- Published on

[SYF] Top Consumer Finance Pick

- Authors

- Name

- Perpetual Alpha

Summary

- Soaring +50% in the last year on disciplined underwriting and management and strong products and sales, the company returned $400M to shareholders in Q2 2024.

- A top Quant-ranked consumer financial with 71M accounts and $102.3B in loans receivables, this company is delivering solid growth despite headwinds.

- With a differentiated business model spanning home, auto, and digital industries, this company has deep and expanding partnerships with titans like Walgreens, Amazon, Lowe's, and Kawasaki.

- Responding to the company's strong offerings, consumer deposits increased by 10% to $7.3B YoY in Q2, and net interest income rose 7% to $4.4B.

- Long-term upside looks strong, with earnings projected to boom by a CAGR of over 38% in the next 3-5 years, and the stock trades at a significant discount to the sector with P/E at a mere 8.5x and PEG forward of 0.23.

Business Overview

Synchrony Financial (SYF) is a consumer financial services company specializing in programs for retailers and healthcare providers, including store and co-branded credit cards and savings products that help fund its lending operations. A spin-off from General Electric (GE) in 2014, where it was previously known as GE Capital Retail Finance, Synchrony offers a differentiated range of credit products and solutions under the CareCredit and Walgreens brands. Synchrony also offers finance solutions in the outdoor, music, and luxury industries, including companies like American Eagle, Dick's Sporting Goods, Guitar Center, Kawasaki, Pandora, Polaris, Suzuki, and Sweetwater.

Synchrony has a balanced portfolio across business segments. Its Digital segment accounts for 30% of purchases, followed by home & auto (26%), diversified & value (33%), and health & wellness (8%). Loan receivables are spread across Super-Prime (40%), Prime (33%), and Non-Prime (27%).

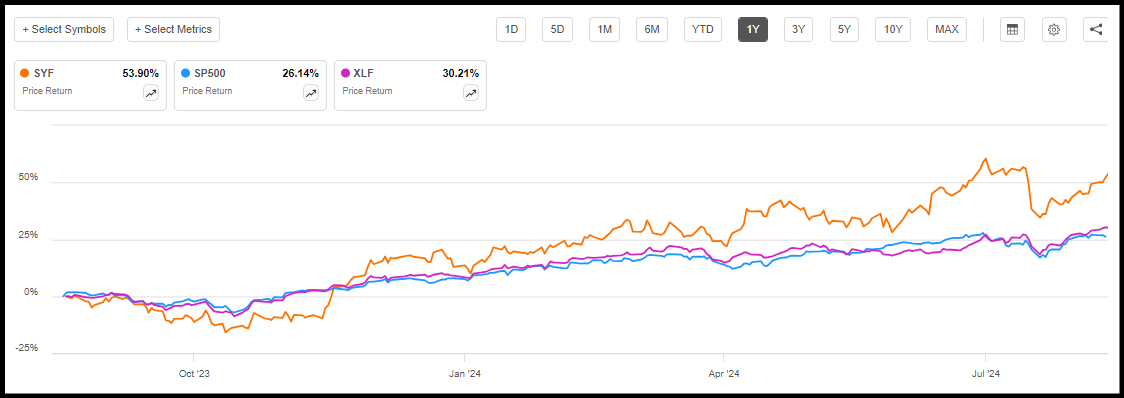

Synchrony is #4 among Quant-rated Consumer Finance stocks and has performed well in the last year, up more than 50%, despite the inflationary pressures that might have otherwise put a damper on consumer spending.

Synchrony (SYF) vs. Financial Select Sector SPDR® Fund ETF (XLF) vs. S&P 500 1-year Trading Chart

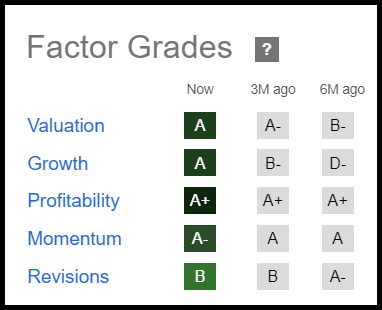

SYF showcases high earnings power along with strong growth and profitability. Although SYF has crushed the market and financial peers in momentum, the stock still trades at an attractive valuation for the sector.

Our Buy Thesis

Synchrony has a solid track record of profitable growth and high return on equity, consistently delivering value to investors while trading at an attractive valuation. SYF offers a diversified portfolio of products that continue to resonate with customers. As SYF innovates and looks to expand categories, its performance has been strong in critical financial, operational, and capital metrics across all platforms.

“Whether it's through the continued expansion of our distribution networks, the addition and renewal of programs that span most consumer spend categories, or the enhanced functionality at point of sale, Synchrony is leveraging our proprietary data and analytics, our diverse product suite, and our innovative technology to drive greater access, flexibility and utility for both our customers and partners,” said Brian Doubles, Synchrony Financial President & CEO.

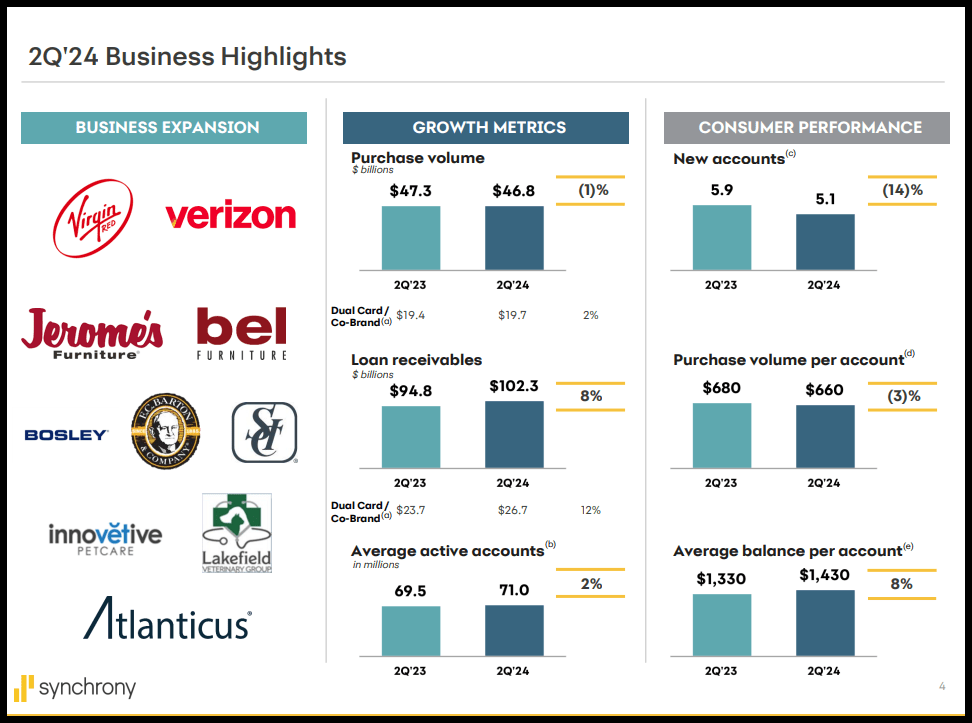

Synchrony earnings growth was driven by core business drivers in Q2, with net interest income up 7% year-over-year to $4.4B. Higher interest and loan fees drove Q2 growth, partially offset by interest expense from higher benchmark rates, interest-bearing liabilities, and slightly lower purchase volume. As consumers responded to Synchrony’s robust offerings, deposits increased $7.3B, or 10%, to $83.1B and comprised 84% of funding. SYF added or renewed more than 15 partners, including a program expansion and extension with Verizon, and the addition of Virgin Red.

Other major highlights from Q2, attesting to the strength of Synchrony’s business, solid track record, and investment fundamentals, include:

Loan receivables increased 8% year-over-year to $102.3B

Average active accounts increased by 2% to 71M

Interest and fees on loans increased by 10% to $489M

Total liquid assets and undrawn credit facilities grew $3.6B to $23B

Common Equity Tier 1 (CET1) ratio of 12.6%

SYF Factor Grades, which rate investment characteristics on a sector-relative basis, indicate that the stock has excellent upside potential compared to its financial sector peers. Synchrony showcases strong cash from operations, high long-term earnings growth targets, and solid dividends, and is trading at a deep discount relative to sector medians.

SYF Factor Grades

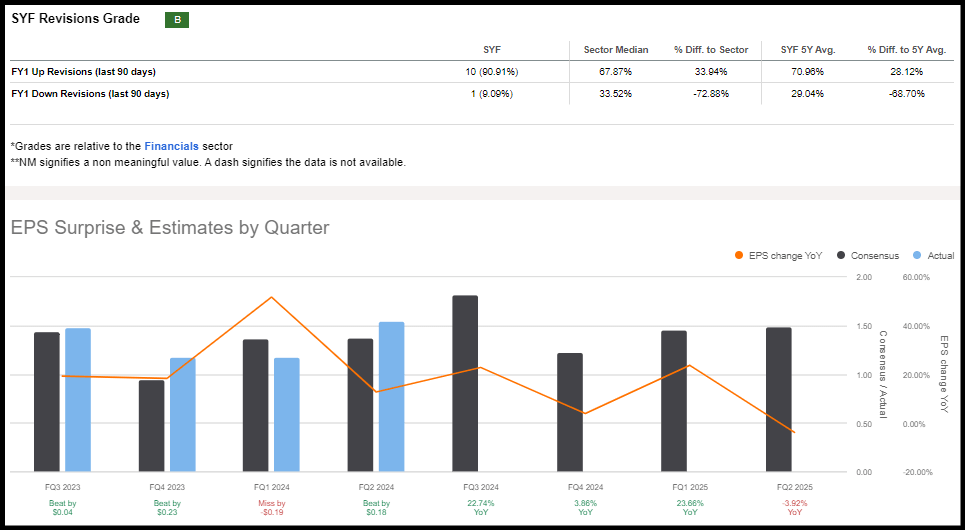

In addition to strong momentum, growth, valuation, and profitability grades, Wall Street analysts are optimistic about Synchrony’s earnings upside potential, as evidenced by ten upward revisions in the last 90 days. According to consensus estimates, Synchrony EPS is projected to grow by 22% in the third quarter and revenue +7% to $3.74B. FY24 annual earnings are forecast to reach $5.83 (+9%) and revenue $15.36B (+12% YoY).

SYF Stock Revisions & EPS Surprises

Bank of America Securities upgraded the stock to a Buy, citing improved credit performance and fewer late fee headwinds as investors gain confidence in credit and earnings trends.

SYF Stock Growth & Profitability

SYF has a solid track record of top- and bottom-line growth, with revenue for the trailing twelve months up 14% year-over-year and Return on Equity (ROE) +13%. Synchrony delivered solid financial results in Q224, beating top- and bottom-line earnings expectations, a consecutive positive EPS surprise; Q2 GAAP EPS of $1.55 beat by $0.18, and revenue of $3.71B (+12.8% YoY) beat by $36.27M.

Synchrony continues to grow and execute at a high level in an evolving environment as it deepens its market position, expands its customer base, and delivers improved solutions for customers. During the Q2 earnings call, Brian Doubles stated:

“We are leveraging our scale, our data analytics and credit management tools, our advanced digital capabilities, and our deep lending expertise to remain nimble and responsive while powering still better experiences and greater value to the customers, partners, providers and small businesses we serve… We are consistently driving compelling results for our many stakeholders and that momentum is increasingly attracting new and deepening existing opportunities for continued risk-adjusted growth, further embedding Synchrony at the heart of American commerce.”

SYF earnings outlook is strong, evidenced by an EPS long-term forward growth rate (3-5Y CAGR) of 38% vs. 9% for the sector, driving an ‘A-’ Growth Grade. SYF also possesses a 1Y dividend growth rate of 8% vs. a sector median of 5% and is crushing the sector in key profitability metrics, highlighted by a net income margin of 34% and an astounding cash per share of $47.16.

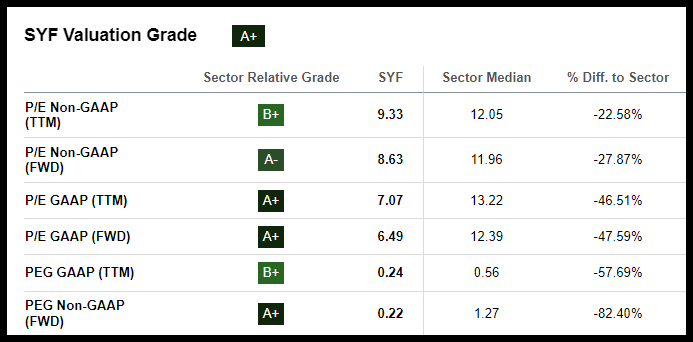

SYF Stock Valuation

Despite massive momentum, SYF trades at a deep discount to the financials sector, with a price/earnings ratio of 9x and price/cash flow of 2.08x. Forward and trailing PEG ratios represent an 82% and 57% discount to the sector, respectively.

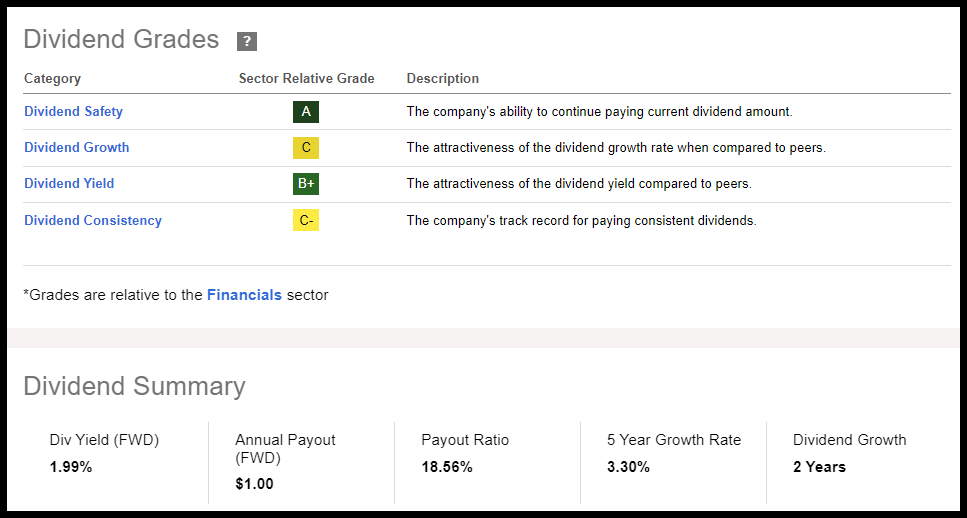

SYF was highlighted among our top dividend stocks, primed for a Fed rate cut. Despite a modest 2% forward dividend yield, SYF possesses an ‘A’ Dividend Safety Grade and has demonstrated its commitment to delivering shareholder value.

SYF Stock Dividend Scorecard

In Q2 2024, Synchrony returned $400M to shareholders, consisting of $300M in share repurchases and $100M of common stock. Synchrony showcases high growth potential, a strong balance sheet, and investment traits associated with strong future returns, although investors should also consider potential risks.

Potential Risks

Financials are considered cyclical industries linked to economic growth, and in a reduced-rate environment, Synchrony could face headwinds from compressed net interest margins. Synchrony’s financials could be negatively impacted if government regulations lead to a cut in credit card late fees, and credit card delinquencies continue to increase. However, Synchrony has been explicit about its strategy to get ahead of the rising trend of delinquencies by focusing on disciplined credit underwriting, and management is focusing on leveraging company strengths for continued growth.

Concluding Summary

Synchrony is a top Quant-ranked consumer finance stock with explosive momentum, strong earnings growth potential, dividend safety, and a disciplined financial approach, making it a great addition to the AP portfolio. Synchrony has a strong business model, offering differentiated products and services across several industries and customer profiles. With 71M accounts and $102.3B in loans receivable, Synchrony continues to deliver financial results beyond Wall Street’s expectations. The company’s offerings drive consumer deposits and net interest income to higher levels, soaring over 50% in the last year.

SYF has returned significant value to shareholders, while long-term earnings are projected to rise substantially as the stock trades at a substantial discount to the sector. We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like. The Alpha Picks Team wishes you all the best in your investment journey. Happy investing. Written by Steven Cress

VP of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.