- Published on

[PPC] Who Wants The Meat?

- Authors

- Name

- Perpetual Alpha

Summary

- This stock is a top Quant-ranked consumer packaged foods and meats company, with roughly 17% of the US poultry market share.

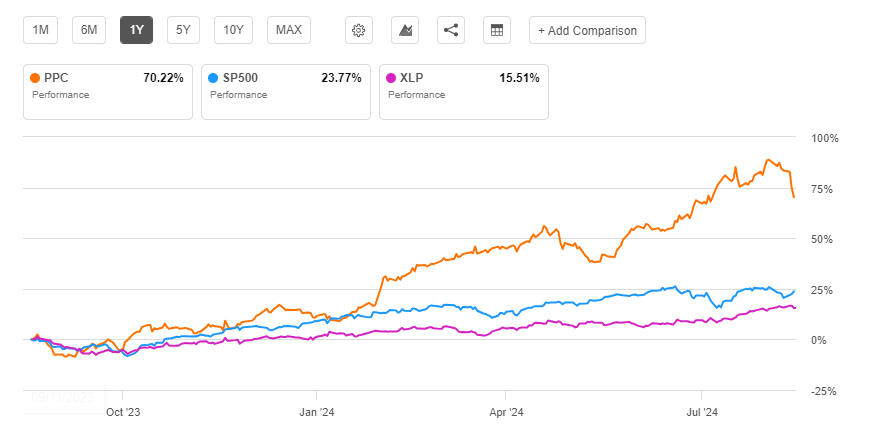

- The company rallied 66% over the last year, reflecting a strategic portfolio to capture market upside while minimizing downside risks.

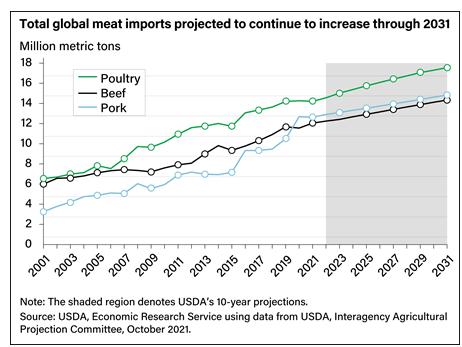

- The company is well-positioned to deepen its market position, as global consumer demand for poultry is slated to increase in the coming decade.

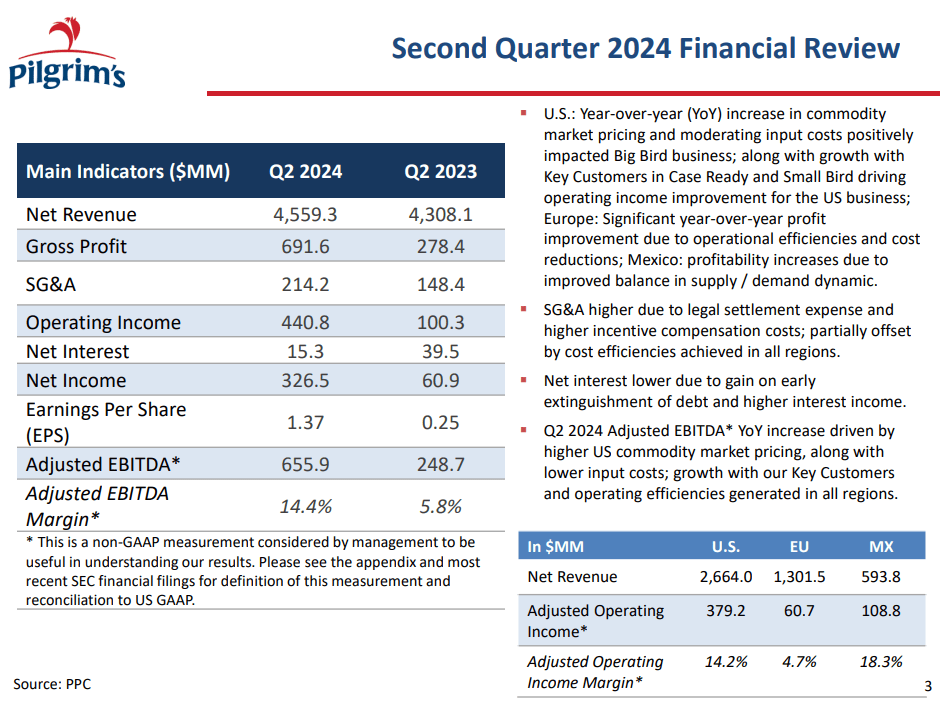

- Robust growth across international and domestic markets, coupled with higher demand for value-added products, helped this company achieve a 164% increase in adjusted EBITDA year-over-year.

- Long-term upside looks strong, with earnings projected to grow by a CAGR of over 42% in the next 3-5 years while still offering significant value with a forward P/E of 10x and a forward PEG of 0.22.

Business Overview

Meat packaging and food company Pilgrim's Pride Corporation (PPC) markets and distributes fresh and frozen chicken, pork, and other meat products internationally. PPC is among the top poultry producers in the US, with 1 in every 6 chickens originating from Pilgrim’s. Key brands include: Just Bare, Gold’n Plump, and Pierce Chicken. These brands produce a wide range of products beyond just fresh and frozen chickens to value-added items like prepared meals and chicken nuggets.

PPC is the #1 among Quant-rated Packaged Foods and Meats stocks and has performed exceptionally well in the last year, up more than 66%, despite the impact of inflation on the broader CPG sector. Reflected in its second-quarter earnings transcript:

“Our Q2 results reflect the structure of our portfolio and our strategy to capture market upsides while minimizing downside risks. To that end, we continually invested in our business throughout cycles and market volatility, further strengthening our competitive advantage and creating opportunities to drive profitable growth as market conditions change,” said Fabio Sandri, Pilgrim’s President & CEO.

PPC was highlighted among our top consumer staples stocks for a potential recession, and in the time since has delivered a 34% return.

Pilgrim's Pride Corporation (PPC) vs. Consumer Staples Select Sector SPDR® Fund ETF (XLP) vs. S&P 500 (SP500) 1-year Trading Chart

With excellent overall Factor Grades, this stock has experienced significant growth, with more room to run, and maintained exceptional value despite its massive gains in 2024.

Our Buy Thesis

PPC saw net revenues increase 5.8% year-over-year, benefitting from a trend for increased demand for chicken products, due in part to its price advantage over beef, as cash-strapped customers choose lower-cost proteins in the inflationary environment. The industry is projected to continue on its solid growth trajectory over the next decade, becoming the top meat import globally.

PPC has a diversified product portfolio and the popularity of its branded and value-added offerings has underpinned its strong financial performance in Q2. Looking ahead, management is focused on strategic acquisitions to enhance its already impressive market position while emphasizing cost control and risk management.

“In the past we mentioned that we'll look for opportunities for acquisitions in three major building blocks. One is on the chicken track where we can operate better than the other markets and create value. The second one is to differentiate our portfolio in branded, Prepared Food offerings. We look to grow that business. We're growing organically, and as we mentioned, the Just Bare brands and the Pilgrim Brands are growing ahead of the market. But we're always looking for opportunities either in the U.S. or abroad to increase the portfolio of Prepared Food branded business. And we're also looking for different geographies in the chicken categories. So those three main themes, let's say, continue to be our focus for our acquisition targets.” said Fabio Sandri, President and CEO of Pilgrim’s Pride Corporation.

PPC had strong performance in Q2, beating EPS estimates by $0.37, despite slightly underperforming revenue expectations. Other major highlights from Q2 that attest to the strength of Pilgrim's business and investment fundamentals include:

Growth in the Mexican market helped generate $115.1M in adjusted EBITDA, which is a 71.3% increase year-over-year.

PPC reduced gross leverage by $164 million by repurchasing its own debt, demonstrating prudent financial management.

Full-year CapEx guidance was raised to $525-575M, reiterating management’s confidence in growth opportunities.

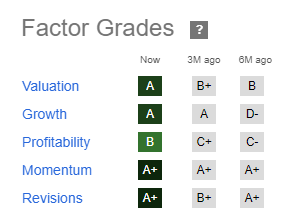

PPC Factor Grades, which rate investment characteristics on a sector-relative basis, indicate that the stock has excellent upside potential compared to its Consumer Staples sector peers.

CLS Stock Factor Grades

PPC is currently sporting ‘A’ range grades for all factors, with the exception of profitability, which is still comfortably above sector averages with an overall ‘B’ grade.

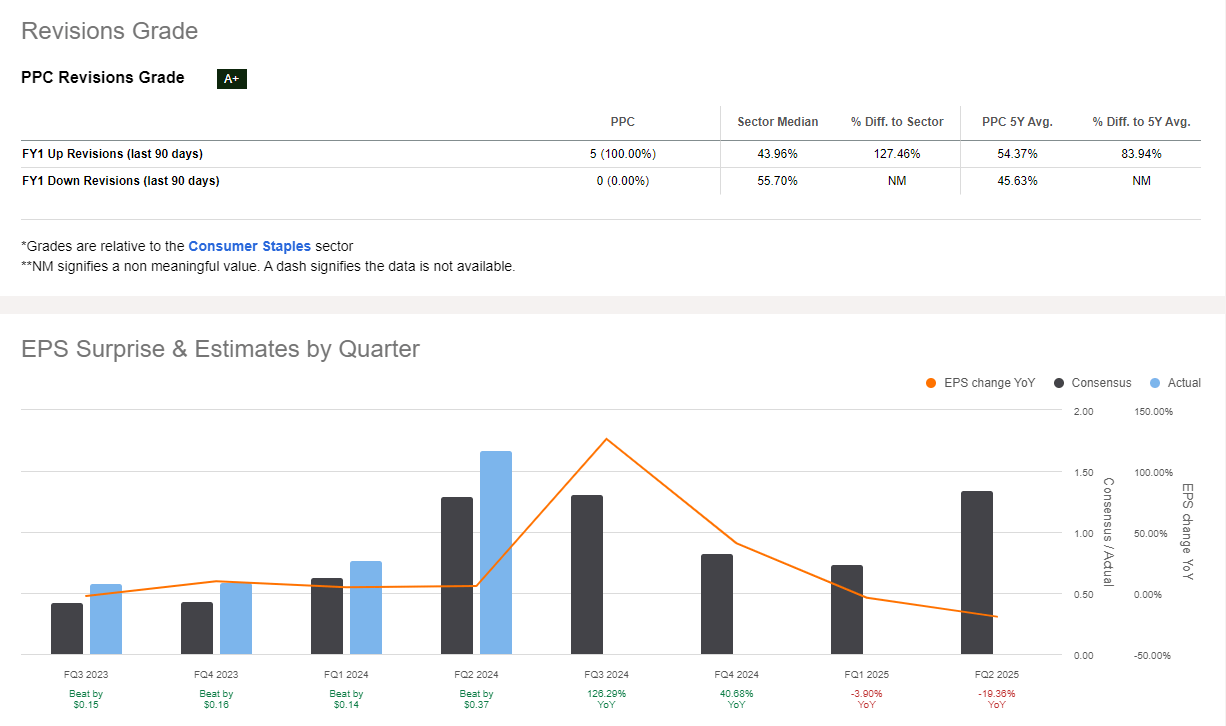

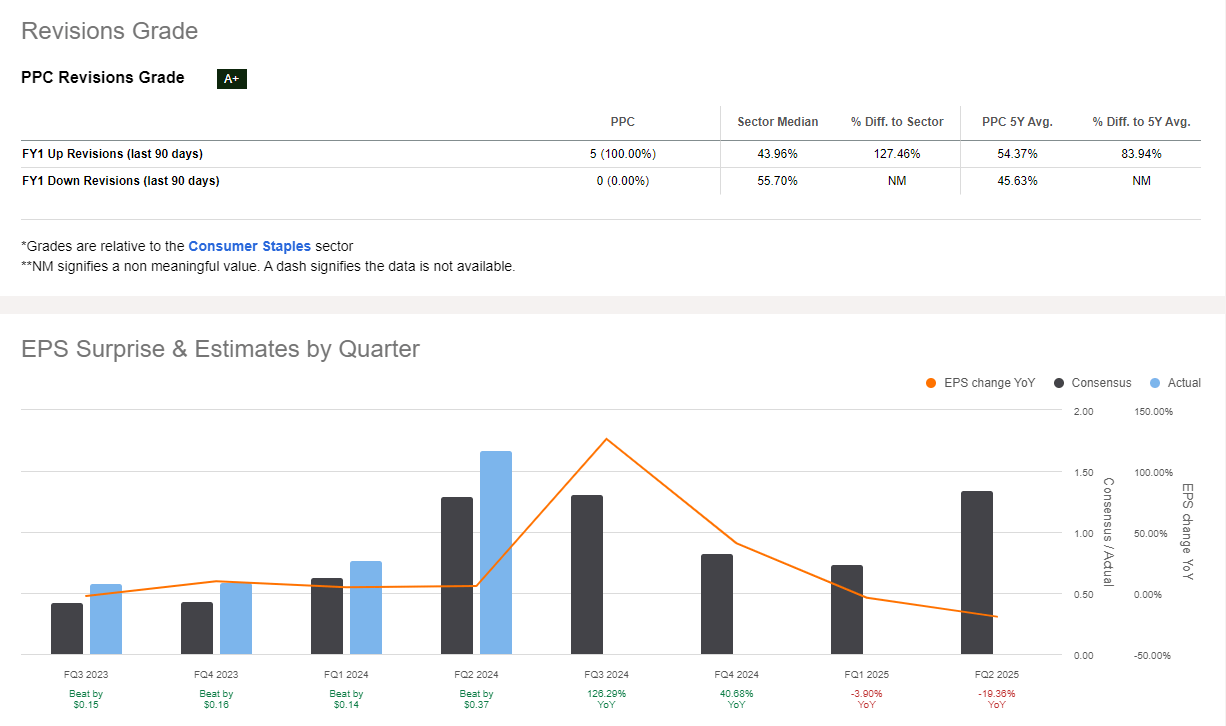

PPC Stock Revisions & EPS Surprises

In addition to strong momentum, growth, valuation, and profitability grades, Wall Street analysts are optimistic about Pilgrim's earnings upside potential, as evidenced by five upward revisions in the last 90 days. According to consensus estimates, Pilgrim's EPS is projected to climb to $4.51 by year-end, which would represent a 166% increase compared with the previous year.

PPC Stock Growth & Profitability

PPC grew its adjusted EBITDA a massive 164%, from $248.7M to $655.9M year over year, and delivered 22.38% in return on common equity, showcasing its ability to convert its growth to value for shareholders. The company was able to generate $1.58B in cash from operations over the last year, which represents a 106% increase relative to the Consumer Staples’ sector median.

PPC has done an exceptional job of rapidly developing products that meet consumer preference for convenience and gained industry recognition in the process:

“Our business has also developed a robust innovation pipeline to further drive profitable growth and diversify our portfolio. To date, the team has launched over 85 new products in retail. Our Waitrose Popcorn Chicken with Hickory BBQ Sauce was awarded as the best ready-to-eat product by Food Management Today.” said Fabio Sandri, President and CEO of Pilgrim’s Pride Corporation.

Additionally, the company has successfully expanded into international markets, where demand for branded products has led to double-digit growth in net sales, contributing to the company’s impressive bottom-line figures.

“Turning to Mexico, profitability improved significantly through balanced supply and demand fundamentals in the commodity market, favorable input costs, and continued execution of our strategies. In Fresh, our key customer partnerships continue to strengthen as net sales are up double digits compared to prior years. Our branded offerings continue to gain significantly market-based traction as pilgrims and unique tastes have grown well ahead of the market. Similarly, the Favoritos and Just Bare brands have grown more than 20% since the beginning of the year.” Sandri also said.

PPC earnings outlook is strong, evidenced by an EPS long-term forward growth rate (3-5Y CAGR) of 42% vs. 8% for the sector, driving an ‘A’ Growth Grade.

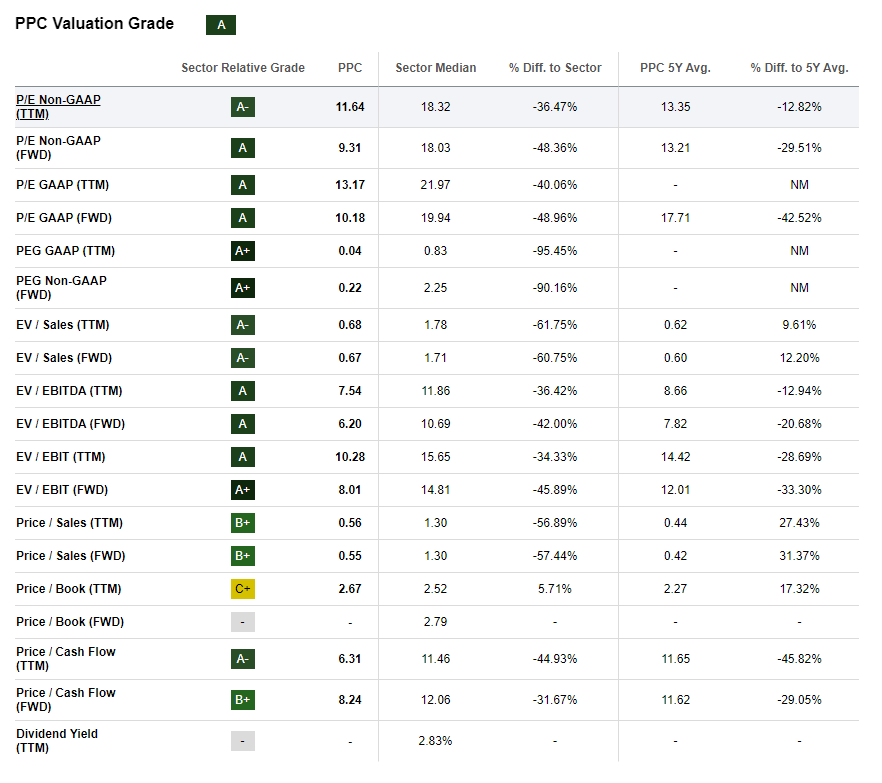

PPC Stock Valuation

Despite being rated as a Quant “Strong Buy” recommendation since this past April, PPC has managed to retain an overall A valuation grade. Pilgrim's scores exceptionally across nearly all of its underlying metrics. It has a forward P/E ratio of 10.18x, nearly 49% below its sector median. In addition, its forward PEG of 0.22x is a -90% difference to the sector, and its strong forward EV/Sales of 0.68x indicate this stock is a bargain for investors, particularly as it continues its bullish trend, +46% YTD in share price.

Potential Risks

PPC’s main risks include livestock diseases. The 2024 Avian Bird Flu outbreak was chief among the disease concerns, although the company is taking increased biosecurity measures at facilities in vulnerable regions.

Reporting on outbreaks could shift the regulatory environment, with the potential for trade restrictions. PPC is also vulnerable to fluctuating input commodity prices, which in turn are exposed to exogenous shocks like extreme weather events or poor crop cycles. The meat industry remains competitive, and demand projections have the potential to invite new entrants into the market, which could lead to oversupply or undercut pricing, bringing down profits.

Concluding Summary

Pilgrim's is a top Quant-ranked consumer packaged foods and meats company poised to continue capitalizing on higher consumer demand for poultry and value-added poultry products. Pilgrim's market position, expansive product portfolio, and international presence provide a diversified revenue stream and a margin of safety that can help insulate the company’s profitability from challenging periods.

PPC has returned significant value to shareholders, while long-term earnings are projected to rise substantially as the stock trades at a considerable discount to the sector despite its momentum. We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you all the best in your investment journey. Happy investing.

Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.