- Published on

[UBER] Drive Your Portfolio Above And Beyond

- Authors

- Name

- Perpetual Alpha

Summary

- One of the largest on-demand transportation companies worldwide, this company delivers services to more than 131M customers per month.

- Despite a premium valuation, this company is driving growth, improving profitability, and delivering solid free cash flow and guidance for better-anticipated Q2 cash flow.

- With consecutive earnings beats, this company’s Q1 revenues were up ~29% Y/Y and crushed analyst estimates by nearly $124M.

- Growth investors interested in a stock on an uptrend with strong growth and profitability prospects should consider this stock for a portfolio.

Business Overview

Outside of China, Uber is the largest on-demand ridesharing company globally, providing services to more than 131 million customers per month. With a growing network of riders and drivers, Uber Technologies (UBER) allows people to get from point A to point B through its app and has expanded its offerings to include food and non-food deliveries.

Uber’s once singular service business model generates gross booking revenue from the excess amount riders pay drivers for rideshare. Where Uber’s mainstay business experienced declines during the pandemic, its Uber Eats fared extremely well, giving rival pandemic darling DoorDash Inc. (DASH) a run for its money.

Uber Technologies (UBER) 1-year Trading Chart

Uber's price performance has increased by diversifying its business to offer food and non-food delivery services. Despite facing competition from rivals Lyft Inc. (LYFT) and Didi Global Inc. (OTCPK:DIDIY), Uber’s growing global ridesharing market (excluding China) is anticipated by some analysts to reach more than $550B by 2027. With its food delivery generating nearly 40% of total revenue versus 11% pre-pandemic, Uber Eats is likely to continue to be one of Uber’s primary revenue growth drivers. Each of the companies’ segments cross-selling to offer in-demand services to improve the company’s fundamentals, and this is why the popular company ranks as our Alpha Pick.

Our Buy Thesis

Uber has experienced quite the turnaround through cost management strategies at the helm of its CEO, Dara Khosrowshahi, hired in 2017. Despite some bad press that included multiple lawsuits, Uber is turning a profit, repairing its staffing issues and fractured Board, to deliver strong free cash flow and improving growth and profitability.

With guidance pointing to a better Q2 than Q1, Uber is capitalizing on the race to use autonomous vehicles. Partnering with Alphabet (GOOG) rival Waymo, driverless vehicles will be tested in Phoenix, Arizona. "Fully autonomous driving is quickly becoming part of everyday life, and we’re excited to bring Waymo's incredible technology to the Uber platform," said Uber CEO Dara Kohsrowshahi. Potential savings on staffing and costs in general, Uber’s shift to autonomous vehicles to pick up riders and deliver food may equalize gross and net revenues, should drivers no longer be needed.

In addition to the use of autonomous vehicles, Uber also plans to launch the use of 25,000 electric vehicles in India. In the race to be carbon neutral while advancing technologies, Uber’s becoming the one-stop shop for transportation needs and deliveries, giving it a potential moat while creating a barrier for other players in the industry.

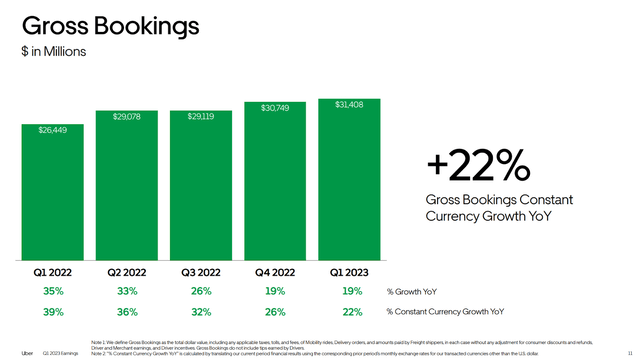

Gross booking increased by 22% Y/Y, which included a 40% increase in mobility and an 8% growth in delivery. As frequency in demand grows, Uber has tracked that monthly usage was 5.45 times for Q1 compared to 4.97 times for the same quarter last year. And while one would expect Uber to continue hiring more drivers, decreases in driver incentives saw a 42% decline in U.S. and Canadian markets, aiding Uber as it changes course to focus on autonomous vehicles in long-term planning for cost-cutting.

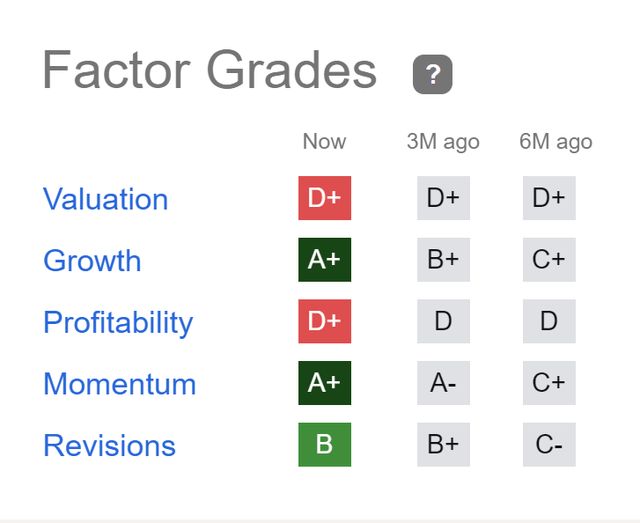

With improving profitability, a strong network, and superior merchant offerings, investors receive many desired results. The factor grades below highlight why UBER is a quant-rated strong buy and how the improvements its management is making to deliver greater value and profitability could benefit investors willing to consider this stock for a portfolio.

Uber Stock Factor Grades

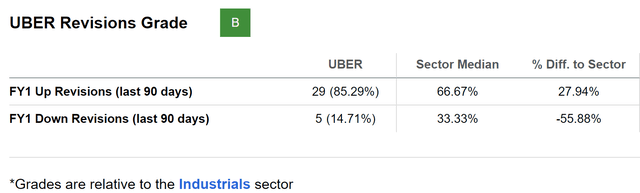

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. Uber’s Growth, Momentum, and Revisions Grades indicate that Uber Technologies has excellent potential and is fundamentally sound compared to the sector. Despite a D+ Profitability grade, Uber delivered impressive Q1 earnings and has been expanding gross profit margins, with the company’s management supporting a strong outlook. Uber also has a whopping $1.23B in cash from operations and $4.1B in cash. Highlighted with a ‘B’ Earnings Revision, Uber is on its way to becoming a very profitable company, is cutting costs, and has strong growth prospects. Given its ability to navigate disruptions and changing landscapes, as evidenced by the pandemic and slowing economies, two consecutive earnings beats, and capitalizing on the electrification of vehicles and tech advancement to maximize returns, Uber’s former “growth at any cost” strategy is kicking in gear, making this stock ready for investment.

Uber Technologies Stock Growth

Back-to-back earnings beats showcase strong results, including a Q1 2023 EPS of -$0.08 that beat by $0.01; revenue of $8.82B, up nearly 29% Y/Y – a crushing blow to analyst estimates by $124M, and 29 analysts have revised their estimates up.

One of the few stocks Seeking Alpha has that is moving from negative EPS to positive EPS, Uber’s guidance is extremely strong. Second quarter adjusted EBITDA is expected to be between $800M and $850M and includes gross booking anticipated between $33 and $34B. Focused on accelerating growth for bookings and improving technologies, Uber One serves as a tailwind for the company’s next leg of growth. As highlighted by SA author Vinay Uthum.

“One of the key standout performances for the quarter for UBER came from its membership program, Uber One. The company saw Uber One memberships reach an all-time high in the U.S. and Canada. The membership plan is now driving a substantial portion of the company's growth. For instance, in the first quarter, 27% of the mobility segment's gross bookings in the U.S. were due to Uber One members. The company is also seeing Uber One driving more than 50% of the bookings in certain markets outside the U.S.

Uber One members are spending 4x more than non-members, and there is a 15% higher retention rate among members compared to non-members.”

Uber Delivers Excellent Revenue for Q1 2023

Bullish momentum and strong guidance are delivering growth and improving technologies that have allowed Uber to drive profitability in 2023. Record free cash flow of $549M, a solid management team that has aided in driver retention, and an advertising strategy that delivered 70% Y/Y growth, exceeding 345,000 total active merchants for Q1. Uber is leveraging advertising to help drive revenue, even as the company trades at a premium valuation.

Uber Stock Valuation

Uber is up 47% YTD and more than 61% over the last year. Although rated a quant-strong buy, the stock’s valuation is stretched with a ‘D’ grade, which includes a forward P/E trading at 36.40x compared to the sector at 16.04x and forward EV/Sales at nearly a 40% premium.

Although Uber’s valuation framework is stretched, the stock is on a longer-term uptrend, evidenced by an A+ momentum grade, an increasing positive earnings forecast, and healthy tailwinds from fourth-quarter top-and-bottom-line earnings beats. New product features that include introducing electric vehicles, robotaxis, and linked accounts for teenagers support the stock’s growth and the quant strong buy rating.

Potential Risks

As exhibited by the surge of its stock price post-pandemic and current valuation, should the stock get more expensive, this strong-buy rated stock may quickly drop to a Hold rating should earnings estimates not revise up quicker. Bear in mind that a Hold rating does not mean Sell. Rather, the stock is generally expected to perform on pace with the market relative to companies within its industry and sector.

One of Uber’s biggest risks is competition, including its long-time rival, Lyft. The development of autonomous vehicles could result in a rideshare business model overhaul, eliminating the need for drivers and the business itself. Because rideshare is still relatively new and has experienced pushback from the age-old taxi services, arguing that Uber is monopolizing the industry, increasing regulation could hurt the company.

In recent years, Uber has also been subject to scrutiny involving background checks, data breaches, and a poor culture of racial discrimination and sexual misconduct. Investigations may force the company to conduct more in-depth background searches, which is costlier and could eat into revenues. But the global company has made a turnaround and is expected to grow through strategic initiatives, working to improve and eliminate inefficiencies and capitalizing on advancements paving the way for the transportation industry.

Concluding Summary

Uber is a company that took the world by storm. In some respects, ridesharing has become the new taxi service at a fraction of the cost in some regions and has become so much more than just ridesharing.

The Uber platform manages global rides, food, and local deliveries for individuals and businesses. Showcasing strong earnings that include year-over-year growth in customers, order frequency, and monetizing conversions, top-line growth has aided margin expansion and operating leverage. Although the global economic outlook is uncertain and may weaken demand, Uber’s revenues and activity have surged. As highlighted by the company’s CEO, Dara Khosrowshahi, “The Uber platform has never been stronger. Our own expectations have never been higher, and we’re excited to leave no doubt as to the scope of our ambitions for exceptionally profitable growth.”

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.