- Published on

[GRBK] Develop Your Portfolio With A Top-Ranked Stock

- Authors

- Name

- Perpetual Alpha

Summary

- In 2023, homebuilding stocks are surging due to tightening conditions in the U.S. housing market.

- Boasting straight A’s across all factor grades and a #1 quant-ranked position in its industry and sector, this homebuilding stock has outpaced the market.

- Despite a surge in mortgage rates and slowing inventory and sales, this home builder delivered its best Q1 results in history, ranking as one of the nation’s fastest-growing homebuilders.

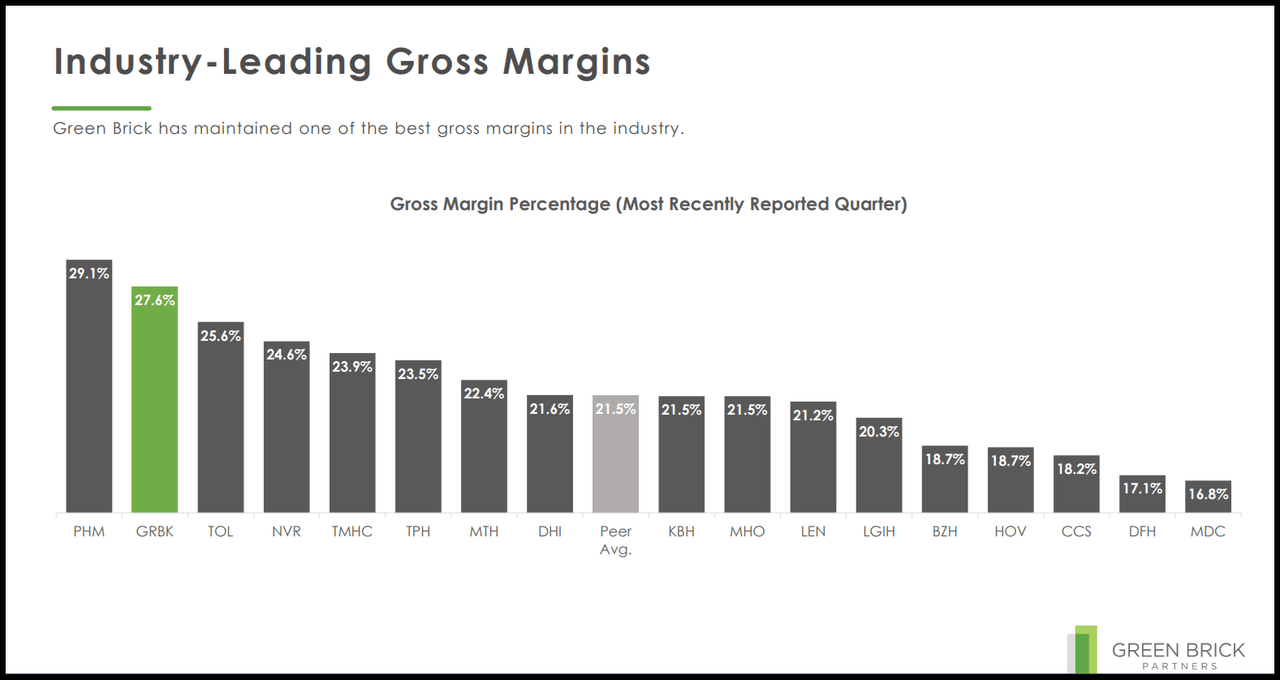

- Leveraging the favorable post-COVID Great Migration trends and establishing new sites accordingly, our Alpha Pick maintains an impressive homebuilding gross margin of 27.6%, one of the highest among homebuilders.

- While there are risks and potential downsides to cyclical business, this stock had a YoY revenue increase of 14.8% and an EPS surge while sporting a P/E ratio of 10.8X, a 30% discount to the rest of the sector.

Business Overview

Building award-winning neighborhoods and homes that have provided investors with long-term returns, Green Brick Partners, Inc. (GRBK) was named one of Fortune Magazine’s 2021 fastest-growing public homebuilders and land developers in the nation.

Owning five subsidiary homebuilders in Texas, controlling interest in Atlanta-based homebuilder The Providence Group, and an 80% interest in GHO Homes, GRBK’s portfolio in diverse geographies and interests has allowed it to grow its market share and build on its financial strength since 2021. Extremely undervalued, GRBK offers excellent earnings growth, and its business is built with state-of-the-art operational support in IT systems, accounting, purchasing, marketing analytics, and HR management. Through rigorous underwriting, Green Brick Partners lays the foundation as a strong buy stock, quant-ranked #1 in its sector and industry.

Our Buy Thesis

Although the Real Estate sector (XLRE) is -4% and one of the worst-performing sectors over the last year, homebuilding (XHB) and U.S. Home Construction (ITB) are seeing green, like Green Brick Partners’ +136% over the last year.

GRBK vs. XLRE, ITB, & XHB 1-Yr Price Performance

GRBK Stock vs. XLRE, ITB, & XHB (1-Yr Price Performance) (SA Premium)

GRBK Stock vs. XLRE, ITB, & XHB (1-Yr Price Performance) (SA Premium)

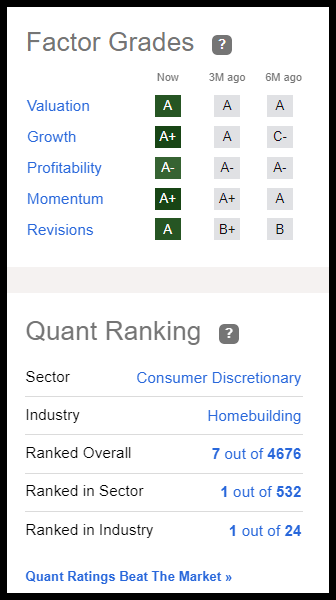

In 2023, homebuilding stocks witnessed a significant uptrend, driven by a tightening U.S. housing market and fears that interest and mortgage rates could climb higher. With straight A’s across all factor grades, GRBK showcases that despite headwinds, there are opportunities to buy homebuilding stocks.

Alpha Picks has proven this with our last homebuilding pick, M/I Homes Inc. (MHO), selected on October 3, 2022, and is up nearly 150%. We chose M/I Homes as they were capitalizing on pricing competition, limited inventory, and strong demand within their real estate areas of operation. Similarly, Green Brick Partners has operations in some of the fastest-growing real estate markets in the country. GRBK delivered a record 761 homes in the first quarter, their best first quarter ever. While the relative risk to return for the industry is compelling, Seeking Alpha’s quant ratings support the buy thesis for Green Brick Partners' which has crushed earnings for six consecutive quarters.

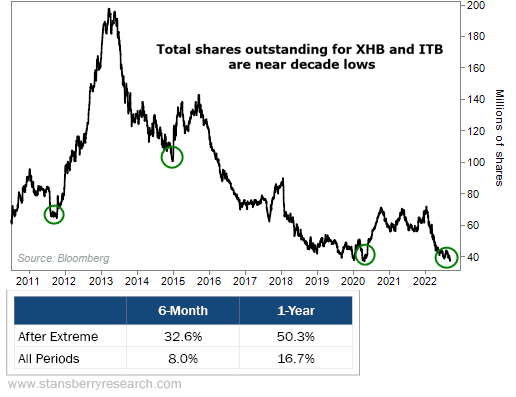

Homebuilder and Construction ITB & XHB Total Shares Outstanding (2010-2022)

Homebuilder and Construction ITB & XHB Total Shares Outstanding (2010-2022) (Dailywealth.com, Bloomberg, StansberryResearch.com)

Homebuilder and Construction ITB & XHB Total Shares Outstanding (2010-2022) (Dailywealth.com, Bloomberg, StansberryResearch.com)

Although the stock trades near its 52-week high and has rallied over 100%, there is still room for upside potential based on the quant ratings. Although past performance does not indicate future results, homebuilder, construction, and materials stocks have started to surge. Since the Great Financial Crisis, there has been a need for more homebuilding in the United States. This supply absence and the Great Migration have added fuel to the situation and should provide GRBK with long-term tailwinds.

The company’s strong top and bottom line results are confirmation. GRBK reported record home closing revenue for Q1 and nearly a 30% homebuilding gross margin. Unsurprisingly, they are currently ranked #1 out of 24 in their industry and #1 out of 532 in the sector. Showcasing straight A’s across all Factor Grades, which rate investment characteristics on a sector-relative basis, GRBK’s Momentum, Growth Grade, Revisions, and Profitability indicate that the company is very attractive on a wide range of financial metrics. Seeking Alpha’s factor grades show that Green Brick is a rapidly-growing home builder with stellar profitability and a compelling valuation.

GRBK Stock Factor Grades & Rankings

GRBK Stock Factor Grades & Rankings (SA Premium)

GRBK Stock Factor Grades & Rankings (SA Premium)

GRBK’s Growth & Profitability

Posting six consecutive earnings beats, Green Brick Partners continues to deliver excellent financials, industry-leading gross margins, and results to outperform the market. First-Quarter EPS of $1.37 beat by $0.71, and revenue of $452.06M beat by nearly 15% year-over-year, resulting in four FY1 Upward analyst revisions.

GRBK Stock has industry-leading growth (Green Brick Partners Q1 2023 Investor Presentation)

GRBK Stock has industry-leading growth (Green Brick Partners Q1 2023 Investor Presentation)

With a strong management team and deep expertise in complicated submarkets, GRBK has navigated volatility and capitalized on superior lot and land positions to sustain operations and support future growth. GRBK consistently has low debt-to-total capital ratios compared to peers at 23.8%. Significant liquidity and strong operating cash flows continue to make for strategic advantages for the company, taking hold in some of the best markets of Dallas-Fort Worth (DFW) and Atlanta, cities that have captured populations as part of the Great Pandemic Migration.

“I am extremely pleased to report that Green Brick started 2023 with the best first-quarter results in our history. During the first quarter of 2023, we delivered 761 homes, which was a record number for any first quarter and led to a 24% year-over-year growth in home closing revenues of $449 million. This revenue level was also a record for any first quarter.

GRBK Stock has industry-leading growth (Green Brick Partners Q1 2023 Investor Presentation)

GRBK Stock has industry-leading growth (Green Brick Partners Q1 2023 Investor Presentation)

While there are some risks when investing in this stock, to be discussed below, TEX has many advantages. Third-quarter EPS of $1.20 beat by $0.16, and revenue of $1.12B beat by $48.40M, an increase of 12.75% Y/Y. Terex’s stellar growth and solid profitability figures resulted in its full-year EPS outlook rising between $4.00 and $4.20. With a backlog of $3.9B, +33% year-over-year, TEX has some cushion coming into a slowing 2023. By focusing on improving costs and pricing, TEX has been able to expand gross profit margins by 21.2%. Operating margins improved by 10.8%.

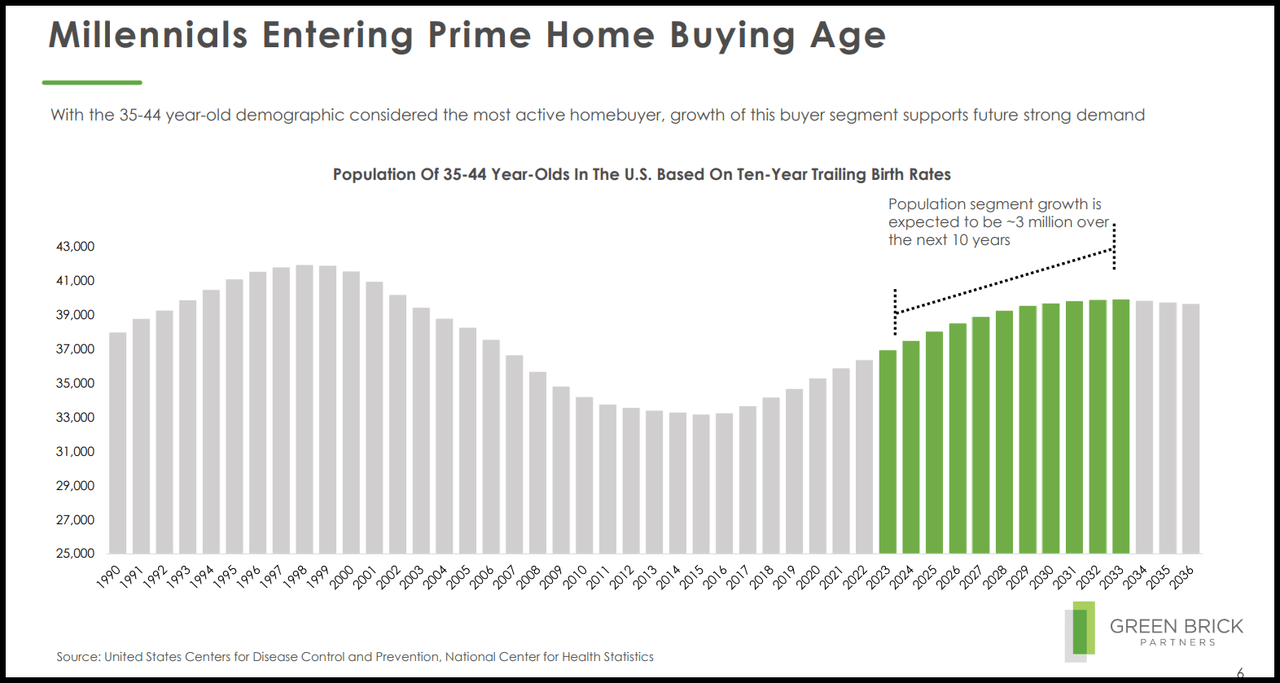

GRBK to Capitalize on Millennials Home Buying Age (Green Brick Partners Q1 2023 Investor Presentation)

GRBK to Capitalize on Millennials Home Buying Age (Green Brick Partners Q1 2023 Investor Presentation)

Gross Margins underscore the profitability of the stock at 29%, EBIT Margins at 20%, and Return on Equity at 30%. Despite market volatility, GRBK had a Q1 net income of $64M. With strong financial, land, and lot positions, Green Brick returned $15.4M to shareholders in Q1 through stock buybacks. Favorable trends include a bustling job market, lower cost of living, and zero state income tax in the DFW. These are keys to potentially drive more housing demand over the long term, especially as millennials enter the prime home-buying age. GRBK not only possesses a strong buy rating given its tremendous growth and profitability, which includes a forward EPS Long Term Growth (3-5Y CAGR) of 73%, Green Brick is still severely discounted price.

GRBK Valuation

Green Brick Partners is highly undervalued, and with economic reports showcasing stronger-than-expected increases in home prices, upside potential seems promising. GRBK has rallied +124% YTD and +135% over the last year. With continued declines in housing inventory, now may be the optimal opportunity to buy GRBK at cheap levels. GRBK has an overall ‘A’ valuation grade with a forward P/E ratio of 10.79x, which trades at a 32% difference to the sector. In addition, its forward PEG of 0.15x is an excellent metric, combining the stock's earnings growth rate with a core valuation metric, and showcases that GRBK is severely discounted at -89% below its sector peers.

Potential Risks

The Fed’s aggressive rate hikes have affected the mortgage industry, and there’s been a slowdown in buying and selling of real estate. Over the last several years, raw material costs for builders also surged. Where investors and developers are experiencing headwinds given the expensive cost of capital, those unable to generate returns find it difficult to stay afloat financially, posing risks when developing in a slower market, greater.

Lower inventory, higher rates, and the run-up in home prices in 2021 have led to decreased affordability, hindering sales. Where 30-year mortgages nearly doubled in 2021, investors that are cash rich and need less financing have an advantage for supplies coming on the market. While Green Brick carries some debt, its proven track record of growth, profitability, and $259M in Cash from Operations and $177M in Cash offers an opportunity for investors willing to take the headwinds with the tailwinds.

Concluding Summary

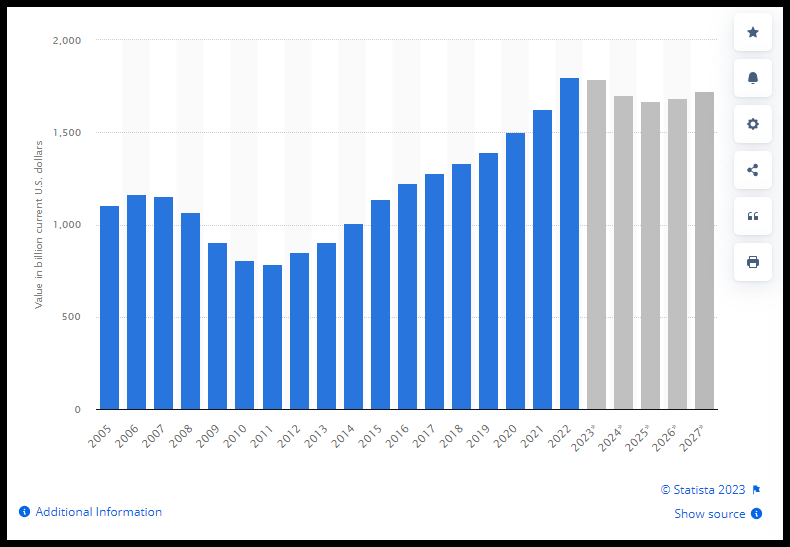

Although the economy has experienced a slowdown and home sales have declined as inventory has fallen, the homebuilding industry remains strong. In 2023, homebuilding stocks are surging due to tightening conditions in the U.S. housing market. The housing market, already facing a supply shortage, is witnessing robust demand, particularly for new homes. This is happening as the inventory of existing homes for sale shrinks, alongside rising interest and mortgage rates. Where input costs outside of labor have come down significantly, developers and companies like Green Brick, with financial fortitude, can take advantage. While some economic risks remain, homebuilding stocks can offer solid returns over the long term amid a rising rate environment.

New Construction in the U.S. with forecasts (2005-2027)

New Construction in the U.S. with forecasts (2005-2027) (Statista)

New Construction in the U.S. with forecasts (2005-2027) (Statista)

Written by Steven Cress

Head of Quantitative Strategies at Seeking Alpha

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.