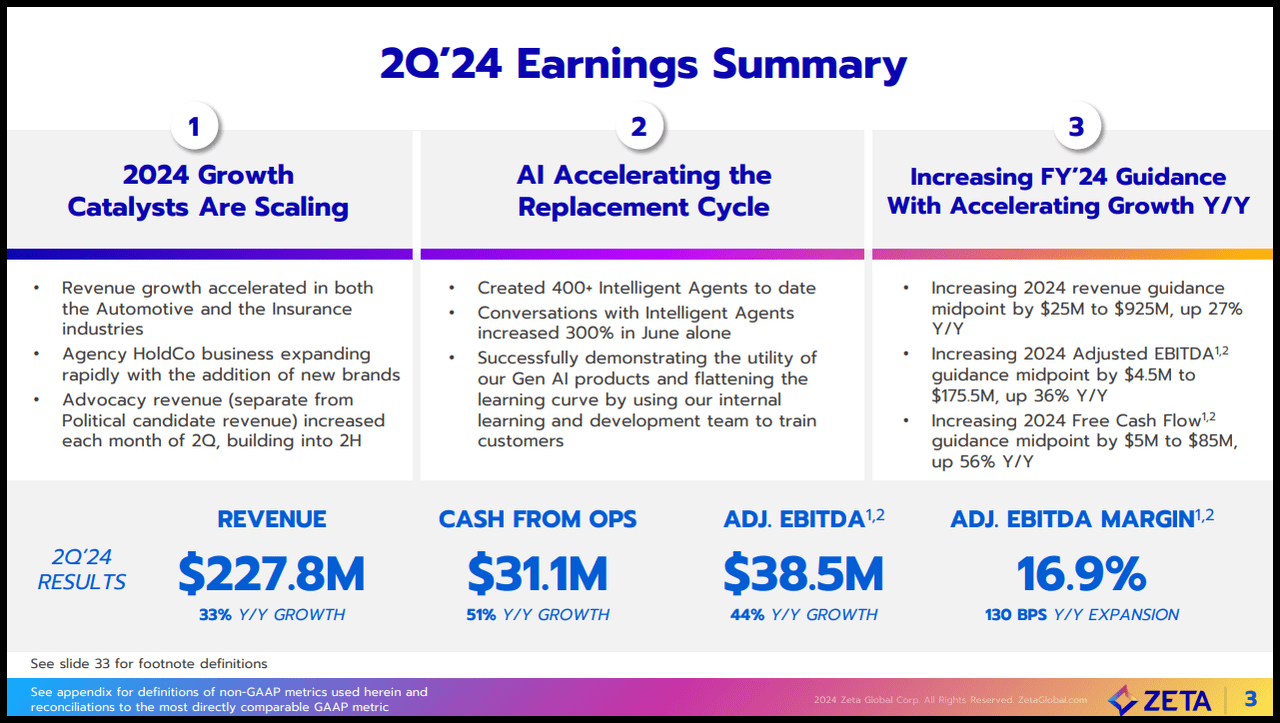

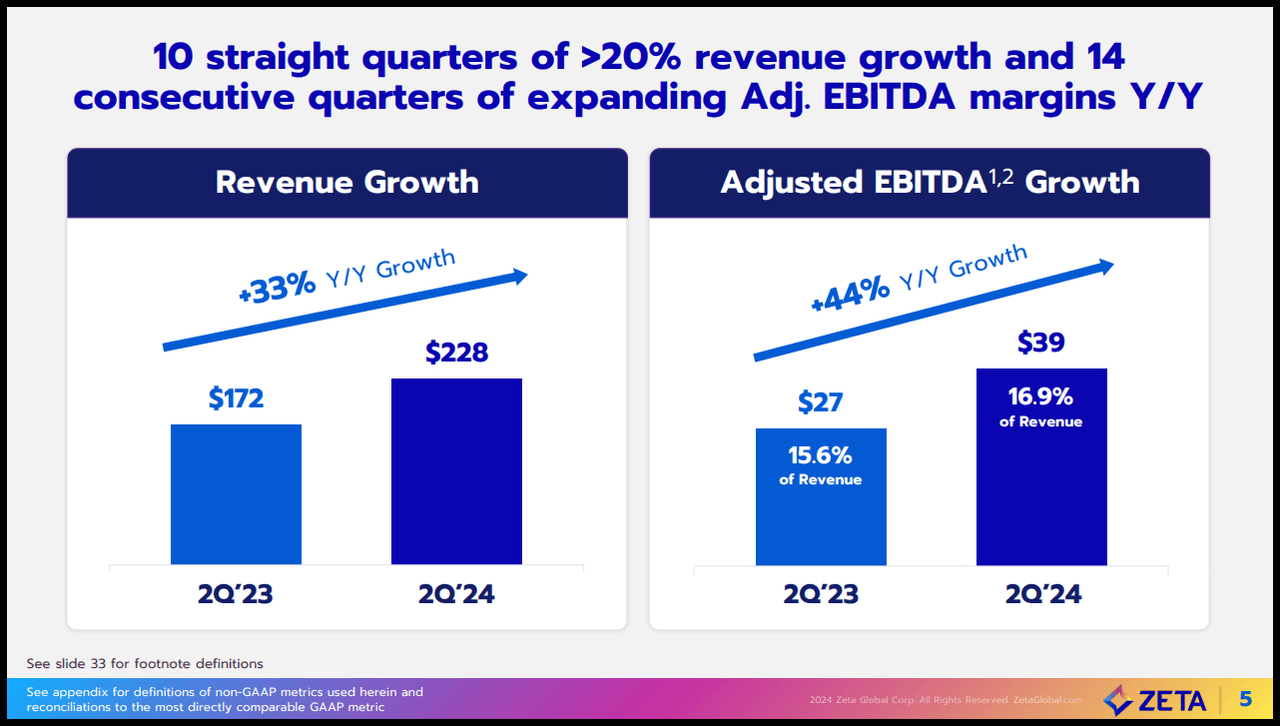

- Posting record-breaking quarterly revenue of $228M, +32% Y/Y, this stock has ten consecutive quarters of +20% revenue growth and 14 straight quarters of expanding Adj. EBITDA margins.

- Leveraging AI to transform businesses’ marketing strategies, Wall Street analysts are bullish on this stock that’s expected to generate more than $80M in free cash flow through FY’24.

- Seeking Alpha’s Factor Grades showcases the company’s excellent fundamentals, strong growth, incredible momentum, and upward analysts’ revisions.

Business Overview

Zeta Global Holdings (ZETA) is a fast-growing, cloud-based company focused on helping businesses acquire, grow, and retain customers. ZETA operates an omnichannel proprietary data-driven platform that provides enterprises with worldwide consumer intelligence and marketing automation. Leveraging artificial intelligence, Zeta helps transform companies' marketing channels through personalized email, social media, web, chat, video, and more. A top Quant-ranked Application Software stock, ZETA has rallied +175% YTD and +200% in the past year, crushing the market and tech sector (XLK).

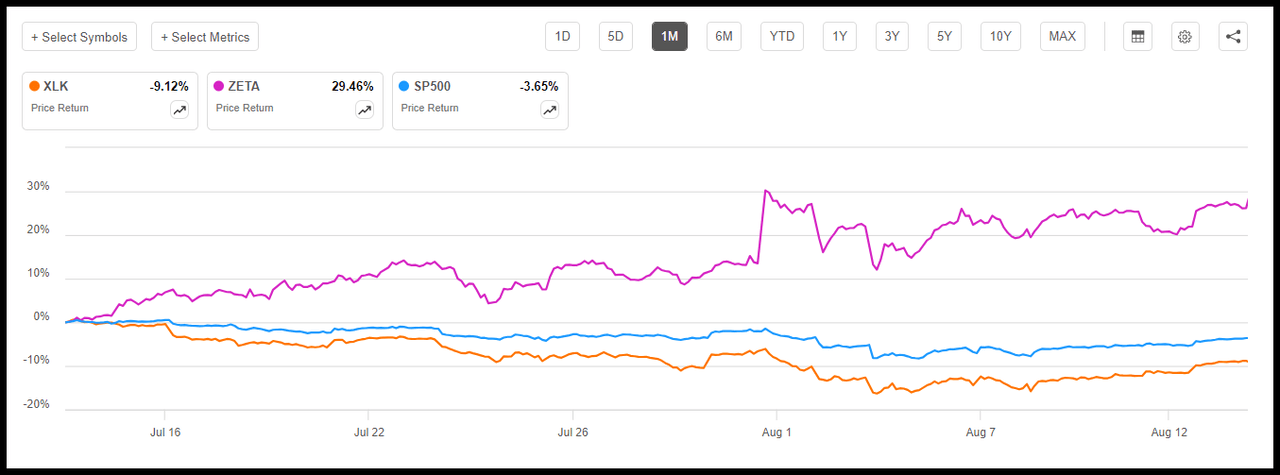

ZETA’s 1-month price performance crushes the benchmark and tech sector (XLK)

ZETA’s 1-month price performance crushes the benchmark and tech sector (XLK) (SA Premium)

Despite recent market volatility that led to a global market selloff, ZETA was barely phased, up nearly 30% over the last month as the S&P 500 declined ~4% and the tech sector fell more than 9%.

Zeta has maintained a Strong Buy Quant Rating since February 29, 2024, and bullish ratings from Wall Street analysts. Led by the Magnificent Seven, major volatility sparked by U.S. recession fears prompted a selloff in August, yet the demand for software and AI offers secular tailwinds for companies like Zeta. Heralded as the next big thing, the Generative AI Revolution is prompting software companies to develop and incorporate next-gen solutions and allowing its cloud-based technology to introduce offerings and increase client capacity. In June, Zeta rallied from an RBC Outperform rating. RBC said the stock is well positioned to benefit from the tech sector data revolution and wider offerings, yielding potential higher average revenue per user (ARPU).

“Management's continued ability to deliver against detailed metrics also gives additional confidence in medium-term targets as we feel a broader product suite could help to elevate ARPU as strong customer acquisitions can be a near-term headwind to this metric,” wrote RBC analyst Matthew Swanson.

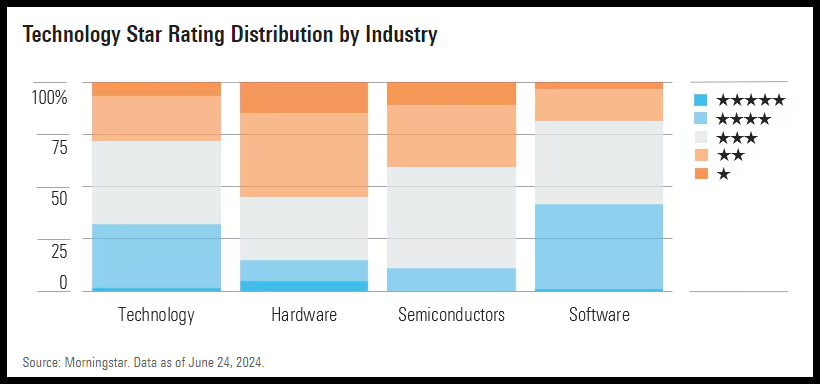

Over the last 52 weeks, the Technology Select Sector SPDR® Fund ETF is up 26% compared with the S&P 500, +21%.

Over the last 52 weeks, the Technology Select Sector SPDR® Fund ETF is up 26% compared with the S&P 500, +21%. (Morningstar)

As highlighted by Morningstar,

“While the median US technology stock is fairly valued, the overall tech sector trades at a 10% premium, as the high valuations on several mega-cap tech stocks skew the overall sector’s valuation. We see semis and hardware as the most overvalued, with software skewing toward undervalued.”

ZETA Stock Valuation

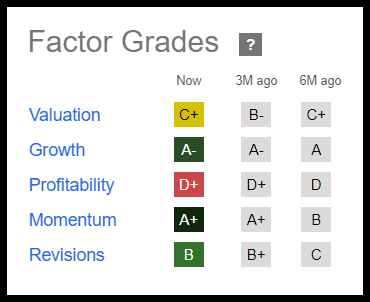

Application software stock Zeta Global Holdings maintains a C+ Valuation grade on the SA Quant valuation scale. Although some of its underlying valuation metrics indicate the stock is trading at a relative premium, ZETA’s forward PEG ratio of 1.26x versus the sector’s 1.88x is more than a 33% discount to the sector. The 'PEG ratio' (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company's expected growth. Given the company’s strong growth prospects, financials, and overall fundamentals, this stock showcases upside potential.

Our Buy Thesis

Zeta has experienced exceptional success over the last year. Showcasing incredible price performance and record third quarter revenue and guidance. One of Zeta’s key growth drivers involves its strong network and agency relationships to service a multitude of brands.

With hundreds of agency relationships, including 400+ Intelligent Agents through Q2, each of Zeta’s agency relationships supports hundreds of brands for expansion opportunities and the ability to become more profitable as channels grow beyond first use cases. The ability to cross-sell tools and offer AI-accelerating products and internal learning and development team training for customers has differentiated Zeta from its competitors. Zeta’s strength has continued to increase, showcased by ten straight quarters of more than 20% revenue growth and 14 consecutive quarters of expanding adjusted EBITDA margins Y/Y.

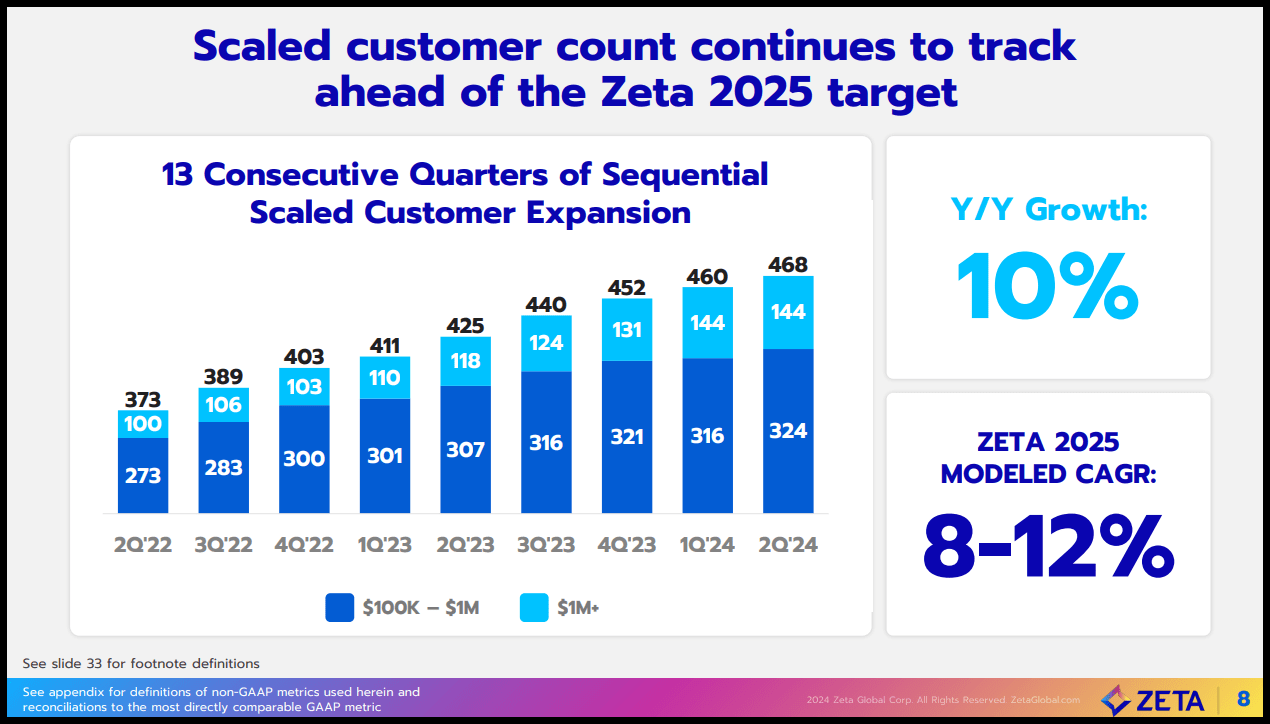

In addition to Zeta demonstrating 13 consecutive quarters of sequential scaled customer expansion, its Quant Factor Grades offer an instant snapshot of the company’s investment characteristics on a sector-relative basis.

Zeta’s A+ Momentum Grade, A- Growth, and ‘B’ EPS Revisions indicate that the stock has strong potential and is fundamentally sound compared to the sector. With fast-growing momentum, ZETA is a company whose shares investors have been actively purchasing and driving higher prices.

ZETA Stock Factor Grades

Zeta Global Holdings Growth

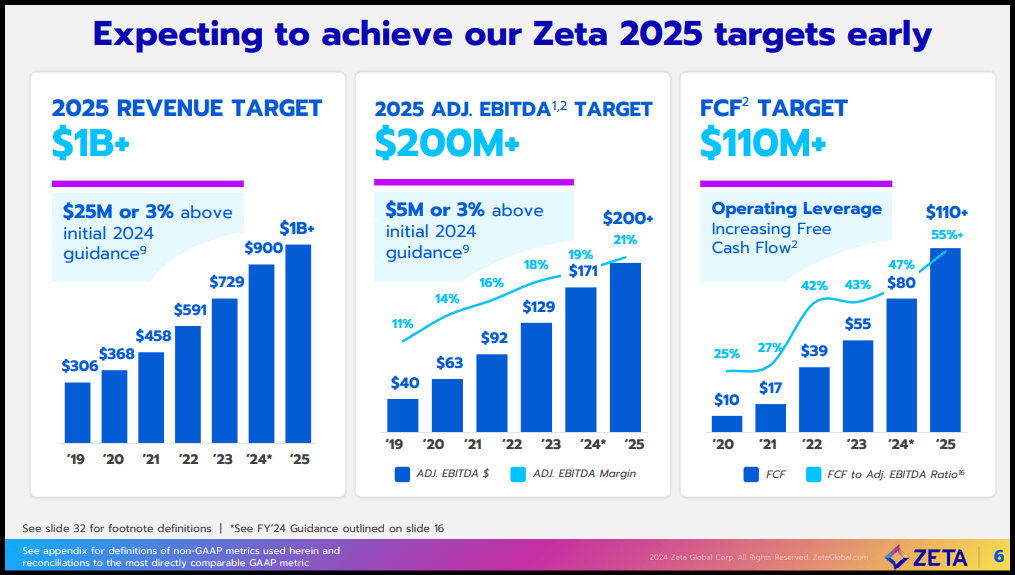

Reporting record Q2 2024 revenue, Zeta has exploded from $306M revenue in 2019 to $729M in 2023. Targeting $925M in revenue in 2024, the company aims to target over $1B for 2025 and has raised its $900M revenue guidance range to $920M-$930M. Revised guidance represents a 26% to 28% YoY increase. Additionally, Zeta has increased its adjusted EBITDA guidance range of $174.5M to $176.5M, up $4.5M at the midpoint from the prior guidance of $171M, a 35% to 36% increase.

“Driven by the AI revolution, which is accelerating the replacement cycle of marketing technology. Artificial Intelligence is disrupting legacy marketing clouds, which, in some cases, are even shutting down parts of their business, creating a large opportunity for more innovative, agile, and AI-powered marketing technology companies like Zeta,” said David Steinberg, Co-Founder and CEO of Zeta Global.

Zeta's advantages and ability to improve companies’ productivity and personalization for superior return on investment are helping drive targets aimed at reaching $1B+ in annual revenue, $200M in EBITDA, and $110M in FCF by 2025.

Zeta’s flexible and scalable platform allowed Q224 EPS of $0.14 to beat by $0.03 and revenue of $227.84M (+32% YoY). Despite Morgan Stanley downgrading Zeta to equal weight from overweight following stellar Q2 results, according to consensus estimates, EPS is expected to rise 31% in FY24 and +26% in FY25. Zeta is outperforming the sector in several critical growth metrics, maintaining an overall A- Growth grade, but has some risks to consider.

Potential Risks

The technology industry can be highly volatile and intensely competitive. Failure to innovate or make appropriate operational and strategic decisions can hinder a company's growth. Technology is also subject to risks that include security breaches, broken authentication, and malware. Failure to comply with evolving regulatory requirements, particularly as artificial intelligence expands, may also affect operations. Although ZETA has strong growth, it showcases a D+ profitability grade. With a higher debt-to-equity ratio, -22.20% Return on Total Capital (TTM), and -25% Return on Total Assets (TTM), the company must focus on managing its capital more efficiently and work to retain and acquire more customers. Overall, Zeta’s revenue has accelerated, and with consistent execution and strong underlying fundamentals has increased guidance for the upcoming quarter and fiscal year.

Concluding Summary

Zeta is a growing industry-leading platform capitalizing on the Generative AI Revolution by transforming companies' marketing channels through personalized email, social media, web, chat, video, and more. Consecutively topping earnings expectations, Zeta has increased its FY 2024 guidance and has accelerated growth year-over-year. With a focus on innovation and proprietary data, Zeta is expanding the business market to its customers. By offering omnichannel marketing for growth, this top application software company delivers strong guidance, improving financials, and an incredible tech option with excellent fundamentals to consider for your portfolio.

Seeking Alpha’s Factor Grades and Quant Ratings can help you make tactical investment decisions when picking stocks without changing your overall risk level. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.