- Published on

[CLS] This High-Voltage Company Continues To Surge

- Authors

- Name

- Perpetual Alpha

Summary

- Rallying more than 195% since its addition to the Alpha Picks portfolio, driven by strong demand for its networking solutions in hyperscaler data centers, Alpha Picks is reintroducing a pick.

- One of the largest electronic manufacturing services ((EMS)), Q3 revenues of $2.5B were 22% higher year-over-year.

- This company has transformed from a traditional contract manufacturer to a key strategic technology partner for hyperscalers and AI infrastructure.

- Up nearly 200% over the last year, this stock maintains an attractive valuation framework, with a forward P/E that trades at an 18% discount relative to the sector.

- The total return of the Alpha Picks’ portfolio continues to outperform the S&P 500, +172% versus +57%, with eight Alpha Picks soaring more than 100% since their addition.

Register for the Money Show Conference in Orlando, Florida, on October 17-19, 2024. The full-day conference will convene top influential figures in business and finance. Steven Cress will share unique insights and unparalleled analysis, including breakout sessions on Politics & Your Money for the election year.

Business Overview

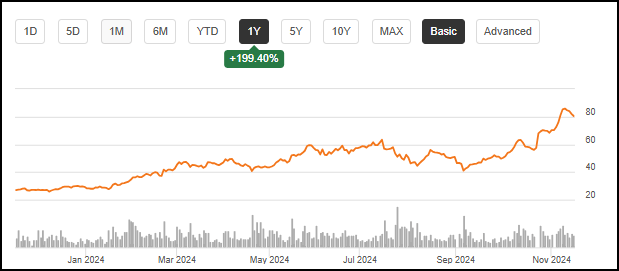

Celestica Inc. (CLS) continues to build on its success as one of Alpha Picks’ top-performing stocks, consecutively topping estimates and showcasing a phenomenal earnings season. Alpha Picks initially selected CLS for the portfolio on October 16, 2023, at $25.65 per share, and today, CLS is trading at $81.24 per share, a return of 198.39% since its addition. Alpha Picks’ buy criteria uses a data-driven process, allowing ‘Strong Buy’ rated stocks to be re-selected after one year. Why choose a stock trading near its 52-week-high? Alpha Picks’ case for Momentum Investing outlines that momentum is a highly predictive factor, one of the most predictive for targeting positive future returns.

Two of Alpha Picks’ top-performing companies have been selected as re-picks. Modine Manufacturing Company (MOD) has delivered an astounding 484% since it was originally picked in December 2022, and more than 100% since it was re-picked in January 2024. Powell Industries, Inc. (POWL) has delivered an incredible 420% since its initial selection in May 2023, and in just six weeks since it was picked for the second time, it has delivered more than 25%.

Toronto, Canada-headquartered Celestica Inc.is a top electronic manufacturing services (EMS) company. With a focus on technology and capitalizing on the recent AI trend, Celestica has expanded globally, offering advanced supply chain solutions throughout North America, Europe, and Asia.

One of Canada’s largest EMS companies, CLS offers a diverse portfolio of solutions through two segments:

- Advanced Technology Solutions (ATS) – Supply chain solutions for Aerospace and Defense, Industrial, HealthTech, and Capital Equipment companies.

- Connectivity & Cloud Solutions (CCS) – Supply chain solutions for communications and enterprise sector, especially servers and storage.

As of Celestica’s October 23, 2024-dated investor presentation, its ATS segment accounts for 33% of total revenue, with CCS accounting for the remaining 67%. CLS’s commitment to shareholder value is evidenced by its strong financials, including expanding margins, strong consecutive earnings figures, and operational excellence. Additionally, CLS repurchased ~2.2M shares during Q3.

Celestica benefits from tailwinds that include robust demand from its core CCS division, which has grown an enormous 42% Y/Y. As the demand for advanced computer capacity to support AI and machine learning (ML) expands, the outlook for Celestica continues to be positive.

Celestica Inc. (CLS) 1-year Trading Chart

At the forefront of AI infrastructure, Celestica's new DS4100 switch is a significant product launch, showcasing the company’s evolution into a premier designer and manufacturer of cutting-edge data center hardware. The state-of-the-art 800G switch directly addresses the explosive demand for AI computing power in hyperscaler data centers. The launch reinforces CLS’s strategic transformation from a traditional contract manufacturer to a key solutions provider, positioning the company to capture significant value from the accelerating AI infrastructure buildout.

Our Buy Thesis

Celestica is positioning itself as a leader in AI infrastructure manufacturing and design, particularly in data center technologies like networking switches, servers, and storage. The company is seeing extraordinary growth in its CCS segment, driven by hyperscaler demand, while maintaining a diversified portfolio through its ATS segment. CLS has a unique position as a North American-based provider offering both EMS and Original Design Manufacturing (ODM) capabilities, with particular strength in networking solutions and AI/ML compute platforms.

“We believe as a North American-based ODM that has been delivering system and rack-level solutions across all the core technologies in the data center, that we’re in an advantaged position... there’s a lot of focus on customization for what I would say this customization for optimization, not just at a solution level, a design level, but also at a supply chain level. I mean we’re anticipating geographic requirements are changing rapidly,” said Jason Phillips, President of CCS.

Celestica's HPS ((Hardware Platform Solutions)) division, operating within its CCS segment, exemplifies the company's evolution from pure manufacturing to value-added design. HPS delivered $761M in Q3 2024 revenue (30% of total revenue), focusing on proprietary networking switches and data center hardware. With projected 2024 revenue of $2.8B, representing 60% YoY growth, this higher-margin business underscores Celestica's transformation into a strategic technology partner for hyperscalers and AI infrastructure deployments, rather than just a contract manufacturer. Given Celestica's strategic positioning in AI infrastructure, its proven execution in HPS growth, and unique advantages as a North American supplier with both manufacturing and design capabilities, the company is well-positioned to capture significant gains from the accelerating demand for AI computing infrastructure.

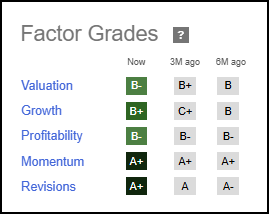

CLS Stock Factor Grades

Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis. CLS’s Growth, Momentum, Profitability, and Revisions Grades indicate that the company is incredibly profitable, offers excellent potential, and is fundamentally sound compared to the sector, with strong growth prospects.

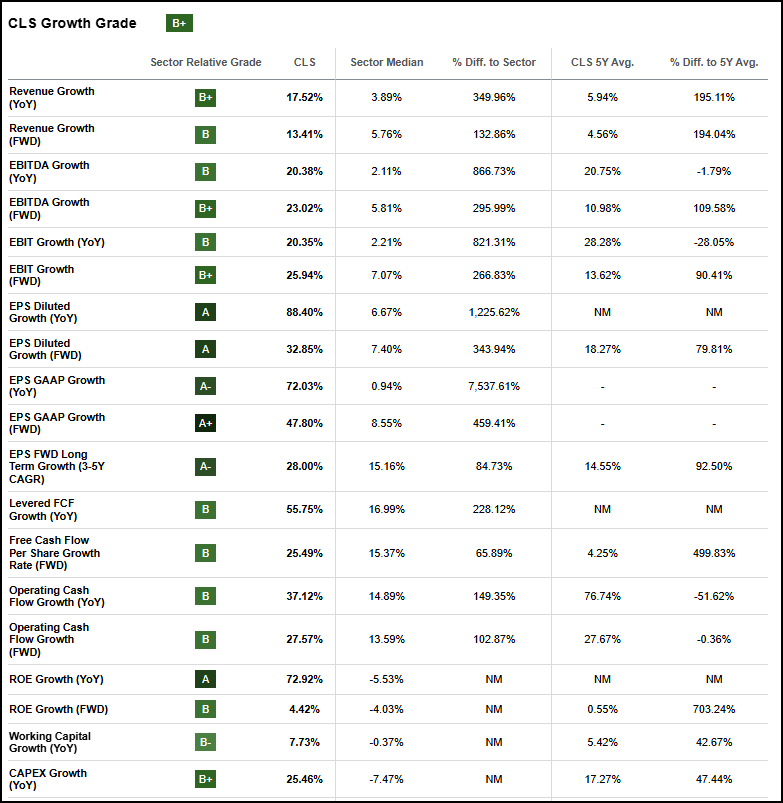

Celestica Inc. Stock Growth and Profitability

CLS produced exceptional Q3 earnings, with revenue reaching $2.5 billion (up 22% Y/Y) and adjusted EPS of $1.04, both exceeding consensus estimates. In CLS’s Q3 earnings call, Jason Phillips, President of Connectivity and Cloud Solutions, stated:

“In 2024, the AI server market is expected to reach approximately $100 billion and this figure is projected to grow to over $250 billion by 2027. The top five hyperscalers account for nearly 70% of spending today, driven by their substantial investments in the back-end infrastructure required to train the latest generations of AI models. And while they are expected to continue to comprise the majority of the AI server market in the coming years, we anticipate that digital native companies will claim a larger share of spend over time.”

CLS Stock Growth Grade

The strength of its results continues to shine. CLS notched its highest quarterly adjusted EPS in company history at $1.04, while margins continue to expand, with its non-IFRS operating margin reaching 6.7%, a 100 basis point improvement compared with 2023. The stock maintains an excellent cash position, with $537.80M, more than a 450% increase relative to the sector. Additionally, the stock’s quarterly price performance is tremendous, as showcased by its A+ Momentum grade, yet it continues to come at a discount.

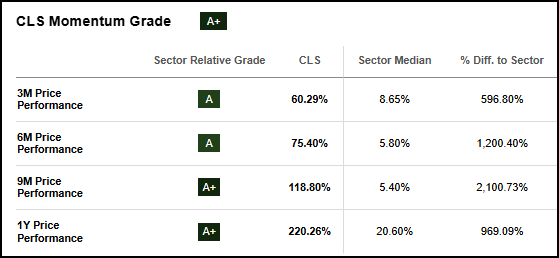

CLS Stock Momentum Grade

CLS Stock Valuation

CLS is trading at a discount despite its +175% YTD price performance. Quant-rated a Strong Buy with a B- Valuation grade, CLS has a forward PEG ratio of 0.76x versus the sector median of 1.91x. CLS also boasts a forward Price/Sales of 0.99x, which is a near 70% reduction versus the sector median.

Potential Risks

Primary concerns for CLS include customer concentration, with two clients representing 37% of total sales in Q3. The company must also navigate increasing competition in its server business. Although Celestica is an IT company, electronic manufacturing components are part of rapidly changing technologies that can be prone to more volatility amid economic uncertainty and short life cycles. Materials shortages, manufacturing disruptions, and longer lead times when inventories are low also pose problems. As a global company, geopolitics can play a factor, especially as competition increases between the U.S. and China. Access to raw materials, ESG regulations, or changing consumer preferences can pose headwinds.

Concluding Summary

Celestica has transformed from a traditional electronics manufacturer into a strategic player in the AI infrastructure space, particularly through its Hardware Platform Solutions division, which generated $761M in Q3 2024. With the stock up 195% since October 2023, CLS continues to show strong momentum while maintaining an attractive valuation. The company's unique position as a North American-based ODM, combined with its expanding capabilities in AI/ML compute platforms and networking solutions, positions it well to capitalize on the projected growth in AI server markets, which are expected to grow substantially in the years to come.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.