- Published on

[SFM] Bag This Consumer Staple Ready For Growth

- Authors

- Name

- Perpetual Alpha

Summary

- Reflecting strong growth and solid profitability on rising consumer demand for organic foods, this top-ranked food retailer has rallied +115% over the last year vs. Consumer Staples +4.66%.

- With over 19,000 natural and organic products in more than 400 locations, this stock’s demand for food and beverage essentials offers defensive and inflation-resilient qualities.

- Sticky inflation and market volatility limit where investors want to invest to avoid losing money.

- This stock possesses a strong balance sheet, has consecutively beaten top and bottom lines, offers an attractive growth outlook, and recently authorized a new $600M share repurchase program.

Business Overview

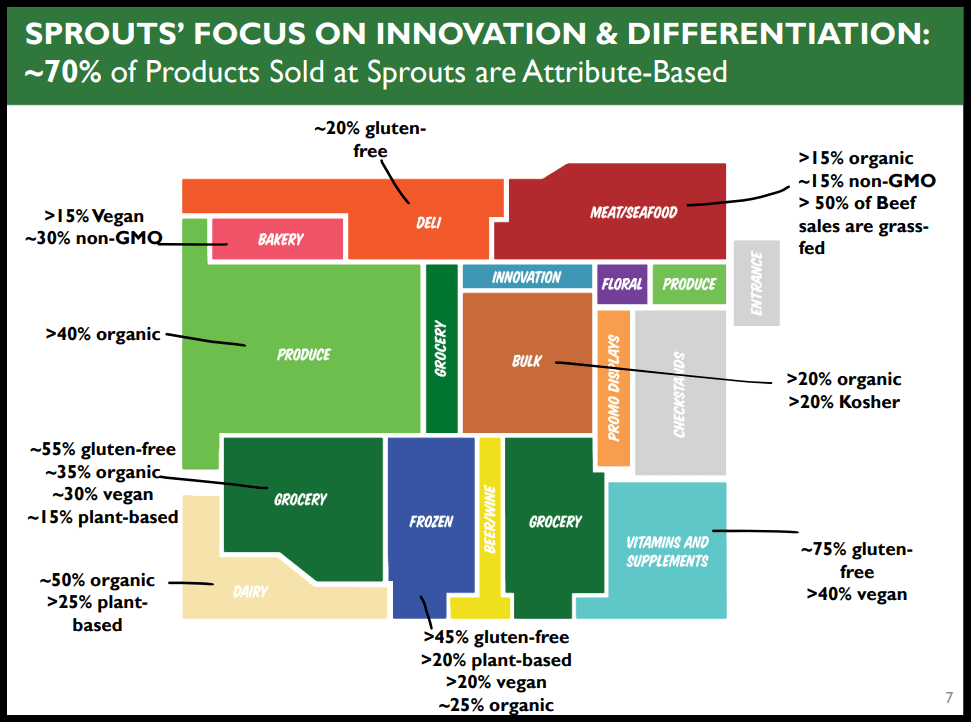

Sprouts Farmers Market (SFM) is one of the largest specialty and natural and organic food retailers in the United States, behind Whole Foods, which is owned by Amazon (AMZN). Offering more than 19,000 natural and organic products in over 400 stores across 23 states, Sprouts is focused on innovation and differentiation.

SFM’s diversified product portfolio includes more than 70% attribute-driven (organic, paleo, keto, plant-based, non-GMO, gluten-free, vegan, dairy-free, grass-fed, and raw) items, which aided its Q1 2024 net income of $114M, a 14% increase from Q1 2023.

Organic Farm Acreage is Growing

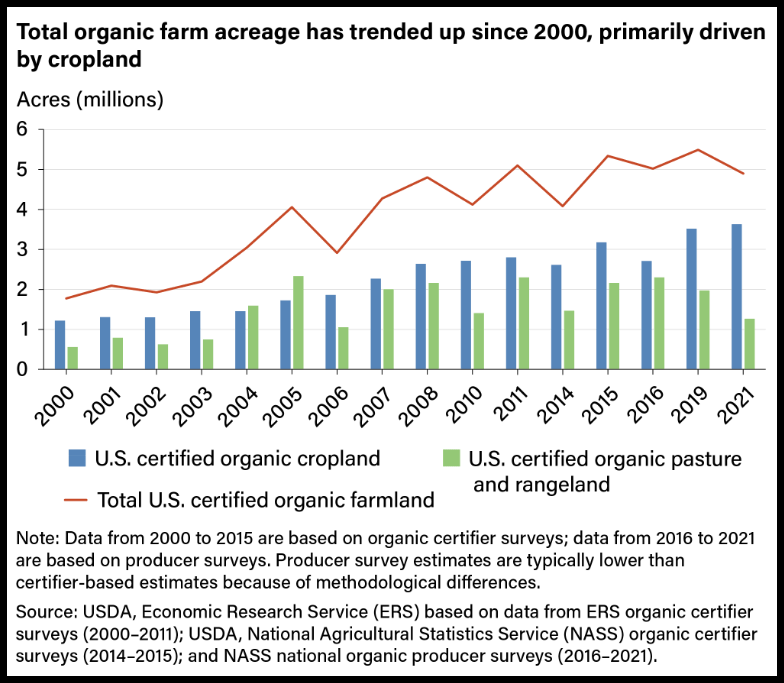

Sprouts is capitalizing on the demand for healthier, natural food options. Over the last twenty years, the desire for certified organic cropland increased from 1.8M in 2000 to 4.9M as of 2021. Rising consumer demand for organic foods has helped support the research and development through USDA projects, with mandatory spending authorization for the Organic Agriculture Research and Extension Initiative growing from $3M in 2002 to $50M in 2023. Specialized retailers like Sprouts with a deep commitment to sustainability have benefitted from the powerful growth within the food retail industry, aiding its better top- and bottom-line growth compared to the Consumer Staples sector.

Organic produce leads the organic retail sales food category with $22B in sales in 2022, accounting for 15% of all fruit and vegetables in the U.S., according to the Organic Trade Association.

“Organic’s fundamental values remain strong, and consumers have demonstrated they will come back time and again because the organic system is verified, and better for people, the planet, and the economy…Organic has proven it can withstand short-term economic storms. Despite the fluctuation of any given moment, Americans are still investing in their personal health, and, with increasing interest, in the environment; organic is the answer,” said Tom Chapman, Organic Trade Association CEO.

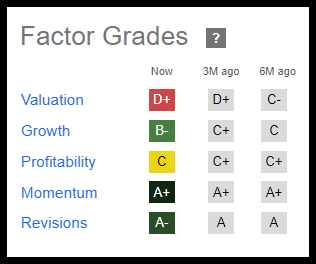

Although Sprouts trades at a relative premium valuation according to the Quant Ratings and Factor Grades below, the stock offers incredible momentum, increased confidence in earnings estimates from Wall Street analysts, strong growth, and solid profitability.

SFM Stock’s Quant Rating and Factor Grades (as of 6/14/24)

Seeking Alpha Factor Grades rate investment characteristics on a sector-relative basis. As of June 14, 2024, Sprouts Farmers Market is the #1 Quant-ranked stock in its sector and industry. SFM’s profitability grade is solid and includes more than $500M in cash and EPS revision grades that indicate the company has a solid long-term outlook, and complement SFM’s attractive growth metrics.

Our Buy Thesis

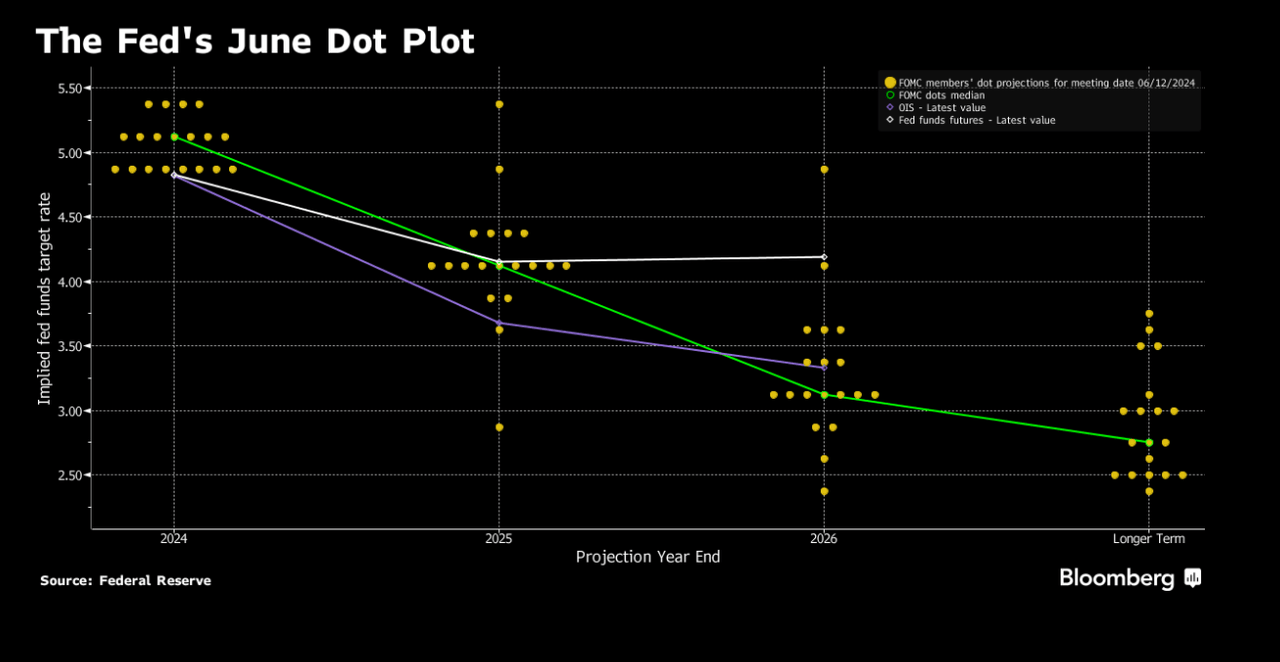

Higher food prices have benefited many companies able to take advantage of pricing power. May CPI was cooler than expected, with headline flat and core easing, with a rise of 0.2% versus the expected +0.3%

For a seventh consecutive meeting, the FOMC held its benchmark rate between 5.25% and 5.5%. The strong labor market coupled with softer inflation data prompted the Fed to update projections to include one rate cut before year-end versus three. The markets reacted with optimism, as the S&P 500 and Nasdaq posted record highs on June 12th, up 0.9% and 1.5%, respectively.

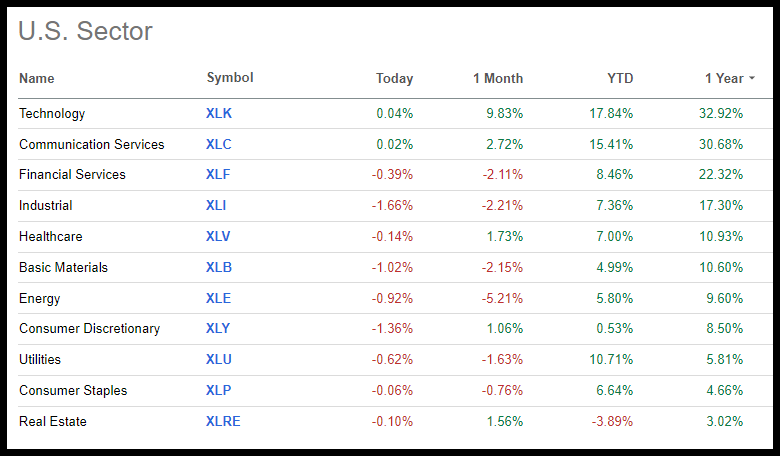

U.S. Sector Performance

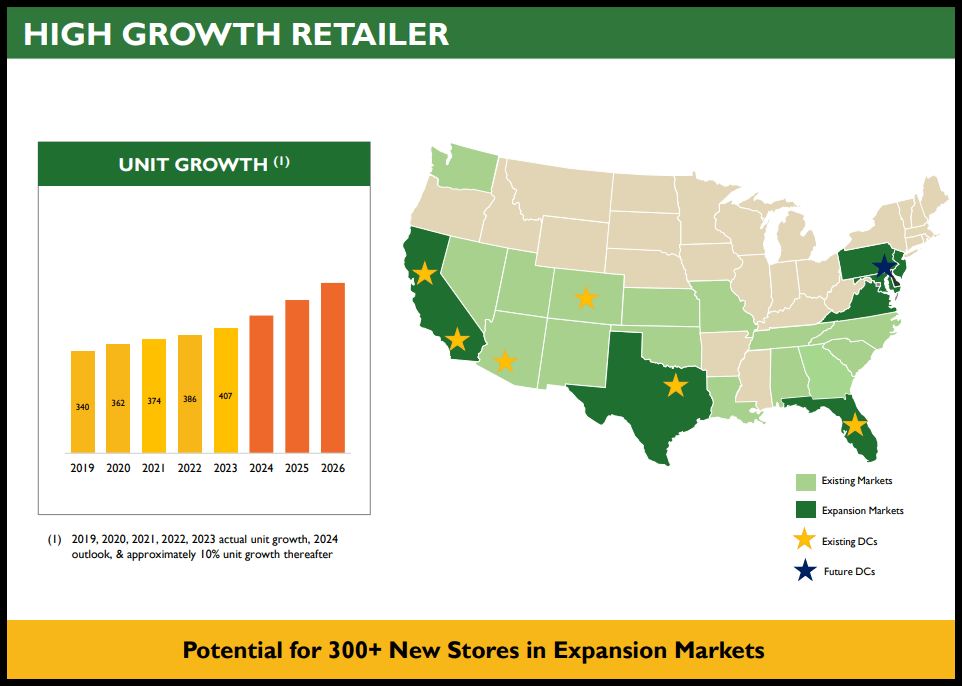

Although Consumer Staples (XLP) was the second-worst performing sector in the final quarter of 2023, rising +5% versus the S&P 500, which was up nearly 11% for the same period, this poses a potential opportunity for investors looking to benefit from the sector’s uptrend in 2024. Given its defensive attributes coupled with SFM’s growth, outlook, and ability to rally in a high inflationary environment, Sprouts offers consecutive top- and bottom-line beats and has plans to open 35 stores in 2024, a 10% annual unit growth rate.

SFM Stock Growth

Strong earnings and analyst upgrades have aided Sprouts’ performance, which is +56% YTD and +115% over the last year. Customer engagement strategies and 25% e-commerce sales growth have aided the high-growth retailer, which plans to open a potential +300 new stores in varying markets by optimizing its supply chain and access to closer distribution centers.

Despite economic uncertainty, Sprouts’ impactful products are essentials like food and beverage and healthcare — must-haves in good and bad times. Despite increasing costs, SFM’s health and wellness segment in Q1 capitalized on its pricing power and demand. Showcasing consecutive top- and bottom-line beats, SFM reported Q1 2024 EPS of $1.12 and revenue of $1.88B (+8.68% Y/Y).

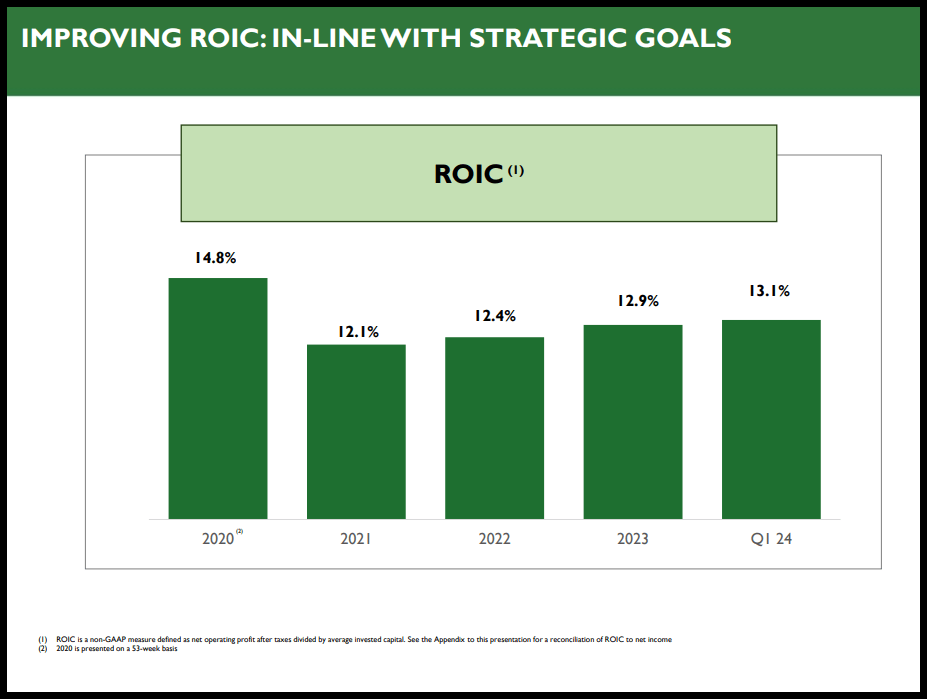

Sprouts is in strong financial health, highlighted by low double-digit earnings growth, solid margins, Return on Common Equity (TTM) of 26% versus the sector median of 11%, and expansion of ROIC.

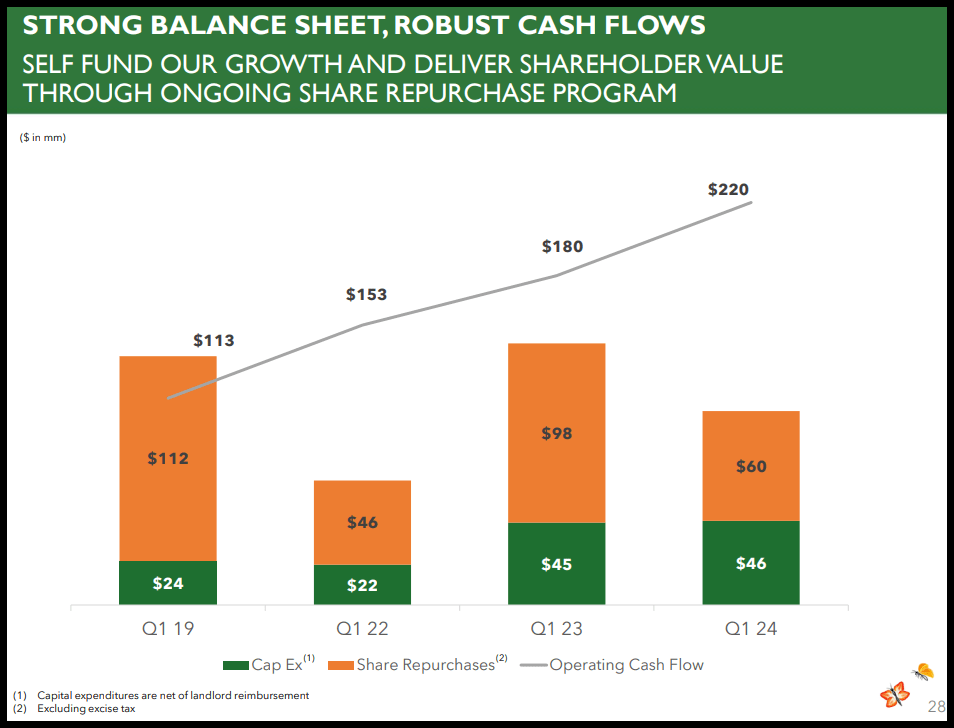

Sprouts’ strong balance sheet and robust cash flow enable it to deliver shareholder value while also self-financing its growth. In addition to opening seven new stores in Q1 2024, Sprouts returned $60M to its shareholders by repurchasing nearly 1M shares, following sales growth and consistent volumes supported by strategic initiatives.

SFM’s Q1 2024 gross margin of 38.3% increased 80 basis points from Q1 2023, and the company continues to experience year-over-year margin improvement amid promotional optimization. Turning to its full-year outlook, Sprouts expects total sales growth between 7% and 8% and comp sales between 2.5% and 3.5%. With grocery stores outperforming amid food and price inflation, Sprouts has rallied double digits as “consumers remain willing to spend, keeping the economy afloat despite fatigue from stubbornly high inflation for services and high interest rates,” said Jack Kleinhenz, National Retail Federation Chief Economist.

SFM Stock Valuation

Sprouts D+ Valuation Grade indicates the stock trades at a relative premium. Sprouts’ forward P/E GAAP ratio is 24.43x versus the sector median of 18.35x. The stock’s 2.38x forward PEG aligns with the sector’s 2.25x, 5% higher than its peers. Although some prudence is needed when considering entering at the current price point, the stock’s EV/Sales are more than a 22% difference to the sector, and Sprouts has incredible momentum.

Potential Risks

Sprouts is one of the largest U.S. natural and organic food retailers behind Amazon-owned Whole Foods, so competition is a factor. As Sprouts looks to expand its locations, wage pressures, higher technology and e-commerce fees, especially in building its new loyalty program, can eat into operating margins. Unlike traditional grocers like Kroger and Albertsons, SFM offers more fresh produce where prices can be increasingly volatile, and competition from big-box retailers like Walmart and Costco may also disrupt price structures and create supply chain constraints, especially amid food recalls. However, SFM maintains solid free cash flow and a healthy balance sheet.

Concluding Summary

Consumer staples offer investors defensive and more stable investments amid economic uncertainty. Consumer staples also help hedge against inflation and reduce the impact of market swings. Sprouts has over 400 stores, with plans to open many more. Its strong history of revenue growth includes a 7.94% forward revenue growth compared to the sector median’s 3.56%; EPS forward long-term growth (3-5Y CAGR) of 10.27%; and a current 9.11% return on total capital and return on equity of 26.24% versus the sector’s average 6.8% and 11.10%, respectively, demonstrating a lower risk and lower cost of capital sector. As highlighted by Caffital Research, “A higher ROIC could also allow for more aggressive unit openings as cash flows are able to finance more openings” and position SFM for more aggressive growth.

In addition to passing price increases onto consumers, as inflation continues to cool, staples remain in-demand items, helping to serve as a defense during periods of uncertainty. Sprouts possesses solid fundamentals and a positive growth outlook, with improving margins. We have many stocks with strong buy recommendations, and you can filter them using stock screens to suit your specific investment objectives. Considerusing Seeking Alpha's 'Ratings Screener' tool to help find stocks that achieve diversification into desired sectors you like.

Written by Steven Cress

Head of Quantitative Strategy at Seeking Alpha

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.