- Published on

[TWLO] A Ready-Made Solution For Your Portfolio

- Authors

- Name

- Perpetual Alpha

Summary

- This company is a growing leader in the Communications Platform as a Service (CPaaS) industry, offering cloud-based communication services for developers.

- This stock is up nearly 18% and has 18 consecutive top- and bottom-line earnings beats (as of 1/31/24).

- Delivering a record Q3 non-GAAP income from operations and free cash flow, this stock offers strength in communications and fundamentals, as highlighted by SA Quant Ratings.

- Offering the best of both technology and communications, this Internet Services and Infrastructure company led the CPaaS market by revenue in 2021, 2022, and 2023, according to the International Data Corporation ((IDC)).

Business Overview

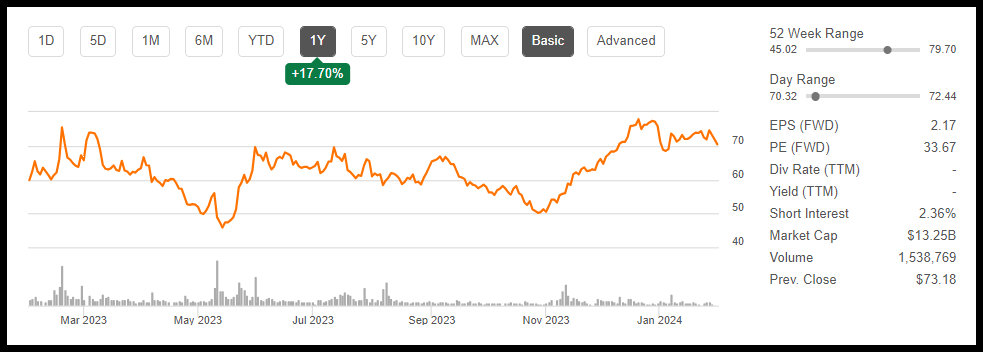

Twilio Inc. (TWLO) is a growing leader in an emerging tech niche known as Communications Platform as a Service ((CPaaS)). TWLO, a cloud-based communications delivery platform, offers internet services and infrastructure for developers to build, scale, and deploy voice, messaging, and real-time interactions for customer-facing applications. Twilio has been trading up nearly 18% in the past year and was recently upgraded by Piper Sandler. Quant-ranked #2 in the Internet Services and Infrastructure industry, shares of the stock surged over 7% following positive guidance in a January 8 announcement by new CEO Khozema Shipchandler. The company plans to cut expenses and help develop a new strategic plan to enhance Twilio’s focus and execution.

“As I step into the CEO role, I am focused on continuing to build on the considerable growth and operating improvements we’ve made across the board, plus taking a fresh look at the areas of the business that are underperforming to realize the full potential of our business.”

Technology (XLK) and Communications (XLC) are the top-performing U.S. sectors year-to-date and last year. The tech melt-up has aided stocks like Twilio, which have experienced price volatility. According to SA Quant Ratings, what’s unique about Twilio is that it captures customers in both tech and communications segments, aiding it as one of the top tech stocks.

Twilio stock is up nearly 18% over the last year

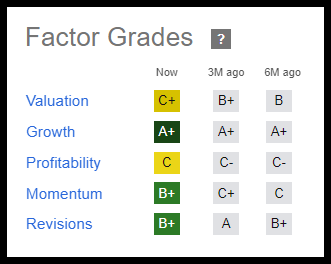

In addition to the company’s versatile platform with unique tools and services, Twilio empowers its developers to design and build communications for greater customer experiences. A snapshot of Twilio’s Quant Ratings and Factor Grades below shows the company trades at a relative discount and offers solid profitability and strong growth, momentum, and earnings estimates from Wall Street analysts.

TWLO stock’s Quant Rating and Factor Grades as of market close on 1/31/24

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. TWLO’s Growth Grade is an A+, complemented by consecutive top- and bottom-line earnings beats since 2018, and a ‘C’ profitability grade, which includes $133.75M in cash and Cash Per Share (TTM) of 3.72 versus the sector’s 1.92, a 94% difference to the sector.

Over the last 90 days, 31 Wall Street analysts have revised their estimates, showcased in Twilio’s B+ EPS Revisions Grade, indicating that the company has a solid long-term outlook, according to Seeking Alpha's Quant rankings.

Our Buy Thesis

Leading the worldwide CPaaS market with over 24% market share, the International Data Corporation (IDC) named Twilio the top-ranked Customer Data Platform (CDP) by revenue in 2021, 2022, and 2023. IDC highlighted Twilio’s 2Q23 revenue growth, which exceeded $913M to grow nearly 16% Y/Y. Focused on a portfolio of application programming interfaces ((APIs)) and “ready-made solutions,” Twilio targets software developers who adopt and build out communication infrastructures. With developers as its primary audience in the rapidly growing CPaaS space, Twilio’s affordable and easy-to-use solutions help expand its reach to customers via its usage model for:

- Messaging: To send and receive SMS and check messages, including WhatsApp.

- Voice: Offers verified voice solutions with interactive recording, transcription, and speech recognition.

- Email: Electronic mail expertise with incredible scale.

- Video: Creation and embedding of video experiences.

Strong product development, acquisitions to add to its portfolio, and cross-selling have aided Twilio’s stellar growth and customer retention, highlighted in the latest earnings beat.

TWLO Stock Growth

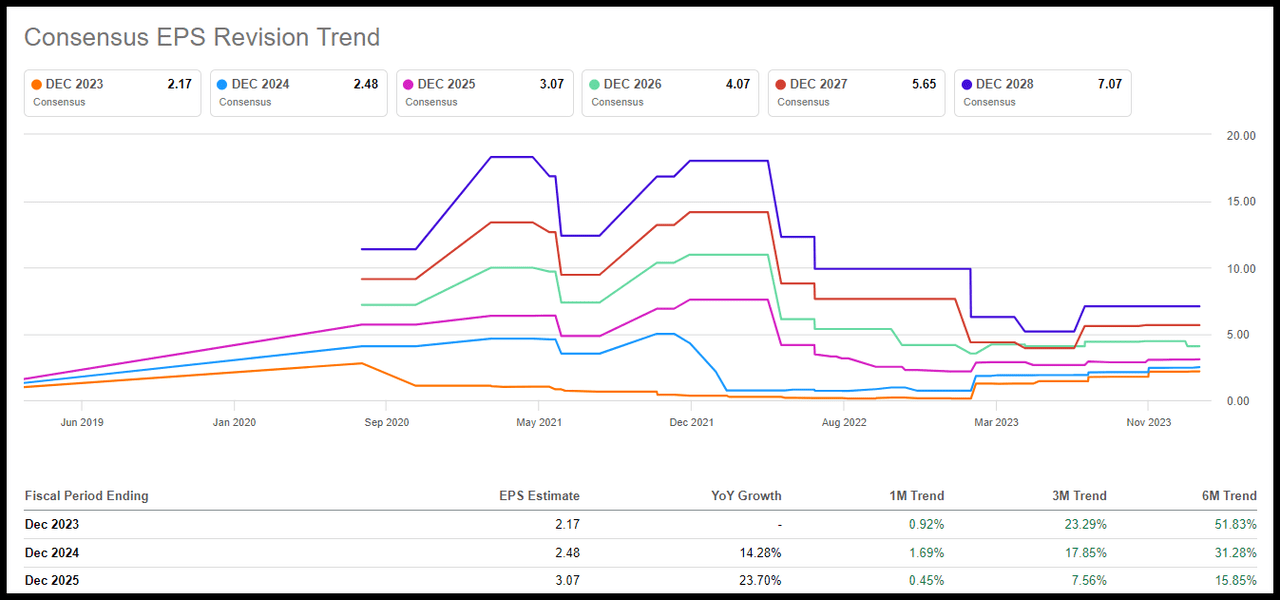

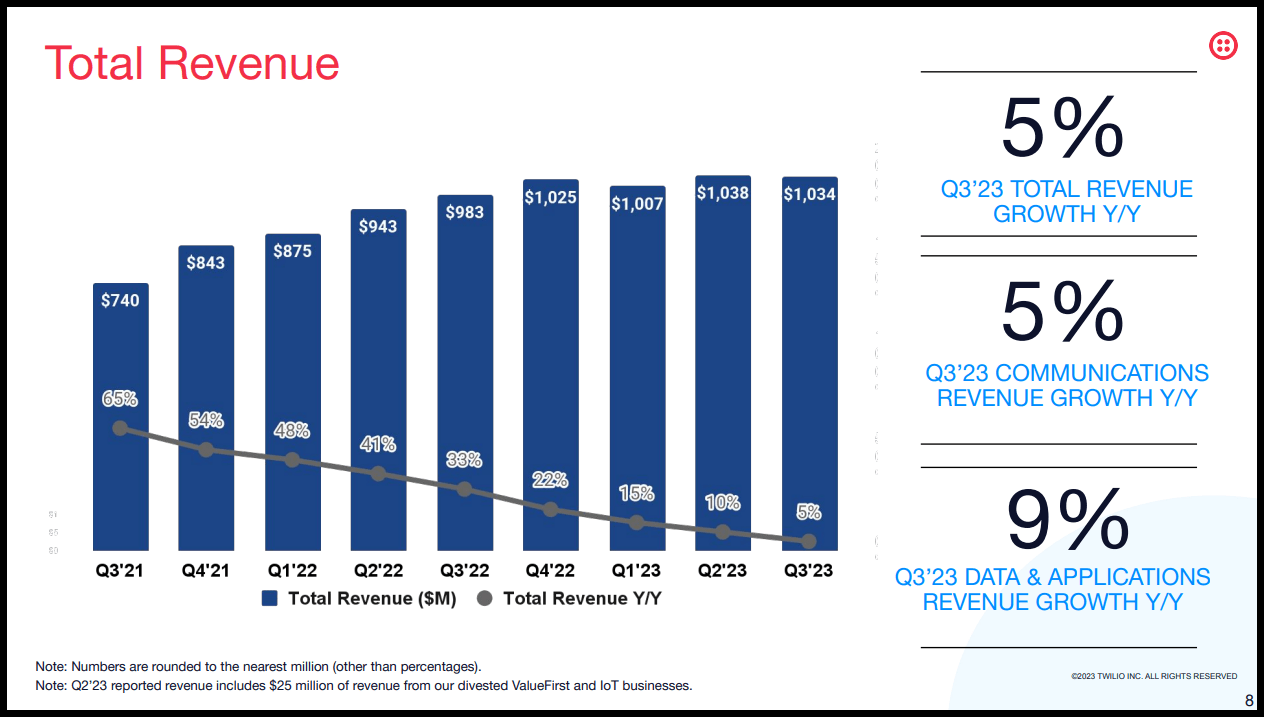

Twilio has beaten top- and bottom-line quarterly earnings 18 consecutive times, with its latest EPS of $0.58, beating by $0.22, and revenue of $1.03B, a 5.15% Y/Y increase, beating by $44.21M.

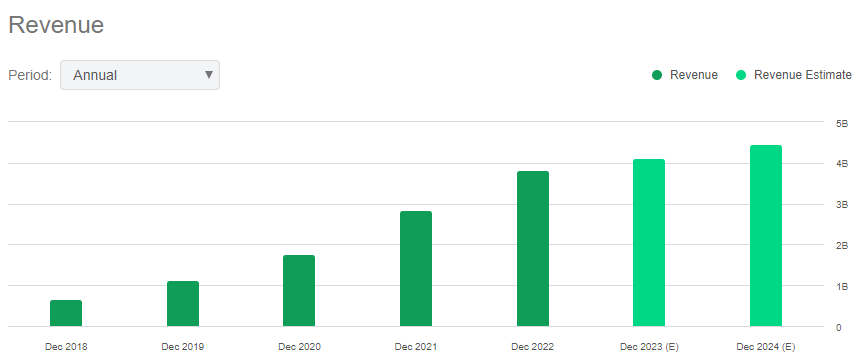

Forward EBITDA growth is more than a 671% difference to the sector, and the company’s full-year non-GAAP income from operations was revised up from $475M to $485M. In addition to forward sales of +16% driving an A+ Growth Factor Grade, Twilio trades at a discount, which I’ll highlight later in the article, and impressive revenue figures showcase Twilio grew revenue 5.8x from $650.07M in 2018 to $3.83B in 2022.

Although Twilio took a nosedive in May 2023 after Q2 guidance fell below analysts' expectations, Wall Street Analysts hold a solid outlook. Consensus estimates have the company reaching $4.12B in 2023 and $4.5B in 2024, and following 9% year-over-year revenue growth in its Data & Applications segment, cross-selling opportunities, and strong guidance through Fiscal Year 2023, let’s dive into Twilio’s valuation.

TWLO Stock Valuation

According to SA Quant Ratings, Twilio trades at a discount. Showcasing a C+ overall valuation grade, the stock’s forward PEG ratio of 1.12x is a 45% difference to the sector. Although the stock is -6% YTD, over the last year, its price-performance is +18% with forward EV/Sales metrics of 2.57x versus the sector’s 2.93x and Price/Book (FWD) nearly a 70% difference.

Highlighted by an A+ Quant Growth Grade, Twilio’s growth outlook is positive. Nearly 90% of its revenue and growth are driven by communications. The company is also focused on its Data & Applications business, and according to management:

“We believe we can continue to grow the top line of our Communications business while controlling costs. With our more streamlined cost structure and continued innovation, we’re proving every day that this business can be a powerful driver of profit and cash flow for Twilio.”

Potential Risks

Twilio is a relatively young company striving for profitability and capitalizing on tech trends that involve voice messaging and video capabilities. Twilio’s emerging niche faces significant competition from larger competitors like Vonage, Bandwidth, and Podium. Factoring in its recent change in executive management, co-founder and CEO Jeff Lawson announced he was stepping down and would be replaced by former Twilio unit President of Communications Khozema Shipchandler. Management changes can pose challenges, but given Shipchandler’s tenure with the company since 2018 and a potential refocus on the brand’s communication business, Twilio may optimize the company in areas where growth and profitability have lagged.

Twilio is also a very acquisitive company. Its focus on small tech deals to drive business can pose financial risks, given the most recent three transactions totaled $6.7B. Additionally, Twilio’s non-scalable network carrier fees are eating into sales, resulting in lower gross margins. And where an uncertain economic outlook and macro headwinds can pose challenges, including cost-cutting measures and growth slowdowns as seen with Twilio’s crypto and social media-related revenue declines, the company continued to beat earnings and raised Q3 2023 guidance amid strong execution and meeting its profitability targets.

Concluding Summary

Twilio is a growing industry-leading platform that prides itself on using “better data and AI” for developers to build, scale, and offer real-time communications tools. Twilio is focused on innovation and a Communications Platform as a Service to capture market share. Twilio boasts an easy-to-deploy cloud-native solution and promoted its Communications executive as new CEO, expecting to bring greater focus to its communications business for a positive growth outlook. Seeking Alpha’s Factor Grades and Quant Ratings can help you make tactical investment decisions when picking stocks without changing your overall risk level. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.